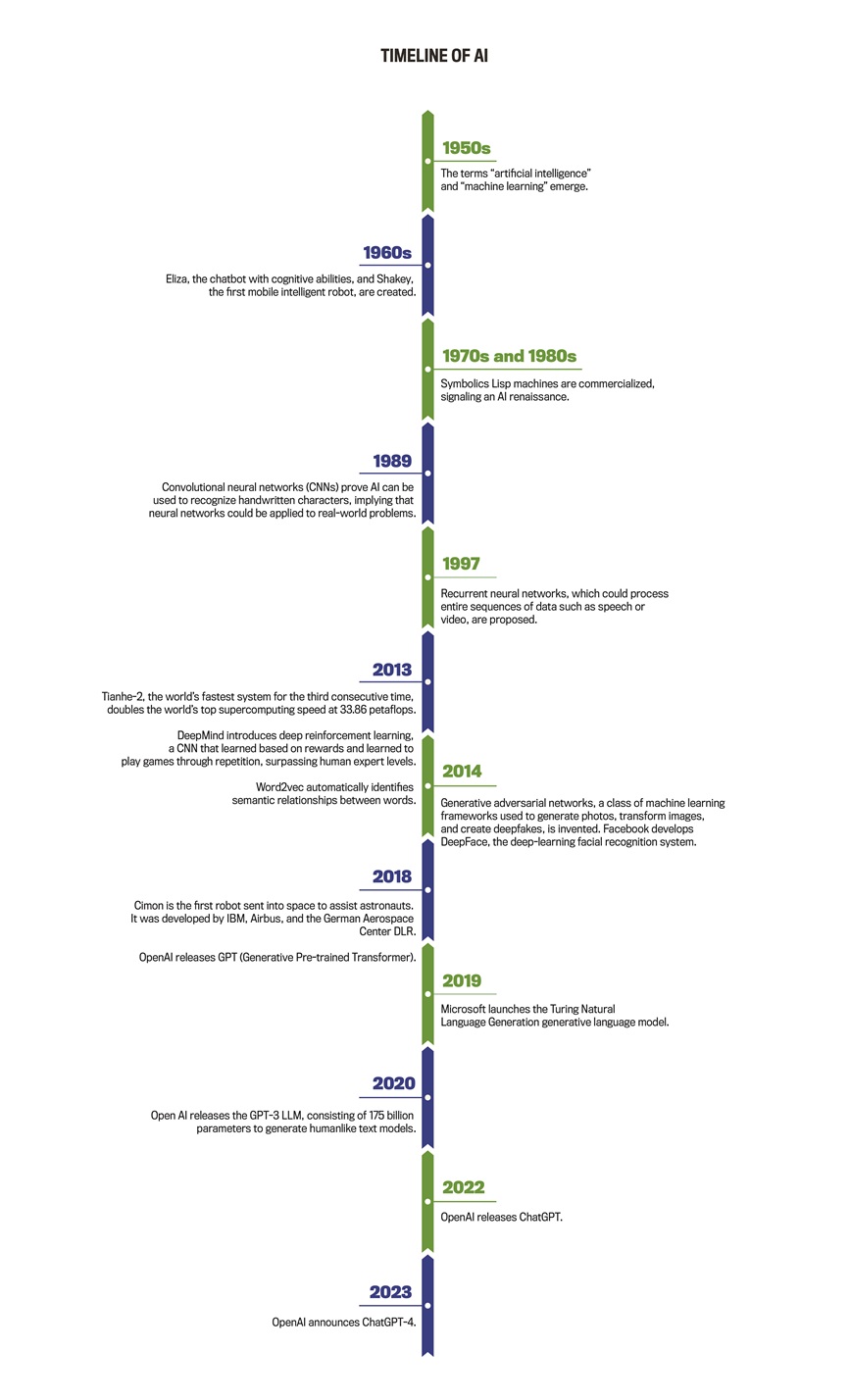

Although we might not realize it, AI has been around for decades. It started with basic systems such as machine learning capable of following instructions and storing commands to assist humans with their tasks. AI has developed so much that it now simulates the thought processes, creativity, and intelligence of real people (see “Timeline of AI”). With the rise of ChatGPT, among other new software/applications related to this field, a lot of attention is being focused on generative AI and its impact on jobs. There are also serious implications for the finance function and the management accounting profession.

Source: Ron Karjian, The history of artificial intelligence: Complete AI timeline, TechTarget, August 16, 2023.

