The challenge for management accountants is that words like “partnering,” “devising,” and “providing expertise” mean different things to different people, which can lead to various expectations of management accountants and missed opportunities to create a win-win relationship.

With responsibilities in Finance at the corporate, regional, and business-unit levels at three global companies, I’ve had the opportunity to experience these differences. What I found the most challenging, and ultimately most instructive, has been working in four different countries, all with very strong cultures. In 2003, during my time in France, I found that each manager was expected to deliver high-quality results that reflect what’s on the job description. There I learned to have formal discussions and create action plans with other functions. Then when I moved to the United States in 2004, I discovered a more holistic approach. I was in charge of financial processes, but I was encouraged to proactively spend time with the sales and production teams to find ways to support them rather than waiting for them to come and ask for help.

After five years, I moved to Italy in 2009 and learned new ways to influence and support others. In this business culture, value is created outside company time as much as inside formal meetings and processes. Finally, arriving in Switzerland in 2011 introduced me to a culture of compromise. All stakeholders systematically take responsibility for reaching a balanced solution that others will accept rather than seeking individually set goals or targets.

Some executives consider management accountants partners who will help them make the best decisions. Others expect them to simply be available to retrieve and report data. Others still tend to limit their interactions with management accountants altogether because they see them as headquarters’ spies. Most of the time, these perceptions depend on the personality or experience of each manager rather than on any deep belief about the role of management accountants.

It’s up to management accountants to detect and handle these varying expectations, especially when moving from one boss or one job to another, and even more when moving to a new company or country. In 2004, for example, I was selected by the top management of my division unit within the Canadian group Alcan to become Finance manager for the American region based in New York. At first, the president of the region and his team didn’t appreciate being forced by headquarters to take on a CFO they hadn’t chosen, so, to get accepted, during my first months I focused on learning from them and helping them fix local issues. To “win a seat at the table” and become trusted business partners, management accountants should master the skills needed on top of the traditional finance curriculum.

