This workfit approach is critical for remaining competitive in the new world of work, which is being shaped by the gig economy, disruptive technologies, the changing role of analysts and accountants, the Millennial workforce, and new service delivery models. Here’s what accountants, both those working inside organizations and those serving as consultants, need to know to stay in the game.

THE RISE OF THE GIG ECONOMY

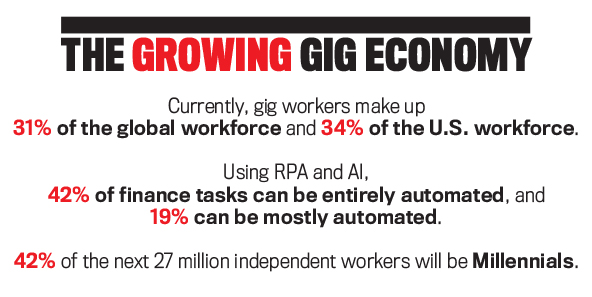

According to research by Intuit and Kelly Services, the gig economy—also referred to as the free-agent economy—is growing rapidly. It currently encompasses approximately 31% of the global workforce and 34% of the U.S. workforce. Experts predict that 43% of the U.S. workforce will comprise gig workers by 2020. Fueling this development is the growing number of workers in traditional professions who are choosing free agency over full-time, permanent employment. Also driving this trend are increased opportunities and new technologies that enable individuals to earn an income independent of any single employer. The rise of the sharing economy and organizations like Uber, Lyft, and Airbnb; the growth of cloud-based gig platforms like Upwork; and the opportunities presented by e-commerce platforms like Amazon and eBay have made it easier for people to be micropreneurs. That’s a term to describe individuals who operate businesses with fewer than five employees either as an extra source of income or as a full-time job.

What does this shift toward gig work mean for the accounting profession?

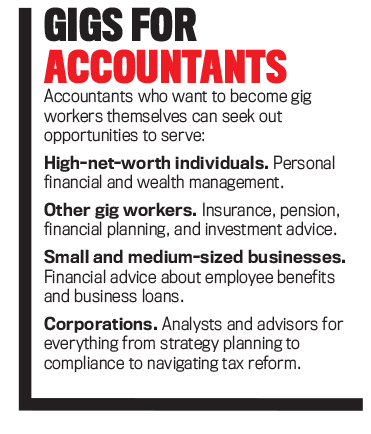

First, there’s the potential for much more work for accountants and financial analysts who want to serve as consultants. As we’ve seen, just under half the U.S. workforce will consist of free agents within a few years. Many of these individuals will be de facto first-time business owners who’ll likely need assistance keeping their books, filing their taxes, and planning their finances.

Indeed, free agents such as independent contractors and micropreneurs will need financial advice on everything from health and life insurance to pensions and from personal financial planning to business investments. Small businesses and start-ups also will need guidance about many financial aspects of running a company, including employee benefits plans, business loans, and fraud prevention.

In addition, accountants and analysts who work with independent contractors will have an opportunity to specialize in one or more specific niches (such as tax, insurance, financial planning, bookkeeping, or strategic advising). After all, the accounting needs of an engineer who’s an independent contractor are very different from those of a micropreneur who sells products on Amazon—and both will need accounting services. There’s also a difference between someone who only needs help with tax preparation and someone who requires assistance with a range of bookkeeping functions from invoicing clients to reconciling accounts receivable and accounts payable. That doesn’t mean there isn’t room for generalists. Still, considering the large number of people who choose service providers because of customer reviews or referrals, there’s clearly an opportunity to leverage specialization.

The gig economy also will present opportunities for accounting and finance professionals to work as consultants for larger organizations, serving as independent CPAs (Certified Public Accountants), financial advisors, controllers, tax preparers, and more. In fact, according to research by Kelly Services, 51% of global talent managers in finance and accounting currently use gig workers.

Free agency also is having an impact on those working in permanent, full-time positions and who are paid directly by an organization. Seeing the advantages their free-agent counterparts enjoy, many management accountants working inside organizations are requesting to work remotely some of the time, and some are considering options like job sharing or part-time work. They also want interesting projects and the opportunity to grow horizontally—within their current rank—as well as vertically by being promoted or climbing the corporate ladder. For these reasons, employers would be wise to tailor their work arrangements accordingly. For example, flexible arrangements can involve remote, deadline-oriented work as opposed to traditional 9-to-5 hours, and horizontal growth can involve things like taking on specific projects, gaining an additional skill set, or being cross-trained in multiple departments.

THE IMPACT OF DISRUPTIVE TECHNOLOGIES

Disruptive technologies—robotic process automation (RPA), artificial intelligence (AI), and blockchain—also are influencing the world of work. According to recent research by McKinsey & Company, 42% of finance tasks can be entirely automated, and an additional 19% can be mostly automated. These activities include accounting, accounts payable, accounts receivable, financial planning and analysis, payroll, and more.

