Yet a fundamental dichotomy exists—where there is great disruption, there is also great opportunity. Beyond the overwhelming need for management accountants to learn new skills, digital disruption presents accounting faculty with an opportunity to modernize accounting curricula to prepare students for the roles they’ll assume when they begin their careers in the Digital Age.

Many accounting programs are still preparing students for old-time careers in financial accounting, ignoring the reality of the shifting business landscape. These outdated programs often focus on journal entries, bookkeeping, and costing in order to prepare financial statements, failing to address the growing business needs of decision support, strategic management, data analytics, and technology. Consequently, employers are often disappointed in the training and knowledge of their entry-level employees and find a skills gap between new hires’ capabilities and the foundation needed to contribute substantively and efficiently to functional delivery.

Accounting programs have a responsibility to develop the next generation of accounting talent, and that development requires regularly modernizing existing offerings to ensure that students’ skill sets meet the needs of employers. This is what the accounting faculty of Florida Agricultural and Mechanical University (FAMU) did. In direct response to the skills gap within the accounting profession, FAMU faculty developed an aggressive plan to incorporate digital technology and analytical techniques into their accounting program.

FAMU: MODERNIZING CURRICULA

FAMU’s plan was formed to meet the demands of the accounting profession and to address the program’s first strategic initiative, which is aimed at providing students with lasting value for their education investment. The FAMU team recognized that employers are demanding students with strong digital technology and analytical skills and that students receive a greater return on their investment if they’re better prepared for a lifelong career in accounting.

Under the leadership of Ira Bates, chair of FAMU’s Accounting, Finance, and Business Law department, accounting faculty sought to expose students to various technologies and facilitate the development of critical technology skills. The program focused on incorporating four specific technology and analytics areas: Excel, financial modeling, process automation, and data analytics and visualization.

Mandating the Basics: Excel Certification

Aware that Microsoft Excel skills are often presumed in the workplace today and serve as the foundation of many analytics tools, accounting faculty, together with peers from other departments within FAMU’s School of Business and Industry, decided unanimously to require all business students to obtain the Microsoft Office Specialist: Microsoft Excel Expert (MO-201) certification prior to graduation. The test consists of four major skills: workbook options and settings, data formatting and management, advanced formulas and macros, and advanced charts and tables.

All business students are expected to complete this requirement by the end of their sophomore year. Interviewers and job recruiters expect students to already be proficient in Excel. And the Microsoft Excel Expert certification shows that students know how to use the application before arriving on the job. FAMU faculty reinforce and expand these Excel skills through direct application during business and accounting courses, while the certification serves as an external, independent validation, attesting to each student’s ability to apply skills acquired. (For more on the Excel skills professionals need, see the article, “Excel: The Common Denominator.”)

Beyond the Basics: Financial Modeling

To apply higher-level cognitive learning skills to data analytics and financial modeling, FAMU accounting students can elect to take an upper-level financial modeling course. This course builds upon knowledge from foundational corporate finance courses and provides students with the opportunity to model financial theorems using advanced Microsoft Excel features.

