Accrediting bodies such as AACSB International and ACBSP (Accreditation Council for Business Schools and Programs) stress the importance of developing an innovative curriculum that incorporates current and emerging technologies. The standards suggest that universities and colleges maintain a future-oriented mind-set and an understanding of the skills students will need in the workforce. These skill sets should be determined based on employer feedback and a thorough evaluation of business trends.

A review of any accounting journal will quickly shed light on the latest technology that organizations are using today. Software programs and tools such as Microsoft Excel, Tableau, Microsoft Power BI, Alteryx, UiPath, IDEA, R, and Python are frequently employed by accounting professionals to understand and analyze data. Given the multitude of available technology and the need to develop students with “technology agility” (AACSB, 2018 Accounting Accreditation Standards, Standard A5), how do accounting educators determine which technology to focus on?

EMBRACING EXCEL

Since it replaced Lotus 1-2-3 as the dominant spreadsheet software decades ago, Excel has remained a product near and dear to management accountants and other financial professionals. For this reason, we suggest that accounting educators start with a focus on Excel and then further expand students’ technological agility by introducing other software, such as Tableau, Power BI, and robotic process automation systems.

Why Excel first? Proficiency in Excel is often considered the common denominator software in the business world, and it’s still a critical skill needed by all accounting graduates, regardless of their intended career path. Knowledge of Excel can also develop a foundation that can then be applied to other software programs. For example, once students understand how to clean data in Excel, they can easily apply this skill set to more advanced software, such as Alteryx.

With a comprehensive software program such as Excel, it’s challenging to determine what skills to teach and when to integrate them into the accounting coursework. Specifically, accounting faculty face two challenges with respect to Excel and the curriculum:

- What specific Excel skills do practitioners view as critical?

- How do accounting instructors find room in the curriculum to address the need to develop their students’ Excel skills?

To begin, we surveyed accounting and business professionals about the key Excel skills needed by new hires. Our results provide real-world insight into which skills are most important for students to learn and can inform faculty on curriculum decisions. As educators ourselves, we also have some recommendations on how to fit Excel instruction into an already packed accounting curriculum.