According to OpenAI, the company that developed ChatGPT, “ChatGPT is a sibling model to InstructGPT, which is trained to follow an instruction in a prompt and provide a detailed response.” It’s a natural language processing tool that allows us to have human-like conversations, like answering questions, and assists with tasks, such as composing emails, essays, and writing codes.

Some perceive ChatGPT as a positive emerging technology that can be beneficial to humans in many ways. Others still consider it a threat that might take away jobs. The positive opinions focus on the fact that AI makes work more efficient since it enhances automation, speeds up work as it frees up employees from automated and redundant tasks, improves data analyses, spots trend and outliers in data, enhances communication with customers and stakeholders while also increasing credibility and trust, and helps to brainstorm and generate new ideas (see “Top 10 Use Cases of ChatGPT for CFOs”).

Top 10 Use Cases of ChatGPT for CFOs

1. Analyze historical data for better financial decision making. 2. Identify and forecast financial trends. 3. Conduct financial analysis. 4. Ensure compliance with different types of rules and regulations. 5. Write source code. 6. Assist in tax preparation: provide guidance on new tax laws and regulations, identify deductions, and calculate preliminary tax liability. 7. Take on repetitive, time-consuming tasks. 8. Assist in preparing reports and related footnotes: income statements, cash flow reports, and balance sheets. 9. Assist in bookkeeping: data entry, invoice processing, and accounts reconciliation. 10. Assist in client communication to enhance customer relationships. |

Perhaps the biggest criticism of this new technology is that ChatGPT gives false answers and lacks common sense (see “Downsides of AI”). Another downside in relation to finance is that ChatGPT lacks the vision and mission of the organization that’s using the technology, which can greatly impact decision making as well as financial analyses.

Downsides of AI

|

The challenge faced by users, especially when asking ChatGPT to answer exam questions, for example, is the format or approach. Users are required to introduce information, and some of the formats (especially tables) can be misinterpreted by ChatGPT or read incorrectly. As a result, ChatGPT gives wrong answers. The first condition to get an accurate response is to send the data and instructions in a way that the software can easily read. We tried to give the software accounting exercises with tables that contain data, but apparently, they weren’t correctly read and understood. On the other hand, when we changed the format and introduced the information in text, the answers were much more accurate. (See “Tips and Tricks to Use to Enhance the Accuracy of ChatGPT’s Answers.”)

Tips and Tricks to Use to Enhance the Accuracy of ChatGPT’s Answers

1. Submit information in an easily readable format, such as a paragraph, and avoid tables or any graphical representation. 2. Use simple, clear, and concise language. 3. Use proper grammar and punctuation. 4. Use specific keywords. 5. Provide details as much as possible. 6. Use correct spelling. 7. Divide tasks into simple, smaller tasks. 8. Ensure you have high-quality data by: a. Removing irrelevant information. b. Removing duplicate entries. c. Standardizing the format. 9. Define the evaluation metrics to be used to assess the accuracy of the results. 10. Assess the results’ accuracy. If you have a big data set, test ChatGPT’s results with a small data set first.

|

Given all of the above, can accounting and finance professionals benefit from ChatGPT in a way that limits the impact of the downsides? Yes.

How Can ChatGPT Be Used in Accounting?

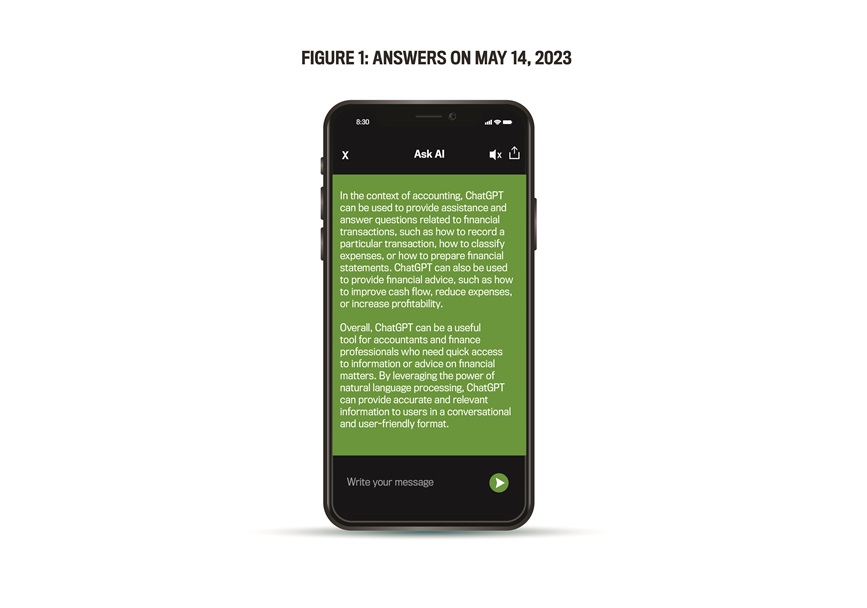

I conducted an interview with ChatGPT out of curiosity—before its May 2023 update—to see what it had to say and to test its accuracy regarding accounting. I conducted another interview after the update and noticed a difference in the answer. The first question I had in mind was “How can ChatGPT assist accountants?” The answer I received was accurate yet incomplete (see Figure 1).

