It may seem like blockchain and cryptocurrencies have run out of steam and that every high-impact application has already been discussed; that couldn’t be further from the truth. The rise of central bank digital currencies (CBDCs) is happening faster than many practitioners expected, and its implications spread far beyond just accounting.

Comments at the end of 2020 by the chair of the Federal Reserve System highlight that while a CBDC project isn’t under way at this specific time, there are several quantifiable ways in which blockchain can improve the current payment infrastructure.

CBDC is a cryptocurrency that’s issued and governed by a central bank or central government. While CBDCs and existing fiat currencies will coexist at the beginning, the pivot toward digital payment options is a structural one rather than a passing fad. Unlike with traditional cryptocurrencies such as bitcoin, CBDC development will be accompanied by regulation, which can facilitate and accelerate adoption. Simply put, CBDCs are a potential game-changing iteration of blockchain and cryptoasset technology, and they’re arriving quickly.

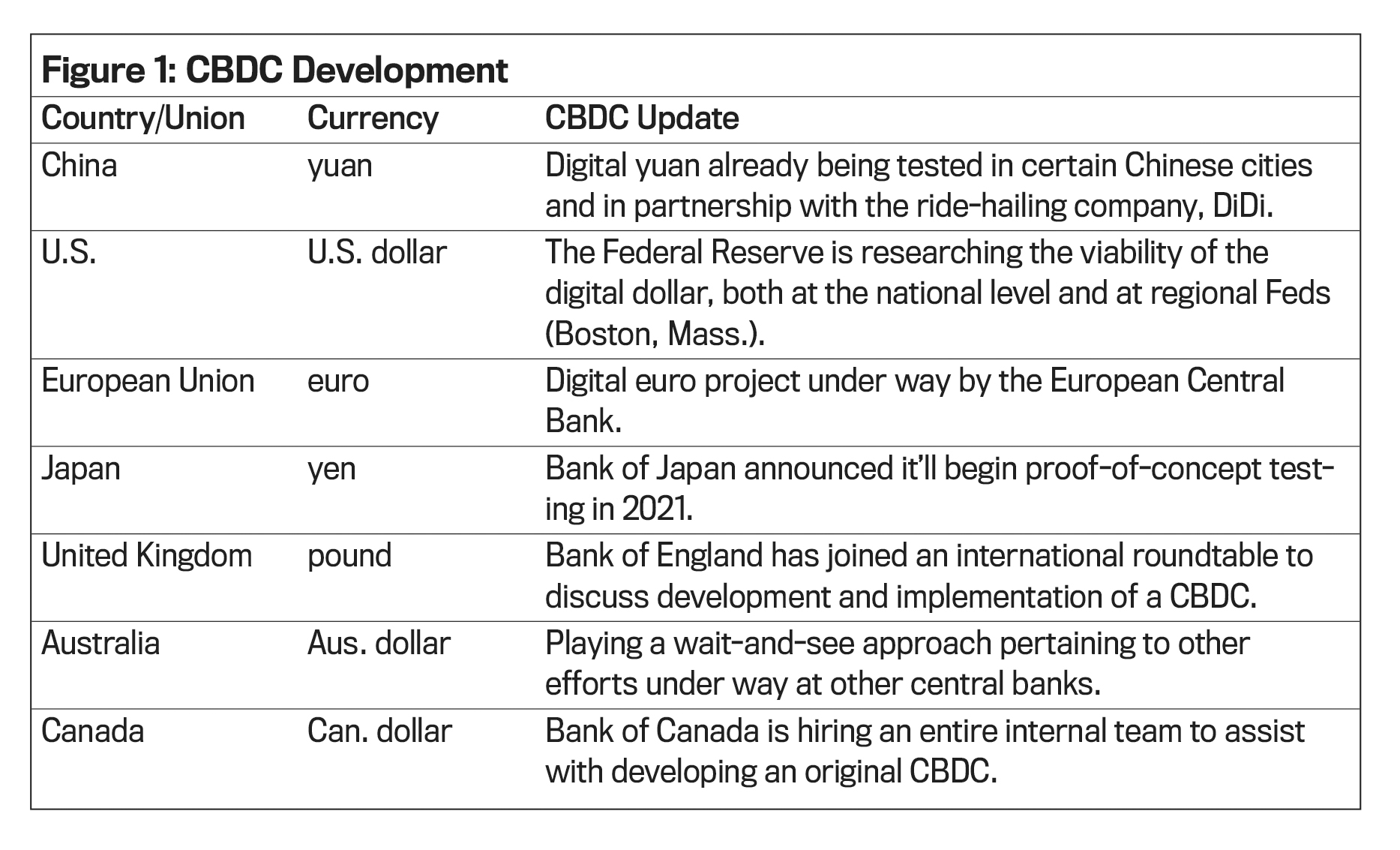

Two distinct trends need to be acknowledged regarding the continued development of CBDCs. First, this is a much broader conversation than simply discussing e-money. Every major economic power in the world is investing resources and dedicating personnel to the development of this blockchain application. Second, no major economic power in the world has dismissed the potential for CBDCs. See Figure 1 for CBDC status in select places around the world.

As we approach the end of 2020, China seems to be in a clear leadership position, with market testing of the digital yuan already taking place in several major cities. That early success aside, the true indicator of a successful CBDC will be one that’s used both in its country of origin as well as internationally. Developing markets within Africa—with Kenya having received significant coverage for its efforts—or small nations such as the Bahamas have leapfrogged the United States and Western Europe in terms of digital or blockchain-enabled payments. These developments show just how dramatically accounting, payments, and reporting can change over time.

THE PAPERLESS REVOLUTION

Transaction speed, immediate settlement, paperless flows, and straight-through processing are obvious benefits of a digital currency and payment system. Payment digitization and automation will continue to reduce the dependence on humans to perform manual and repetitive operational tasks. While manual tasks are being eliminated, digitization is creating a rich array of complex data that requires unique skills to mine, model, and analyze—sometimes in real time. With the digital world expanding around us, the need for advanced data analytical skills is a huge opportunity for finance professionals.

