Given the ongoing headlines regarding the volatile cryptocurrency market, including the collapse of the cryptocurrency exchange giant FTX and the indictment of its founder and CEO Sam Bankman-Fried, it isn’t surprising that many are skeptical about the cryptocurrency space. Despite these alarming headlines, we know one fact: Cryptocurrency may be relatively new and slightly unstable, but it’s built on top of a powerful and stable technology called blockchain. Not only is blockchain here to stay, but there are various applications and implications for the finance function.

A December 2022 Nasdaq article noted, “While the cryptocurrency fallout from the collapse of digital currency exchange FTX might be roiling the markets, financial firms are moving on undeterred, continuing to explore ways to use blockchain technology.” This is spot-on. Finance professionals must keep their eyes on the ball as their clients evaluate the potential benefits blockchain technology can deliver, including benefits to their recordkeeping practices and accounting functions. Therefore, it’s critical that management accountants and finance professionals continue to understand how blockchain technology can impact daily business operations and improve organizational efficiencies.

IMMUTABLE DISTRIBUTED LEDGER

By definition, blockchain is a shared, immutable ledger for recording transactions, tracking assets, and sharing information. Blockchain technology is particularly well-suited for accounting applications and could become a bedrock of global recordkeeping systems.

Interest in blockchain and distributed ledger technology (DLT) continues to surge worldwide. Deloitte’s 2020 Global Blockchain Survey revealed that 55% of executives identified blockchain technology as a critical priority for their organizations. In 2021, Deloitte’s global survey reported a seismic shift in acceptance of blockchain technology, with financial leaders increasingly envisioning digital assets as the future.

Blockchain technology is still relatively young, just around 15 years old. Even so, the blockchain economy is already massive and still growing rapidly. In a 2015 survey, the World Economic Forum estimated that 10% of the global gross domestic product (GDP) will be stored on blockchain technology by 2027.

Blockchain analysts predict increasing investments in blockchain technology in 2023 and beyond. For instance, the use of blockchain in the financial sector will likely reach a value of $22.5 billion by 2026. Beyond finance, blockchain investments will continue expanding into other areas. For example, in the healthcare space, spending on blockchain technology is expected to rise to $5.61 billion by 2025.

Having access to the real-time, highly reliable data that blockchain provides is a game changer for management accountants. They can use it to increasingly monitor financial performance and provide invaluable strategic insights in real time. The current environment around blockchain technology presents opportunities for management accountants to get in on the ground floor and lead their organizations’ blockchain-related strategies.

ORIGINS OF BLOCKCHAIN

Blockchain technology’s history traces back to 1991 when research scientists Stuart Haber and W. Scott Stornetta first proposed digital time-stamping documents in sequence to authenticate authorship of intellectual property. At the outset, Haber and Stornetta sought to develop a computationally practical solution for time-stamping digital documents so no one could backdate or tamper with them.

The first reference to this data structure as a “chain of blocks” appears to come from Satoshi Nakamoto in 2008. Nakamoto’s innovations with bitcoin included the connection of the blockchain concept to a public ledger jointly updated by numerous participants in an open-source network (see “How Blockchain Works”).

The most well-known blockchain in the world is the public blockchain behind the cryptocurrency bitcoin. By any measure, bitcoin has enjoyed broad adoption. As of September 2022, more than 15,000 businesses accept bitcoin for payment of goods and services, including more than 2,000 in the United States. Microsoft is the largest U.S. company that accepts bitcoin, and, as of June 2022, the top five industries that accept bitcoin are gambling, tourism, banking, food, and retail.

While it was the application to cryptocurrencies that put blockchain technology on the global map, that represents only one application of blockchain. The technology lends itself to dozens of other potential applications across many industries including:

- Online voting

- Insurance policies

- Property and real estate records

- Forecasting

- Medical records

- Cloud storage

- Private transportation and ride sharing

- Copyrights and licenses

- Supply chain tracking (see Table 1)

THE GROWTH OF BLOCKCHAIN ADOPTION

According to a 2021 survey by research firm Blockdata, blockchain adoption has grown exponentially since PayPal and The Walt Disney Company embraced the technology in 2014. Currently, at least 81 of the world’s top 100 public companies by market capitalization employ blockchain technology, with at least 27 having a fully functioning live product.

Leading public companies from all sectors are incoporating and leveraging blockchain technology in various ways. For example, energy companies utilize blockchain technology to create peer-to-peer energy trading platforms and streamline access to renewable energy. In one case, homeowners with solar panels use an energy trading platform to sell excess solar energy.

In the finance sector, banks and stock exchanges utilize blockchain technology to manage online payments, accounts, and market trading. Singapore Exchange Limited—an investment holding company that provides financial trading services throughout Asia—utilized blockchain technology to build a more efficient system for batch processing and manual reconciliation of thousands of financial transactions.

Governments are also betting on blockchain growth. The European Union, for instance, announced plans in 2021 for a multibillion-euro investment into blockchain infrastructure that provides grants and prizes to fund blockchain research and innovation.

