Certified B Corporations (B Corps) are for-profit companies that have met a set of established standards for environmental, social, and governance (ESG) performance; accountability in terms of profit and purpose; and transparency regarding operations, offerings, and policies such as sourcing, ingredients, and labor practices. They require leaders to act in the interest of all stakeholders, including customers, employees, vendors, and the local community. As a member of the first list of Certified B Corps in 2007, King Arthur Baking Company was an early mover in embracing sustainability and corporate social responsibility (CSR), tracking ESG metrics, and taking all stakeholders’ interests into account.

Reporting to one of King Arthur’s two co-CEOs, three vice presidents—Suzanne McDowell, VP of CSR and sustainability; Janis Abbingsole, VP of operations; and Brock Barton, VP of finance—collaborate to lead the way on prioritizing sustainability, ESG standards, and CSR in the company’s goal setting, strategic planning and execution, tactical implementation, and reporting and disclosure. That cross-departmental approach to sustainable business management instills trust and confidence in the company’s purpose, governance, and oversight, as well as its financial and nonfinancial reporting. It also boosts morale, fuels recruitment, and leads to better decision making by prioritizing long-term success for all stakeholders over short-term profitability.

BECOMING A CERTIFIED B CORP

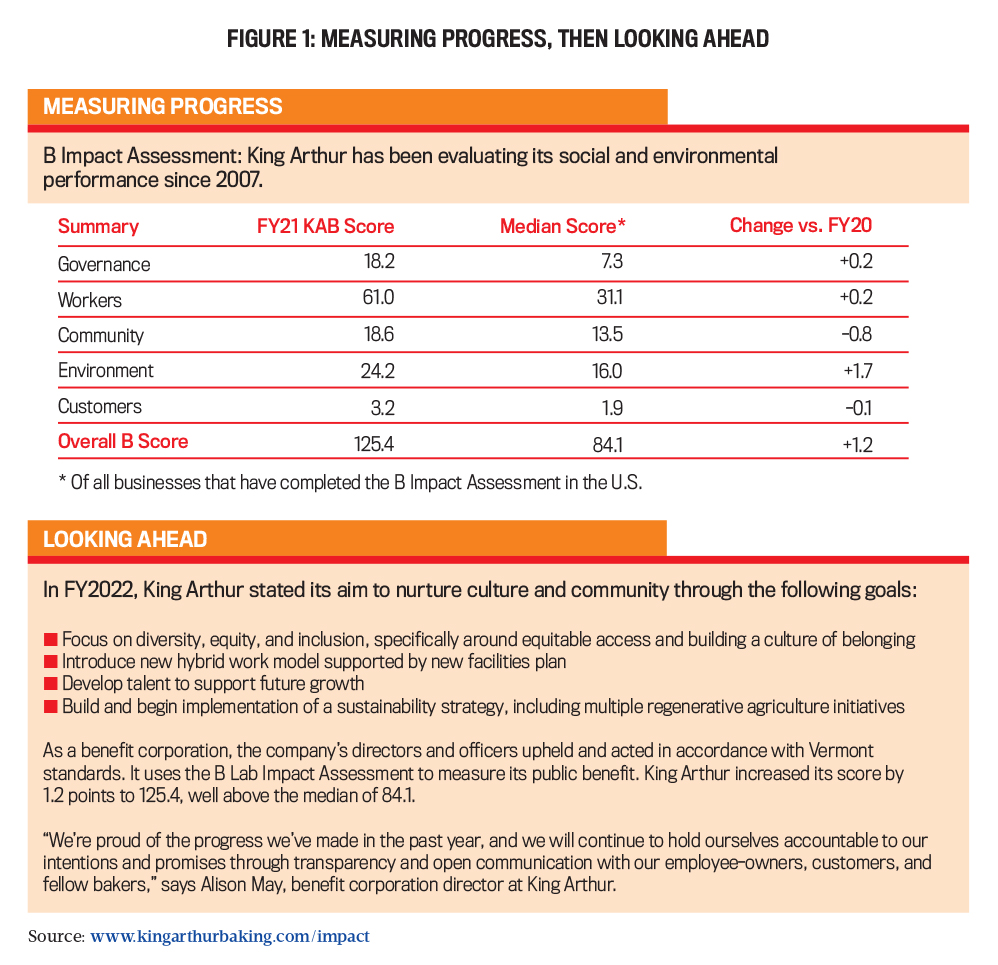

To achieve B Corp certification, companies must apply to the nonprofit network B Lab. Every three years, the organization updates the B Impact Assessment, which asks companies to answer a series of questions about their practices and outputs across five categories: governance, workers, community, the environment, and customers. This allows company leadership to set improvement goals against the most up-to-date standards and to benchmark performance. For certification, businesses are graded on contributing to an inclusive, sustainable economy by how completely they abide by a set of principles.

