A two-year period of exit negotiations has begun to determine the U.K.’s new relationship with the EU and the method for its exit. Arguments currently revolve around whether the U.K. will divorce itself from the EU using a “hard Brexit”—with none of the trade benefits of being in the bloc—or a watered-down “soft Brexit,” which may allow the U.K. to remain part of the EU market without having to accept complete free movement of people. It’s hoped that either version will be finalized early in 2019.

THE IMPACT IN EUROPE

Regardless of how and when Brexit occurs, the process and its implications are highly speculative. For some, it represents the beginnings of deglobalization or the move toward independent economies in the extreme, while others remain skeptical about whether there will be any change at all in the free-trade regime between the U.K. and the rest of Europe.

Similarly, it’s a toss-up with respect to how Brexit will impact the region’s prospects in the coming months. According to Duke University’s quarterly Duke CFO Global Business Outlook survey, views around the European economy are mixed; approximately 28% of European CFOs were more bullish in the third quarter than they had been in the second quarter. But 31% also were more pessimistic on the European outlook as a whole, with expected 12-month earnings growth declining from 10.4% in June’s poll to 5.2% in the September survey.

The top five concerns for top management during the third quarter were relatively unchanged from the second quarter, with 53.8% of CFOs citing economic uncertainty as a major concern. Thirty percent were worried about weak demand, 28.8% were concerned about regulatory requirements, 28.1% were concerned about currency risk, and 27.5% indicated that government policies were an issue.

As for what risks are ahead in the foreseeable future in the wake of Brexit, the Duke University survey showed that an overwhelming majority (69%) of European CFOs rated the degree of political uncertainty as either a “large” or “moderate” risk. Not surprisingly, the top political concerns were proposed regulations, government gridlock or dysfunction, potential for tax reform, and the upcoming elections. Consequently, EU CFOs say that their companies will be more cautious in capital spending (58%), hiring (49%), and making acquisitions (38%).

More than 75% of the European CFOs expected that that the U.K. referendum will lead to similar calls for voting in other EU countries, and one in four forecasted a hit to their financial performance should the U.K. ultimately leave the EU. In September, almost one third of CFOs indicated that should the U.K. leave the EU, their companies would shift production and/or operations to the rest of Europe.

NORTH AMERICAN CONCERNS

In North America, the bottom line is also uncertainty—and this uncertainty has created all manner of forecasts from pundits, particularly with respect to:

- The long-range impact on the value of the U.S. dollar against international currencies;

- The reaction of the U.S. Federal Reserve, such as a pause in interest-rate increases;

- The possible negative impact on U.S. manufacturing trade with the U.K. and the EU if U.S. export prices are driven up further by a stronger U.S. dollar;

- A possible drying up of foreign direct investment from companies that were banking on a free trade regime between the U.K. and the rest of Europe;

- Whether the City of London will remain the financial center for the European region; and

- Ultimately whether the U.K. can hold together if there is another Scottish referendum to leave.

That’s a lot to chew on, and in the months since the vote, I’ve been keeping close watch on what some of the more notable U.S. think tanks and experts have had to say on the matter. For example, according to Wells Fargo economists, “Brexit is a monumental decision that could potentially start an unwinding of the globalization that has been in train for the past few decades. A period of heightened geopolitical uncertainty would not be conducive for robust growth in investment spending in many of the world’s major economies.” Bain & Company stresses that “The flight to safety away from the epicentre of this British-EU divorce will push capital away from the region and toward key safe-haven markets including the U.S.—especially treasuries—and to Japan. This will further lower market interest rates and raise relative currency values.” And in the words of Ben Bernanke, Brookings Institute economist and former chairman of the U.S. Federal Reserve Board, “In the United States, the economic recovery is unlikely to be derailed by the market turmoil [resulting from Brexit], so long as conditions in financial markets don’t get significantly worse.”

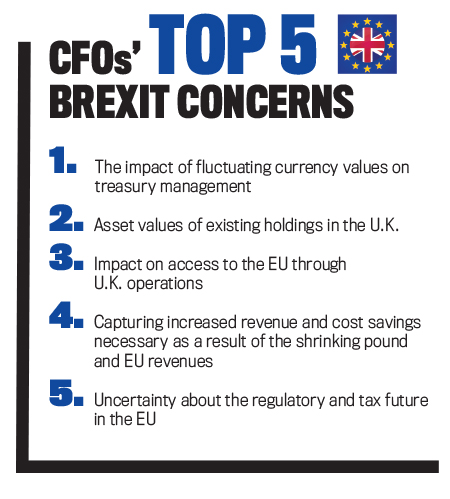

So what does the possible exit of the U.K. from the EU mean for CFOs in the U.S. and Canada who are trying to figure out the financial management impacts on their companies?

