At the Strategy, Execution and Valuation Initiative and Strategic Risk Management Lab in the Kellstadt Graduate School of Business at DePaul University, we’ve examined high-performance companies and integrated the various perspectives of our research partners, executive teams, board members, and the investor community.

The goal is to help CFOs and executive teams in making better strategic resource allocation decisions. This analysis includes reinvestments in all forms of capital, including human capital, and impacts decisions in mergers and acquisitions (M&A) and divestitures. Today, strategic valuation thinking is needed to understand how a company intends to create value and to communicate the strategy within the organization, to the board of directors, and externally to investors and other stakeholders.

WHAT IS STRATEGIC VALUATION?

SF: Let’s begin with a definition. How do you define strategic valuation? What are the steps in strategic valuation? FRIGO: Strategic valuation is a qualitative and analytical valuation process, and a logical foundation for properly valuing a company (or business unit); it can be used to help develop and validate the key assumptions and value drivers (return on investment (ROI), margins, asset turns, and growth) in the traditional quantitative valuation processes and models and can be used in capital and resource reinvestment decisions.

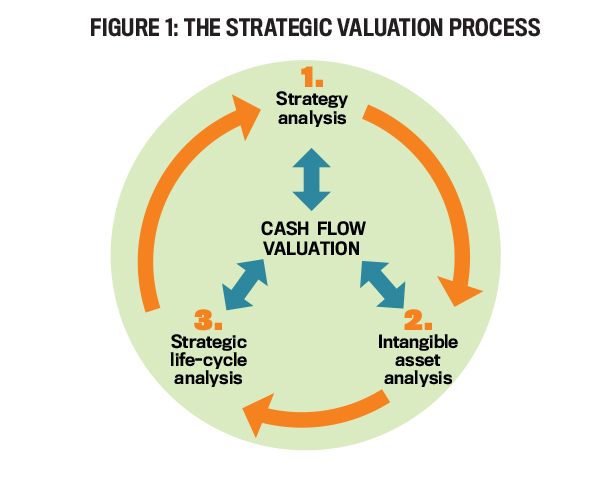

Figure 1 presents a visual representation of the steps involved in strategic valuation. The process is continuous, beginning with strategy analysis, and each step in the process drives cash flow valuation and is part of an interactive knowledge-building process.

Step 1. Strategy Analysis: In this step, the Return Driven Strategy framework is used to describe and analyze the strategy of a company in terms of how the company intends to create long-term sustainable value with its business strategy. There are several questions to address in this step:

- Targeting value-creating customer needs: What are the otherwise unmet customer needs we fulfill? For how long will the customer needs exist and how are those needs changing? How valuable and valued are these needs to our customers? These questions will help determine the profit margins and pricing power of the company that are key assumptions in traditional quantitative valuation models.

- Targeting the right customers: Are we targeting the right customers? Do the customers have the otherwise unmet needs we’re targeting? How many customers have these needs? Is the number of customers growing, shrinking, or stagnant? These questions will help determine the potential revenue growth of the company.

- Innovating offerings: How well are we innovating our offerings to better fulfill changing customer needs?

- Vigilance to forces of change: How well are we managing the threats and opportunities in forces of change? How skilled are we at strategic risk-taking?

- Shareholder and stakeholder value creation: Can we ethically create shareholder value with this offering? Will it generate the margins, growth, and ROIs that are superior and sustainable? How does the strategy create value for stakeholders (other than shareholders) who can be viewed as capital providers? (See also Mark L. Frigo and David R. Koenig, “Achieving Purpose through Innovation,” Strategic Finance, July 2021.)

- Corporate purpose: How can we achieve both our purpose and profits in our business model?

Step 2. Intangible Asset Analysis: Here we examine how the intangible assets of a company create financial value using the lens of the Return Driven Strategy framework. We also examine how intangible assets are created, developed, and protected in the company. This step involves taking an inventory of intangible assets (remembering this is valuable since most intangible assets aren’t on the balance sheet) and then describing how intangible assets create value in the business strategy. Intangible assets can include organizational capital such as managerial skill, knowledge-building culture, and the ability to adapt to forces of change, which in the parlance of Return Driven Strategy, we call “genuine assets.” We can also use balanced scorecard strategy maps to describe how intangible assets create value.

There are key questions to address in this step:

- How would you describe the key intangible assets of the company?

- How would you rate the effectiveness of the company’s research and development (R&D) strategy in creating long-term financial value on a 1-10 scale?

- What is your company’s research quotient? (See Anne Marie Knott, “The Trillion Dollar R&D Fix,” Harvard Business Review, May 2012.)

- How would you rate the company’s knowledge-building culture on a 1-10 scale?