Like all other B Corps, King Arthur is committed to stakeholder governance. Also qualified for benefit corporation status under Vermont state law, the company is legally required to consider the impact of its decisions on all of its stakeholders, including workers, communities, customers, suppliers, and the environment.

“[Being a] B Corp creates a legal structure that [obliges] our corporate governance and our board to take into account all stakeholders when they’re evaluating strategies, budget allocations, and transactions,” Barton says. “If somebody comes in and tries to acquire us, in a traditional company, it comes down a lot of times to dollars and cents, but with the Vermont benefit corporation legal structure, there’s an evaluation of [the impact on] all stakeholders and whether or not the acquirer would also adhere to those values. We put our money where our mouth is when we shifted to this legal structure that embodies some of the B Corp values.”

REPORTING AND DISCLOSURE

The U.S. Securities & Exchange Commission (SEC) is planning to issue disclosure requirements for climate-related risks and financial statement metrics, including greenhouse gas emissions, in the near future. There are also various sustainability and ESG guidance frameworks such as the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the International Integrated Reporting Council (IIRC). B Lab’s B Corp structure offers an approach that will likely overlap with many of those standards and guidelines while providing a clear path for the company to pursue its commitment to sustainability, CSR, and ESG.

For King Arthur executives, prioritizing sustainability, CSR, and ESG comes down to a triple bottom line: people, planet, and profit. Reporting on the latter is a traditional role of the finance function, but benchmarking the first two requires reporting and disclosure of a range of nonfinancial metrics. That’s where B Lab’s B Corp standards come in. Every year, the company fills out a survey, makes nonfinancial disclosures, and receives a B Corp score (see Figure 1).

“In addition to B Corp reporting, there are a few things on the legal aspect of the Vermont benefit corporation and disclosures related to employee ownership, and I provide data to the team that manages that,” Barton says. “Every few years, we have to provide a little bit more thoroughness to our [sustainability and ESG] data, and we also rely on our outside auditors [to vet] our financials, as well as how we report out internally into [B Lab to satisfy the] B Corp [requirements].”

B CORP CLASSIFICATION

Founded in 1790 as Henry Wood & Company—the first flour company in the United States and the first food company in New England—King Arthur has been 100% employee-owned since 2004, a process that began in 1996 when owners Frank and Brinna Sands decided to sell the company to its employees. But the decision to become a B Corp and follow the B Lab standards came from the top down. In fact, a board member initially brought the designation to the company’s attention during the transition to employee ownership.

“It has to be a belief that being able to include your employees as well as your customers as part of the stakeholders in what the company is achieving allows you not to be driven by profit for the sake of profit, which puts companies in a corner of having to make choices that sacrifice the stewards of your company, which are your workers, or your product quality, and we’re not doing that,” Abbingsole says. “We’re putting people and the planet first—it doesn’t mean that we’re not profitable and that we don’t want to be profitable.”