SURVEY ON EXCEL SKILLS

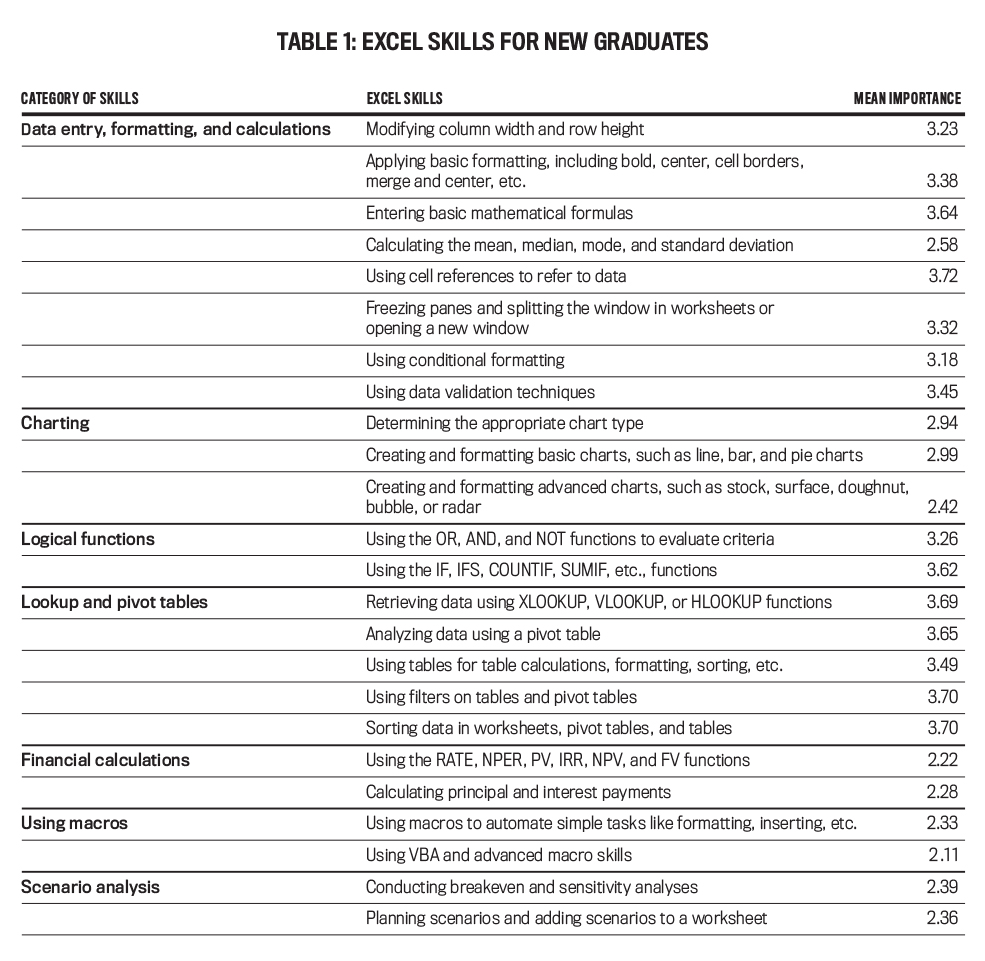

To understand which skills are most critical, we developed a survey on LinkedIn that asked accounting and business professionals to indicate the relative importance of 24 different Excel skills for new graduates to possess, along with some demographic questions. The 24 skills were grouped into seven categories: data entry, formatting, and calculations; charting; logical functions; lookup and pivot tables; financial calculations; using macros; and scenario analysis. Table 1 lists the 24 Excel skills included within our survey.

We received 411 responses. Of those, 59 responses were deleted for either duplicate or missing data, resulting in a total sample size of 352. Participants responding to the survey were from a variety of different industries, with 77% of respondents currently working at for-profit companies and the remainder working in not-for-profits, government, healthcare, education, or “other.”

Company sizes ranged from one employee to more than 5,000, with the highest number of participants (38%) working at companies with 1,000 to 4,999 employees. Nearly all (98%) of the respondents were between 18 and 65 years old, with 57% of respondents ages 26 to 40. A little more than two-thirds (68%) live in the United States, and almost 9 out of 10 (89%) have a bachelor’s or master’s degree.

We also asked participants to rank their own Excel skills on a five-point Likert scale, with 1 indicating little or no experience with Excel and 5 indicating an advanced Excel user. Participants, on average, ranked themselves as possessing strong Excel skills (mean score of 3.97).

Respondents were also asked to rank the relative importance of 24 Excel skills under seven different categories using a four-point Likert scale, with 1 = not important, 2 = somewhat important, 3 = important, and 4 = extremely important, and a value of 5 equivalent to being unable to answer. The mean for the importance of each of the 24 skills is also shown in Table 1.

CRITICAL AREAS OF EXCEL SKILLS

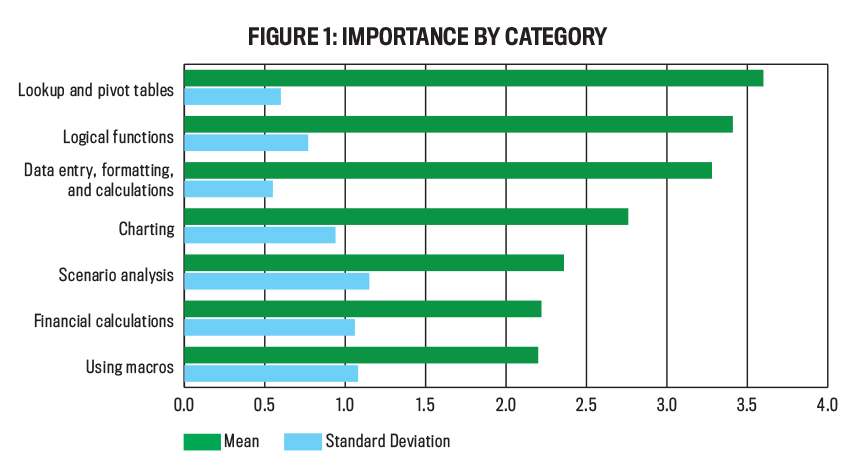

All seven Excel skills categories were ranked to be at least somewhat important by participants, with lookup and pivot tables as most important and using macros the least important. Figure 1 shows the categories ranked from highest to lowest in importance.

It’s important for faculty members to understand not only the ranking of these Excel skills categories but also the Excel skills that are included within each category. With this in mind, let’s take a look at some of the specific skills in each category and their relative importance for new accounting graduates.

