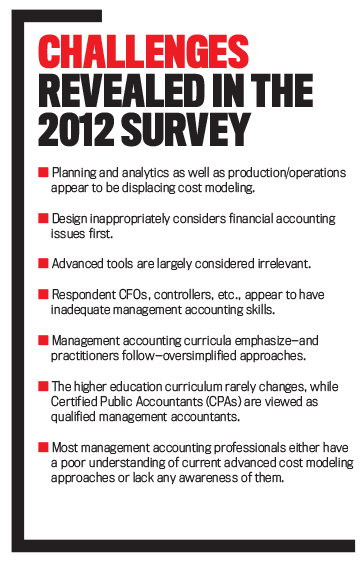

Respondents to the survey, which included CFOs and controllers, indicated declining practices, reduction in innovation, and a lack of adequate management accounting skills, particularly in regard to the area of measurement and management. Cost modeling is diminishing, production and operations management appear to be displacing cost modeling, and advanced management accounting approaches are regarded as irrelevant. Part of this picture may have been painted by a stagnant economy at the time of the survey, but we can’t blame the direction of this trend on external forces alone.

In the face of these ongoing challenges for management accountants, IMA undertook an initiative to establish a set of managerial costing principles. In 2013, IMA’s Managerial Costing Conceptual Framework (MCCF) Task Force published The Conceptual Framework for Managerial Costing (the Framework), which provides prescriptive documentation for cost modeling and the establishment of managerial costing accounting principles for the first time in the history of the profession. (Note: Doug Clinton was one of the authors of the 2012 survey, along with Larry White, and also was a member of the MCCF Task Force.)

After the detailed Framework monograph was published in 2013, an abbreviated version was published as a Statement on Management Accounting (SMA) in late 2014. Both the monograph and the SMA focus on establishing unified principles for the entire profession. The Framework states, “There is no clear reference point for the creation of cost information for internal decision use; therefore, a need exists for such a reference.” Consequently, we believe the Framework can be applied to the 2012 survey results, encouraging the healthy promotion of management accounting’s most important role—supporting cost modeling for internal decision support. This includes using principles-based, internal decision-support approaches to help achieve an enterprise’s strategic objectives.

ENCOURAGING EFFECTIVE MANAGEMENT ACCOUNTING

Most discussions about principles of managerial costing quickly turn into comparisons of different costing methods and approaches. Previous ad hoc costing solutions historically skipped the foundational work for assessing their effectiveness against a comprehensive set of concepts. In fact, it isn’t uncommon for the results from competing methods to point to contradictory decision alternatives. Since the 1980s and 1990s, experts have gone back and forth trying to push their preferred method without a principled basis to ground their approaches. This can be very dangerous for achieving accuracy to support decision making. For example, consider Eli Goldratt and his creation of the popular Theory of Constraints (TOC). TOC is a selective tool to deal with a narrow problem. Unfortunately, Goldratt didn’t provide any insights into its limitations beyond simple throughput applications. Nevertheless, some accountants inappropriately latched onto TOC as a comprehensive managerial costing approach.

Another example is the use of simple activity-based costing (ABC). This method fails to consider the nature of costs (i.e., by capturing overhead in one pool, it doesn’t separate variable cost from fixed costs). Moreover, ABC lacks capacity information. The confusion is based on whether capacity resides in resources, activities, or both. Activities don’t have capacity of their own—rather, activities merely consume resources.

We’re convinced that the profession must embrace a managerial costing principles-based approach to cost modeling. This, of course, doesn’t mean that we’re promoting a cookie-cutter approach to cost modeling or that every organization should perform cost modeling in the same manner. What it does mean is that managerial costing professionals can now assess how closely aligned their cost models are to the principles outlined in the Framework. If we collectively embrace these principles of managerial costing, then ultimately we must believe that principles are good for the profession and should be integrated into our practices—and into our discussions.If we agree that establishing principles will encourage the revitalization of our industry, then we must dive deeper into understanding the principles themselves. The Framework includes the principles of causality and analogy, stating:

Principles can be thought of as innate laws for which proof is not necessary because they are self-evident. Causality is the basis for all inferences in the scientific method. It is appropriate, and in fact essential, to apply causality to managerial costing, and as a principle it is the basis for discerning truth in cost modeling and its decision support information.

This isn’t to say that management accounting is a science; it isn’t. But decision science, which managers apply in their optimization endeavors, is dependent on cause-and-effect insights. The Framework defines the principle of analogy as “the use of causal insights to infer past or future causes or effects.” Thus analogy “applies when insights are used and inferences are made about known cause and effect relationships.” In other words:

- Causality deals with understanding and capturing enterprise quantitative cause-and-effect relationships for the purposes of modeling, and

- Analogy is concerned with applying those causal insights in learning and optimization actions.

