The broad scope of its impact across multiple business functions raises important questions regarding how business schools need to teach blockchain. In this article, we present a framework as a starting point for integrating blockchain concepts within business school curricula.

Blockchain concepts and technology have taken root in recent years during the cryptocurrency craze. While this technology has only emerged fairly recently, the initial seeds of this idea were proposed more than 30 years ago by Stuart Haber and W. Scott Stornetta in a January 1991 article in the Journal of Cryptology. The key idea was the implementation of a system where documented time stamps couldn’t be altered or tampered with. It wasn’t until 2008 that a person (or group of people) known as Satoshi Nakamoto implemented what has been called the first blockchain as an integral component of the cryptocurrency bitcoin.

Nakamoto improved upon the ideas proposed by Haber and Stornetta by introducing a hashcash-like technique that time-stamped blocks of information without the need to be signed by a trusted party, which could then be added more quickly to a chain of information. A basic blockchain has blocks of information, with each block containing three important elements: the data of interest, a hash (which is basically a block’s fingerprint), and the hash of the prior/previous block.

HOW BLOCKCHAIN WORKS

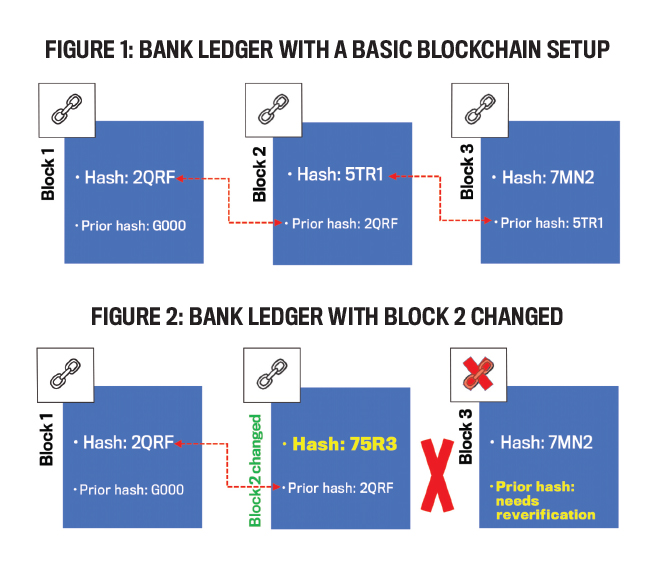

Figure 1 shows what the activity between three different banks might look like, with each block representing a transaction among the three banks. Once a block is created with the pertinent data, a hash is calculated for that specific block. The hash links the blocks of information together, and each one must be verified by all parties that intend to link to that block of information. Each participant creates a new block in the chain, with its own unique hash number linking it to prior blocks. Thus, a block of data may have one or thousands of linkages, with each party that links to the block required to verify the data they’re linking to.

The hash of the prior block is the third element that’s stored within the block. This serves as the linkage between the two blocks and, more importantly, acts as a security check. If a block of information is altered, changed, or updated in any way, the hash is recalculated, requiring it (the information) to be reverified, thus breaking the chain of information until reverification is achieved (see Figure 2).

The current use of blockchain technology to create a public transaction ledger for bitcoin and other cryptocurrencies has been viewed by business leaders as a disruptive technology because of its ability to act as a distributed ledger system that records and tracks data in a decentralized and transparent system. The blockchain system doesn’t have an institution or organization, such as a bank, that acts as an intermediary; instead, the transactions occur directly in a peer-to-peer structure. But when you break it down, a blockchain is essentially a time-stamped series of records managed by a cluster of computers. The structure of the information is designed to be open, decentralized, tamper-proof, and transparent to all parties who access the information, with everyone involved being accountable for their actions and activities.

A FRAMEWORK FOR BUSINESS SCHOOLS

Blockchain’s potential impacts across finance, accounting, IT, and the operational sectors of businesses are still in their nascent stages. Given its potential impact across a broad spectrum of business functions, blockchain raises an important question regarding how it needs to be covered within business school curricula in terms of topics and subjects. Since the current practical implementations of blockchain have centered on financial and accounting practices, our proposed curriculum leans more heavily into financial and accounting content, though that isn’t to say that IT and operations aren’t worth covering as well. Our framework highlights those, too.