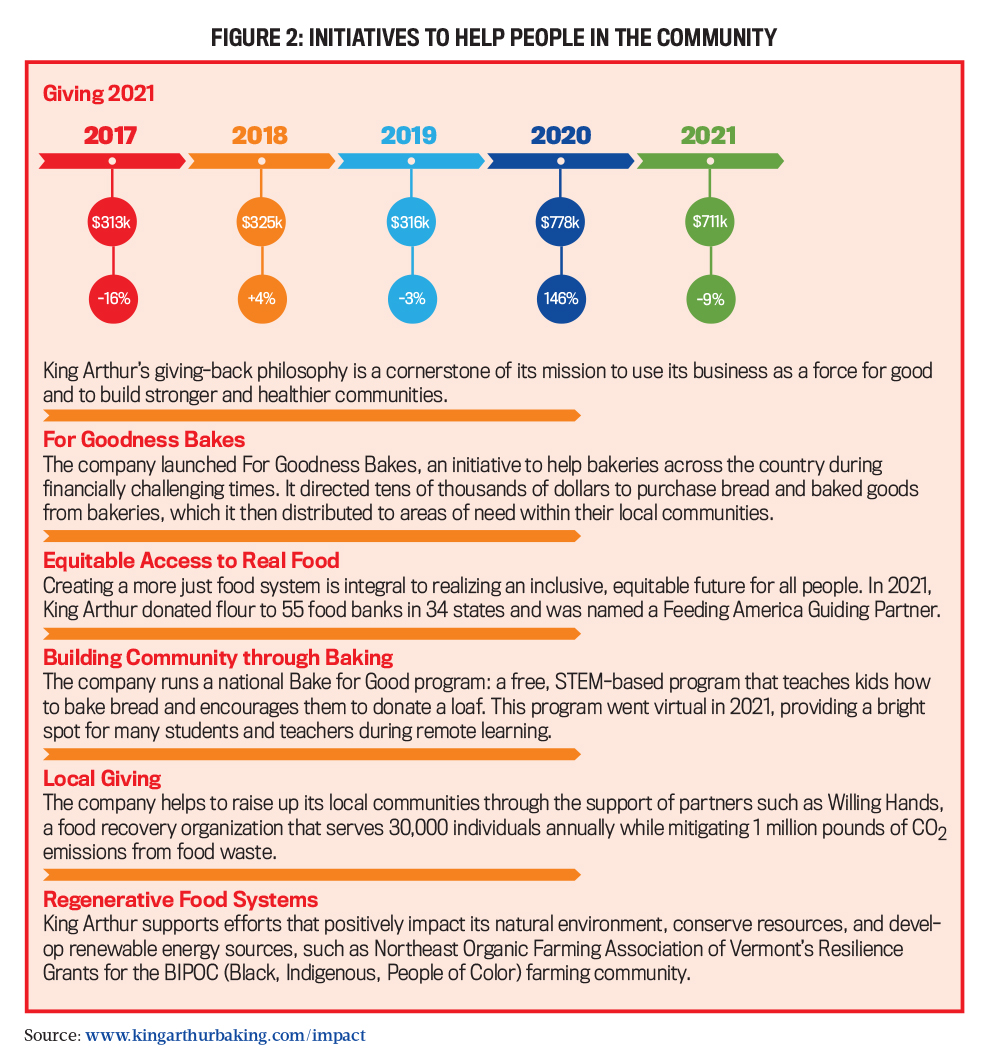

A tangible example she gives is that King Arthur leaders know that as the company’s profits continue to rise and its earnings before interest, taxes, and amortization (EBITA) values go up year-over-year, those monies can go to help fund its ESG initiatives (see Figure 2). Focusing on the triple bottom line fosters a virtuous cycle.

“ESG, sustainability, and even what we’re doing with regenerative agriculture don’t always have a clear path to a revenue line within the P&L [profit and loss], and that’s okay; we don’t need it to do that,” Abbingsole says. “We know that to be a company that’s benefiting more than just profit in our pockets as employee owners, we’ve got to be investing some of our dollars on an annualized basis into these other initiatives for something that’s greater than ourselves. The B Corp standards that hold us accountable there enable us to do that and to continue striving to increase our B Lab score year-over-year.”

CROSS-DEPARTMENTAL COMMITMENT

King Arthur’s co-CEOs lead an 11-person executive team in a collaborative leadership structure. McDowell heads up CSR and sustainability and is ultimately accountable for adherence to B Lab’s B Corp standards. It’s a trifecta between her, the finance function led by Barton, and operations led by Abbingsole, as well as directors within each of those teams, who sit on a committee that makes sure that the company meets all the requirements of the B Corp standards and contribute to strategic planning. Cross-departmental collaboration is a key to success.

“Part of why I came to King Arthur is to break down the silos, and it’s actually been an initiative in operations in particular,” Abbingsole says. “We’re working on this mission, and it takes collective effort, energy, intellect, and heart to achieve the outcomes that we desire, and so if we’re siloed, we can’t achieve it in the way that’s the most long-lasting.”