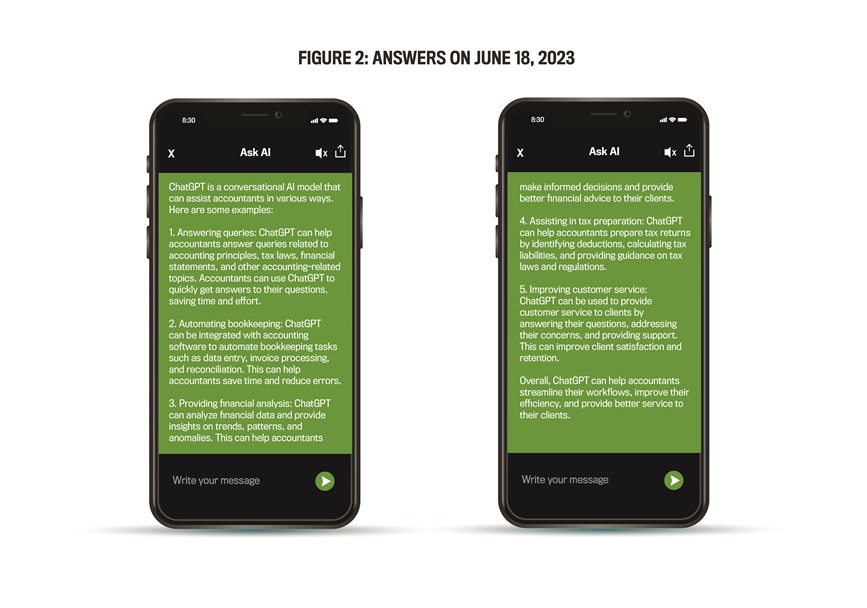

The updated version of ChatGPT gave a clearer and more complete and concise answer (see Figure 2). However, this technology is still a work in progress, which is why critics say we can’t rely on it solely.

According to ChatGPT, its competitive advantage is that it provides relevant information in a conversational and user-friendly format. Studies have already shown that ChatGPT can take on time-consuming and repetitive tasks, such as processing invoices, reconciling accounts, creating financial reports, extracting data from financial documents, categorizing transactions, generating financial projections, and composing audit reports. By handling these tasks, ChatGPT gives accountants more time to spend on more valuable tasks to enhance their efficiency and boost their productivity. AI can also enhance footnotes and comments sections in financial reports, making them more readable for stakeholders and third parties.

ChatGPT said it can help identify potential risks and opportunities as well as provide risk analysis in financial markets by analyzing market trends and economic indicators. It can also provide decision-making support through analyzing financial data and provide insights that can help businesses make informed decisions. ChatGPT is also being promoted for its ability to provide analysis of investment opportunities, including evaluating the financial performance of companies, assessing the risks associated with investment options, and identifying potential investment opportunities. These tasks can directly impact CFOs, controllers, management accountants, and other finance professionals in their decision making, since getting information related to financial markets, trends, financial analysis, and competitors in the industry takes considerable time to gather or might be incomplete. Therefore, ChatGPT saves time by helping finance professionals focus more on analysis and evaluation related to decision making rather than data generation. This will positively impact the quality and accuracy of decisions made.

ChatGPT and the CPA Exam

In early 2023, ChatGPT 3.5 failed the CPA (Certified Public Accountant) exam. This led accountants to believe the technology couldn’t interpret information vital to an accountant’s job. ChatGPT retook the CPA exam in May 2023 and passed it with a score of 85.1 compared to 53.1 out of 100. The second attempt was run by ChatGPT 4.0, which was provided with examples. This newer version of ChatGPT was better equipped with training and reasoning capabilities even though it performed worst in the “financial accounting and reporting” section.

This result provides some insights into what makes ChatGPT most successful. You can’t rely on ChatGPT’s answers without first providing the software with information it can understand and making sure it’s well equipped with the right learning tools and clear instructions in order for it to generate an accurate and credible response. As much as this technology is helpful, it still needs human intervention and support to be used properly.

