In a recent Deloitte survey (bit.ly/2Vm8aGp), more than 52.8% of accounting professionals stated that their organizations plan to leverage process automation, analytics, and other technologies in the coming years. Thanks to the increasing use of automation technology in businesses, the demand for business graduates with these skills has exploded. Understanding how RPA systems are used to process business transactions and create efficiencies is a necessary skill for today’s business school graduate.

External stakeholders also emphasize the need for business graduates to have not only skills in existing technology (such as Microsoft Excel, Microsoft Power BI, and Tableau) but also the ability to adapt to emerging technology such as RPA. The Association to Advance Collegiate Schools of Business (AACSB) standards for accounting programs advocate incorporating emerging technologies throughout the curriculum. The AACSB also calls for students and faculty to develop technology agility, recognizing the need for continual learning as new technologies emerge. Incorporating RPA in introductory accounting is a first step in providing students with learning experiences that develop skills and knowledge in information technology and business processes.

AUTOMATING REPETITIVE TASKS

RPA is a software system that emulates human interaction with computer applications to automate processes. RPA is delivered through development of workflows, sequences of process steps like click or type into, that a “bot” then executes to replicate a human’s process. A bot (or software robot) is best used for repetitive tasks that are based on rules.

In general, processes can be automated by individuals with an extensive amount of coding skills or by using an RPA system. With an RPA system, in addition to developing a process using user-friendly drag-and-drop activities, standard screen recording functionality can be employed to capture the process steps. In this scenario, the individual initiates the screen recorder at the start of the task and completes the task while the system observes. All the employee’s actions are recorded while performing the task, including all keystrokes and mouse clicks. Upon completion of the observed task, the employee stops the screen recorder. Additional information can be used to edit the task, if needed; otherwise, the workflow is saved and ready for use. The benefit of using an RPA system is that minimal to no coding is required for lower-complexity opportunities, and an employee with limited programming knowledge can easily build a process for a bot to automate selected tasks.

Although an Excel macro can also automate certain tasks, an RPA bot is much more powerful than a macro because the macro runs only within that one Excel program. A bot, on the other hand, can interact with several applications across different systems at the same time. For example, an employee who is responsible for reconciling information from multiple sources such as QuickBooks, Excel worksheets, and customer invoices can build a bot to automatically compare the three data sources and determine discrepancies in less than a minute.

Certain activities are more suitable for RPA automation than others. Any type of activities that require creativity, emotional intelligence, and judgment can’t yet be effectively handled by a bot. Instead, activities should have the following conditions and characteristics:

- The process task is rule-based. The bot can be programmed to use certain “rules” to make decisions. For example, if an email has the word invoicein its subject line or body, the bot immediately forwards the email to the accounts payable department.

- The steps to complete the process are repetitive and routine.

- Each process involves a high volume of data.

- The data associated with the process follows a consistent pattern. For example, invoices include structured data such as customer names, addresses, and amount due.

- The data contained in source documents, emails, or attachments can be recognized by the software. Bots look for patterns to recognize data. For example, the bot may look for the date by looking for data in the document that fits the pattern of MM/DD/YYYY or month, day, year. Even though patterns can be complicated, bots are able to recognize a variety of different formats.

- The chance of human error is likely in the existing process. The use of a bot can greatly reduce the number of mistakes and related costs attributed to human error.

- The benefits of using a bot outweigh the cost of automation.

TEACHING ABOUT RPA SYSTEMS AND BOTS

As a foundational course, introductory accounting covers many of the routine tasks that are often automated by businesses. Many business majors leave introductory accounting believing that an accountant’s job involves handling these day-to-day, routine transactions. One way to discuss RPA in introductory accounting is to demonstrate how a bot can handle the tasks students are learning about. This also emphasizes to students that many of the routine tasks learned in the introductory courses are often automated by companies. Using RPA allows accountants to spend their time on more meaningful work.