As the head of operations, Abbingsole oversees the entire supply chain for the company, which includes sourcing both ingredients and packaging materials, flour mill relations, transportation, commercialization of new products, sales support for the wholesale and bakery food service channels, and oversight of the manufacturing facility and direct-to-consumer operations—what she calls “pick, pack, and ship” for the e-commerce business. It also includes all quality and regulatory oversight for the company, including all U.S. Food and Drug Administration food and safety regulations.

From the standpoint of understanding cost of goods sold (COGS) implications and labor cost efficiencies, operations and finance work together every day. A large percentage of CSR and sustainability initiatives are operations-led because they run through the supply chain.

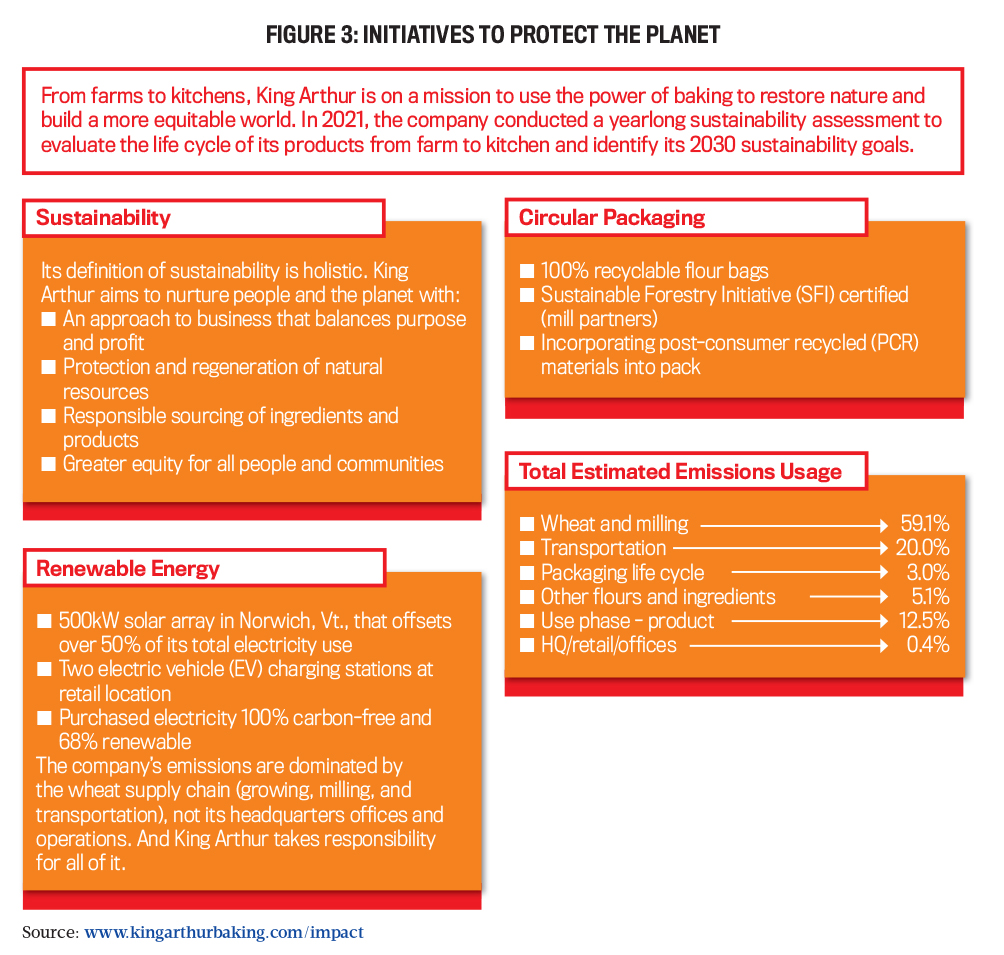

“Take something like greenhouse gas emissions across our operational footprint,” Abbingsole says. “My operations group is responsible for our strategy for how we source ingredients of packaging, as well as regenerative agriculture, how we work with our milling partners relative to the way wheat is farmed in the U.S. That’s operations running those programs, in concert and deep relationship with our sustainability team.”

Supply chain management, procurement, and oversight of suppliers are intimately related to sustainability and ESG initiatives. Instead of those efforts being driven by top-down directives from the CEO or head of sustainability, at King Arthur, the leadership team makes collaborative decisions about where the company is headed, with contributions from all employee owners, so it’s much flatter or more bottom-up than hierarchical.

