The IMA® Committee on Ethics is proud to announce that Dawn Schwartz, DBA, CMA, CPA, CFE, has won the Best Case Award in the 17th annual Carl Menconi Case Writing Competition for her case, “When Change Isn’t So Good: New Management Brings Ethical Dilemmas.”

The competition is named in memory of Carl Menconi, who held leadership positions in IMA for many years and served as chair of the IMA Committee on Ethics. The objective of the competition is to develop and distribute business ethics cases with specific application to management accounting and finance issues and that use the IMA Statement of Ethical Professional Practice as a reference or guidance tool.

The winning case and teaching notes will be available later this year for use in a classroom or business setting. IMA academic members will be able to access and download the teaching notes from the Academic Teaching Notes library via the IMA Educational Case Journal section of IMA’s website.

A tear rolls down Liz Kane’s cheek as she thinks about the last 20 years. She has devoted most of her career to Break Free Renewal, Inc. (BFR) and loves the company, its customers, and its employees. Liz has always been the shining star in the office, everyone’s biggest fan and strongest supporter. If someone has a question, Liz is the one to go to. Everyone trusts her to get the job done, be fair, and, above all, protect the company. She has been dedicated to her work and the company. It’s her life’s mission.

Now it appears Liz has hit a fork in the road, and she isn’t quite sure how to move forward. She has become increasingly worried about the credibility and reliability of the financial information being distributed to BFR’s board of directors by BFR’s CEO, Sam Phillips. Initial efforts to raise the issues internally were brushed aside, and Liz now faces a decision regarding what actions to take next.

The question is a difficult one. Liz can’t imagine life without BFR. It’s all she has known for two decades. But her integrity means everything, and she’s trusted to make tough choices. Not one to jump ship when it’s sinking, Liz would rather repair the ship and keep it steering in the right direction. Yet she feels that’s impossible. Several people had tried and were terminated. If Liz stands up for what she thinks is right, she could lose her job—and with it, her health insurance coverage, which is very important to Liz.

COMPANY BACKGROUND

A 501(c)(3) organization located in Charleston, W.Va., BFR was founded in 1995 to provide support for addiction recovery, including inpatient and outpatient support, housing, and family support services. Its main sources of revenue are individual and corporate donations, grants, and the sales of some products and services.

The company also developed an addiction-support training certification program that it charges participants to complete. BFR also offers continuing professional education courses and partners with a local college to teach some of the courses in the school’s psychology and nursing programs.