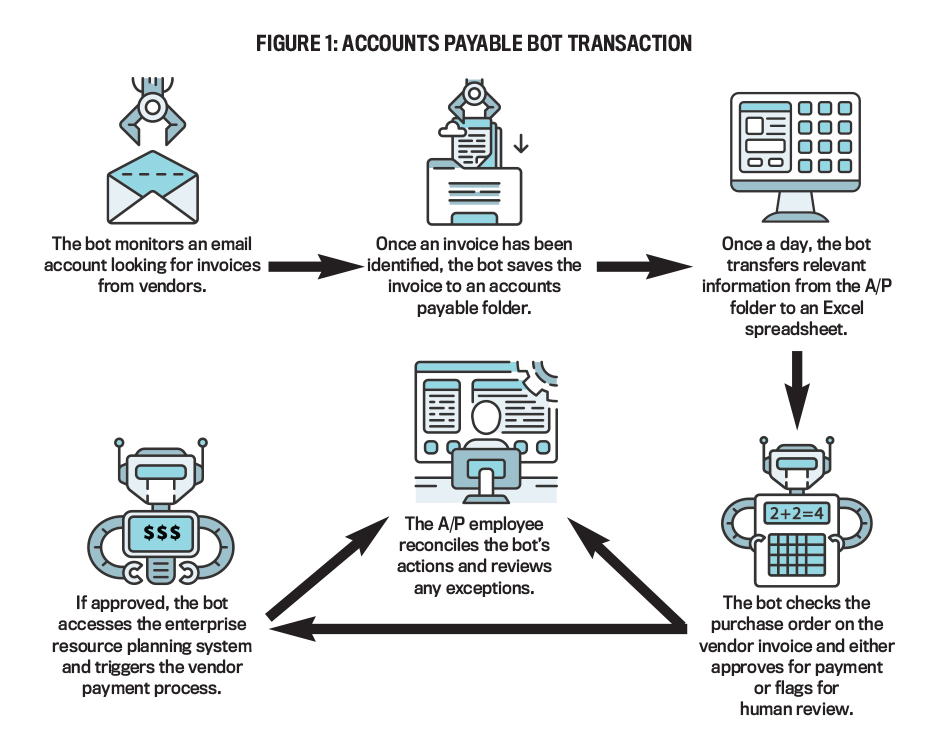

As an example, one topic that’s always covered in introductory financial accounting is accounts payable. RPA bots are commonly used to automate accounts payable tasks for companies. After covering the basics of accounts payable, an instructor can discuss how a bot could take the routine transaction and process the vendor payment. See Figure 1 for an example of an image that can be used to describe and teach the process.

In general, the accounts payable bot performs the following steps:

- The bot monitors an email account, looking for invoices from vendors in PDF attachments. Once the bot finds a PDF attachment, it downloads and saves the attachment to a cloud-based folder for accounts payable invoices.

- Once a day, the bot transfers relevant information from the vendor invoices and places the relevant information in an Excel spreadsheet. For example, this data might include vendor name, date, purchase order number, and quantity purchased.

- The bot checks for a purchase order number on the vendor invoice. If a purchase order number is identified, the bot compares the invoice to the purchase order and makes the decision to approve and continue or flag the purchase order number as an exception requiring human review.

- The bot accesses the company’s accounts payable system and triggers the vendor payment process.

- The bot follows all company rules related to vendor payment. When the bot detects an exception, the transaction is flagged for human review.

- The bot sends an email confirmation to the accounts payable employee confirming completion of the task.

After discussing this example in class, it’s important to have students brainstorm about the benefits the company received by automating the task. Students might identify the following:

- The bot was able to eliminate human errors that occur when the invoices are entered in the accounts payable system.

- There is a complete log generated of all steps for later review or audit.

- The amount of time spent by employees to enter data is vastly reduced; repetitive tasks such as matching purchase orders to vendor invoices or routing exceptions for approval have greatly decreased.

- The time savings allows employees to be assigned to more interesting, valued-added activities that draw upon human decision making and other strategic thought processes.

OTHER ACTIVITIES THAT CAN BE AUTOMATED

There are many other activities and processes that can be automated with RPA. These can be great examples to discuss with students. The topic of RPA can be intertwined with several topics throughout introductory courses.

When covering accounts receivable in class, the instructor can discuss how a bot can be used to automate customer billing, payment updates, and past-due notice mailings. When covering the topic of inventory, the instructor can also describe the customer order process and discuss how processes can be created to transfer orders from the website ordering system to update the inventory records.

When the topic of accounts payable and bad debts is covered, the instructor can discuss how a workflow can process customer credit applications, monitor customer credit ratings, and notify the credit department staff if a customer’s credit rating has been downgraded so that the customer’s credit limit can be reassessed by the credit department.

When internal control and fraud is covered, the instructor can describe how a process can be created to perform bank reconciliations by matching the bank statement activity against the company’s general ledger activity. This can also be applied to processing and checking employee expense reimbursement claims.

If covering payroll, the instructor can describe how a new workflow can be used to read time-clock reports and enter those hour totals into the payroll system. The process can then validate the hours worked against the scheduling system with any identified exceptions investigated by a supervisor.

POTENTIAL BENEFITS OF RPA

When discussing these examples and RPA systems with your students, it’s important to point out both the benefits and disadvantages. RPA systems offer many potential benefits to companies, including:

- Eliminating data-entry errors.

- Providing a complete documentation log, or audit trail, for later human review or audit.

- Developing informed employee decisions based on accurate and timely data processed by the bot.

- Receiving needed information faster.

- Reducing operational costs by decreasing the time needed to perform repetitive tasks and by eliminating data-entry errors.