Given that these principles are self-evident, cost models that are consistent with causality and analogy would naturally provide information that aids managers’ decision-support needs. Remarkably, most current methods don’t consistently follow causality. As a result, they don’t produce efficient and reliable cost modeling solutions nor the clear, causal insights that decision makers need to perform their most important work.

For example, the CPA exam still teaches students to allocate all overhead costs from manufacturing support into one main manufacturing cost pool. This means that fixed overhead can no longer be analyzed in a meaningful way. Once again, fixed and variable costs aren’t separated. These “nature of cost” issues plague management accounting. These problems are even worse when we consider that even well-accepted textbooks defer to manmade GAAP principles rather than principles needed for internal decision support when teaching traditional standard costing. They teach some adjustments from GAAP for management analysis but don’t teach any principles for internal decision support.

The 2012 survey indicated that the availability of investment funding in relevant cost modeling technology wasn’t a significant financial constraint for most companies, but companies were reluctant to invest in new cost modeling methods. We believe these survey results may reflect increasing levels of regulation that have created commensurate amounts of uncertainty, effectively stalling investment.

This may also indicate a lack of proposals to justify improving cost information or the possibility that accounting and finance professionals lack the knowledge to provide an effective cost information solution. One approach already exists—resource consumption accounting (RCA)—that has the ability to encourage the healthy promotion of management accounting’s role. This principles-based managerial costing approach completely conforms to the Framework but is now sparsely employed in practice. The 2012 survey reveals the gap between managerial costing’s problems and the practices needed to effectively achieve improved results.

QUANTITY STRUCTURE

Inherent in principles-based approaches to managerial costing is the ability to integrate costing and budgeting through an emphasis on tracking resource quantities. This also allows the cost model to be completely back-flushed for cost and capacities for budget, scenario, and operational planning. Principles-based approaches facilitate both the costing of the conversion process and the budgeting processes by tracking the quantity-based relationships between the resources and the activities as well as the relationships between the activities and managerial objectives (i.e., where activities are appropriate).

The German Grenzplankostenrechnung (GPK) method refers to this as quantity structure, and it conforms to the principle of causality. Pushing costs from resources to cost objects based on arbitrary allocation rules obscures insight and doesn’t achieve causality. For example, the cost of excess/idle capacity is causally unrelated to the cost objects actually produced and shouldn’t be assigned to these cost objects. But excess/idle capacity should be measured, tracked, analyzed, and reported in order to understand any associated effects and opportunities. The first result of any successful process improvement is often the creation of idle capacity for some resources.

When using a quantity structure, measuring, tracking, and reporting of quantities is determined directly through operational transactions. This drastically changes how decision support and reporting take place. Once the resource quantity model is established, value can be layered on the quantities to provide dollar abstractions to achieve the costing and reporting perspective of interest (e.g., external compliance reporting—financial/tax, costing for decision support, budget, actual, etc.). This operational foundation rooted in existing operational master and transaction data provides a cost model that’s simpler to maintain, less expensive, more accurate, and more consistent across the company. Moreover, excess/idle capacity is made transparent through the enablement of appropriate managerial action. Initially, it’s middle management’s job to create excess/idle capacity through greater efficiency, and it’s top management’s job to make that excess/idle capacity profitable.

The cost of the goods or services produced relates directly to the quantities consumed in their production, reflecting only the resources used rather than all resources supplied. Analysis of capacity data with this approach is made transparent in that the causal foundation benefits budgetary procedures, reporting of information, and essential business intelligence.

DECREASE IN COST MANAGEMENT

The 2012 survey results show that the use—and perhaps the importance—of managerial costing has decreased over time. Respondents indicated that cost reduction itself was considered more important than generating relevant cost information in the first place. Moreover, cost accuracy and transparency were shown to be significantly impaired over time as well.

During the last decade, next to nothing has been done to correct this. On average, CFOs and controllers seem to stubbornly reject any ideas of straying from data generated for external financial reporting. Yet cost information based on Generally Accepted Accounting Principles (GAAP) is often impaired and significantly limited for internal decision making by the inaccuracies of normal costing, standard costing, and the application of financial accounting principles.

A managerial costing approach that comprehensively reflects managerial costing principles has an advanced cost modeling capability, providing superior insights to all levels of managers and maximizing strategic results. Unfortunately, the decision maker often starts by working with a smorgasbord of data that was designed to achieve the needs of conforming to regulations limited to external reporting. Examples include multiple depreciation methods that somehow pass for appropriate use in evaluating strategic results. GAAP rules are designed to report results externally to investors and creditors. Managerial costing is designed to facilitate the decisions that will create long-term, sustainable value.

