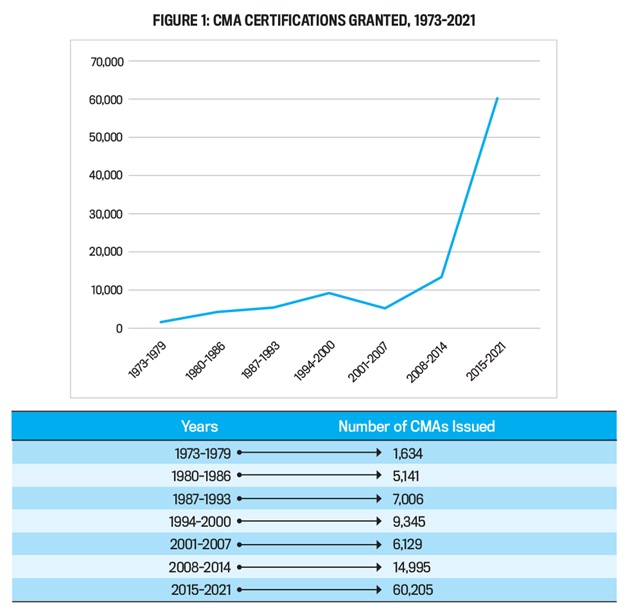

Ever since IMA® (Institute of Management Accountants) debuted the CMA® (Certified Management Accountant) certification 50 years ago, management accountants have taken on the challenge of earning the designation and then spreading the word about why those efforts would be worthwhile for their peers to emulate. The CMA’s prestige and growth have resulted not only from these individual professionals telling their stories, but also from hiring managers, human resources (HR) professionals, and companies prioritizing candidates with the CMA during the recruitment process and supporting employees who seek to earn the credential.

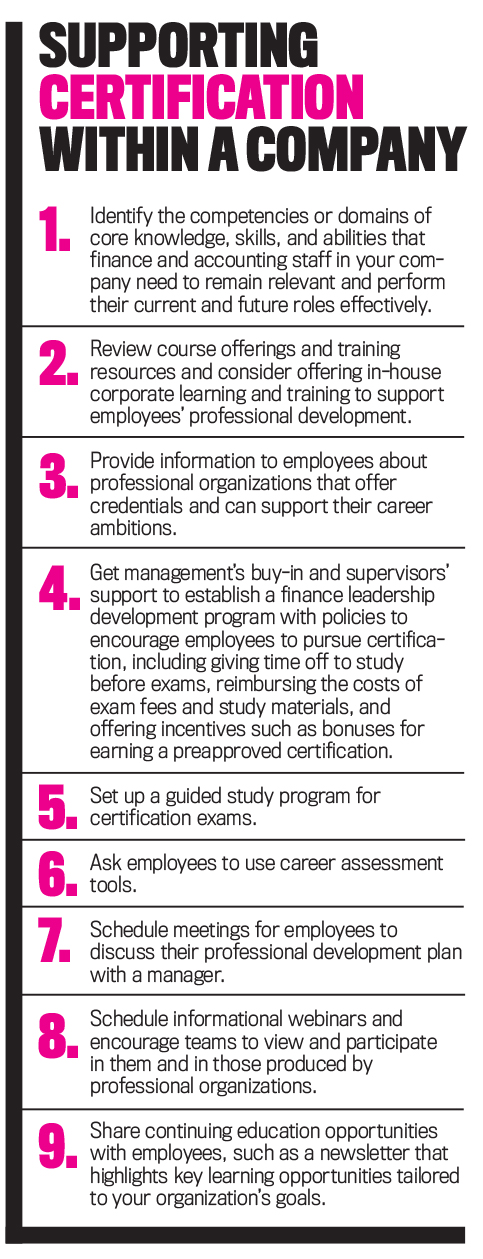

There are several commonalities among the policies and culture of companies that prioritize certification in their recruitment and professional development initiatives. These can be good examples for organizations that want to improve in the same areas.

