Presbyterian is one of the largest nonprofit providers of senior care in the U.S., offering healthcare, housing, and services to more than 9,000 seniors annually. Our growth, mission, financial success, and ability to thrive vs. survive in a challenging healthcare environment have been driven by our strategic planning and execution.

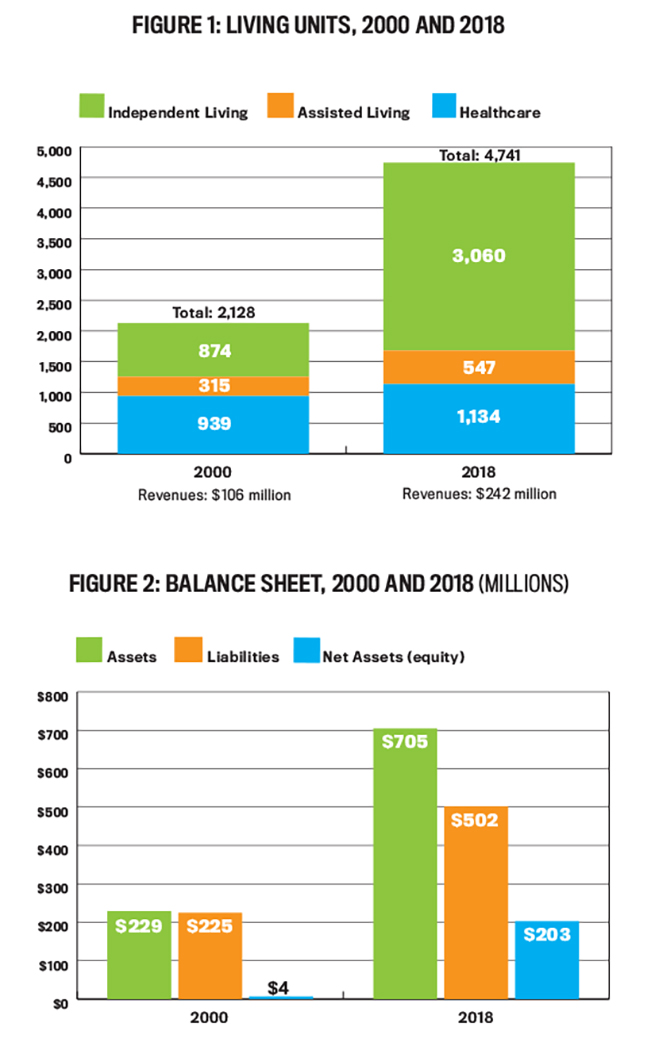

In the year 2000, healthcare made up 41% of Presbyterian’s total number of living units and 70% of our total revenues. Today, healthcare represents 24% of our living units and 49% of our revenues. Everyone in the senior care industry expects healthcare revenues per unit to decrease further over the next several years. The multiple past and present federal and state legislative initiatives in the healthcare arena are targeting all areas of healthcare spending, especially those on Medicare and Medicaid. Insurers and employers as well are aggressively reducing their healthcare costs. Many of those in the senior living industry are struggling with these challenges, which has resulted in closings, sales, restructurings, and, like most of healthcare, consolidations.

Presbyterian’s success in this very challenging time hasn’t come from watching and reacting. We have proactively planned and led ourselves to mission and financial success. Since 2000, Presbyterian’s total number of living units has increased by 218%, revenues have grown by 230%, and asset growth has increased almost 300%. Net assets (equity in a nonprofit) has improved from $4 million in 2000 to $203 million today. (See Figures 1 and 2.) This growth has been both internal as well as from affiliations with other nonprofit senior care providers that joined Presbyterian to benefit from our combined intellectual and financial capital.

Many nonprofit providers are seeking to affiliate with, or become part of, a larger system. While this is much like an acquisition for the larger entity, to some degree it’s becoming part of a family. Rarely is any money exchanged. Both organizations desire to maintain each other’s mission and identity while helping both achieve more together. The parent board often includes board members from the affiliate and has the right to control affiliate boards, but often these remain in place to support a focus on the community the affiliate serves. Presbyterian’s success truly is from the sum of our operations and profitably delighting our customers.

Here’s one example: In 2009, Quincy Retirement Community, a large independent nonprofit senior living provider with more than 300 living units, became part of Presbyterian. Quincy had limited debt but had a large burden with the investment in capital and technology needed to address the changes in healthcare at that time. Since becoming part of Presbyterian, its operations have thrived, and with the number of units being added this year, the campus will have grown by more than 30% since affiliation.

Opportunities have presented themselves during this time, but it’s strategy that has provided Presbyterian Senior Living with the ability to capitalize on opportunities and enhance our financial strength while greatly expanding our mission. Our finance area has played a critical role in the process.