RELEVANCE OF COST MODELING TOOLS

The 2012 survey also included a new section on technology that wasn’t in the original 2003 survey. Alarmingly, respondents indicated that 62% to 78% of all new management accounting tools were “not relevant.” Also, fewer tools were considered for adoption in 2012 than in 2003.

One way to explain the conclusion that these tools weren’t relevant is the accounting curricula in higher education. This is a “which came first” argument. Those in the profession use what they are consistently taught. Unfortunately, virtually all cost management texts fail to present information based on managerial costing principles. Rather, these texts more often include practices that undermine the principles needed for supporting decision making, such as:

* the stubborn use of mostly outdated and inaccurate costing approaches such as standard and normal costing,

* the wholesale allocating of support-department costs to the overhead allocation pool,

* a disregard for consistently and systematically classifying cost behavior as variable or fixed, and

* neglecting the importance of supply-based capacity concepts.

In the 2012 survey, perhaps the greatest threat to management accountants was the displacement of cost modeling by production or operations. While maintaining very accurate cost modeling, a managerial costing principles-based approach (due to its operational foundation) benefits operations and has the ability to provide integrated metrics to make the job of those in operations easier. These aren’t just metrics that are pushed down to operations from higher management—they are metrics that actually benefit those in operations.

Using business intelligence analytics, a managerial costing principles-based approach connects and communicates the entire view of business—operational quantities integrated with dollars. A managerial costing principles-based approach is able to link the cause-and-effect relationships from the operational level—where value is created—to the business level. The key point here is that diverse tools can often be integrated, which results in a simplified and consistent experience for users of the information.

GETTING COMPANIES INVOLVED

With technological costs and limitations becoming less of a constraint, we can turn to the in-house expertise that deals with the people and skills side of management accounting. As confirmed in the 2012 survey, many controllers and CFOs are struggling in the area of advanced management accounting skills and in their use and choice of managerial costing tools. We believe this gap has contributed to the downward spiral that is now affecting corporate accounting leaders, hindering their ability to support value-added skills in management accounting. It takes a courageous CFO to openly acknowledge that this management accounting knowledge shortfall exists, much less show a willingness to correct it.

Survey respondents clearly recognize that cost accuracy is impaired, but most of this inaccuracy seems to be ignored. The in-house expertise gap will worsen if management accountants continue to use the same familiar, compromised tools and techniques that they were taught in school. Others will find it difficult to challenge new management accounting methods that their employers have assumed were sufficient. We believe methods are often irrelevant because they provide noncausal decision-support information based on authoritative (but inappropriate) financial accounting principles. In this case, internal decision making often uses the wrong principles, i.e., financial accounting principles rather than managerial costing principles.

WORKING TOWARD SOLUTIONS

How do managerial costing principles-based, internal decision-support approaches improve the state of management accounting or encourage the promotion of management accounting’s role in business? Few approaches currently align themselves with the principles-based Conceptual Framework for Managerial Costing. As stated in the 2012 survey, respondents indicated that decision makers and decision enablers identify “actionable” cost information as their topmost priority, yet respondents also claimed that adopting new cost management tools isn’t a priority.

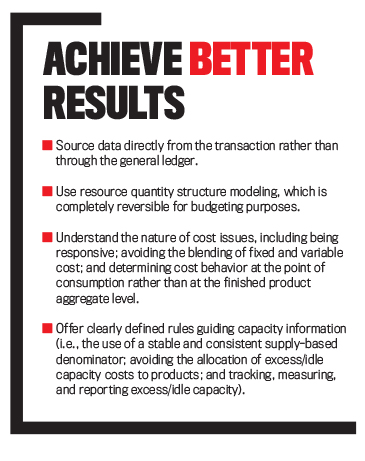

Fortunately, principles-based, internal decision-support approaches are able to make sophisticated cost modeling possible through the use of best practices and business intelligence tools that are integrated into enterprise resource planning (ERP) and other operational systems. In this sense, cost modeling doesn’t have to be extremely complex or expensive. Principles-based, internal decision-support approaches not only provide advanced cost modeling, but they also mitigate or solve problems mentioned in the 2003-2012 longitudinal surveys.

Our most important recommendation is that management accountants consider and support contemporary best practices that follow the principles of causality and analogy. These approaches are available now. Benefits include greater cost accuracy, quicker and more accurate budgeting, reduced decision result time, less confusion regarding cost data sourcing, better causal insights, and, thus, better decision making in your organization. Be sure to vet new costing methods using a managerial costing principles-based, internal decision-support approach. Your actions will encourage the healthy promotion of management accounting’s role.

September 2016