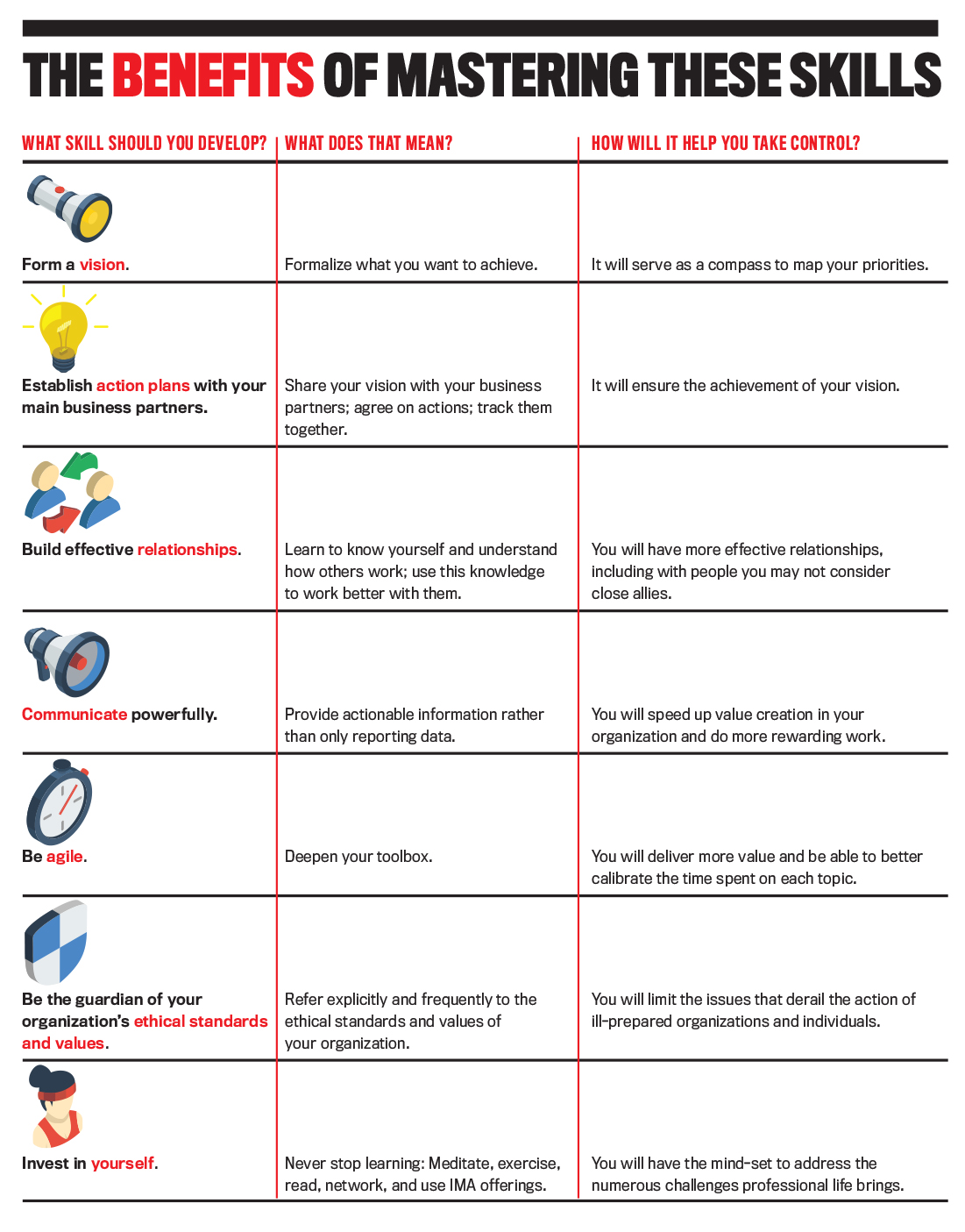

1. Form a vision of what you want to achieve in your position.

A job description isn’t enough. You need to have a clear understanding of where you’re starting from and a vision of where you want to go. The format doesn’t matter, but I recommend you keep it as simple as a list of three to seven bullet points. Each one will identify, for a specific area, the initial situation and the target situation. The list of topics will depend on the context, the priorities you identify, and where you think you can bring the most value. It should also follow the strategy of your organization and be aligned with the objectives assigned to you and your team by your manager. You should put it in writing, refer to it regularly, and amend it as much as needed as circumstances change. The point isn’t to carve it in stone forever but to have it as a compass to help you continue moving in the right direction. This is an essential tool to help you navigate between conflicting requests and priorities that will inevitably come your way.

2. Convert your vision into action plans, and anchor them with the right business partners.

Once you know where you want to go, you need to translate it into specific actions and anchor the plan with your boss, your teams, and your main business partners. You should expect this to be an iterative process and an opportunity to fine-tune, if not deeply adapt, your vision.

The keys here when teaming with colleagues to achieve your objectives are to put yourself in their shoes and try to always make it a win-win process. In order to have a hint of what your contribution may look like from the standpoint of your nonfinance colleagues, I recommend you refer to the article “Don’t Be Stuck in the Last Century!” by Gary Cokins, Joseph Cherian, and Pamela Schwer in the October 2015 issue of Strategic Finance. It was an eye-opener for me on how management accountants sometimes tend to underestimate the frustration of their colleagues and take for granted the satisfaction or buy-in of other departments, for instance with confusing cost allocation roll-ups or lagging instead of leading indicators.

One manager quoted in the article said, “I need real-time accurate profitability numbers on a daily basis. I can’t wait because then I can’t fix anything.” For many finance organizations, that sounds like a very long shot, hence the temptation to push back, ignore the feedback, or focus on more achievable improvements. In this case, though, the right approach is to sit down with the manager, take time to explain the current constraints, consider possible quick wins, and agree on longer-term improvements.

3. Establish robust relationships with your key business partners.

The success of your action plans to achieve your vision will depend on many parameters. The one that truly makes a difference is your ability to work effectively and efficiently with all relevant people. It’s important first to insist that the idea isn’t to try to make everybody happy all the time. As the journalist Herbert Bayard Swope once wrote, “I cannot give you the formula for success, but I can give you the formula for failure, which is: Try to please everybody.” The idea is rather to take sufficient time to reach out to all important stakeholders to listen to their standpoint whether you instinctively “like” them or not.

An important prerequisite that unfortunately isn’t always part of the curriculum of management accountants is a key to success: Develop a deep understanding of your own personality and be able to perceive the main traits of other people’s personality. Finding common ground is often easier than we think, but we sometimes fall into the trap of formulating and sticking to limiting judgments. As a very organized, rational, and analytical person, I’m not comfortable when colleagues use their intuition to jump to conclusions or begin each morning with new ideas without bothering to consider their feasibility. But I’ve learned by experience that the people behaving this way are eager to contribute to the organization’s success. Learning how to interact with colleagues with different personalities can be a game-changing opportunity.