FROM CATERPILLAR TO OWENS CORNING

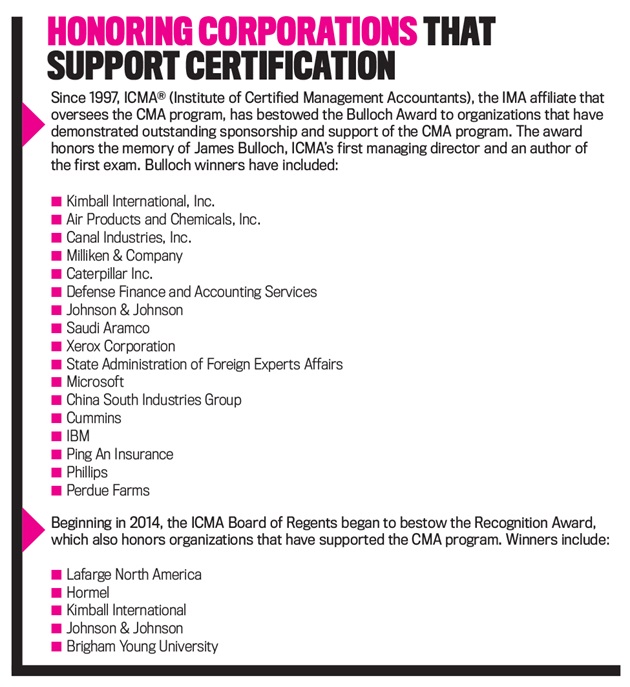

Jennifer Wolfenbarger, vice president and group CFO of the insulation division at Owens Corning, as well as a former division controller at General Motors (GM), group CFO at Stryker, and division CFO at Caterpillar, earned her CMA while working at Caterpillar, which strongly encouraged employees to pursue certification (see “Honoring Corporations that Support Certification”). Caterpillar supported the CMA and CPA (Certified Public Accountant) at the time and has since expanded to other certifications.

“Through my development conversations at Caterpillar, I knew I wanted to take more of a corporate business-partner path through to a CFO role,” Wolfenbarger says. “As I was working through my development plan, I loved what the CMA offered in terms of more of a management and strategy focus, in addition to a good base of technical accounting.”

There were only a handful of CMAs when Wolfenbarger joined Caterpillar in 2005, but there were a lot of CPAs. She researched both and took and passed the CPA exam but never kept up with the requirements. Instead, she focused on the CMA, and her immediate manager, who reported directly to the CFO, was supportive. The organization paid for her test preparation and exam and enabled her to take off a couple of days leading up to each part of the CMA exam in order to prepare. Her current company, Owens Corning, has a similar policy. (See “Supporting Certification within a Company” for steps any organization can take to encourage and empower employees to earn a professional certification.)

“In general, Caterpillar is supportive of continuous learning,” Wolfenbarger says. “I chose the CMA based on where I wanted to take my career—I really love strategy, the aspect of growing the business and driving it toward a better future, so my company was very supportive of the CMA path and saw it as a really good fit for what I wanted to do with my career.”

Wolfenbarger says that Owens Corning expects leaders to prioritize employees’ professional development. She feels that it’s critical to establish a culture of professional development and to communicate to staff that the company is willing to give the time off needed to properly prepare for the CMA exam and support them throughout the certification process.

“Those development conversations that you have with your leader, specific to what you want to do with your career, are an important part of our DNA, so that’s a great forum to say, ‘I see this as an opportunity for you to really take your game up a level,’” Wolfenbarger says. Wolfenbarger says that the CMA exam is rigorous, and earning the certification added cachet to her résumé, helping her navigate the strategic business partnership path that she wanted to take. In addition to bolstering her business partnership credentials and the strategy side of what she brought to the table, it provided a great refresher on the management accounting elements of her job.

“Prepping for and attaining the CMA really opened my eyes to the importance of focusing on strategy as a finance leader and constantly working at ‘How can we up our game?’ from a business perspective,” Wolfenbarger says.

At both GM and Caterpillar, she says she wouldn’t have been able to move beyond a certain level without certification. Both required all accounting and finance professionals to get some sort of certification to get promoted to manager level or higher, so it was career limiting for those who chose not to or were unable to do that. Her former employer Stryker had a selective financial rotational program, which was one avenue to bring talent into the company, and all participants needed to get a certification to complete the program.

In her role with Stryker, Wolfenbarger worked on reevaluating the company’s data analytics strategy and reached out to various IMA employees to get advice on best practices to follow and pitfalls to avoid. She’s continuing to do so in her current role at Owens Corning, which is in the early stages of its data analytics journey.

“IMA is a great forum for sharing best practices and to get a lot of different perspectives from professionals at different companies in or out of our industry, and I’ve continued to leverage this [organization] for continuous learning and to meet professionals through webinars and conferences,” she says.

When it comes to the recruiting process, Wolfenbarger says that having the CMA demonstrates that candidates have gone through the rigor of preparing for and attaining that certification and indicates that they’re capable of a high level of performance. She also stresses the importance of continuous learning that comes with the CMA and maintaining IMA membership.

