The massive energy consumption plus the global e-waste from both threaten the environment and cryptocurrency sustainability.

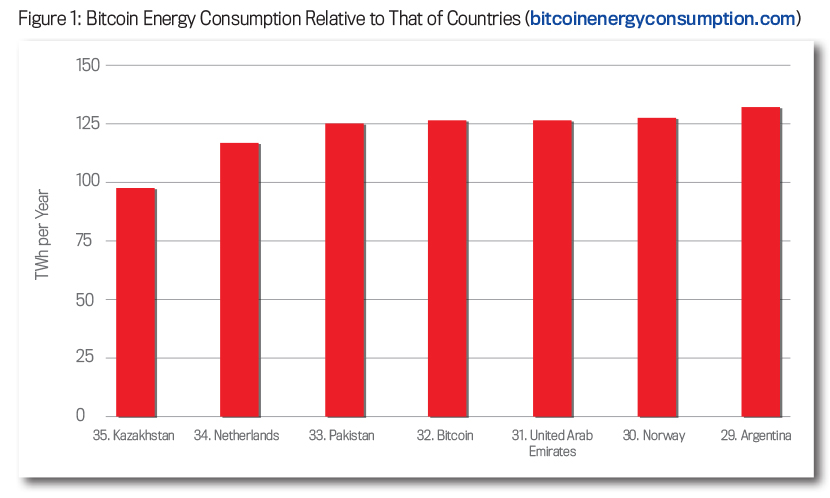

Bitcoin, the leading cryptocurrency, depends on a worldwide network of miners who do processing for the blockchain using an algorithm called proof of work. According to the Cambridge Centre for Alternative Finance, bitcoin currently consumes about 110 terawatt hours of electric power per year, which is about the same as the countries of Malaysia or Sweden (see Figure 1).

While conventional banking also consumes electrical power as it processes financial transactions, it’s nowhere near the levels of cryptocurrency. The Digiconomist group in the Netherlands has parsed bitcoin’s power consumption data in a number of interesting ways. Founder Alex de Vries and his group estimate that the footprint from a single bitcoin transaction is “equivalent to the carbon footprint of 1,716,811 VISA transactions or 129,102 hours of watching Youtube.” In terms of raw electrical energy, that’s “equivalent to the power consumption of an average U.S. household over 47.60 days.” The reason for the difference in energy requirements is that it takes a couple of terminals and a database to manage the VISA transfer, while it takes a community of miners around the world engaged in looking for a solution that will validate the block called the consensus mechanism. The first to get the solution earns bitcoins. Proof of work is an intense process, and the number of competitors at any given time is unknown.

Digiconomist explains the difficulty of the search: “The process of producing a valid block is largely based on trial and error, where miners are making numerous attempts every second trying to find the right value for a block component.... The number of attempts (hashes) per second is given by your mining equipment’s hashrate. This will typically be expressed in Gigahash per second (1 billion hashes per second).”

China had been a center for crypto mining, but once the demands from the mining farms began to encroach on internationally agreed-upon environmental limits it banned crypto mining outright in 2021. Other countries also have bans in place, and New York State passed a moratorium in 2022 on cryptocurrency mining that uses the proof of work algorithm.

Mining farms don’t use conventional computers. Their equipment has an average useful working life of 1.3 years. These small computers are specifically designed for mining and can’t be repurposed when they fail. In 2020, it’s reported that bitcoin generated more than 37.27 kilotons of e-waste. Researchers say that less than 20% of this waste is collected and recycled. The rest is sent to disposal sites to be buried, toxins and heavy metals included.

CHANGING THE ENGINE

An alternative method for mining is called proof of stake, and Coinbase explains that it serves a similar function to proof of work’s function but “in general proof of stake blockchains employ a network of ‘validators’ who contribute—or ‘stake’—their own crypto in exchange for a chance of getting to validate new transaction, update the blockchain, and earn a reward.” The process consumes far less energy and is used currently by Cardano and other cryptocurrencies.

Ethereum, the number two cryptocurrency, began its own transition to proof of stake in December 2020, and it finally completed the transition in mid-September 2022. This wasn’t an easy thing to do, and Investor’s Business Daily invoked an adopted metaphor for the difficulty of the change in its headline on September 15: “Ethereum Changed Engine While Car Was Running.”

The Crypto Carbon Ratings Institute called the switch “one of the largest and most complex upgrades to any cryptocurrency network in history.” Its report The Merge—Implications on the Electricity Consumption and Carbon Footprint of the Ethereum Network estimates that the change reduces the electricity consumption and the carbon footprint of the Ethereum network by more than 99.988% and 99.92%, respectively. Prior to the changeover, Ethereum, like bitcoin, was consuming massive electrical power, equivalent to the national annual demand of Bangladesh.

There will no doubt be blowback from the proof of work miners and those who see Ethereum as a competitive threat, but the more important questions now are how well the proof of stake system will work at Ethereum’s scale and who else will follow its example.

November 2022