Many tasks can be automated through RPA, which can work with a company’s existing IT structure to perform specific back-office functions in a range of fields, including finance and accounting. Recently, RPA has become much more sophisticated, affordable, and secure, making its adoption a viable option for many companies. EY, for example, now uses approximately 200 bots in its tax operations.

At the same time as RPA has become simpler, easier, and faster to deploy, there also has been a growing number of citizen developers—individuals who, despite not being formally trained in programming, are creating applications or workflows using IT-sanctioned no- or low-code platforms. As a result, companies no longer have to wait for their IT departments to develop workflows when they can enable motivated finance professionals to do it—with IT oversight to ensure security and compliance.

Many other accounting tasks can be automated using AI or, more precisely, cognitive automation and machine learning. For example, advanced algorithms are now being developed that can be used for auditing, predictive analytics, and risk analysis as well as to pinpoint discrepancies and identify fraud.

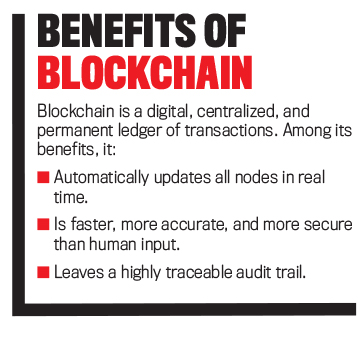

Then there’s blockchain technology. Blockchain is a permanent, centralized, and digital ledger of transactions. Each transaction is entered simultaneously into all the nodes on the blockchain in real time, which makes it almost impossible to corrupt. The records of the transactions are secured by means of cryptography. Whenever anything is changed at one node, all the other nodes on the blockchain are updated automatically and in real time.

Because of its ability to automatically update all records simultaneously and in real time, blockchain offers enormous potential for accounting. Everything from accounts receivable to accounts payable to the audit function is already being automated. Such technology decreases the need for manual journal entries, as well as for manual reconciliation and even auditing, making the entire bookkeeping process much faster and more accurate. It also becomes more secure because once the entry has been made in the blockchain, it can’t be altered.

There are still questions surrounding the security of blockchain, in particular how consumers’ proprietary information will be protected. But it’s important to understand that there are two main categories of blockchain: public and private. While public blockchains use the public internet, private blockchains create closed networks that are available only to members of the chain. It’s this latter type that holds much more promise for enterprises. Even so, the security of a private blockchain is heavily dependent on an organization’s protection against internal threats. That’s why more work needs to be done before blockchain can be considered sufficiently compliant for widespread use in finance and accounting.

These technologies have the potential to change the roles of finance and accounting talent in a positive way. They’ll actually create new jobs since there will be increased demand for tech talent with finance and accounting backgrounds who can create RPA workflows, write algorithms, oversee blockchain applications, and implement adequate security. In addition, there will be a growing need for talent who can work with the new technologies—individuals who are accustomed to the workflows, who can interpret the numbers generated by the algorithms, and who know how to use blockchain applications.

THE CHANGING ROLE OF ANALYSTS AND ACCOUNTANTS

There’s no doubt that a large segment of finance and accounting tasks can be performed by technological applications that are faster, more accurate, and more affordable than humans. This isn’t due only to RPA, AI, and blockchain but also to cloud-based accounting and finance tools that collect financial data and update it in real time. As a result, the need for human input in repetitive functions will be reduced.

It’s understandable that the rise of these powerful technologies has led to a widespread fear of displacement among many financial services professionals. Yet rather than simply replace humans, technology will more likely change the role of analysts and accountants, both independent CPAs and professionals within organizations. They’ll become less about pure “number crunching” and more about helping clients and organizations understand the meaning and implications behind the numbers. While automation and AI can collect and process enormous amounts of data, interpreting the numbers is still more of an art than a science. And this art relies heavily on the ability to see through the lines and connections within the bigger picture of a specific financial environment.

Fortunately, there are many opportunities for analysts and accountants to move into a more strategic, advisory role. For those accountants serving as consultants, personal financial and wealth management are two areas that offer such potential. Although individuals will have more access to online tools and even “robo advisors,” according to research by Deloitte they’re still likely to prefer human consultants when it comes to things like investments and estate planning.

In addition, more and more job opportunities are opening up for management accountants to use their budgeting, forecasting, and modeling expertise within organizations—in other words, to provide financial analysis to help propel the business forward. Tax reform will also provide opportunities now that the U.S. corporate tax rate has been cut to 21%. As a result, corporations will need advice on how to leverage the new tax reform package to their advantage.

Moving forward, analysts and accountants will need to work with new technologies, as well as possess skills such as critical and strategic thinking, in order to provide advisory services. And they’ll need outstanding communication skills, too. Analysts and accountants within organizations will be expected to be more consultative with their approach to internal business partners.

ENTER THE MILLENNIALS

Millennials, also referred to as Generation Y, were born between 1981 and 1996. In the U.S., they’re poised to overtake Baby Boomers as the largest generation by 2019 when their numbers will surpass 73 million.