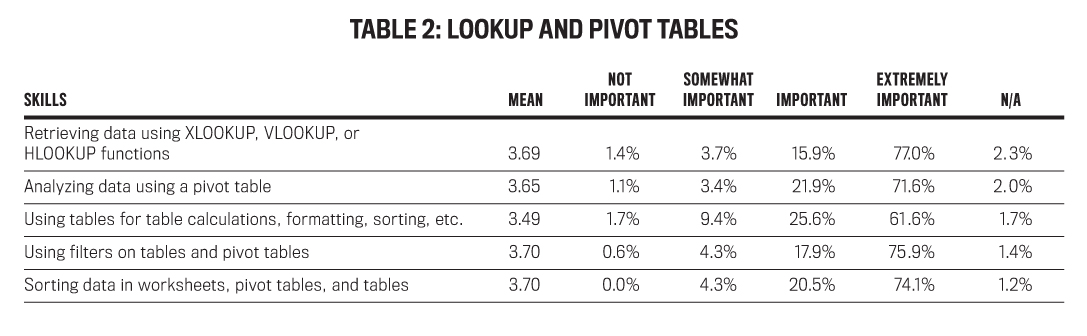

Lookup and pivot tables. Lookup and pivot tables were ranked as the most important Excel skill category for accounting students to master before graduating. These skills include using the various forms of the LOOKUP functions; building, sorting, and filtering pivot tables; and using tables in Excel.

Heidi Hanan, an accounting specialist at Mickey Thompson Tires & Wheels, a tire and wheel manufacturer located in Stow, Ohio, explained why she rated building pivot tables as the most important Excel skill category: “Two days of combining, sorting, filtering, and summing data in Excel sheets is a daunting task, and that’s how long it used to take me to process yearly 1099s. I felt trapped in data. I thought, ‘There has got to be a better way.’ Eureka! Pivot tables! With Excel pivot tables you can summarize large amounts of data and create reports quickly and easily. This makes my 1099 reporting process painless.”

The survey found that all five pivot table skills were ranked highly, with four of the five rated as extremely important by more than 70% of respondents. The ability to retrieve data using the XLOOKUP, VLOOKUP, or HLOOKUP functions was the most highly rated skill at 77%, closely followed by using filters (75.9%), sorting data (74.1%), and analyzing data using pivot tables (71.6%). The majority of respondents also rated being able to use tables in general as an extremely important skill.

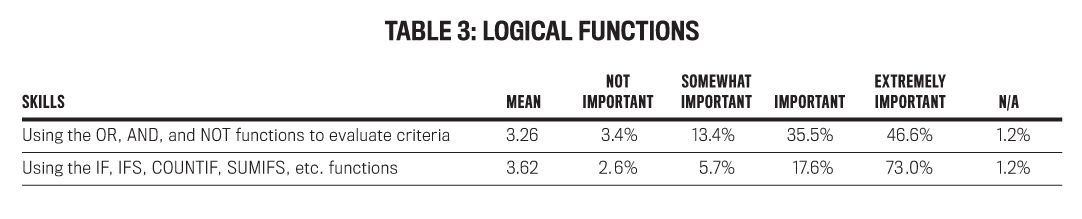

Logical functions. Logical functions were also ranked as extremely important Excel skills. In the survey, we asked about two specific types of logic skills. One group relates to using the IF functions, including IF, IFS, COUNTIF, SUMIFS, and other similar functions. The other group of logic skills relates to using the OR, AND, and NOT functions.

Although the vast majority of respondents viewed both groups of logic skills as being important or extremely important, the ability for students to use the IF, IFS, COUNTIF, SUMIFS, and other functions is clearly ranked higher, with 73% of respondents indicating that those skills are extremely important vs. 46.6% for the OR, AND, and NOT functions. Thus, educators incorporating logical functions within their coursework should place emphasis on the IF functions.

Data entry, formatting, and calculations. The data entry, formatting, and calculations skill group contains eight specific skills on a variety of basic Excel tasks, including using cell references, entering basic mathematical formulas, and using data validation techniques.

A majority of survey respondents rated each of the eight specific skills in this group as extremely important or important. More than 70% agreed that using cell references and entering basic math formulas were extremely important skills. Another 50% or more of respondents rated using data validation techniques, applying basic formatting, and freezing panes as extremely important. And although calculating mean, median, mode, and standard deviation was ranked much lower than the other skills listed, more than half of the respondents still considered it extremely important or important.