- Genuine assets: Why us? Do we have the genuine assets necessary to have a competitive advantage? Are there missing genuine assets we’ll need to succeed? How can we develop, acquire, or partner to get missing genuine assets?

Step 3. Strategic Life-Cycle Analysis: In this step, we use the competitive life-cycle framework to understand when, how, and where capital should be reinvested in a company or business unit based on economic returns and capital reinvestment metrics. (For a detailed description, see Mark L. Frigo and Bartley J. Madden, “Strategic Life-Cycle Analysis: The Role of the CFO,” Strategic Finance, October 2020.)

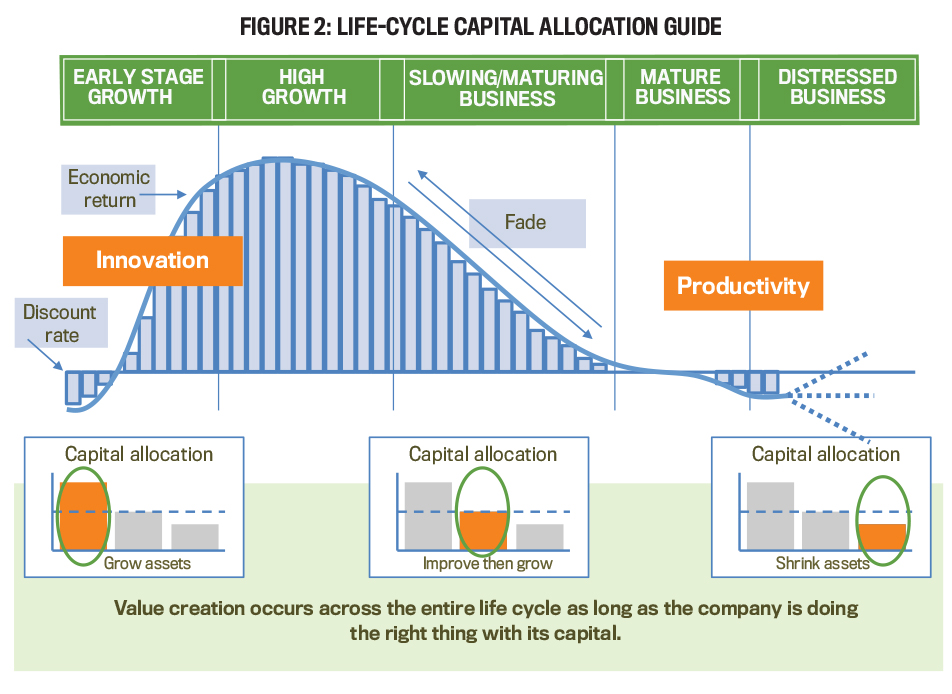

Here, we also analyze capital resource allocation and reinvestments in the company (or business unit) using the Return Driven Strategy and insights from investors regarding long-term value creation. See Figure 2 for the life-cycle capital allocation guide. Here are two key questions to address in this step:

- Where should the company grow assets?

- Where should the company shrink assets?

WHY STRATEGIC VALUATION?

SF: Why should CFOs and finance organizations use a strategic valuation approach? What are the advantages of this approach?

FRIGO: Strategic valuation ensures that strategy will drive resource allocations to create long-term value. This may seem reasonable, but in my research with Joel Litman, we see many cases where management teams inadvertently let capital expenditures and resource allocation drive strategy (and therefore the direction of the company). A key question to address: How well are capital expenditures evaluated, with rigorous attention to how the capital expenditure will create long-term financial value through the strategy?

Strategic valuation helps companies avoid the common problem of allowing operating plans and budget targets (rather than strategy) to inadvertently drive capital investment decisions that work against long-term value creation and lead to short-termism (see Mark L. Frigo and Gregory V. Milano, “Avoiding Corporate Short-Termism,” Strategic Finance, April 2021). Strategic valuation is based on the basic premise that strategy should drive capital investments and resources allocation.

STRATEGIC VALUATION AND START-UPS

SF: In recent years, many companies have launched new ventures and many independent start-ups have been launched, driven by investments in primarily intangible assets. How can strategic valuation be valuable for start-ups and for new ventures in established companies?

FRIGO: Start-ups can describe how their business strategy will create financial value using the Return Driven Strategy framework and understand where the company is in the life-cycle framework. For entrepreneurial start-up or early-stage companies, strategic valuation can be a form of due diligence that builds the organizational expertise and managerial skill and sets the stage for valuation of the company in the future.