“We’ve got all the employee owners involved in supply chain management and operations who have the opportunity to impact our corporate goals around sustainability, ESG, and CSR, and so that makes it much more potent,” Abbingsole says. “From a change management perspective and getting people rallied around the cause, it’s a much easier lift, because we’re not trying to convince people we need to do it—they want to be involved.”

There’s a subcommittee that’s part of the B Corp council that makes sure that the organization is on track to achieve the outcomes laid out in the strategic plan across people (spearheaded by human resources), the planet (led by the CSR/sustainability team), and profit (shepherded by finance), but, ultimately, operations, CSR/sustainability, and finance share responsibility for all three.

“My sourcing director sits on that committee because so much of what we do from the standpoint of how we source all ingredients and packaging impacts our B Lab score,” Abbingsole says. “We work in partnership with HR for people [initiatives] and with finance for profit [meetings] about how we roll through our profitability structure relative to influencing B Lab’s B Corp certification.”

King Arthur has to report on how the company is sourcing its materials, ensuring that it’s sourcing from companies that treat their workers well and have their own sustainability statements. A top strategic priority is minimizing its carbon footprint, so the company is working to reduce greenhouse gas emissions and thus continue to increase its B Corp score. This process can be challenging because the company doesn’t control the entire supply chain. In the last 12 months, operations has transitioned more of the company’s goods to be transported by rail vs. truck because rail has less of an impact on the environment due to lower greenhouse gas emissions than truck shipping.

“I have people who are accountable for running those baseline reports and making sure we’re updating them quarterly so we can see that we’re moving the needle toward less emissions,” Abbingsole says. “It’s within people’s corporate goals every year to achieve the CSR standards that we want as a B Corp. We drive that into people’s jobs so they know that they’re held accountable from a goal standpoint to meet the needs of our ESG and B Corp values; we want to be able to have it be culturally relevant for everybody, which means it needs to be part of their daily experience of being an employee owner at King Arthur.”

THE SUSTAINABILITY DEPARTMENT

After becoming a Certified B Corp, King Arthur created the CSR and sustainability department, which includes an environmental manager and a sustainability manager reporting to McDowell, and gave it a seat at the table to weigh in on product innovation and how existing products are packaged and sourced. The financial planning and analysis (FP&A) team is also involved in collaborating with research and development (R&D) and helping to model new products. The question of “How could we do this more sustainably?” has become part of those teams’ foundation and mandate (see Figure 3).

“‘How could we limit certain types of [nonbiodegradable] packaging?’ It comes into play for FP&A both short-term, when we talk about products, but also long-term, when we’re talking to the board,” Barton says. “There’s always this push and pull between employee ownership and B Corp [standards]. A traditional finance person may say, ‘It needs to be an X profit, no questions asked,’ but how do you layer in the employee ownership piece, B Corp investment, and understanding how that may not necessarily meet your traditional modeling when it comes to financials?”

In addition to leading the finance function, Barton also oversees the facilities function. He started at the company almost 10 years ago as a senior accountant before moving up to controller and then eventually to his current position. The finance function is a three-tiered team. The aforementioned FP&A team helps the various business units to drive performance. There’s also the core accounting and transactional accounting team, which includes the controller, the accounts payable team, and the accounts receivable team. The third piece is payroll and retirement benefits, which, because the company is employee-owned, is a much more significant part of the finance function. Barton says that the employee stock ownership plan (ESOP) administration is somewhat complex, so a position was created with its sole focus on managing, promoting, and advocating for the ESOP.

“It’s quite a collaborative team—operations, finance, and HR, along with the CSR team, are driving the results,” Barton says. “CSR and sustainability collaborate with so many other teams, including the new product team. They’re given a seat at the table for a lot of these discussions, whether or not we’re bringing on new vendors or introducing new products, looking at expanding buildings, etc., so they’re very cross-functional.”

Having a dedicated CSR and sustainability team has been an incredible benefit to the organization, Barton says, because it helps the leadership team to always keep sustainability, CSR, and ESG commitments top of mind, balancing out his top priority of the financials and margin targets.

“A good example is if we’re saying we need to hit a 30% margin and we’re at 26%, we say, ‘Yeah, we’re at 26, but we’re doing A with our packaging for the planet, we’re doing B for our people, and we’re doing C to grow the business five years from now,” Barton says. “We need to be able to fund those really good things, and, to do that, the portfolio has to achieve a certain target, so for every two or three products that aren’t meeting [profitability] targets, you need to have another four or five that do. So let’s find that balance.”