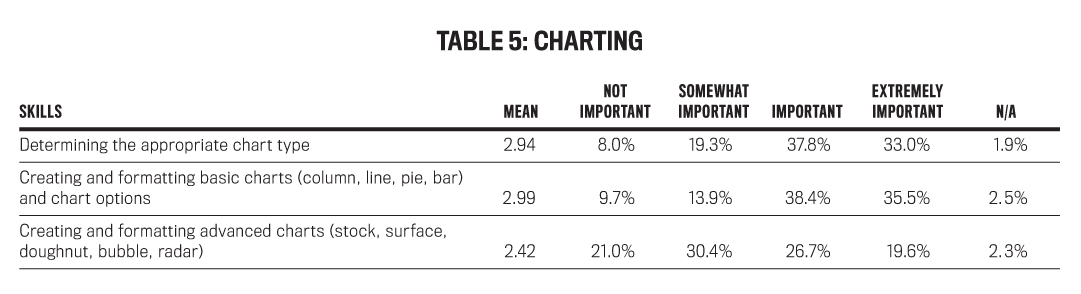

Charting. Excel charting skills were ranked as extremely important or important by 55% of the respondents. These skills include determining the appropriate chart type and creating and formatting basic charts, such as line, bar, and pie charts. We also asked respondents to rank the skills associated with creating and formatting advanced charts, such as stock, surface, doughnut, bubble, and radar charts.

Participants indicated that determining the appropriate chart type and creating and formatting basic charts are important skills, while creating and formatting advanced charts are less important.

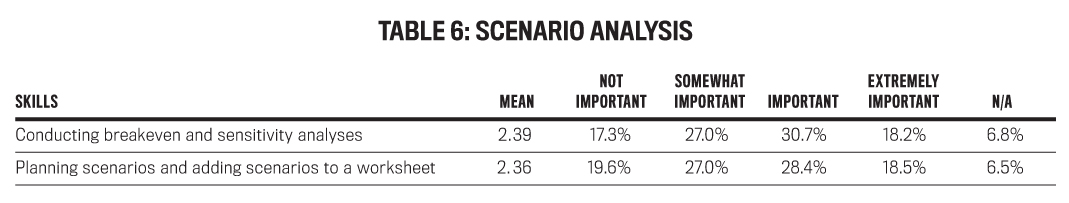

Scenario analysis. We asked respondents about two scenario analysis skills: (1) conducting breakeven and sensitivity analyses and (2) planning scenarios and adding scenarios to a worksheet. These were ranked as extremely important or important by fewer than half of the respondents, at 48.9% and 46.9%, respectively. But fewer than 20% of respondents in each instance rated these skills as not important.

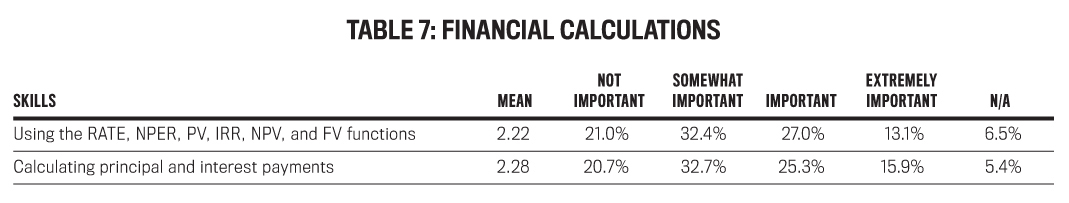

Financial calculations. Overall, financial calculations were ranked as extremely important or important by just 36.3% of the respondents. But less than 25% rated the skills of calculating principal and interest payments and using the time value of money functions as not important, so obviously these skills are still considered to be vital parts of an accountant’s tool kit.