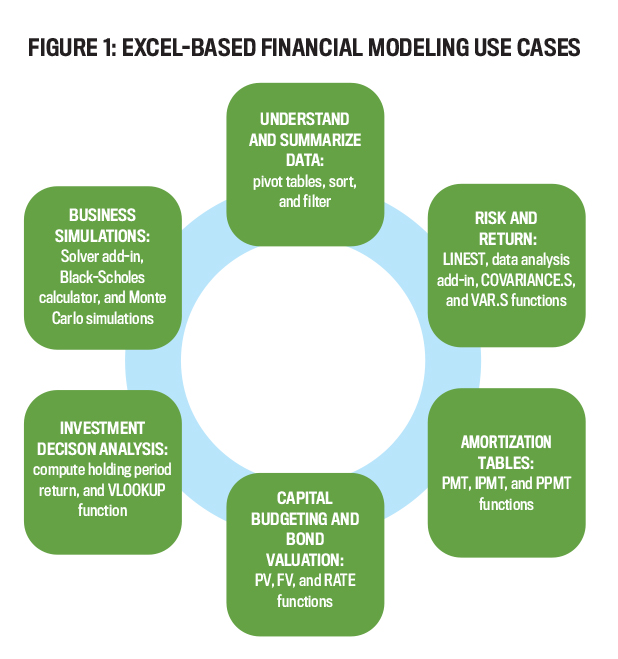

“We designed the course to allow students to expand their knowledge of Excel functionalities, as well as deepen their understanding of complex financial models,” says Inger Daniels, visiting assistant professor of finance and course instructor. When describing the course content, she notes, “The specific Excel-based projects cover a wide variety of corporate finance topics, many of which are subtopics of the CMA® [Certified Management Accountant] exam’s Corporate Finance and Investment Decisions sections.”

As a foundation to the course, students use pivot tables, sort, and filter to understand and summarize economic data that can then be used as model inputs. Students explore risk and return by estimating betas and the security market line, using multiple techniques involving LINEST, the data analysis add-in, and COVARIANCE.S and VAR.S functions. Weighted average cost of capital is computed by extracting data from Excel-based financial statements and performing the relevant computations.

Students build amortization tables for auto and mortgage loans using the PMT, IPMT, and PPMT functions and then evaluate the effects of changes in inputs. PV, FV, and RATE functions are applied in the context of capital budgeting and bond valuation. To analyze an investment decision, students build a spreadsheet that computes the holding period return for varying dates and then use the VLOOKUP function to analyze the effects on the investment.

Other advanced financial management topics include using the Solver add-in program to construct efficient portfolios and examining option pricing by building a Black-Scholes calculator and by using Monte Carlo simulations to analyze changes in option inputs. Students build these analytical skills through repeated practice in the form of timed in-class workbooks, home workbooks, and a final workbook.

Creating Efficiencies: Process Automation

Another key technological trend is the use of process automation tools to expedite and improve the accuracy of routine, repeatable tasks traditionally done by humans, thus creating value for the business. Accountants don’t need to become computer programmers, but they should be able to identify process automation opportunities and navigate user-friendly process automation tools.

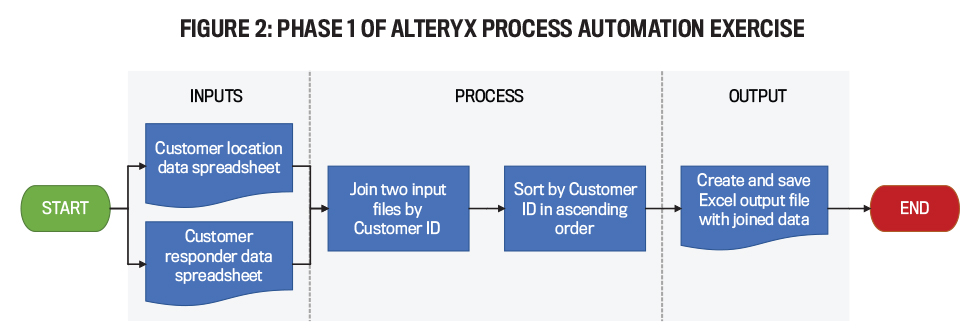

FAMU introduces students to Alteryx, a free analytic process automation software platform, in the management accounting course. Students are required to complete an assignment that uses process automation to combine two large data sets in separate spreadsheets by a customer ID number, similar to the VLOOKUP function in Excel, and then to analyze that data. The high-level process map for the first phase of this assignment is included in Figure 2.

Baruch Lundy, who designed this management accounting course assignment, says, “These types of hands-on activities and the supporting context offers students a host of what is needed in the technology-enabled finance transformation component of the CMA exam’s Technology and Analytics section. Students are exposed to process automation, apply their understanding of the role of business process analysis in overall improvement efforts, and evaluate the impact of digital technology on accounting processes.” This simple assignment allows students to experience all aspects of the automation process from documentation to development and testing. From this introduction, students are encouraged to attain the Alteryx Designer Core, Advanced, and Expert certifications before they graduate.