For new ventures in established companies, the strategic valuation approach offers a fresh point of view on the venture, unencumbered by bureaucratic systems of an established company. Johnson & Johnson Innovation is a great example of strategic valuation thinking in action: “Established companies can create greater value by acting more like start-ups. Given their size and capabilities, those like J&J have an opportunity in terms of strategic growth, which requires a balanced approach to organic growth and business development” (see Mark L. Frigo and Darren Snellgrove, “Why Innovation Should Be Every CFO’s Top Priority,” Strategic Finance, October 2016).

INVESTOR PERSPECTIVES

SF: How can CFOs and executive teams use strategic valuation to communicate with investors and other stakeholders? What are some investor perspectives that would be useful for companies developing strategic valuations?

FRIGO: Jeffrey B. Madden makes a compelling case for changing the way investors analyze intangible assets and value companies in the new economy (see “The World Has Changed: Investing in the New Economy,” The Journal of Wealth Management, Fall 2019). The ideas Madden presents are useful for executive teams and boards in making M&A, investment, and divestiture decisions and for best practices in communicating how the company intends to create value and its valuation. Madden notes:

- Valuation in the new economy requires a focus on managerial skill, knowledge-building culture, and distinct adaptive capabilities.

- Strategic valuation can help you uncover the right analytical questions and focus attention on the key issues likely to determine future cash flow returns, value creation, and valuation of your company.

- A company’s position on the life cycle depends on the level and change of its economic returns and its reinvestment rate especially in intangibles.

- Value creation can occur across the entire life cycle as long as the company is doing the right thing with its capital.

SUSTAINABILITY AND ESG STRATEGIES

SF: How can a company’s sustainability and environmental, social, and governance (ESG) strategies be reflected in strategic valuation? How can sustainability strategies create competitive advantage and create greater long-term sustainable value?

FRIGO: Companies can develop effective sustainability strategies and related metrics to communicate to investors and other stakeholders using a three-step strategic valuation process. These metrics can include carbon-adjusted ROIs as important factors in valuation and in the strategic life-cycle analysis step in strategic valuation. They should also integrate sustainability strategies and metrics in their risk management processes. Here are some other factors to consider:

U.N. SDGs: Companies can consider how the United Nations Sustainable Development Goals (SDGs) can be reflected in the strategy and reporting of the company, demonstrating long-term financial value and impact to investors (see Cristiano Busco, Giovanni Fiori, Mark L. Frigo, and Angelo Riccaboni, “Sustainable Development Goals,” Strategic Finance, September 2017).

SASB metrics: Companies can include sustainability strategies and related Sustainability Accounting Standards Board (SASB) metrics in the strategic valuation process (see Mark L. Frigo and Ray Whittington, “SASB Metrics, Risk, and Sustainability,” Strategic Finance, April 2020).

Zero-carbon strategies: Companies can use the strategic valuation process to understand and communicate how their zero-carbon strategies can drive more effective innovation, growth, competitiveness, and risk management.

BRANDS AND STRATEGIC VALUATION

SF: How can brands and reinvestments in brands be reflected in strategic valuation?

FRIGO: Companies can use the strategic valuation approach to evaluate and guide reinvestments in brands as strategic assets. In steps 1 and 2, this would involve describing the purpose of their brands and in step 3 using strategic life-cycle analysis. (For more, see Bobby J. Calder and Mark L. Frigo, “The Financial Value of Brand,” Strategic Finance, October 2019.)

HOW INTANGIBLE ASSETS CREATE VALUE

SF: How does Baruch Lev and Feng Gu’s “Strategic Resources & Consequences Report” on the items that create a sustained economic advantage inform strategic valuation?

FRIGO: Companies can develop their own internal strategic resources and consequences report as part step 2 in the strategic valuation process. This can help the CFO and finance organization develop performance measures and incentives that are more highly aligned with long-term sustainable value creation.

SF: How can balanced scorecard strategy maps be used in the strategic valuation process?

FRIGO: Balanced scorecard strategy maps can be very useful in steps 1 and 2 of the strategic valuation process to develop the cause-and-effect linkages between intangible assets and financial value creation. The architecture of the balanced scorecard and Return Driven Strategy framework are consistent, so we can use strategy maps to describe and connect the strategic objectives and performance measures in the four perspectives of the balanced scorecard: financial, customer, internal processes, and innovation and growth.

This article is part of the Strategic Finance Creating Long-Term Sustainable Value series, which includes “Creating Greater Long-Term Sustainable Value,” by Mark L. Frigo with Dominic Barton (October 2018); “Strategic Life-Cycle Analysis: The Role of the CFO,” by Mark L. Frigo and Bartley J. Madden (October 2020); “The CFO and Strategic Risk Management,” by Mark L. Frigo and Richard J. Anderson (January 2021); and “Achieving Purpose through Innovation,” by Mark L. Frigo and David R. Koenig (July 2021).

October 2021