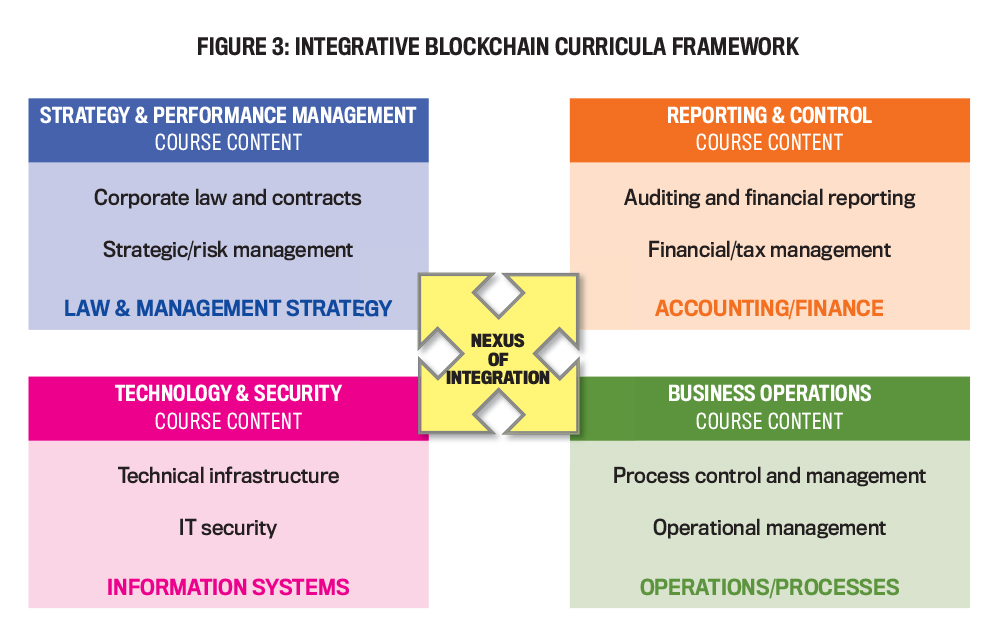

The integrative blockchain curricula framework proposed in Figure 3 is modeled after the IMA® Management Accounting Competency Framework. It utilizes portions of the IMA Framework to lay out the impacted business disciplines and key areas of coverage.

Our framework segments business curricula into four core areas: Strategy and Performance Management, Technology and Security, Reporting and Control, and Business Operations. Each of the four areas delves into different but important business concerns that need to be integrated to help organizations derive the most benefit from blockchain methodologies. Let’s take a deeper dive into each of these core areas.

STRATEGY AND PERFORMANCE MANAGEMENT

Business organizations that use blockchain need to understand not only the benefits, but also the legalities and risks associated with this technology. A security audit of the blockchain technology as well as a risk assessment of vulnerabilities become a critical part of the blockchain audit. The conventional control goals related to information processing—validity, completeness, and accuracy—will be critical in the immutable ledger infrastructure.

An important risk management area of note within blockchain deals with the execution and placement of “smart contracts.” The concept of smart contracts is currently being applied to legally binding arrangements, which automatically adjust when triggered by some external input. Given its inherent importance to blockchains, vulnerabilities and risks related to smart contracts—including poor cryptographic-key management, risk of unauthorized access to the data, and the validity of the smart contracts stored on the blockchain—must be well-understood.

Although there’s a demand for more transparency, individuals and businesses are also demanding more privacy. Accordingly, any blockchain system needs to be designed with general data protection while keeping in mind privacy concerns such as those found in privacy laws, such as the European Union’s General Data Protection Regulation or the California Consumer Privacy Act. Both give individuals the right to request all personal information a company has collected on them and the right to force the company to delete it. This may be difficult when information embedded in blocks is immutable. Accordingly, blockchains may need to exclude human resources and other personal information, such as medical records.

Public and private blockchains are another risk that must be managed. There will be both “open,” or “public,” blockchains as well as private proprietary blockchains with more secure, limited access. A public blockchain’s transparency could cause problems because outsiders would have access to information that wouldn’t otherwise be readily accessible. Even private blockchains pose privacy problems because they’ll have multiple access points in the supply chain. Students must be instructed on how to assess these issues as well as how to manage and mitigate the potential risks that come from using blockchain technologies. These issues raise security concerns that also cross into the Technology and Security portion of the integrative blockchain curricula framework.