FINANCE AND THE STRATEGIC PROCESS

Finance must be an integral part of the strategic process. Yet a Deloitte study reported on in the May 2017 issue of Strategic Finance, “The changing role of controllership,” noted that “91.2% of all organizations expect the controllership function to more directly determine strategic priorities in the future. That said, only 37.6% of respondents believe their current financial leadership offers the kind of vision that shapes business growth.”

The business environment needs accounting and finance professionals to develop the skills and behaviors required to play an essential role in driving business strategy. Without this, we may find ourselves in very important roles but essentially managing the present and remembering the past. With our participation in strategy, we can contribute greatly to our organizations’ future as well as add to our personal value as finance professionals.

THE THREE E’S

Successful engagement in the strategic process requires finance professionals to play key roles—and often lead the process—in three specific ways: education, evaluation, and execution. Let’s look at some things we in our finance area have learned that contribute better to Presbyterian’s strategic planning and performance.

Education

Far too often, we as finance professionals presume that if we create great information, our work is done. Never think that. Education is the bridge between information and knowledge. With the diversity of leadership skills and backgrounds in today’s organizations, proactive education about how our work in finance and accounting can and should influence business decisions is essential to strategic success.

If there’s one key concept here, it’s this: Compiling and sharing information doesn’t always result in knowledge. Reporting doesn’t always lead to understanding. Business leaders have diverse backgrounds and training, and we accounting and finance professionals are inundated with information. Our job has to be to inundate these leaders with wisdom. Education has to be an important part of our work.

Perhaps the attention-directing function many of us learned about in college, where management accountants provide information that’s important for managers to focus their attention on, should be thought of today as the attention-educating function, where we also explain what that means to organizational success. Most of us in finance don’t think of ourselves as educators, but we can contribute much more than information by being one.

Some steps that we at Presbyterian have found helpful are:

- Never assume that what you’re communicating is understood the same way you understand it. Make sure to explain key concepts and what they mean. Talking and writing in a language that your listener understands is essential. Avoid abbreviations and “finance speak.”

- Educate about principles and concepts concerning specific areas before sharing information. For example: An important measure affecting credit ratings is the debt service coverage ratio, which measures operational production of cash over debt service for the same time period. This may also be the most common debt covenant lenders require. We share this ratio all the time along with the three measures that produce it. But this doesn’t mean our internal “customers” understand it and its importance. Now we also talk about the sources of operating cash flow, the costs of borrowings, and, most important, what that extra cash flow provides in terms of furthering our mission.

- Tell your audience what they’re going to see and how it applies to the business decision being made.

- Ask questions and solicit feedback to ascertain understanding.

- Constantly educate your finance and accounting team about these concepts.

Information without knowledge is just that. We might as well share a random page of numbers from a phone book. We need to be looking at and driving strategies that will lead to future success.

A Presbyterian Senior Living Example

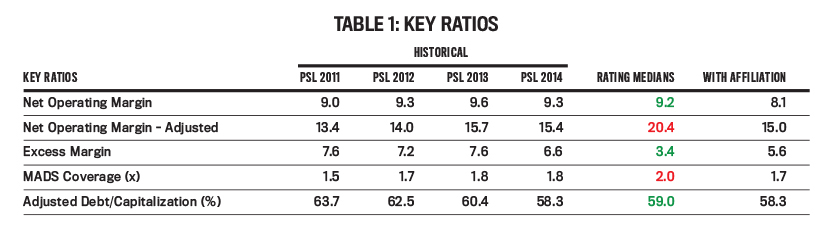

As Presbyterian evaluates the affiliation of others into our continuum, a key consideration is the impact of the affiliation on our investment grade credit rating. Senior living is very capital-intensive, and the ability to finance improvements, additions, and expansions at a low cost of capital is essential to our strategic success. Our finance team calculates numerous ratios comparing these to others in our credit rating category. As part of the work we did when considering an affiliation, the finance team could have communicated a portion of our work to Presbyterian’s board of trustees as shown in Table 1.