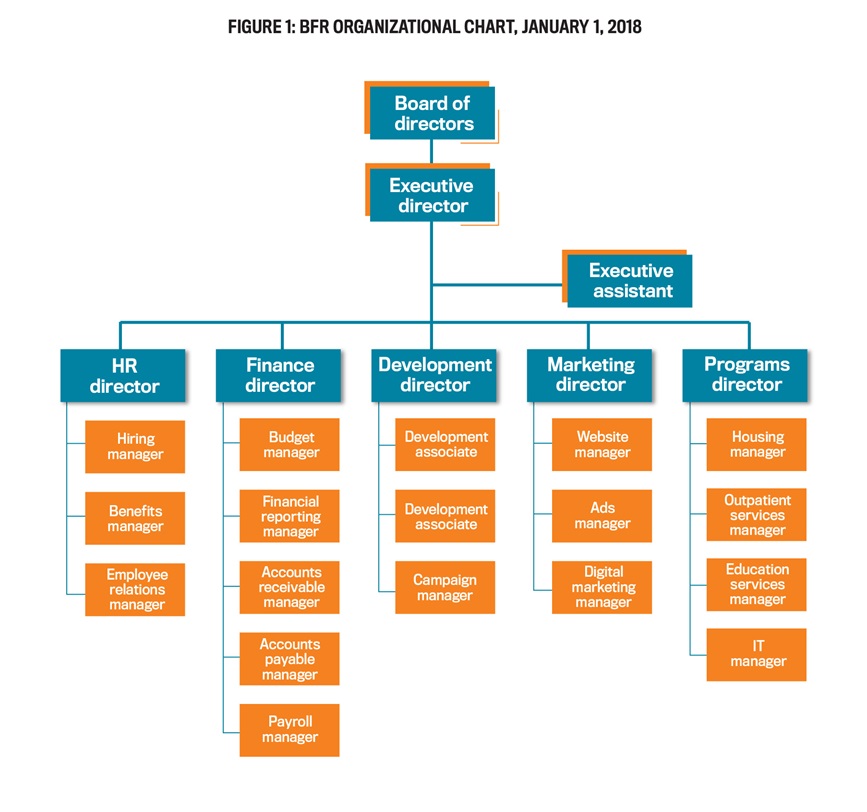

As of 2023, BFR has 38 full-time administrative employees, 87 full-time counselors, and another 75 part-time employees. In the early to mid-2010s, BFR experienced a five-year period of growing revenues that resulted in the accumulation of a large, unrestricted cash balance of $36 million. At the time, the money had been earmarked to save for future growth and potential economic downturns. Then, in 2018, BFR began to use the cash reserves to upgrade and expand its facilities and program offerings, which also involved hiring additional employees and revamping its marketing. Now the company is facing the impact of the economic downturn from the pandemic and doesn’t have the large cash reserves to help mitigate the impact. The company was managed by James Sims from 2003 to 2018 (see Figure 1). He had a laissez-faire leadership style and was very friendly, energetic, and transparent. James felt BFR was his legacy. He thought of the employees as family and walked through the office halls every morning to say hello to them. He held quarterly meetings with employees to discuss the current state of BFR and future projections, brainstorm ideas, and address any issues or concerns they might have.

James was economical with an accounting background. Having been through tough times with the company, he believed in saving money and knew the value of having savings on hand. James was always very transparent about plans and finances with the board of directors, donors, and other stakeholders.

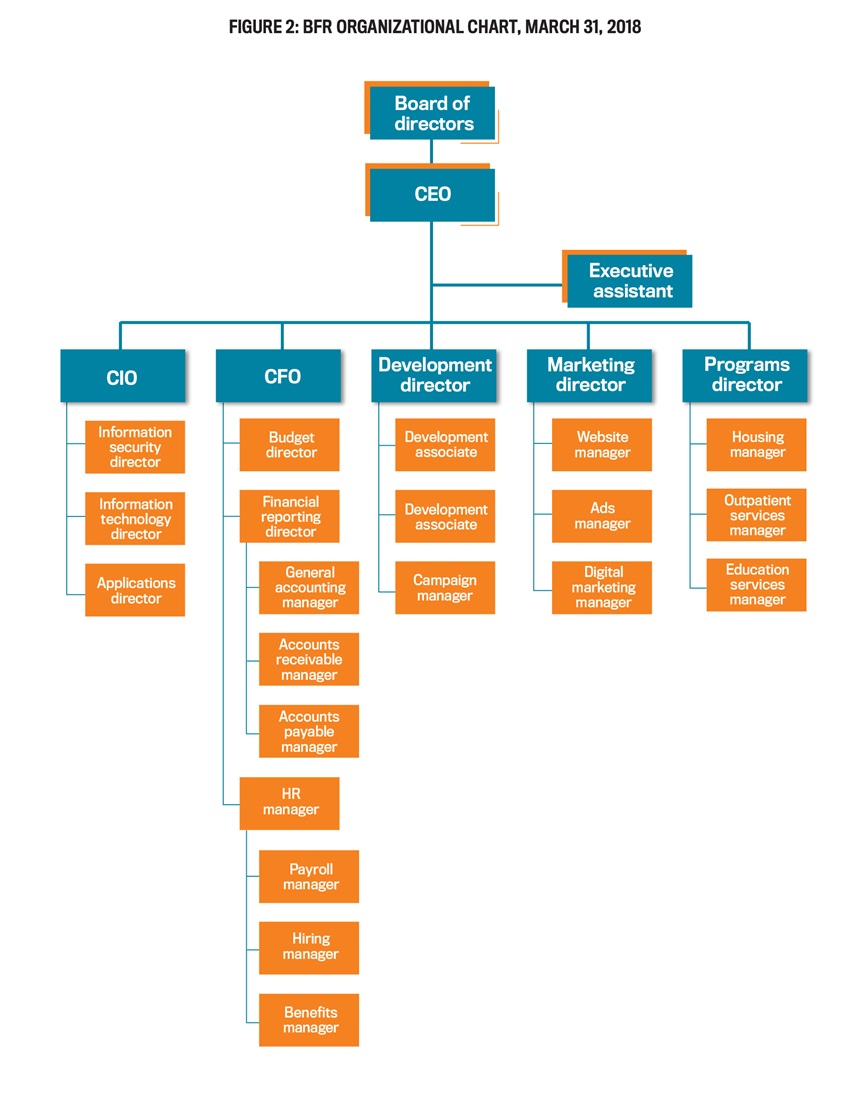

James retired in early 2018 and was replaced by Sam Phillips as executive director. Sam came from the private sector. He had a management background but limited finance and accounting experience. Sam restructured the company and created the positions of chief information officer (CIO) and CFO. He brought in two of his previous employees, Miguel Teague and Amrita Gupta, to be CIO and CFO, respectively. The executive director position title was changed to CEO. The organizational structure was further changed to combine the administrative and finance functions under the CFO (see Figure 2).

