MORE PLATFORMS EMERGE

Low-code application platform providers are increasing. Equipped with these platforms, management accountants can evolve to become champions in the financial digital transformation journey. Vendors whose platform may be known across the industry include:- OutSystems

- Appian

- Microsoft (Power platform)

- Salesforce

- Mendix

COMMON FUNCTIONS

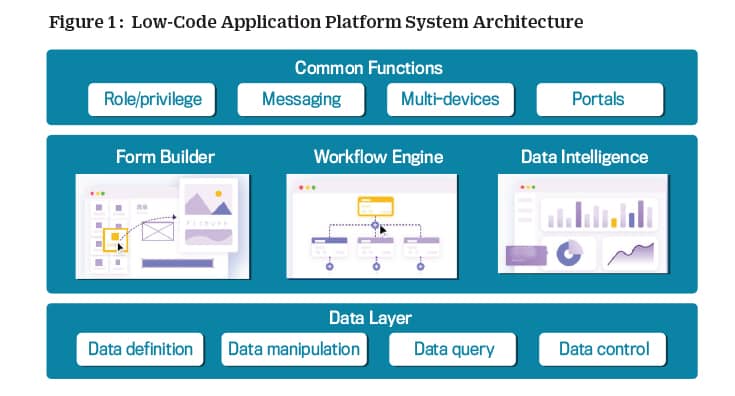

Most low-code application platforms provide similar functions that enable users to build their own applications with little to no professional IT help. (See Figure 1 for more detail.)

- Form builder. End users can rapidly build a new form by themselves. For example, a finance professional can create an expense application form with just his or her financial knowledge and simple drag-and-drop mouse steps.

- Workflow engine. Continuing with the form builder example, after building an expense application form, the user can then continue to design the approval flow using the same drag-and-drop operations. No code is required.

- Data intelligence. The end user can also build custom analytics across multiple data sources without typing one line of source code.

BENEFITS FOR THE FINANCE TEAM

Fabrizio Biscotti, vice president of research at Gartner, notes, “The economic consequences of the COVID-19 pandemic have validated the low-code value proposition.” And end user development has become a crucial means of driving digital transformation for finance teams. McKinsey & Company research estimates that 42% of finance activities can be fully automated, but traditional IT-dependent software development is slowing down productivity and responsiveness to changing business needs. My own research shows that adopting end-user development in finance activities can benefit finance teams in multiple ways.

- Shorter duration. Without back-and-forth discussion and clarification of requirements between finance users and IT professionals, non-IT employees can build their enterprise-level applications easily with drag-and-drop interfaces and automated workflows, so go-live speed will be faster than ever. Unlike the several months or multiple years required for traditional software development, low-code platforms enable finance professionals to draw their own applications within weeks or even a couple of days.

- Reduced cost. About a 70% cost reduction can be expected with low-code platform adoption, compared to that of traditonal programs used for software development. It can also free up IT professionals’ time so that they can focus on higher-value strategic tasks such as IT landscape road maps.

- Higher employee satisfaction. Low-code platforms allow finance teams to achieve independence as well as upskill across the team and drive finance process innovation. Increased transparency and enhanced innovation increase employee satisfaction for both the finance team and IT team.

- Greater return on investment (ROI). Besides faster development speed, low-code capability also equips finance teams with the agility to adapt as business needs rapidly change. For example, when company policy requires the addition of a new column expense category in an expense application form, end-user developers only need to drag a new list box component into the expense application form and publish the new version to the entire company application store. This kind of speed and agility allows finance team to do more with less. Enterprises will benefit with a greater ROI.

December 2022