TECHNOLOGY AND SECURITY

As the digital world becomes more complicated, cybersecurity is a top priority for companies, and controls need to be in place to ensure data is stored and held in a secure environment. The adoption of blockchain technologies is an important tool for IT cybersecurity systems. Training and educating students on techniques such as network security, data security and privacy, access controls, and cryptographic-key management can serve as an initial layer of control to quickly respond to external threats such as security breaches.

Students will also need to understand how the core technology operates and how it must be initiated within the technical infrastructure of an organization. Instruction on the hashing methodologies utilized for information blocks and the network infrastructure that serves as the backbone of the blockchain will be crucial. Understanding these technical components will be vital in securing the validity of the data that’s being transacted. Blind trust in the information and a general reliance on the technology (trusting that it’s running appropriately) can be detrimental.

While the level of technical competence will vary by business acumen (IT students vs. accounting and finance students), all business students must have at least a top-level comprehension of the technology involved. A lack of understanding will not only open up an organization to fraudulent records that may go undetected but may also invite tampering with both the technology and information that’s being stored.

It will also be necessary to instruct students on the security concerns regarding blockchains. Since the technology was initiated to help create more secure record keeping, vigilance in this regard is mandatory. For example, smart contracts are pieces of code that run on the blockchain. Automatic code review controls can be implemented to ensure that the code is processing the transactions correctly, effectively, and as intended by the originating parties. Students should be cognizant of how the data is being secured and what methods are being used to ensure data validity (i.e., the hashing technologies). While business students aren’t expected to be security experts, an understanding of how systems are being secured and how the information is being validated is essential.

REPORTING AND CONTROL

Blockchain may prove to be transformational for the accounting profession. Just as the use of both mainframe and personal computers revolutionized the acquisition, recording, and manipulation of financial information, blockchain offers the potential to automate many of the routine data-entry tasks that have so long been associated with bookkeeping and accounting, delivering more accurate information in real time and at a much lower cost.

Although adoption of blockchain-based accounting systems will change transactional reporting, record keeping, the much-feared “close,” and financial reporting, blockchain-based accounting also has the potential to transform both internal and external auditing. Real-time assurance of transactions may eliminate many of the routine tasks associated with financial audits, such as data collection. Other audit procedures, such as sampling, can be eliminated and replaced with 100% testing through data analytics. The immutable blockchain records themselves may be audit evidence for many financial statement assertions; however, the shared ledger technology can’t determine whether the blockchain data source is valid or whether the transactions have been correctly classified, have been properly recorded, made between related parties, or are even fraudulent. Thus, human judgment will continue to play an important role in auditing.

The Internal Revenue Service and other tax authorities around the world will likely embrace blockchain, which will allow them to collect more detailed tax filings with accurate financial information, including more details of international transactions. PwC, for example, predicts that blockchain will be especially useful in transfer pricing. More specifically, blockchain has the potential to make transfer pricing more accurate initially because of the availability of real-time data, which tax authorities can use to verify the transfer prices rather than having to rely on voluminous company-created work papers. Many organizations expect blockchain, along with AI, to automate much of their tax compliance function.

As financial statements migrate to digital formats and can be accessed in permission-less public blockchains, their transparency will provide detailed financial information that until recently would have been considered proprietary. Although the identities of companies participating in certain transactions will be redacted, anyone may be able to use analytical tools (or just make an educated guess) to learn the identity of a company that had taken part in a transaction. The company’s entire financial history on the blockchain will then be open for scrutiny. For accounting students, as well as current practitioners, this is a new risk area that must be addressed.

BUSINESS OPERATIONS

Since the use of blockchain will change how information is being received and utilized, students will need to grasp the operational impacts of this technology. Implementing blockchain will allow organizations to link more fluidly with partners and suppliers via the information shared on the chain. This raises the possibility of streamlining redundant systems and making current supply chains more efficient. Teaching students how to adjust and integrate blockchain within current supply chain principles will therefore be crucial if it’s to make a positive impact on business operations.

Legal compliance is another area of concern. Accountants and auditors spend considerable time and effort in checking on legal compliance of various kinds. Blockchain has the potential to allow automation of much of this routine compliance work. For instance, smart contracts on blockchains will enable many more business-to-business transactions to be automated, which will greatly improve operational efficiencies relating to legal compliance. This automation concept can potentially be applied to other areas of financial record keeping as well, such as UCC (Uniform Commercial Code) filings, which will have the potential to greatly improve accessibility and decision making.