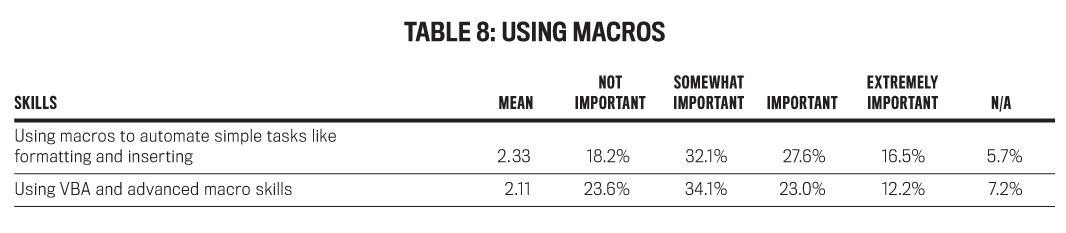

Using macros. Like financial calculations, macro skills were ranked as extremely important or important by a minority (34.9%) of the respondents, although another 35.5% found macro skills to be somewhat important. These skills were split into two types of macros. The first macro type was a basic macro that would automate simple tasks such as formatting, inserting, etc. Overall, 44.1% of the respondents ranked these skills as extremely important or important, with another 32.1% indicating these skills are somewhat important.

The second macro type ranked involves using Visual Basic for Applications (VBA) and other advanced macro skills. Respondents felt that these advanced macro skills weren’t as important; only 35.2% ranked them as extremely important or important, with another 34.1% indicating these skills are somewhat important. Still, only 23.6% of respondents rated macro skills as not important at all.

IMPLICATIONS FOR ACCOUNTING EDUCATORS

Even though Excel is sometimes maligned as “old technology,” many organizations today still use it. As Heidi Hanan explained: “Most corporations today use ERP [enterprise resource planning] systems. In many cases, however, accounting and finance professionals more commonly export that data into Excel. It’s easier and faster to sort, organize, filter, and perform calculations in Excel in many cases. You can also analyze data and create charts and graphs. If you look at job postings for accounting positions today, you’ll find that experience in Excel is a requirement. So, it’s important for new accounting professionals to know how to use Excel.”

As educators, we couldn’t agree more. We’re doing our accounting graduates a disservice if we don’t include Excel in the curriculum. One college course in Excel isn’t enough, either—while a good first step, it’s unlikely to develop the comprehensive, robust Excel skills that students need as accounting professionals. Excel needs to be integrated into our classes as a tool used to analyze and understand accounting concepts. That way, students will be exposed to Excel many times, creating lasting learning through repetition and reinforcement.

Of course, we aren’t advocating that Excel be the only tool used in the accounting curriculum. Other software, such as Tableau, Power BI, Alteryx, and SAP, are also quite important. But Excel remains the common denominator among organizations. When departments within a company exchange information, it often comes in the form of an Excel or comma-delimited file. When clients give information to their auditors, much of that information is in Excel. Accounting staff, therefore, need to know how to use Excel, even if the end goal is to use the information in another program.

When instructors are asked why they don’t teach Excel, they often indicate that there’s no room for it in the business or accounting curriculum. Faculty argue that their courses are already overloaded with accounting concepts and that they don’t have time to teach anything extra. That’s no excuse. Because it remains so ubiquitous in business settings, Excel shouldn’t be viewed as an “extra component” and should instead be considered an integral theme across all accounting courses.

As demonstrated by our survey results, employers still consider proficiency in Excel a much-needed skill for business school graduates. Teaching Excel simply can’t be skipped in the accounting curriculum; to do so would put students at a severe disadvantage. Instead, faculty should focus on the most important Excel skills and integrate them into their classes as a tool to teach accounting concepts so that students graduate with real-life technology skills that attract top employers.

Resources for Teaching Excel

For students to have a successful experience in learning Excel, faculty may need to incorporate tutorial videos in their course management system. Many high-quality tutorial videos can be found on YouTube or from Microsoft.

Faculty looking for Excel projects are invited to visit our two blogs, Accounting Is Analytics and Accounting in the Headlines. Many of the projects are Excel-based and include step-by-step tutorial videos. Our projects are aimed at introductory accounting, but most can be adapted for upper-level courses. The projects provide turnkey solutions for faculty who want to easily integrate Excel into the accounting classroom. Free for instructors to use in their individual classes, each project also includes an instructor guide with detailed instructions, solutions, grading rubrics, and other assessment options as well as a student guide that contains the assignment, software download instructions, and frequently asked questions.

We use the cases ourselves in our teaching. The Pepper Food Delivery case, which helps students understand transaction analysis and the accounting equation, is a perfect project to use in the first week of a financial accounting course when students are learning the basics of the accounting equation. For management accounting courses, we use the Ivy Corporation project (to teach students how to perform job cost analysis) as well as the Cabinet Accessories Company (to teach contribution margin analysis) and City of Somerville (to teach budgeting and performance evaluation) cases.

August 2021