Informing Decisions: Data Analytics and Visualization

In the auditing and assurance services course taught by Aretha Hill, students perform a host of advanced analytics functions in Tableau, a leading data visualization platform. Prior to analysis that informs a risk assessment of the order-to-cash cycle leveraging sales and cash transactions, students gather and cleanse transactional data using Excel. To demonstrate an analytics mind-set, students employ multiple techniques to assess collectability risk and prepare a detailed audit data analysis plan.

These incremental activities lead to a series of audit work steps being performed in Tableau that enable reconciliations, identification of missing sales transactions, review of gross margin percentages by customer, and aging analysis of accounts receivable—all presented with visualizations and culminating in a robust summary of audit findings.

The same tools and techniques can be leveraged by management accountants as they conduct analyses, execute control processes, ensure compliance, and inform strategic decisions daily. Pairing these activities with process automation strategies gained in management accounting coursework positions students to automate some of these analytics activities if they need to perform similar activities repeatedly.

Continuous Improvement

Even with all these changes, FAMU accounting faculty aren’t done—and don’t plan to be. Given the intense rate of change in business demands, the FAMU faculty members are committed to continuously improving their educational program quality and enhancing the relevancy of the accounting program. To expose students to RPA and process automation through the user interface of desktop and web-based applications, the IMA® (Institute of Management Accountants) RPA course series has been incorporated into the management accounting course content. This enables students to prepare business cases and design controls for automation opportunities and grants students a digital badge visible on LinkedIn.

FAMU faculty also intend to grant access to a suite of additional data visualization tools and RPA platforms. Just as working professionals are encouraged to commit to continuous learning, the FAMU accounting strategic plan is grounded in the faculty’s dedication to keeping their student offerings current and robust.

Stamp of Excellence

In recognition of its curriculum modernization, FAMU’s undergraduate accounting program was recently endorsed under the IMA Higher Education Endorsement Program. The FAMU team shared, “We were excited to apply for the endorsement because we are proud of the quality of the accounting program and looked forward to utilizing the endorsement to demonstrate excellence. Most of our students will spend the bulk of their careers in management accounting roles, so we sought the endorsement as a respected external authority’s confirmation that we are preparing them for their future.”

FAMU began considering the IMA endorsement in the early part of the fall 2020 semester and submitted the application by the end of the semester. “The process of completing the application was an excellent opportunity for us to carefully review our program and independently evaluate its effectiveness in preparing students for the CMA exam,” says Lundy, who led FAMU’s endorsement initiative. “It did require some thought, but IMA staff supported us through each step, and we found that the application process itself was well worth the effort.”

FAMU accounting faculty expressed that they were honored to be the second historically black college and university in the United States awarded endorsement by IMA and were hopeful to see many others join in this recognition.

READY FOR THE DIGITAL AGE

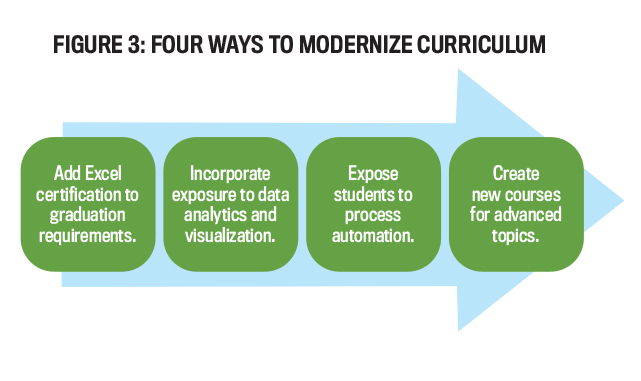

What can academics do to modernize their curriculum by incorporating technology and analytics? Following the efforts of FAMU’s faculty to modernize their curriculum, here are four suggestions of increasing difficulty:

- Consider adding Excel certification to graduation requirements. Many programs already have Excel components in the curriculum, but certification would ensure that students can perform a comprehensive set of tasks within Excel. Moreover, students would be able to differentiate themselves for future employers, who would know the level of Excel skills of the candidate. This is low-hanging, but extremely important, fruit. Certification could be achieved any time in the program and wouldn’t require an additional course.