For the biggest global players, a wholesale change in strategy with respect to the U.K., and specifically England, doesn’t appear to be in the cards. In fact, according to a recent CNBC survey of 48 CFOs from some of the world’s largest companies, 70% say there is no change in their perspective on the likelihood they will do business in the U.K., and roughly 14% are only slightly less likely to change their strategy in the region.

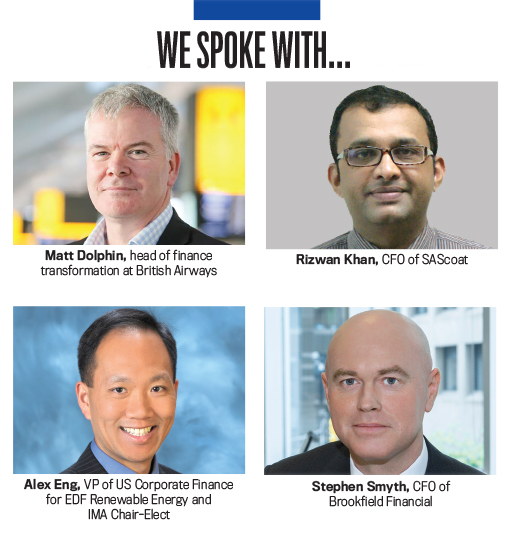

Alex C. Eng is VP of US Corporate Finance for EDF Renewable Energy, a U.S.-based subsidiary of EDF Energies Nouvelles headquartered in France, and Chair-Elect of IMA® (Institute of Management Accountants). He has seen lesser immediate concern for the Fortune 100 American operation, pointing to the ongoing risk management practices within his company and others like it. “Certainly,” he says, “many strong global Fortune 100 companies have responsive and agile risk mitigation strategies…including business review policies and procedures robust enough to address many geopolitical events.” He adds, “These geopolitical events have become almost a part of everyday life, and that’s what being in business is all about. For strong global companies, we have already seen decades of what amounts to material geopolitical events, and many are still here, emerging as stronger and better organizations.”

But for others in North America with significant exposure to the U.K. and the Eurozone, a new risk model emerges that will require rethinking the value of their foreign direct investments—and, of course, treasury. As Stephen Smyth, CFO of Brookfield Financial, a global investment bank headquartered in Toronto, Canada, with U.K. interests, explains, it’s the real estate sector that’s feeling the immediate impact of a potential U.K. secession from the EU. “Values are a key concern, certainly in the U.K. market,” he notes, “and with respect to high profile real estate funds, blocks on redemptions are creating liquidity issues. The liquidity in the market is such that you’re being locked into assets because there’s no activity; there’s no transactional activity [so] if you want to get out of it, you can’t—certainly not at a price that makes sense. So it becomes a difficult situation.”

To date, some companies have reacted quite decisively to the changing risk outlook and uncertainty surrounding Brexit. For example, Canada Life Financial Corporation, a large insurance and wealth management company with significant exposure in the region, promptly suspended trading of its U.K. property funds, a portfolio valued at £500 million.

With respect to the longer-term impact, it’s hard to predict at this stage, Smyth says. “Some fund managers are saying that they’ve already marked down the value of the buildings they own by 4.5% to 5%, which are usually office buildings. So that’s not a good sign of things to come. Worse case projections: Office values could fall by as much as 20% within three years of the country leaving the EU, and that will certainly impact a company’s ability to refinance,” he adds.

At the same time, a fall in values, compounded by a weaker British pound or euro, also makes an attractive proposition for U.S. investors. But, Smyth notes, being nervous about what the ultimate value of that asset is going to be in three years’ time means that the company isn’t willing to pull the trigger. “I don’t see a lot of M&A activity in the U.K. until the exit picture becomes a lot clearer,” he predicts.

For the likes of Brookfield and many others, a prolonged decline in the value of the British pound will definitely impact their bottom line. “Europe is one of our largest regions so in terms of revenue, a sustained decline in Sterling would obviously be detrimental,” Smyth explains. “When that region’s results are consolidated, it’s obviously expressed in our functional currency, which is U.S. dollars. So that’s a concern. At the same time,” he adds, “a lot of our European deals are denominated in euro currency and I think what’s bad news for Sterling is not going to be good news for the euro. They’ll probably move pretty much in tandem.”