“Continuous learning, including taking advantage of the programs that are offered through IMA, sets that individual apart, so I definitely see value there, as there’s a lot that comes with the certification beyond just a piece of paper,” Wolfenbarger says. “[The candidates with CMAs] have a linkage to opportunities for benchmarking and learning from CMAs at other companies and through the courses that are offered through IMA.”

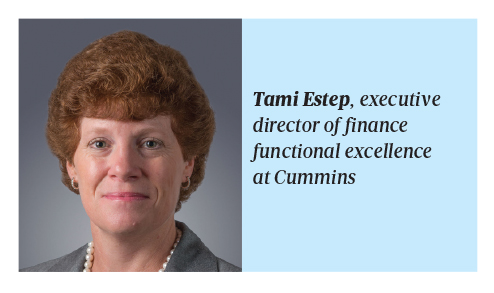

CUMMINS NURTURES FINANCE TALENT

Tami Estep, executive director of finance functional excellence at Cummins, joined the company in the late 1980s. At the time, some of the company’s senior leaders were IMA members who participated in a local chapter near Cummins’s corporate headquarters in Columbus, Ind. They offered guidance to finance professionals that continuing professional education (CPE) and certifications are important and promoted the CMA in particular, reimbursing the cost of employees’ exam fees and study materials in an effort to boost their accounting capabilities.

“When I started working at Cummins, my manager encouraged me to both join IMA and pursue the CMA, which I did,” Estep says. “He said, ‘This is a good way for you to improve your accounting skills, as well as reinforce the managerial accounting [education] that you’d gotten through school.’”

A key to the success of any certification initiative is to get commitment from the CFO right from the beginning. In addition, having the requirements and goals that finance leaders want from a certification clearly outlined is crucial.

“As you launch, be clear on what you want out of a certification—that the skills being trained are relevant, that they’re being tested, that there’s an experience component, and that it has continuing education—and incentivize participation in the program by giving employees support,” Estep says. “Providing support for certifications all the way from the top is important—not only financial support, but also flexibility [for employees] to study for and take their exams.”

Cummins held live CMA exam preparatory study sessions at the corporate headquarters led by an accounting professor from a local university. Estep participated in those sessions and received her CMA within the first five years of her employment at the company.

“Getting the CMA requires some kind of experience level, and then it requires continuing education credits because we all know that things change and people need to continue to develop their skills—that’s one of the things we really like about the CMA and why we’ve continued to support it,” Estep says.

Cummins launched the Finance Development Program as a campus recruiting initiative to provide recent graduates and early-career professionals with training to boost their experience in planning, forecasting, reporting, financial analysis, audit, plant finance, transaction support, and treasury. Program participants are required to obtain a certification during their two-year rotation working on various teams across the finance function. As for Cummins’s professional recruitment efforts, its job postings for finance roles are tagged “certification preferred.”

“We’ve seen that with our employee base in those individuals that have the CMA, and particularly for those that are getting recruited or promoted into additional responsibilities or more senior roles, having that experience has provided more capability,” Estep says.

During Estep’s time as an IMA member, the CMA experience has grown stronger and become more global (see Figure 1). She has enjoyed seeing the CMA expand worldwide and become one of the leading certifications that management accounting and finance professionals in China pursue.

“Compared to several years ago, it’s definitely a more global certification now,” she says.

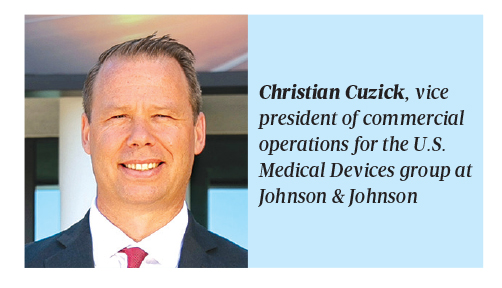

J&J VALUES CMAs

In 1997, Johnson & Johnson (J&J) launched the Finance Leadership Development Program (FLDP) to cultivate early-career professionals through training, continuing education, job rotations, and mentorship. The program targets recent graduates who majored in accounting, finance, economics, data analysis, technology, business administration, or business management. Program participants complete two rotations over two and a half years in various finance disciplines, including accounting, financial reporting, internal auditing, operations, research-and-development finance, and sales-and-marketing finance. Emphasizing leadership skills development, FLDP includes five weeks of classroom instruction and e-learning courses and assists participants in building a network of peers, mentors, and business leaders.

FLDP doesn’t require participants to obtain a certification, but J&J finance executives encourage them to do so. In addition, IMA personnel give presentations about the benefits of the CMA at finance training sessions, and the organization offers guided self-study cohorts. J&J covers CMA-related costs such as study materials, exam fees, and IMA membership dues and offers a monetary award to employees who earn the CMA as their first certification.