- Incorporate exposure to data analytics and visualization. Tableau and Microsoft Power BI are two common software packages that offer tutorials, practice sets, and free versions of the visualization software for skill development. The IMA Educational Case Journal (IECJ®) case “Huskie Motor Corporation: Visualizing the Present and Predicting the Future” introduces students to data analysis and visualization using Big Data. It could be included in a management accounting course or data analytics course. Upon completion of this case, students will be prepared for the CMA exam’s Technology and Analytics section.

- Expose students to process automation. It’s possible to include process automation as a project within a course, as FAMU did in its management accounting course through an Alteryx use case. Leading RPA vendors like UiPath, Automation Anywhere, and Blue Prism all offer a host of free learning resources for user-friendly RPA development that academics can incorporate into existing courses. In “The Bots Are Coming…to Intro Accounting,” a path toward incorporating RPA development in introductory accounting courses is presented. The suggested application of RPA is the accounts payable transaction cycle. Familiarity with process automation prepares students for transformation initiatives they’re likely to support at their future employers.

- Consider including additional topics. If a program has the capacity to add a new course in technology, students would benefit from a comprehensive course that incorporates the recommendations found in Management Accounting Competencies: Fit for Purpose in a Digital Age? by Raef Lawson, IMA’s vice president of research and policy and professor-in-residence. Strategic management of technology and analytics looks forward (insight and foresight) and backward (oversight and hindsight) and addresses foundational activities (data governance, date life cycle, data security, and data design), analytical activities (data mining, data extraction, data query, data analytics, and business intelligence), and delivery activities (visualization, storytelling, and communication), each of which are also covered in the CMA exam.

Technology and analytics are here to stay. They didn’t appear out of thin air, but recent advancements, greater data accessibility, and increases in the user-friendly nature of emerging digital tools have transformed management accounting for the better. Future accounting talent must be prepared to deliver value in the Digital Age, and that means accounting programs need to equip students with a toolbox full of digital capabilities, an analytics mind-set, and an inclination toward continuous improvement. Champion modernization in your accounting program today to ensure students have the foundation needed to contribute meaningfully when they enter the workforce and, ultimately, assume leadership roles in the profession.

The IMA Higher Education Endorsement Program

The IMA® Higher Education Endorsement Program recognizes undergraduate and graduate programs that provide the rigorous curriculum needed to not only prepare students for the CMA® exam but also for successful careers in management accounting. The program was developed to address the concern that many schools were failing to adequately prepare their accounting students for a lifelong career, as the focus in most accounting curricula is on public accounting career preparation even though the majority of accounting graduates end up pursuing careers in management accounting.

Receiving the IMA endorsement conveys important messages to prospective students and employers. It communicates that the university provides a holistic accounting education that doesn’t only emphasize preparing students for a career in public accounting, but also prepares students for the important roles of accountants in diverse industries and companies.

IMA-endorsed programs are attractive to students because they know that, upon completion of the program, they’ll be prepared to take the CMA exam. Additionally, IMA offers numerous benefits to students and faculty from endorsed schools. Since its inception, almost 100 schools, large and small, public and private, from around the world have been endorsed, and this number is growing rapidly.

To achieve endorsement, a school must be accredited, substantially cover the CMA exam topics at the appropriate cognitive level, and demonstrate processes in place to evaluate the effectiveness of the program in meeting the needs of employers. These topic areas include technology and analytics, decision analysis, internal controls, and all of the core accounting and finance competencies used by management accountants today.

August 2021