Although, on the whole, a continued fall in the value of the British pound is good news for U.S. importers and conversely not so great for exporters, the net impact on the U.S. economy is relatively small in the grander scheme of things. For example, the U.S. Census Bureau reports that goods exports from the U.S. to the U.K. in 2015 totaled roughly $56.1 billion compared to imports of $59 billion. This compares with total U.S. exports of $1.5 trillion and imports of $2.25 trillion.

UNCERTAINTY REIGNS

With pound and euro revenues shrinking, CFOs in industries across the board are sharpening their pencils to reduce costs and maintain margins, which could ultimately lead to reductions in head count. Matt Dolphin, a veteran financial manager in the U.K. airline industry and most recently head of finance transformation at British Airways, explains that, for his sector specifically, the weaker pound could pose some serious cost management issues.

“In the airline industry there are a lot of fuel costs specified in dollars,” Dolphin says, “and obviously any fall in the pound relative to the greenback will have a cost bite. Therefore if you want to stay in the same place in terms of margins, this drives further cost pressures on the rest of the cost space.” At the same time, on the revenue side, “You could definitely see a scenario where corporate clients pull back from their air travel in the light of uncertainty of how things are going to play out. As a result, that drives down some of your corporate revenue streams. So there will be those definite impacts to the P&L as a result of that uncertainty of the market.”

The most likely place for increasing rounds of cost cutting in this industry and others, in general, is on the people side, Dolphin adds, and, at the end of the day in the air travel business, there are still quite a number of labor-intensive areas where carriers will look for efficiencies. Dolphin anticipates an increased focus on technology as a primary way of creating those efficiencies and reducing head count. It’s an end-to-end process, he explains, and all the interactions with the customer can be made more efficient with the use of technology, from printing off their own boarding pass to specific apps about flight schedules to automated ID checking as current examples. “Brexit, in my view, will increase the emphasis on and speed at which new technologies are being applied,” he adds.

But for companies farther afield, while managing cost and treasury will remain tricky, a positive outcome of Brexit could be access to markets that were previously out of reach. According to Rizwan Khan, CFO of SAScoat, a manufacturer of label stock with production facilities based in Vietnam, the company is indeed hoping for the upside. Says Khan, “For us, Brexit could have a very beneficial impact; in fact, we believe that it will actually open up the competition for companies in general outside of Europe.” He adds, “Right now, European companies get the benefit of trade terms in the U.K., and British companies have the benefits in Europe. Should Britain leave the EU, this may allow for international companies like ours to compete on a level playing field.”

Although the how and when of Brexit is yet to be determined, the train has indeed left the station. Whether a hard or soft Brexit will prevail will have significant consequences for companies operating in the region. At the moment, however, most companies are making no sudden movements. Once the dust settles, there will be a number of additional issues for U.S. CFOs to keep an eye on. “Brexit: What U.S. CFOs Should Know” (p. 36) outlines legal experts’ advice for the possible post-Brexit fallout. As the list demonstrates, the uncertainty in and around Brexit will remain for quite some time.

©2016 by Ramona Dzinkowski. For copies and reprints, contact the author.

Brexit: What U.S. CFOs Should Know

CFOs concerned about the potential impact that Brexit may have on their company’s strategies and interests should keep in mind the following legal issues:

- Brexit may impact contracts between U.S. and U.K. businesses governed by English law and may lead to the unpicking of any U.K. legislation currently dependent on EU regulation.

- Brexit also may affect disputes over contracts between a party based in the U.K., such as a subsidiary of a U.S. company, and a party in another EU member state or where the subject matter of the contract has some connection to a member state.

- For new contracts, parties may opt for arbitration clauses on the basis that enforcement is through the New York Convention of 1958 rather than EU regulations.

- In terms of existing contracts between U.S. and U.K. entities, the question may arise whether these could be terminated as a result of Brexit. This would depend on the terms of the relevant contract, such as the terms of any material adverse change clauses and whether the implications of the Brexit vote or an ultimate Brexit, such as market and currency fluctuations, are sufficient to trigger the relevant clause.

- Companies with subsidiaries or operations in the EU that employ citizens from other EU member states in the U.K., or vice versa, should be concerned about any change to the freedom of movement of EU nationals. An audit of the workforce may be necessary to identify individuals who may be affected, including those who may be able to apply for citizenship or permanent residence and to target communications to employees who may be most affected.

- Plans for recruitment and secondment of staff may also be impacted.

- Companies or groups of companies with community intellectual property (IP) rights will need to be ready to respond if those rights cease to have effect in the U.K. IP owners should identify which of their rights are likely to be affected and may need further application or registration to be protected.

Source: Adapted from David Gent, “Brexit Implications for U.S. Businesses,” Bird & Bird blog, July 19, 2016, http://bit.ly/2dhSlbJ.

December 2016