Many senior J&J executives, including current and past CFOs and corporate controllers, have earned the CMA and consider the credential to be an asset for employees being evaluated during the company’s succession-planning process. On that list is Christian Cuzick, vice president of commercial operations for the U.S. Medical Devices group at J&J, previously vice president of finance for the company’s Vision business (and a former Chair of the IMA Global Board of Directors). He joined J&J’s finance department as an MBA graduate without any prior finance or accounting experience, or a certification. Cuzick was encouraged by his manager, who was a CMA and CPA, to sign up for the CMA study courses and take the exam.

“When I was recruited into a finance role, one of the very first challenges I faced was a peer set working alongside me who were either a CPA or CMA, and I was uncomfortable navigating a lot of the accounting topics,” Cuzick says.

After Cuzick completed the CMA, J&J paid him a bonus, part of an incentive structure in place at the time he came into the organization. Certification is encouraged to further employees’ professional development by compensating them for the time and effort necessary to earn the CMA. In addition, those who achieve a professional certification get recognition from their direct manager and senior management.

“The CMA certainly was very attractive from the perspective of being able to immediately gain some credibility and personal knowledge about the way accounting works and get myself up to the competency and proficiency of my peers,” Cuzick says.

Most MBA programs don’t focus on accounting but rather are more oriented toward preparing students for careers in investment banking, private equity, venture capital, management consulting, or entrepreneurship. Upon graduating, those weren’t the areas that Cuzick wanted to pursue. He was, however, very interested in working in finance because coming into his MBA program from a general management background, he wanted to acquire hands-on knowledge of accounting, financial statements, factors to look for when investing in and growing a business, and making necessary trade-off decisions.

“It was very enticing to join a large multinational company that would take a risk on hiring somebody in its finance area who had no prior close experience or accounting experience, but I was going to invest the time, effort, and energy to make sure that I would be confident in that area alongside my peer set,” Cuzick says.

J&J communicates to employees that certification is an important area of the overall professional development of its finance professionals and supports the CMA certification, along with only a few other certifications, as being consistent with that ethos and applicable to jobs in the finance function. Cuzick stresses that making a commitment to promoting certification from the top down is key.

“My manager at the time encouraged it, and that was a big part of my pursuing it,” Cuzick says. “The company is certainly making an investment dollar-wise, and it’s an investment of employees’ time outside of work when they aren’t going to be spending time with family or with friends, so they have to step up and make that commitment to studying and learning concepts so that they can apply them.

“The ‘Aha!’ moment for me was realizing that the commitment is also an ongoing one because the CPE is an integral part of how finance professionals keep current with the times and stay up to speed on all the relevant things happening in our profession, whether they’re new [U.S. Securities & Exchange Commission]-related disclosure requirements, new revenue recognition rules, or even new accounting concepts,” he says.

J&J lists “certification preferred” on its finance job postings, and the CMA and a small number of other preferred certifications are a feather in the cap of experienced finance candidates who hold one or more of them during the recruitment process.

“Especially [candidates] who have gone above and beyond their attainment of a four-year degree or even an advanced degree by investing in themselves with certification, we know that [they’re] committed to developing themselves professionally, so certification is certainly a preferred option,” Cuzick says.

While the name recognition of the CMA has come a long way, especially among senior finance executives worldwide, its profile continues to rise among students, early-career professionals, HR personnel, and hiring managers. But awareness of the CMA can vary from one school to another.

“You have certain schools where [awareness and knowledge of the CMA] is very strong and we have a deep connection for recruiting, and then it’s almost like we know that the candidates are going to be well versed in terms of what we expect for certification,” Cuzick says. “But when you get into some of the smaller schools or universities that don’t have an IMA student chapter, we do have to explain it to them.”

Given the ongoing challenges that all certifications are facing, a renewed global push around the importance of certification, explaining to students and professionals why they should consider getting certified, needs to be supported better, according to Cuzick. In addition to touting the benefits of achieving certification, he says that professional organizations, including IMA, need to continue communicating their value in keeping professionals up to date on what’s new and relevant in the ever-evolving management accounting and finance profession.

“Folks shouldn’t just leave school and then they’re done for the rest of their lives in terms of their education, as there’s always a lot of changes to learn about, prepare for, and adapt to,” Cuzick says. “There’s a recognition among associations that there are areas that they can do better in, but I do think that certification is an important extension of an ongoing professional development plan.”

June 2022