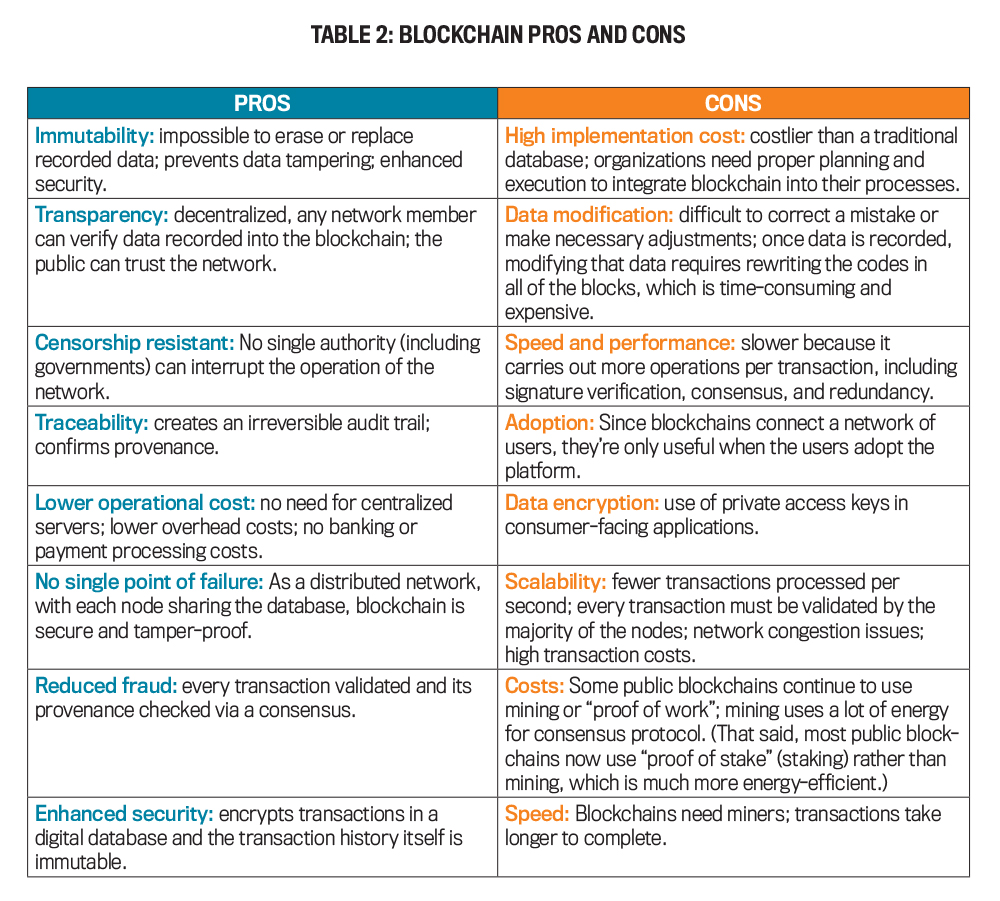

On the flip side, these benefits require certain trade-offs. For example, blockchain doesn’t allow easy modification of data once recorded. Changes would require rewriting the codes in all blocks in the chain, which is time-consuming and expensive. Correcting a mistake or making any necessary adjustments is difficult at best.

Another trade-off, particular to consumer-facing applications such as bitcoin, is that—without a centralized third party governing the database—users can’t recover assets if they lose their private key. For these reasons, decentralization is a mixed bag. Still, most observers agree that blockchain’s overall benefits far outweigh these trade-offs (see Table 2).

PUBLIC AND PRIVATE BLOCKCHAINS

Whether blockchains are public or private may impact certain governance risks. Thus, the distinction is important for management accountants and financial professionals to understand when assessing the adoption of private or public blockchain applications.

Public blockchains are “permissionless,” meaning that anyone can participate in the network. The two largest public blockchains are bitcoin and Ethereum, which both have their native cryptocurrency. Cryptocurrency and public blockchains are closely related, because cryptocurrency is the payment mechanism on a public blockchain. Executing a transaction on a public blockchain requires payment in a cryptocurrency; therefore, public blockchains don’t function without cryptocurrency. The blockchain is the underlying platform for the network, and the cryptocurrency is the value being transferred on the network. A peer-to-peer cryptocurrency transaction occurs when some amount in crypto tokens is sent by one participant to the blockchain address of another participant. Public blockchains allow anyone to participate in this open and transparent exchange of value on the network.

Although private blockchains feel “safer” due to the closed network, private blockchains haven’t lived up to much of the hype generated over the last five to 10 years. This is likely because private blockchains are similar to traditional systems of accounting. Although they use different technology, the governance of the technology is still largely centralized, which undermines many of the benefits of blockchain as decentralized.

With public blockchains, on the other hand, there is no “trusted third party” to verify transactions. This is typically thought of as removing the need for a government or bank, but it also could apply to accounting firms. There’s no external auditor to serve as the ultimate source of truth. The blockchain is the single source of truth.