The article “New Science of Team Chemistry” in the March/April 2017 issue of Harvard Business Review notes that “Organizations aren’t getting the performance they need from their teams” and explains that most of the time “the fault doesn’t lie with the team members….Rather, it rests with leaders who fail to effectively tap diverse work styles and perspectives.” It argues convincingly that there are four work styles: pioneers, drivers, integrators, and guardians. “Most people’s behavior and thinking are closely aligned with one or two.” Becoming aware of these dominant work styles can enable managers to anticipate potential pain points between opposite styles and benefit from leveraging complementary styles. The good news is that, unlike cognitive intelligence (the one measured by IQ), emotional intelligence can be developed throughout life.

4. Communicate clearly.

Let’s face it: Reports coming from Finance aren’t always self-explanatory for a nonfinance audience. Most managers “live with it” but would prefer clearer inputs from their management accounting department. Here are a few main principles that can help you move in that direction:

- Take time to explain the concepts, offer glossaries for the data and key performance indicators you report, and connect the dots between them. Don’t assume that everybody knows how internal rate of return works or what “absorbing fixed costs” means. Management accountants should take the time to educate their nonfinance colleagues (for instance, by proactively offering them crash courses in finance). It’s an excellent way to build trust and goodwill.

- Improve the way data is presented and communicated. Many practical books offer insight for maximum improvements with a minimum of efforts, including Made to Stick from the Heath brothers.

- Never forget that producing data is only the beginning of your mission. The best way to avoid the frustration of getting only more requests for more data is to never release data without your analysis. At minimum, this analysis should:

- Be descriptive (what happened?),

- Offer a diagnostic (why did it happen?), and

- Be predictive and prescriptive (what will happen, and how can we make it happen?).

5. Be agile!

You know the saying “If all you have is a hammer, everything looks like a nail”? Management accountants receive more and more requests for new regular and ad hoc analyses, business cases, and scenarios. By leveraging different approaches rather than going through the same data-gathering and detailed modeling process, you can reduce hours of work for many people. Today’s management accountants must deepen their toolbox to be able to adapt the way they approach each topic.

Becoming familiar with Lean Six Sigma tools or any other continuous improvement methods available in your organization can be an excellent way to adapt and optimize business processes. I myself have successfully used process mapping to reduce budgeting process lead time and workload considerably. We gathered representatives of all departments involved in the process during two days, mapped the existing process down to the most detailed level, identified useless and burdensome steps, brainstormed together to find solutions, and ultimately designed a new process that was 30% lighter while reorienting some time and efforts on the most value-adding tasks.

6. Be the guardian of your organization’s values and ethical standards.

Respecting ethical standards is a given regardless of any other consideration, but we sometimes take it for granted and forget to make explicit reference to it with our teams or with our colleagues. An issue in this area can slow down the achievement of your vision, if not derail it altogether.

Positioning yourself as the uncompromising guardian of your company’s values and ethical standards will attract the respect of your colleagues. And there’s the obvious upside of limiting the risk of corporate governance issues.

7. Invest in yourself.

Last but not least, management accountants should take good care of themselves and never stop learning. There are many ways to do so. They can be bold, like engaging in an executive MBA, but they don’t have to be: Read self-development and business books, develop your network through social media and conferences, learn the benefits of meditation, and stay tuned into the ongoing digital revolution.

And never hesitate to use the many great tools offered by IMA: Webinars, Strategic Finance magazine, thought leadership material, and continuing education courses are all valuable services. Earn the CMA® (Certified Management Accountant) certification to validate your skills and knowledge of the most up-to-date tools and approaches available to management accountants. Then become a CSCA® (Certified in Strategy and Competitive Analysis) to go one step further in becoming a trusted partner to design and implement the strategy of your organization.

You want to deliver more, work less, and become happier in your job? You should and you can: Make sure you have a vision of what you want to achieve, put in place action plans to make it possible, and create robust relationships with all key contributors. Then master your communication and become more agile by deepening your toolbox. Don’t be shy about being the uncompromising guardian of your company’s values and ethics, and never stop investing in yourself. To me, this isn’t a destination but part of the journey. It’s helped me so far to make my work more enjoyable and to continue growing professionally and personally on a daily basis.

October 2017