Striking that delicate balance of the right level and speed of investments requires intentionally sequencing them in waves so that it’s more manageable and can be calibrated appropriately. Investing a little bit over time to achieve objectives is more prudent than trying to do everything at once.

“Everybody wants to incorporate so many things for all the right reasons, but we need to be able to fund it, so that’s a little bit of a struggle where sometimes it has finance coming off as the bad guys who are policing the budget a little bit, but obviously we feel that passion as well, knowing that we need to find a way to be evergreen with our ESOP and our B Corp funding, balancing all three aspects of the triple bottom line with it,” Barton says.

B CORP CULTURE

All of these elements of the B Corp, the Vermont benefit corporation, and the employee ownership structure all feed together to cultivate a particular sort of company culture at King Arthur. A key element of that is transparency.

“King Arthur does [all-hands meetings] in a great way every month where I or someone on my team will present financials—good, bad, or ugly—to the whole company, and I love that transparency and visibility into that, but it’s also to measure other things, [such as nonfinancial metrics] like philanthropy and the number of hours employee owners spend volunteering every year,” Barton says. “We report on stuff like that, which we try to build into that scorecard, and the planet piece has always been like any of these initiatives that are still somewhat immature.

“We measure our waste and energy usage and report on whether or not that’s improving, so it gives it substance and puts accountability behind some of the things that do for [meeting] B Corp [standards], and it helps us prove that out,” Barton says.

The pros of becoming a B Corp and maintaining those commitments are quite clear to McDowell, Abbingsole, and Barton. They say it brings more of a sense of purpose to their daily tasks. They see finance and operations functions as engines to do better things.

“Especially in a finance role, where we aren’t used to necessarily being part of something bigger and better, [the norm is] being part of a finance team that ideally drives profitable results,” Barton says. “Both employee ownership and [being a] B Corp bring everybody together for a common good and benefiting all stakeholders, and that permeates through the culture where, yes, we know that finances are important, but we also know that doing well and growing the pie allows us to do better things.

“[A commitment to sustainability, CSR, and ESG] was like gravy in the past, but now, especially with the younger generations, we’re seeing it more and more as a recruiting tool, where people are coming to us for these reasons, not necessarily because of our product or the role,” he says. “It provides a great avenue to get like-minded people in the door.”

Abbingsole seconds the notion that being mission-driven has become part of King Arthur’s culture and reputation as a B Corp, which has turned into an effective recruiting tool. B Corp is branding that demonstrates the company’s corporate purpose and values.

“People come to work for us because we’re a B Corp, because being a B Corp has social currency for people about how they want to live their lives and the [types of] companies that they want to work for,” Abbingsole says. “It aligns with our mission and values that we had even before we were a B Corp; it helps form a sense of cohesion and cultural relevancy for the people who work at the company and gives us something to feel proud of when we see our products with the B Corp emblem, when we see other CPG [consumer packaged goods] companies in particular who have shared values with their B Corp emblem on their products.

“We have to go through the process on an annual basis; it’s an investment for us that holds us accountable and keeps us on track,” she says. “You pay to be audited and have the certification, and it keeps us accountable to those values that we hold dear.”

There are different points of entry depending on the size of the company to meet the B Corp standards. Abbingsole doesn’t see any pitfalls, but you have to be prepared to invest time and resources, so go in with your eyes open.

“It’s important as a company of our size to be vocal about being a B Corp so that we’re helping to inspire other companies to become a B Corp, [demonstrating] that there’s a different way to participate in capitalism, and B Corp provides that structure in order to do that,” Abbingsole says. “Employee ownership, being a B Corp, and open-book management absolutely create a great sense of cohesion about understanding that every employee owner is a shareholder, and it also really engenders a feeling of entrepreneurial spirit.

“Transparency engenders a deeper level of trust, and employee owners are showing up with their best selves—even if we don’t agree about how we’re going to achieve the outcome that we set out to do, people show up with candor about how they want to do their work,” she says. “People have a sense of pride about what they do and what they contribute to as a result of employee ownership and [being a] B Corp.

“That sense of belonging definitely feels very tangible to me in the organization—I’m doing something that’s greater than myself, greater than the sum of all of the parts of employee ownership.”

March 2023