Conventional wisdom says that a higher taxable income leads to a higher tax liability while a lower taxable income results in a lower tax liability. But occasionally the interplay between different types of taxes and deduction rules leads to a situation where taking fewer deductions—and thereby increasing regular taxable income—can actually reduce overall tax liability. One such example is the interaction between the alternative minimum tax (AMT) and the choice between itemized deductions and the standard deduction.

ITEMIZED VS. STANDARD

For the vast majority of taxpayers, it makes sense to choose the larger of the standard or itemized deductions. The amount of the standard deduction depends on the taxpayer’s filing status and is adjusted annually for inflation. The 2014 amounts were $6,200 for single and married taxpayers filing separate returns, $9,100 for heads of household, and $12,400 for those married filing jointly and for surviving spouses. Not surprisingly, various popular software packages are programmed to default to the largest deduction amount and to minimize regular taxable income. Yet this may not be the optimal choice.

ALTERNATIVE MINIMUM TAX

The choice becomes complicated if the AMT is involved. In essence, the AMT is a parallel tax system that calculates tax liability under a different set of rules, with various deductions and exemptions disallowed or reduced. The taxpayer essentially pays the higher of the two amounts—the AMT or the regular tax system.

If a taxpayer claims the standard deduction, the full amount of that deduction is added back when determining the individual’s alternative minimum taxable income (AMTI). Not only does this increase the tax base amount for AMT purposes, but it also may impact the exemption available for AMT purposes since the exemption is phased out for higher AMTI taxpayers. Depending on the taxpayer’s marginal income tax rate, AMTI, and filing status, he or she may actually benefit from choosing itemized deductions instead of a higher standard deduction amount.

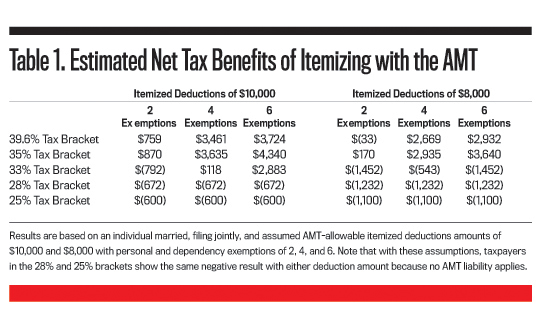

Table 1 presents the estimated benefits of using itemized deductions when the AMT applies for a taxpayer with a filing status of married, filing jointly. It includes different tax brackets, exemption numbers (2, 4, and 6), and two distinct assumed itemized deduction amounts ($10,000 and $8,000) that are below the standard deduction amount ($12,400). The number listed for each case is the net tax savings (i.e., the difference in tax liability) when selecting itemizing deductions instead of taking the standard deduction. In cases where the result of itemizing is negative, such as in the 39.6% tax bracket with two exemptions and itemized deductions of $8,000, then it would be better to take the standard deduction.

Taxpayers in the higher marginal tax brackets receive the biggest benefit of using itemized deductions. The lower the tax bracket, the less likely taxpayers will benefit from electing the lower itemized deduction amount. The benefit from choosing itemized deductions over standard also changes when the number and amount allowed for exemptions varies. Generally, taxpayers in the 33% and higher bracket should consider the impact of the standard deduction on the AMT when filing their tax returns. Taxpayers in the 35% bracket benefit the most because of the phase-out of the AMT exemption amount and the interaction of the deductions eliminated, AMTI, and exemption phase-out.

The trade-off between using itemized deductions that are allowed for AMT purposes vs. the standard deduction can be summarized as: The closer the amount for itemized deductions is to the standard deduction amount, the more likely itemizing may result in lower overall taxes. This is true for all tax brackets. But taxpayers in higher marginal tax brackets are more likely to benefit and receive a higher benefit due to the interaction between itemized deductions, AMTI, and the AMT exemption amount.

PLANNING OPPORTUNITIES

Taxpayers and tax preparers need to be aware of the fact that, in certain cases, itemizing may result in a lower overall tax liability even when the standard deduction amount exceeds the total itemized deductions. As noted previously, this is due to the fact that the standard deduction is a preference item, i.e., added back, for AMT purposes, creating an interaction between the deduction amount, AMTI, and the AMT exemption.

Taxpayers in higher tax brackets are more likely to receive a higher benefit from this option. Taxpayers in states with no or lower state income taxes also might be more likely to benefit because state and local taxes may be a large part of itemized deductions for many taxpayers and are added back for AMT. It may also benefit taxpayers filing as head of household, as they are treated the same as single taxpayers for AMT purposes.

Procedurally, it’s best to prepare all returns with itemized deductions, even when the itemized deductions are less than the applicable standard deduction. Then have the tax software calculate the taxes based upon itemizing and with the standard deduction, and compare the two results. For instance, we were able to save more than $900 in taxes in just one instance by forcing the tax software to use the lower itemized deductions. In this particular case, a married couple with four children had adjusted gross income of approximately $214,000 and itemized deductions of around $12,200 (of which $3,400 was a deduction for state taxes). When the tax liability was calculated with the standard deduction, the total liability was $38,240. When the lower itemized deductions were used, the tax liability was $37,300. The taxpayers saved $940. This happened because only the state taxes (and not the entire standard deduction) were disallowed when itemizing.

© 2015 A.P. Curatola

December 2015