As an entrepreneur, you must understand the options, their unique parameters, and the best way to subsidize the financial needs of a growing business. So where do you stand in terms of growing your small business, and what funding remains available?

The first place a small business typically starts is the 4 F’s: friends, family, founders, and fools. These are the people that put something forward to help a business get on its feet. “Fools” are included in this because a great leap of faith is required when a small business is nothing more than chicken scratch on the back of a cocktail napkin. At this stage in the game, believers in the potential of a business are the founder(s) and their supporters, and thus funding comes from a close circle. These arrangements typically become partial ownership or loans.

Beyond the close network of the founders, banks are historically the first source a company approaches for further investment. Whether a business is just getting off the ground or seeking an SBA loan, a line of credit is a common first stop because interest rates are generally the cheapest. Due to banks’ requirements for securing a loan and their low cost of capital, banks can maintain significantly lower rates. The obvious downside is that a startup or younger business typically doesn’t have the assets necessary to secure a loan. On the other hand, the bright side to bank loans is that you maintain equity; their interest will always be debt.

If banks aren’t an option, the next step in the process is seeking investors, either by offering debt or equity. This could be individual investors, angel investor groups, or venture capitalists. It’s key to know to whom you are pitching and how to pitch to them. Typically, when pitching an investment to individual investors or angel investor groups, you offer equity or debt with specific terms. Venture capital firms will usually assign a valuation to your business. One thing that has changed considerably in recent years is the lack of early-stage venture capital. Early-stage venture capital firms used to jump in as early as the concept, but typically they are now asking for sales proving that the company is viable.

What other sources are out there? Crowdfunding comes up more and more these days, and equity crowdfunding has the potential to revolutionize the funding of businesses. With equity crowdfunding, businesses have open access to new investors that they didn’t previously know existed. Currently, equity crowdfunding involves many restrictions, mostly related to public vs. private offerings. When looking at equity crowdfunding, it’s essential to consult an attorney, as noncompliance can be a major issue. An easier step, generally reserved for product companies as opposed to service businesses, is crowdfunding where the product is what’s being traded for funding. This can obviously be a fun way to get buzz about your product and gives consumers the chance to be first to have it. If you’re operating a service business, non-equity crowdfunding can still be an option with your trade being for your services or for something symbolizing your services. For example, if you’re going to revolutionize IT consulting you might have a flash drive with your logo on it for a $50 gift, an hour’s worth of consulting services for $100, and so on. Services often are harder to find financial support for, but not impossible, especially if you get creative in your giveaways.

Grants and competitions are another interesting way to seek initial or early funding. For example, the Arch Grants competition annually gives away 20 gifts of $50,000 to competitors, with the only real qualification being that the company must locate its business in St. Louis, Mo. Every year, hundreds of companies from around the world apply to this competition. Winners also receive services that can help their businesses grow, access to future capital, and many other great prizes.

There are several grants competitions around the country and around the world, with Arch Grants being one of the largest and perhaps one of the best run and least restrictive. Competitions like these can be a result of several different factors, and it’s good to understand the driving forces of a grant or grant competition to understand how best to pursue the competition, just like a sales call where you would want to know what your customer needed instead of going in with a blanket sales pitch.

Factoring can be of interest to companies that are growing fast but don’t have the capital to grow with their sales. Factoring is an expensive, short-term funding option that should only be used to turn sales, as it can run at 3%-4% per month (i.e., 36%-48% annually). The largest benefit of factoring is that the only thing supporting the loan is your sales, so you don’t have to run the risk of personally securing the loan. Likewise, your line of credit rises and falls in relation to your outstanding accounts receivable, so as your company’s sales grow so does your available funding. Recently, there have been a lot of private operations that have taken on factoring businesses as a result of very cheap money on the open market. This has had two effects: First, it has lowered the cost of capital a little bit. Second, these private operations often take on your accounts payable collections, which can be seen as a benefit or a burden depending on who you are. It can reduce your staff needs and allow you to focus on your operations, but if your clients fall behind, someone else is calling them to collect and you are no longer controlling your relationship.

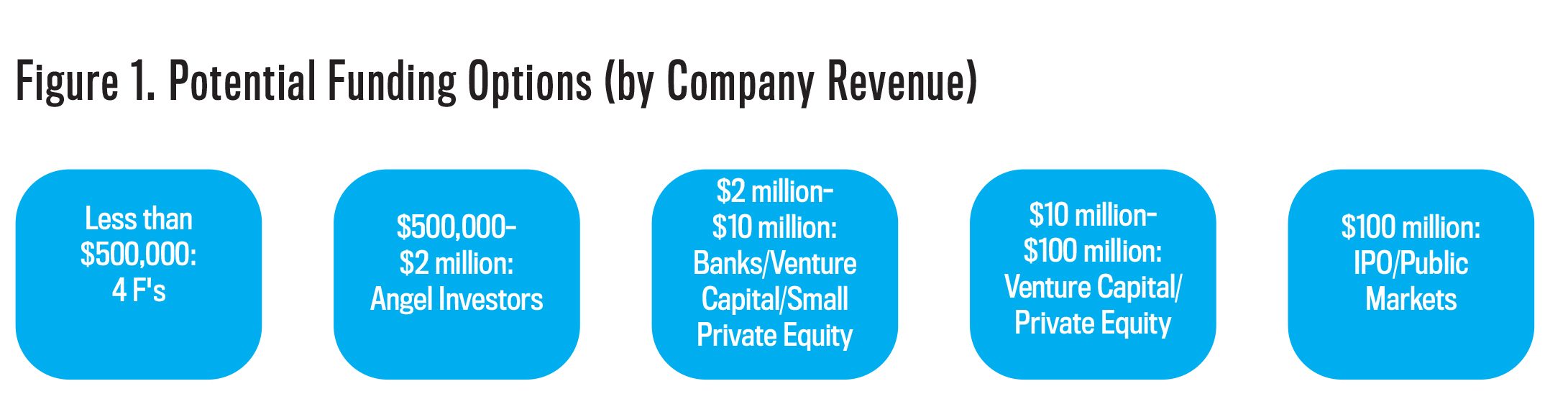

Companies also may seek funding from international interest, joint venture partnerships, and licensing arrangements, among other options. Typically, these other options mean that the company has grown and can be noticed by international businesses or potential joint venture partners or has a product line starting to sell enough that someone sees licensing potential. Once your revenues have grown, a variety of other options become available. See Figure 1 to identify your own funding opportunities. Remember, of course, that there are exceptions to every rule.

February 2017