- Devoting less time to process internal requests such as gathering customer information; the bot performs the work faster than a human could.

- Enhancing customer service: Bots can respond to customers 24 hours a day. For example, a customer in need of a car insurance quote from Progressive Corporation can access Progressive’s website at any time. After the customer inputs personal application information, a bot responds accordingly with an insurance quote.

- Increasing productivity, as bots don’t take vacations or sick leave and always arrive on time to work.

- Employee satisfaction increases: When employees are freed from repetitive tasks, they can focus on value-added processes. If a bot, for example, processes vendor invoices for payment, then accounts payable personnel, in turn, can focus on investigating exceptions, responding to vendor queries, and developing their analytics skill set.

- Ability to handle large fluctuations in data processing activity without hiring more employees.

POTENTIAL DRAWBACKS OF RPA

RPA systems aren’t without drawbacks. One disadvantage to using RPA bots is that employees may push back against bot creation and implementation, as some may believe automation eliminates human jobs. While bots may replace some human tasks, employees can instead be reassigned to higher-level tasks. Another disadvantage is that bots, over time, could lead to relatively high maintenance costs. When third-party systems are updated by vendors, the process workflows that RPA bots use must also be updated. These necessary updates could be costly or may be overlooked.

Because RPA processes can be created by the employee who was responsible for the specific RPA-targeted task, there may be instances when no central IT department oversaw and documented the process development. Documentation and tracking of bots and the processes they perform are important. Without continual tracking and oversight, the company may be unaware of the need for documentation and updating.

Before implementing RPA systems, companies should closely evaluate the cost-benefit equation. Bots may not reap the expected net savings. Justifying the cost of an RPA system may be difficult when labor cost savings is the only factor being evaluated in the cost-benefit equation. Other benefits must be factored into the initial decision, such as the additional value-added work that employees can do once freed from repetitive tasks.

PROJECTS FOR INTRO ACCOUNTING

Because there are limited resources currently available for introductory accounting courses, we have created a few introductory projects that give students exposure to building a simple process for a bot. We used Automation Anywhere (automationanywhere.com), which is free software for use by individuals, for the bot projects.

After testing the project in a large section of introductory financial accounting in spring 2020, we have released the first of these projects for instructors to use in their own classes. This introductory Hello Bot project can be accessed at our blog, Accounting is Analytics (accountingisanalytics.com).

This Hello Bot project is suitable for students in introductory accounting and should take students less than one hour to finish. It’s designed to be completed outside of class and includes step-by-step instructions, starting with signing up for Automation Anywhere as well as building and running the bot.

The bot itself is simple. The completed bot will ask the user for their name and then the bot will say “Hello, <name>! The day and time is <date/time>.” The objectives of this first project are to walk the students through the steps of installing the necessary software, introducing the concept of a bot, and providing a hands-on experience on how to build a bot to perform a repetitive task.

It’s important to note that Automation Anywhere requires the use of the Windows operating system when running the process, which became a challenge when implementing this project. Students using a Mac computer will need to have access to a computer lab that has Windows or the ability to run Windows on their Mac computers. To assist instructors and students, we have included resources and information on how to install Windows on a Mac computer in the Hello Bot project document.

Instructors are free to adapt the Hello Bot project (and future projects to be released on the site) for use in their own classes; we ask that the project not be published in any form without express written consent from the site authors. Adventurous instructors might also want to develop their own projects based on several of the examples discussed in this article. Both Automation Anywhere and UiPath offer several tutorials on how to use the software.

But we do have some words of caution. When implementing the Hello Bot project, we quickly realized that the instructions for students must show each individual step clearly because RPA software isn’t entirely intuitive for students. It’s also difficult for students to build more advanced processes for bots if they don’t thoroughly understand business processes, which is a common knowledge gap for introductory students. Also, if you create your own projects, be aware that RPA software is updated frequently, and you will need to update your step-by-step instructions to reflect any changes that impact the projects.

RPA is here to stay. The demand for RPA bots is growing as companies look for new opportunities for increased efficiency and effectiveness in their systems. Human errors cost businesses billions of dollars annually, and using RPA could greatly reduce these errors. As AI is integrated into RPA systems, the capabilities of RPA bots will expand greatly. As educators of future accountants and business leaders, we need to include RPA in our curriculum, beginning at the introductory accounting level. Although we believe building more advanced bots and workflows is beyond the scope of an introductory accounting course, instructors can easily discuss how businesses are using emerging technologies such as RPA to automate several repetitive tasks within many of the topical areas being covered.

MAJOR RPA SOFTWARE COMPANIES

Several companies offer RPA software. The three major RPA companies are Automation Anywhere, Blue Prism, and UiPath. All three companies have experienced rapid growth over the past few years, as have dozens of smaller competitors. RPA software continues to evolve as bots gain more AI capabilities.

August 2020