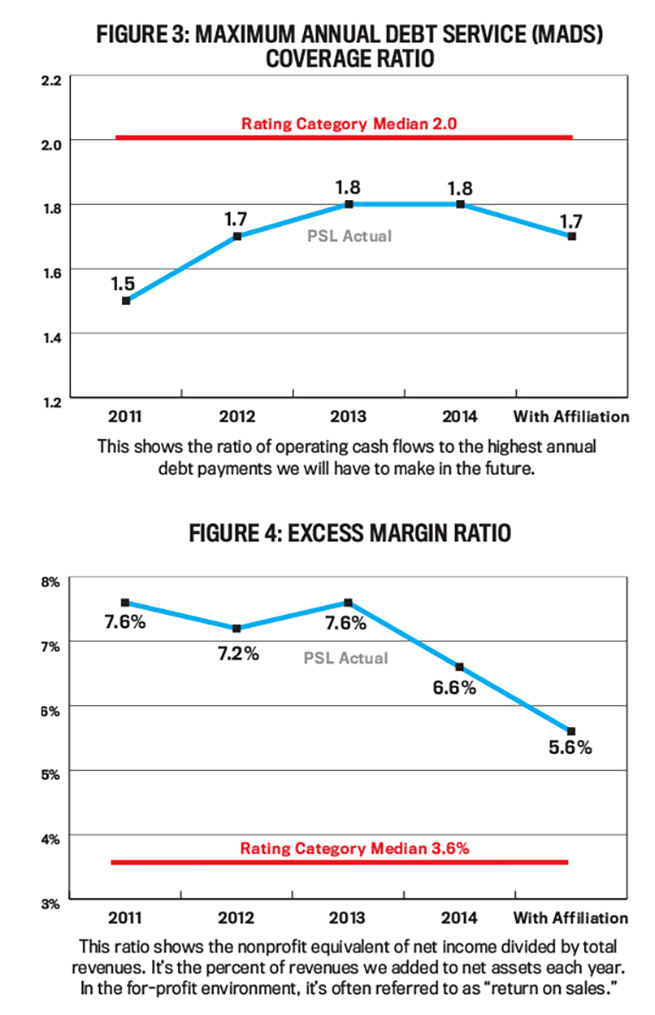

We track about 20 ratios, and all of them could have been shrunk to fit onto one page. But we would have used about a four-point font. (We’ve done worse.) “Shrink to fit” is the antithesis of good communication. As with many organizations, our board purposefully includes a great diversity of backgrounds to contribute to our success: healthcare professionals, those in ministry, business owners, a former rating analyst, etc. We need to educate. Figures 3 and 4 show how two ratios were presented better. A chart or graph is usually much more effective than words. It can give a sense of perspective that a narrative can’t. If we had pursued this affiliation, we would have added a three-year forecast of the combined results.

Education about our financial position and the credit-rating process at Presbyterian Senior Living began way before presenting any ratios. We continually educate our board and staff about our finances and share all the data and results of the ratings process with them.

To be most helpful, education shouldn’t be situational when we feel it’s important. It involves the constant sharing of information about how finances contribute to our present and future. For more than a decade at Presbyterian, we’ve put our monthly, quarterly, and annual financial results, along with key data, on our website. This includes our consolidated results and those of our largest affiliates. Any of our residents, lenders, employees, and board members can see our financial position and results monthly. We aren’t aware of another nonprofit with this level of transparency. Transparency and education definitely go hand in hand.

Evaluation

Evaluation involves finance’s analysis of the present reality and possible future. In many organizations, evaluation is the area that finance contributes to most often. Finance provides future operational plans, capital project analysis, financial markets planning, and execution. Finance professionals typically have a significant role in translating possibilities into financial outcomes.

We can add much more value being part of establishing strategy up front vs. quantifying it later. Some key steps finance professionals should consider in furthering their role in the strategic process are:

- Become one of the most knowledgeable people in your organization about trends and changes in the legal and business environment your organization operates in. As the U.S. federal tax reform moved through Congress in November and December 2017, no one at Presbyterian knew more about its potential impact on our financing and growth than our finance area. We led the discussions regarding its impact on our organization. As various board and staff members heard or read things and told us about them, we were able to let them know that we had already studied them and the impact and opportunity of the legislation as it progressed.Another example is that recently we agreed to pilot a new medical billing and collections program under a new state-mandated managed care program before it was implemented with other providers. The entire state will move to this new system over the next two years. This absolutely gives us a strategic advantage over other providers. As the state has implemented the new program, we’ve been able to change without a hitch. We know what to do, have done it, and it works very well. We were proactive vs. reactive.

- Become an expert about best practices in your industry. Here I’m talking specifically about finance and accounting but also about overall trends in the business. We believe finance has to understand what best practices are in all areas of senior care. Like the internal information we produce, external information is equally and perhaps more important to the strategic process. Our state housing agency has given Presbyterian an innovation award for our work in integrating affordable senior housing in our campuses along with green energy-efficient buildings, which in some locations reduced our energy spend by more than 50%.

- Provide tangible value-added knowledge and relevant information. Another senior living provider recently shared with us a challenge they had in pricing a specific area of service. We shared our method, developed over several years, which was in fact quite easy to implement. Their immediate reaction was, “That is a very good idea.” We hope it leads to some future tangible benefit for them and possibly for us.

- Build in-house talent. When we undertake an affiliation, virtually none of the finance due diligence is outsourced. We want our team to understand the details, formulate relationships, and then play a major role leading in the execution if decisions are made to proceed. They also participate in that decision making. This has greatly enhanced our contributions to Presbyterian’s success in all areas.

The quote from Deloitte earlier in this article noted the need for “vision that shapes business growth.” Vision is the sum of knowledge and initiative.

