That chaos was layered on top of an already-spreading anxiety over losing one’s position to automation. Now as the COVID damage begins to get resolved, the threat of replacement is reemerging. Looking to measure the concern over “Is a robot going to take my job?” the online marketing company Semrush found that almost 200,000 people type that very question into online search engines every month. And their concerns are well-founded because the threat is increasing. In 2018, McKinsey & Company conducted a study, Bots, algorithms, and the future of the finance function, that concluded current technologies can automate 42% of finance activities and mostly automate another 19%.

A BRIGHTER VIEW

Tradeshift, a cloud-based business network and platform for supply chain payments, explored the same questions about digital’s place in the financial workforce and produced a surprisingly optimistic study on the subject. Named in Fast Company’s annual list of the world’s most innovative companies in 2020, automation is a key issue for Tradeshift, and it released Are Friends Electric? How finance professionals really feel about automation on May 25, 2022.

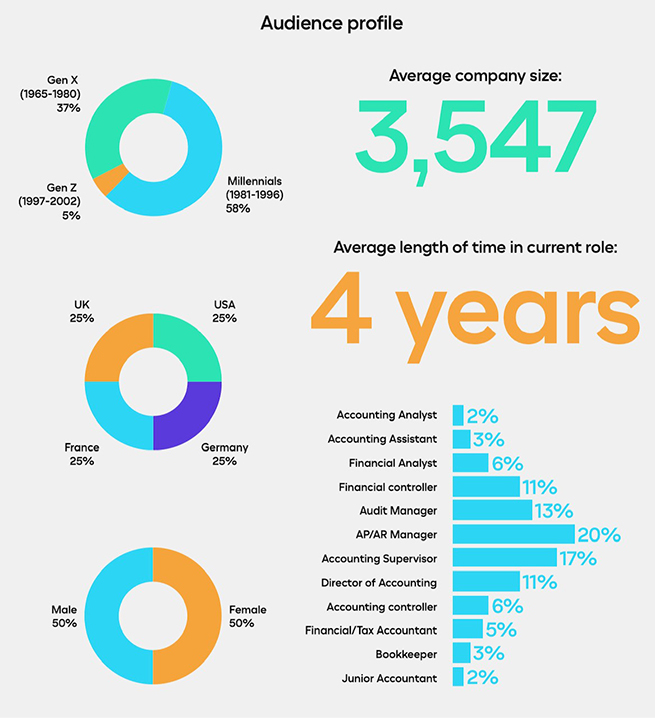

Tradeshift commissioned the U.K. research firm Coleman Parkes Research to conduct the online survey. The survey respondents were from four countries and had “a high level of understanding of the investment their company had made in technologies related to automation in their current job.”

Tradeshift, Are Friends Electric?

Fifty percent of the respondents were male and 50% were female, and each country—the United States, the United Kingdom, France, and Germany—made up 25% of the total 500 finance and accounting professionals questioned.

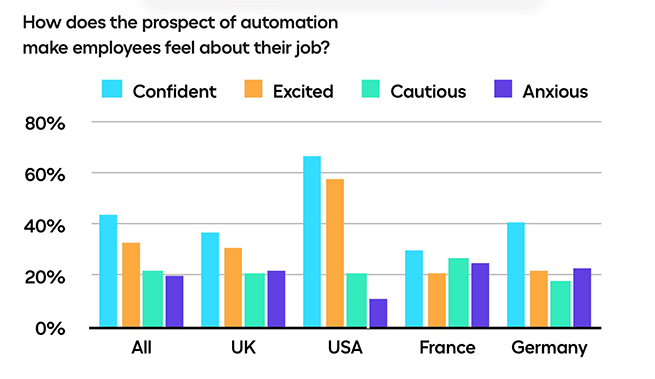

The anxiety over automation differed from country to country, and those numbers were tied to the level of advanced automation available. Respondents from the countries with the greater availability of advanced automation felt less threatened and more excited by the changes.