BRINGING BLOCKCHAIN TO THE CLASSROOM

The idea that blockchain is just some new technology that only IT has to worry about is faulty at best and potentially dangerous at worst. In fact, blockchain implementation requires thinking that cuts across multiple disciplines, requiring technical and operational knowledge as well as accounting and financial knowledge. For example, integrating blockchain within the operational functions of an organization can potentially help solve inventory inaccuracies, find ways to better optimize volume discounts, and be a more efficient means for product recalls. Procuring supplies and tracking sales via a blockchain would have an especially big impact on the accounts payable and accounts receivable functions.

Just as accountants now operate in an environment where digital information hasn’t completely eliminated paper forms, students will be entering an environment that mixes conventional accounting and blockchain-based systems. At least initially, conventional accounting and blockchain-based data may exist side by side. Accordingly, not only do students need to be familiar with blockchain and competent in using blockchain-based systems, they’ll still need to learn conventional accounting systems. Besides embracing newer technologies, the next generation of accountants must also play a role in designing platforms that provide useful financial information to help themselves and their teams make both strategic and operational decisions. Many educators are currently grappling with this realization.

College accounting students already have a significant number of required courses compared to those in business school. This poses two distinct questions: First, should topics like blockchain, accounting information systems, and data analytics be integrated into existing classes, or should they be taught in new stand-alone courses? Second, if they’re taught in the existing classes, what topics must be jettisoned to make room for the new topics? Accounting educators don’t have free rein in designing programs because there are institutional requirements that mandate students take nonaccounting courses. The profession will therefore need to resolve the practical issues of course content and course balance. Essentially, the question of what can be taught in college and what must be left to on-the-job training needs to be addressed.

DEVELOPING A WIDER SKILL SET

Although everyone seems to agree that incorporating technology-based instruction is desirable, there’s less agreement on how this can be accomplished. A college accounting major faces demands for proficiency with programming languages (i.e., Python, Visual Basic, and SQL), even though most college accounting programs currently don’t require it. This skill, however, may potentially be learned by either requiring students to take integrated programming courses or by adding a dual-major track that incorporates a blend of accounting and information systems courses. This would probably require a true fifth year of study.

Another approach is to examine the need from a technology, information systems-major perspective, where business students who have chosen to concentrate on the technology side of business can supplement the financial and accounting aspects of their studies. These students will need to have a refreshed emphasis on financial and accounting matters, especially as they pertain to blockchain concepts. Likewise, information systems majors would need to go beyond the basic accounting requirements stipulated for all business majors and gain knowledge in areas like intermediate accounting, accounting information systems, and audit and taxation. The pedagogical approach from this vantage point is the reverse of that for accounting-based students.

WHAT’S NEXT?

We believe that our proposed integrative blockchain curricula framework is an initial step toward helping business educators consider how to best implement technology-based instruction for new concepts like blockchain. The framework can be applied to not only accounting and finance majors but also to majors in the information systems, and possibly even operational management, disciplines.

Our proposed framework should only serve as a starting point for institutions of higher learning; business schools would need to determine how to adopt and adjust it to match their specific needs. Our hope is that these ideas can help business schools begin to develop their own pathways toward instructing future business majors on blockchain and other cutting-edge technologies.

Data Disruption via Quantum

Y2Q heralds a countdown toward the emergence of quantum computing devices. Initial quantum devices are being used by companies such as Lockheed Martin to help process information on fighter jets more quickly and has led Microsoft to develop a new programming structure to take advantage of quantum computing power. The promise of quantum will inevitably lead to the disruption of how we construct and process information.

The building blocks of quantum, qubits, will move us away from the binary bits (0s and 1s) that are the current backbone of all technologies currently employed. Since the qubit can exist in multiple states (not just as a 0 or 1), we can theoretically harness this ability to process information hundreds, or even thousands, of times more quickly and efficiently than the fastest machines we have today. Just considering this possibility, we can visualize how our current information security systems would become obsolete.

Since blockchain and cryptocurrencies rely on current bit-based technology for security, they’ll be vulnerable to quantum machines. Ask yourself the following question: If I can crack a security system in seconds, what’s to stop me from recreating and inserting an entire blockchain across multiple servers with a quantum device in minutes? Because of this possibility, any disruption of Y2Q is potentially landscape-altering and demands that businesses and financial institutions rethink and develop new strategies that can counter these potentially more formidable cybersecurity risks.

August 2021