I have asked ChatGPT, “Why did you fail the CPA exam?” ChatGPT stated that it can only provide answers to CPA questions to the best of its ability and that it depends on the information learned from its training data set. ChatGPT also listed some of the possible causes of failure (see “Why Did ChatGPT Fail the CPA Exam?”). This answer was convincing, which made me believe that the enhancements in the newest version greatly upgraded the abilities of the software (ChatGPT 4.0).

Why Did ChapGPT Fail the CPA Exam?ChatGPT listed the possible reasons it failed the CPA exam:

|

I also asked ChatGPT about its limitations related to accounting tasks. Although AI can generate responses based on patterns, it may lack the specialized knowledge and expertise required to answer complex accounting questions due to accounting’s many specific rules, regulations, and principles that govern how financial transactions should be recorded, reported, and analyzed. These rules and principles may be complex and may vary, especially if they’re country- or industry-specific. Therefore, ChatGPT might not have the domain-specific knowledge needed to answer questions or perform tasks correctly. Also keep in mind that accounting involves the use of specialized software and tools such as spreadsheets and accounting software. AI might not be able to interact with these tools properly, which will eventually limit its ability to perform accounting tasks.

ChatGPT ended the conversation by stating that it’s an AI language model and should be used as a tool to supplement human decision making and not replace it.

What People Are Saying about ChatGPT

Opinions on ChatGPT vary, even among financial experts. “ChatGPT is a great productivity enhancer. It can speed up any task that requires research and analysis or content creation,” says Aaron Harris, chief technology officer of Sage, which provides businesses with payroll, HR, and finance software and services.

Harris says this technology’s greatest power is its ability to convert complex instructions into a set of tasks. On the other hand, he said that even if ChatGPT has what it takes to execute accounting and finance tasks, human review is still needed. “[ChatGPT] will enable professionals to create more and more valuable reports,” Harris says. “It will increase the quality of data analysis. However, human accountability is still central to credibility. AI won’t be signing audit reports any time soon.”

Jason Averbook, senior partner and global leader of digital HR strategy at Mercer, which provides human resources and financial consulting services, has a different take on ChatGPT. He questions the benefits of ChatGPT on the work of CFOs and says that CFOs who implement an autonomous finance function will significantly be impacted by ChatGPT. “CFOs should use their unique risk-focused perspective to push for, and help, shape a policy at the organizational level that mitigates the risks posed by unrestricted use of ChatGPT, including output quality risks, data security and regulatory risks, as well as their downstream implications,” Averbook says. In other words, CFOs can add prerequisites to use ChatGPT within the finance function depending on the risks the software can pose and try to mitigate them while still benefiting from this technology.

Even though Averbook considers this technology to be of great added value, he says he sees some limitations related to the finance unit. For example, ChatGPT can help generate software code or structured query language statements but can’t answer questions about financials because it can only answer questions it was trained to answer; it can’t provide accurate feedback to answer financial questions or give any financial advice due to a lack of insight into the vision and mission of a given organization as well as other necessary components needed for accurate decision making.

Averbook says leaders should focus on transitioning culture and skills toward using this advanced technology and training their team members to acquire the skills to use this technology the right way. “Finance is just about keeping pace with the bare minimum of running the business and meeting regulatory requirements,” he says. AI, on the other hand, can raise that bar and enhance human productivity to help employees work more on strategic tasks in the company. This shows how roles might be shifting due to AI assigning humans better things to do. Leveraging AI is becoming a very important skill that employees need in order to establish a competitive advantage in the market and stand out to employers. So, AI won’t replace people but might cause a threat to those who don’t use and learn it as it’s becoming the more efficient and productive way to conduct business. This technology shouldn’t replace people but rather should increase the scope of work accomplished by them.

Averbook says the best way to work with any AI tool or machine is by not expecting too much from it and to not give it too much control. Unfortunately, finance leaders tend to expect more from AI than they do from humans. This might create risk due to insufficient oversight and control. Instead, finance leaders shouldn’t expect perfection or too much from a machine and assign specific tasks to AI, then check the outcome in order to enhance AI-related processes.

Neil Taurins, general manager of community brands for MIP Fund Accounting, assists nonprofit organizations and has been incorporating AI into MIP’s accounting software to help accountants become more efficient. Taurins says accountants should be excited about the potential of this technology for their day-to-day functions. He also says even though this technology can streamline some accounting tasks, human accountants will remain indispensable due to their specialized knowledge, vision, discernment, and contextual comprehension that AI lacks. Accountants might just need to adjust their skills and embrace AI tools to expedite their daily repetitive and redundant work. ChatGPT might also be helpful in fraud detection and forecasting.