Three baseline numbers defined the most general assumptions for the respondents: 25% believe automation will eliminate their current role, 63% believe there will always be aspects of their role that demand the human touch, and 71% believe automation will have a positive impact on their career. That last number provides the basis for Tradeshift’s takeaway for the study: “Confidence comes from experience and that’s certainly what we’re finding among employees who have been exposed to the benefits of automation. Not only are these employees more optimistic about their own future career path, but they also recognize automation as a way to empower humans rather than replace them.”

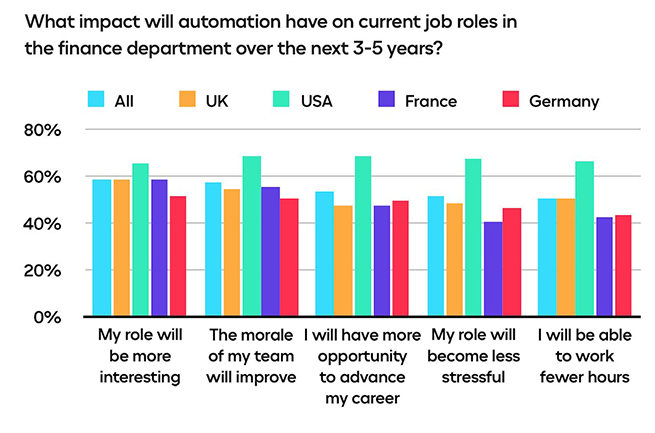

A snapshot of five specific upsides that can accompany automation are mapped in the following graph.

The report elaborates on the advantages of automation and concludes with a list of eight benefits for those adapting to a workplace where humans work alongside new technologies.

- The more frontline workers embrace automation, the happier they’re likely to be in their job. The numbers here are strongly influenced by location. Globally, the number of finance and accounting professionals who said they’re very happy in their job is 54%. With the highest automation levels in the world, 75% of U.S. respondents said they were very happy with their jobs. With the lowest level of automation of the four countries in Germany, the survey finds only 40% German respondents were very happy.

- Finance workers are optimistic about the role automation will have on their careers. An important baseline number from the survey shows 71% of the respondents saying they believe automation will have a positive impact on their future prospects.

- Employees believe automation will make their job more interesting and less stressful. A major source of optimism among those questioned derives from the type of automation that reduces the time spent on low-value repetitive tasks. Free from this kind of work, they will have more time for interesting work and career improvement.

- Companies that invest in automation stand a better chance of attracting and retaining talent. Almost two-thirds (62%) said they would more likely apply to any company if it showed a clear strategy for investing in automation. In the U.S., that number is almost three-fourths (74%) of those surveyed.

- Employees are increasingly comfortable using technology to inform their decision making. Forty-three percent of the respondents said they felt very comfortable giving over low-value, repetitive tasks to software.

- Middle managers will face pressure to stay relevant and demonstrate value. In a somewhat surprising response, 40% of the surveyed frontline workers said they thought software would be a more effective line manager than their current boss. That number was 48% in the U.S.

- Workers admit that keeping up with the pace of change can be a struggle at times. Thinking about what’s coming, 52% said they expect departmental investment in automation to accelerate in the next 12 months. Most said that’s happening at about the right pace, while 25% believe the change is happening too fast.

- Businesses must prioritize upskilling and training to help workers make the transition. While 45% of those surveyed felt their employer was very committed to education and upskilling employees to meet the change, nearly one-third (29%) said their employer wasn’t committed. Perhaps the most disturbing number in this category, nearly one in five said they currently had no plans to address changes to their job caused by automation.

REMAINING RELEVANT

Mikkel Hippe Brun, cofounder and general manager of payments automation at Tradeshift, offers a final observation on the study. “If data entry is what gets you out of bed in the morning,” Brun writes, “you’re likely to face an unwinnable battle for relevance against automation. Similarly, if you’re a line manager who lives to double-check other people’s work, automation isn’t your friend. But if you’re ready to become more strategic, more collaborative, and ultimately more visible within the business, technology can be an important ally in your journey.”