Expanded, this is Vision = Knowledge of the past, present, and what might be the future combined with the initiative to translate that into plans and actions.

Execution

Finance professionals have some of the critical orientations and skills to lead strategic execution. We can be valuable leaders of change. Three ways to do this are:

- Be the first in. When affiliations are undertaken at Presbyterian, our finance area usually leads the process. Once we have an affiliate on our systems with our data, then all areas of Presbyterian have key intellectual capital in a way we all understand it and can use it to implement any other needed changes. An additional benefit is the integration of the finance area first because this often results in the most significant economies-of-scale savings. Once we have systems in place, other changes also can contribute greatly early on though the finance consolidation leads to early and significant incremental cash flows.In everything we do, we think about how it can be performed better. Over the last two years, the Presbyterian finance area devised and then led a process for developing and constructing senior living apartments. As far as we know, Presbyterian is the first in the country to integrate units funded with federal low-income housing tax credits for seniors with limited incomes with units in the same building where seniors with more resources pay a fairly significant entry fee and monthly fees.

- Fill the gaps. Strategy frequently results in change. With change, there often are gaps in information or responsibilities, areas not thought of even with the best-laid plans. If a task or area isn’t being done, do it! Usually that’s temporary, but in the long run it will greatly increase the value of your career as well as contribute to the success of the organization.

EXECUTION ADVICE: Behave like a basketball team, not a golf team. Manage the team and process. Golf team members each plan and act independently and then add up their scores when the round is over. Basketball success is dependent on team members working together. They have to be aware of their teammates every moment of the game and use them strategically and opportunistically to achieve success.

MECHANIC, DRIVER, OR BOTH

If business is a highway and strategy propels us down it, finance professionals can be the mechanics who build and maintain the vehicle or the drivers who steer and direct it—or both. If pay is an indication of value, race car drivers are much higher paid than mechanics. But both are essential to success. So let’s look at ourselves with a goal of being both. In the right circumstance, no one may be a better driver than someone who understands the most about how the vehicle is built. The keys to this are:

- Become an educator. I’m not sure many car mechanics or finance professionals are good educators. Become one. Don’t assume that if you build it, anyone knows how to drive it successfully. Deliver information with education as to what it means to organizational success. Share knowledge as well as data.

- Be the evaluation expert. Know what’s happening in the business environment you’re operating in. If it’s raining outside on the road, we as finance professionals should be able to provide a great strategy for winning in whatever weather we face.

- Lead execution. Driving the first few laps provides valuable insight and knowledge to others who may play roles later in the race. Don’t be afraid to fill gaps. If it’s raining and the windshield wipers are missing, get some and put them on by yourself.

THE FUTURE

If it hasn’t already, financial reporting is becoming more and more systematized and automatic for most of us. Early in my career I spent a week each quarter manually doing warranty liability regression analysis on 12-column paper. Then we purchased a Radio Shack TRS-80 with eight-inch floppy platters. It shortened the work to a day. Today it probably takes a minute. The value proposition of finance team members to our organizations is evolving. What we’ve traditionally done doesn’t always add the most value today. We need to become educators, evaluators, and executors to help ensure the strategic success of our organizations.

A Finance Officer in Senior Living

I believe the greatest benefit and challenge of being a finance officer in senior living is the residents who have entrusted their lives and future to us. We aren’t a transactional business where customers change every day. Most will be with us several years. They are stakeholders. Many care about our communities and our finances. To this end, we openly share our financial information on our website, www.presbyterianseniorliving.org, under the About Us tab, and we have regular resident finance committees at our communities. The residents want to know, and deserve to know, that they are in good hands for both their care and finances.

Another challenge in my 20-plus years in healthcare is limited visibility of federal and state public policy and legislation that affects us all. We have to plan for a future where we often have to assume that several different changes could happen quickly and unexpectedly. New healthcare laws or governmental regulations can have a significant impact on our mission of caring for seniors. Most healthcare providers hope for more support but would be thankful for more stability. The challenges of healthcare funding—who pays for what—is a major macroeconomic issue in the U.S. and to some degree the rest of the world.

As CFO, most of my day-to-day work is strategic development, affiliations, and staff development. Like many others in healthcare, I’ve come to realize that economies of human and financial resources are leading to industry consolidation.

Also, staff development (the Education E) is very important to Presbyterian and our finance area’s success. I spend quite of bit of time on it. Humans are the constrained resource of this era, and we need to recognize how valuable they are in all that we do. My finance team does a wonderful job with all the traditional roles of management accounting: reporting, analysis, billing and collections, and planning. We’ve built systems where we can easily obtain and rely on that information to be accurate. My role as part of the leadership team is looking forward more than looking back. The great data is there when we want to look back. I have the exciting opportunity to help lead our organization into the future.

September 2019