Anders Fohlin, CFO of Medius, which develops accounts payable automation and global payment software, says ChatGPT and other large language models (LLMs) have the potential to revolutionize accounting and all the other functions of a company. LLMs can alleviate time-consuming and outdated processes such as invoice analysis, inventory data, account coding, and manual data entry into systems (e.g., enterprise resource planning systems and Excel spreadsheets) and take over repetitive and manual tasks more accurately and more quickly compared to humans. Fohlin also says ChatGPT can help in data analysis (e.g., decoding statistics, crunching numbers, and flagging key paradigms), but it won’t be able to take over abstract problem solving unless it’s rule-based. The recent Medius report The Financial Professional Census found that 62% of 2,750 senior finance executives believe that the technology they currently use is outdated, while ChatGPT can be useful.

Fohlin says the idea that ChatGPT poses a threat to jobs within the tech industry isn’t founded on anything concrete. The Medius research found that 24% of financial professionals were at risk of leaving their jobs because of a workload primarily dominated by monotonous, boring tasks that are simply demotivating and not challenging enough.

Ultimately, every organization is responsible for keeping within legal boundaries, a responsibility that can’t be outsourced. Fohlin also considers data privacy to be paramount. Those using AI software must understand that while humans know they’re sharing information with third parties and the agreed-upon terms and conditions, ChatGPT lacks that ability, which is a clear limitation. “AI models like ChatGPT are complex, and in many cases often referred to as ‘black boxes’ because their decision-making process can be so challenging to understand,” Fohlin says. “To avoid ethical dilemmas from the onset, companies need to ensure AI-generated outputs are auditable, justifiable, and understandable to maintain trust.”

Gerald Ratigan, senior vice president of accounting and controls of The Gearbox Entertainment Company, points out that companies must take ethics into consideration when implementing AI. “ChatGPT offers the ability to achieve increases in efficiency and effectiveness across many processes. It could even replace people in certain use cases. Therefore, it is paramount to perform a risk assessment to address growing ethical considerations during implementation. With the increasing usage of ChatGPT, companies must act now to implement strong governance to maintain an appropriate level of risk management. First steps should be to establish clear policies and procedures to mitigate growing bias and safety risks. Forward-thinking companies have even created committees to continuously monitor inputs and outputs of ChatGPT.”

Looking toward the Future

The world evolves daily at a fast pace, and we should be quickly adapting with it. Google launched its own AI software: Palm 2, a generative AI chatbot similar to ChatGPT; Med-PaLM, which can answer medical questions and has an accuracy rating of around 85%; and advancements to Bard and Search, which are used for coding, math, and logic, and are also expanding to Japanese and Korean languages. Microsoft is also working to enhance its search engine, Bing, by incorporating a generative AI chatbot technology into its products. (See “AI in the Future.”)

AI in the Future

Katta Andersson, vice president of data capture at Medius, provides some insights regarding what to expect from AI in the future. Andersson says AI helps Medius ensure that businesses receive market-leading intelligent automation today and for the foreseeable future without the need to maintain configurations or templates.

AI enhances the detection of anomalies in the accounting process to figure out the necessary safeguards to ensure time and money are effectively and wisely spent, Andersson says. AI helps to protect businesses against external and internal frauds due to its ability to identify changes in behavior and abnormal activities. All of this will eventually lead organizations to become more strategic instead of reactive in their accounting approach, which will help in removing mundane and repetitive tasks.

Andersson says that AI “will help Medius make businesses and accounts payable departments in particular become more intelligently automated every day.”

AI’s support also extends to helping employees in the strategic decision-making process through the usage of chatbots, which can aid businesses in analyzing all financial data.

|

Like any other new skill or technology, ChatGPT provides us with another opportunity to think outside the box. Finance professionals have the opportunity to work proactively with AI to optimize benefits and minimize the harm associated with it. Humans and machines can complement each other to achieve better outcomes.

It should be apparent that this technology can impact workers’ daily lives and skill sets and improve the overall economy. AI is being used more widely each day to enhance existing applications, software, and search engines in increasingly sophisticated ways.

But finance professionals and management accountants have nothing to worry about: They're already seizing the opportunity to allocate more room for financial analysis and decisions, process improvement, working capital management enhancement, costing accuracy enhancement, profitability measurement, and much more.

Alternatives to ChatGPTGoogle Bard Anthropic’s Claude 2 GitHub’s CoPilot Adobe’s Firefly Otter AI Chat Jasper.ai Meta’s Llama 2 HeyPi

|

October 2023