Millennials are digital natives who grew up with devices—primarily smartphones—at their fingertips. Many were adolescents during the economic recession, saw their parents experience financial hardship, and graduated college into a job market with relatively few opportunities and while they had significant student debt.

Although the global economy has since recovered, challenging financial factors have, to a large extent, shaped Millennials’ worldview as well as their attitudes about work. Millennials are accustomed to finding information quickly, efficiently, and—as much as possible—independently, whether that’s through articles, blog posts, videos, social media, reviews, or customer service departments.

When it comes to work, Millennials work to live, not the other way around. In addition, thanks to the proliferation of technological solutions and the emergence of the sharing economy, a relatively large proportion of Millennials have an entrepreneurial spirit and are highly motivated to create their own business opportunities. It isn’t surprising, therefore, that a large portion of companies that generate revenue between $500,000 and $25 million per year are led by Millennials—retailers Ivory Ella, Stargaze Jewelry, and Everlane plus real-estate tool dotloop, to name a few. In addition, many Millennials are gig workers and micropreneurs. By some estimates, 42% of the next 27 million independent workers will be Millennials. So it’s valuable to know how to work with this specific generation.

Because Millennials want to be able to independently access the information they need, it’s important if you’re working with them on a consulting basis to provide quality information online via a variety of channels, tools, and assets. In addition, they want their accountants and analysts to serve as true business partners who will think with them and help them define financial strategies based on their goals, regardless of whether those objectives are personal or business related. Instead of opting for paper-based records, Millennials want cloud-based services and their accounts accessible via multiple channels, including apps. Finally, they value communication and want to be kept up to date regarding their financial affairs.

Working with Millennials—whether they’re individuals, free agents, or leaders of large corporations—will require a new approach. Financial services firms will need IT talent to manage online platforms and tools as well as to develop apps. They’ll also need professionals with strategic thinking skills and excellent interpersonal abilities to interact with customers.

THE EMERGENCE OF NEW SERVICE DELIVERY MODELS

Without a doubt, the buying behavior of Millennials is creating new norms. Unlike previous generations, Millennials overwhelmingly prefer subscription-based services for a wide variety of things from entertainment and groceries to software and professional services. Just think of Netflix and Amazon’s “Subscribe & Save” option, as well as Microsoft Office 365, Adobe Creative Cloud, and even some online legal advice providers. In fact, according to the “2017 Millennial Business Owner-Accounting Firm Survey Special Report” by Bill.com, 44% of Millennial business owners in the U.S. prefer monthly flat rates for services over hourly billing. Why? Because hourly billing can be unpredictable and hard to budget.

These trends pose new opportunities for accountants who work as consultants, such as the creation of subscription-based service delivery models to replace the traditional hourly billing model. For example, a delivery model could comprise different packages, each with its own set of services. There could even be a self-serve option with the ability to add additional services or consultations for an extra fee. In keeping with Millennials’ overall preference to do things digitally, these subscriptions would, of course, need to be delivered via apps and online platforms.

In addition to offering Millennial clients more predictability with regard to budgeting for financial services, subscription-based delivery models can also help strengthen the client-advisor relationship because clients are likely to be less inclined to wait until an emergency arises before reaching out. This, in turn, can help maintain their and their businesses’ financial health.

Management accountants can help their companies learn how the shift to subscription-based services will impact aspects of their processes. For example, if their organizations are selling a service on a subscription basis, they will need to determine and explain how to recognize that revenue.

The offering of subscription-based services is likely to increase the demand for finance and accounting professionals who can design and implement new service delivery models, as well as for IT talent who can create and maintain online platforms. And since Millennials expect their accountants and advisors to be responsive 24/7 and provide personalized attention, financial services professionals also will need to develop their soft skills in order to establish and maintain good client relationships.

A NIMBLE APPROACH

Taking a workfit approach to changes in the finance and accounting sector can bring substantial returns for organizations and professionals, both in public accounting and private industry. By recognizing developments such as the expansion of the gig economy, the growing importance of disruptive technologies, the changing role of analysts and accountants, the rise of the Millennial workforce, and the creation of subscription-based delivery models, organizations can make better business decisions and attract talent with relevant skills. This nimble approach can help organizations and independent professionals maintain their competitive position in a rapidly changing market.

Further Reading

The following sources are helpful for learning more about these topics:

“2017 Millennial Business Owner-Accounting Firm Survey Special Report” — http://bit.ly/2KE1T1g

“Blockchain security: What keeps your transaction data safe?” — https://ibm.co/2Gv5tbj

“Bots, algorithms, and the future of the finance function” — https://mck.co/2LcvwaM

“From Workforce to Workfit” — http://bit.ly/2khIXKy

“Intuit: Gig economy is 34% of US workforce” — https://cnnmon.ie/2GtRLFz

“Robotic software sweeping large accounting firms and clients” — http://strib.mn/2KBU5Nh

“3 Reasons Why Offering Subscription Accounting Makes Sense for Your Practice” — http://bit.ly/2rRWGeZ

“10 disruptive trends in wealth management” — http://bit.ly/2LcVHhN

June 2018