BLOCKCHAIN AND MANAGEMENT ACCOUNTANTS

Blockchain isn’t simply software for analyzing or visualizing data: It’s a foundational technology for recording data. This could have a much more transformative impact than many of the other incremental technologies being explored in accounting.

In “Blockchain Disruption on Management Accountant’s Role: Systematic Literature Review,” Vecco Saputro, Hamzah Ritchi, and Sofik Handoyo acknowledged the foundational nature of blockchain and attempted to identify many areas where blockchain implementation could impact the management accountant’s work (Journal of Accounting Auditing and Business, January 2021). For management accountants, blockchain can potentially disrupt (in a good way) certain aspects of such tasks as:

- Accessing performance data in real time,

- Facilitating continuous financial monitoring,

- Advising on decreasing operations costs, e.g., data transmission costs,

- Leveraging the ability to better track error information,

- Implementing more efficient and effective accounting practices,

- Leveraging the increasing accuracy and reliability of a company’s underlying transaction and operational data, and

- Improving corporate compliance and internal controls.

Continuous updating of financial and operational data on a blockchain provides management accountants with highly reliable information at all times. Strategic analysis and corrective actions can improve, which in turn improves corporate monitoring, performance monitoring, and internal controls. Basic accounting and auditing activities can also become more efficient with blockchain. For example, once in place, blockchain can reduce the costs of maintaining and reconciling ledgers and eliminate uncertainty regarding the ownership and history of assets.

In the auditing space, the underlying foundations of auditing and internal controls can be embedded into each transaction at the outset. As Deloitte and others have observed, this means that the internal audit design would shift from being a “retroactive, point-in-time examination to an ongoing, real-time monitoring process” instead.

MANAGING ETHICAL AND GOVERNANCE RISKS

In general, adopting new technology introduces new ethical and governance risks, and blockchain technology is no different. Management accountants can assist the rest of the management team and the board of directors in analyzing and overcoming these risks.

From a corporate governance standpoint, there are several overarching issues to consider before assessing ethical and governance risks. First, management accountants can help the rest of the management team and the board determine:

- Appropriate potential uses of blockchain technology for their industry and organizations;

- Their organization’s commitment and ability to deploy the necessary internal controls to maintain security;

- The necessary tools needed to monitor the governance and health of each blockchain platform their organization partners with; and

- Their organization’s personnel/skill sets to maintain appropriate blockchain applications on an ongoing basis.

Once the decision is made to adopt blockchain technology and the necessary personnel and infrastructure are in place, an organization can zero in on potential ethical and governance risks. In a May 2022 Harvard Business Review article, Reid Blackman identified four overarching ethical and governance concerns around blockchain adoption that management accountants should be cognizant of:

1. A lack of third-party protections

2. Privacy violations

3. The zero-state problem

4. Bad governance

One of the common misconceptions about blockchain is that being “decentralized” or “permissionless” equates to a lack of governance. This couldn’t be further from the truth. In reality, blockchain governance is quite complex. According to Blackman, a blockchain’s creators have to set forth at the outset “who has power; how they acquire it; what, if any, oversight there is; and how decisions will be made and operationalized.” Making any changes to these significant items after the fact isn’t easy.

Many blockchains use a form of decentralized governance known as decentralized autonomous organizations (DAOs). A DAO is a community-led entity with no central authority. It’s fully autonomous and transparent: Smart contracts lay the foundational rules and execute the agreed-upon decisions, and, at any point, proposals, voting, and even the code itself can be publicly audited.

As Blackman aptly noted, blockchain governance can raise various “significant ethical, reputational, legal, and financial ramifications” for anyone utilizing the blockchain. To properly advise clients and mitigate risk, it’s imperative that management accountants understand the governance structure of a particular blockchain, including with respect to how potential issues will be resolved.

ASSESS FUTURE IMPACTS

As blockchain technology expands into multiple industries, it will be important for management accountants and finance professionals to stay knowledgeable about how blockchain can be a value-add to their organizations. We must remember that blockchain adoption extends well beyond cryptocurrency and has been utilized to improve organizational efficiencies such as real-time access to financial reporting and other operations data. As blockchain technology becomes embedded throughout various industries and additional blockchain applications continue to surface, we can expect heightened regulatory scrutiny. Key takeaways for finance professionals include the following:

- Blockchain adoption is growing across a wide range of applications beyond cryptocurrencies.

- Public blockchains and cryptocurrency are an important part of the blockchain ecosystem.

- Adopting blockchain technology has improved efficiencies within organizations.

- Concerns about potential ethical and governance risks associated with blockchain adoption can be mitigated.

Management accountants should be assessing the future impact of this rapidly emerging technology on their own role and responsibilities, the finance function, and their organization’s industry vertical. (For more, also read “Blockchain Implementation and Cybersecurity” on p. 58.) Whether or not it’s the right time for your organization to implement blockchain, gaining expertise in this rapidly emerging technology is paramount for forward-looking finance professionals.

March 2023