Treasury and payments departments are ahead of the game in terms of implementation, but they still have opportunities to generate additional cost savings. Digital payments, whether they’re connected to blockchain and cryptocurrencies or not, have transformed almost every form of treasury functionality. Letters of credit, wire transfers, automated clearing house payments, bond issuances, and the accounting that goes along with these are quantitative examples of benefits that have already been actualized. With digital payments and other forms of automation, the push for a continuous close and reporting process will only increase. Outstanding balances connected to accounts receivable and accounts payable, and the need for confirmations and verifications, will also shrink.

THE BLOCKCHAIN CONNECTION

Blockchain and cryptocurrencies have generated nearly endless headlines since 2017. That said, for practitioners to be able to offer comprehensive and realistic advice to colleagues and supervisors, it’s important that the type of blockchain technology being discussed is understood by all parties involved. Without diving into overly technical details of specifications (for more, see bit.ly/387HdNV), there are several core considerations that need to be assessed and incorporated into a blockchain digital payments network.

The most important consideration is the set of controls around the payment channels, from both a cybersecurity and financial reporting point of view. Assuming that the type of blockchain being considered is a permissioned blockchain—a type of blockchain that allows the organizing companies to customize the blockchain to fit the need of the enterprise—establishing controls over access and data rights is critical. Following initial implementation, there should always be an assessment of how the blockchain itself will interoperate, i.e., communicate with other technology platforms that are already in place at the entity. Nearly all of the hacks and breaches that have occurred around the digital and crypto payment space have occurred at these connection points rather than at the specific blockchain or digital payment platform.

The underlying reality of the situation is that, no matter what specific payment technology tool or infrastructure is being used—blockchain or not—digital transactions are here. Whether they take the form of applications developed by incumbent financial institutions or cryptocurrencies, the accounting profession will need to keep pace. The role of accounting and finance will obviously evolve and change as a result of this increased digitization—but that doesn’t mean it will become less important, especially as various iterations of blockchains become increasingly integrated into payment infrastructure practices. Whatever the future holds, CBDC will be game-changing.

December 2020