Sam has a very different leadership style than James did. Sam leads with more of an authoritative style; he’s the primary decision maker and only communicates directly with the CIO, CFO, development director, marketing director, and programs director. Sam isn’t in the office much because he’s also helping to run a family business. As a result, the culture at BFR has shifted from the upbeat, comfortable, friendly, and family-like atmosphere to a more reserved, secretive, and disconnected atmosphere.

Many employees have left because of clashes with the new CEO; some left on their own, while others were fired. The employees who left no longer keep in contact with the others still at the company, even though they had been like a family for years. In fact, when current employees see them out in public, they make it seem like they’re no longer allowed to talk to them. Rumors of nondisclosure agreements have been circling, and people are nervous.

NEW MANAGEMENT, CHANGES, UNCOMFORTABLE ADJUSTMENT

As the budget director for BFR, Liz is responsible for creating and managing the company’s budget, including projections, monthly reviews, and compliance reports. Liz works with other departments and considers market and economic trends to determine revenue and expense projections. She compiles and reviews the monthly reports and addresses any issues.

Liz has held the position for 20 years. She was skeptical when Sam came in, but her optimistic personality and extreme dedication to the company drove her to fiercely defend him and try her best to be supportive. She reinforced her support to her employees, letting them know that new management and leadership styles can be difficult to adjust to, but that they all shared the same goals, would find middle ground, and learn to work well together. Liz knew BFR needed a united front and believed employees must support management, or the company and everything they had worked so hard to create could be destroyed.

But it was becoming more difficult each day. Things changed gradually over the past three-and-a-half years. Liz and the other directors previously attended all board meetings and presented information from their departments. Board members often asked questions directly to the directors. Now the directors aren’t allowed in the board meetings at all. At first, Liz thought maybe they forgot to invite her and the other directors to the board meetings, so she went to the first one after Sam took over. After the meeting, Sam informed her that she was no longer needed at the board meetings. Only the CEO, CIO, and CFO were to attend the board meetings going forward.

Liz was a bit taken aback by that change and wondered if she had done something to offend Sam. She enjoyed seeing the board members and always answered questions about the budget and the projections. Liz was frustrated and disappointed, but she knew that new management meant new perspectives, new visions, and new goals. She knew she needed to be supportive and work hard toward the new goals. Liz was determined to support Sam even if their personalities clashed and their perspectives were very different. She knew from discussions with her executive coach that sometimes she could be resistant to change. So Liz made it her personal mission to work hard toward acceptance of the new management style and other changes.

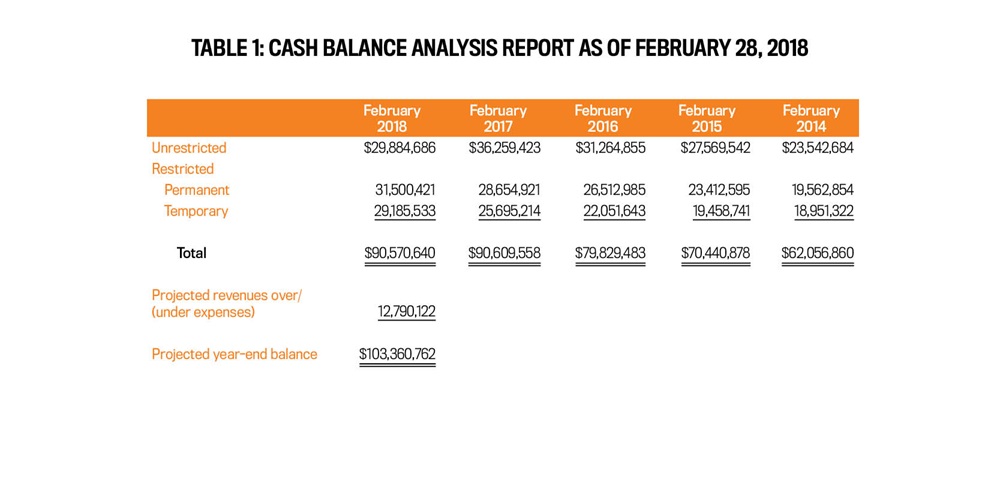

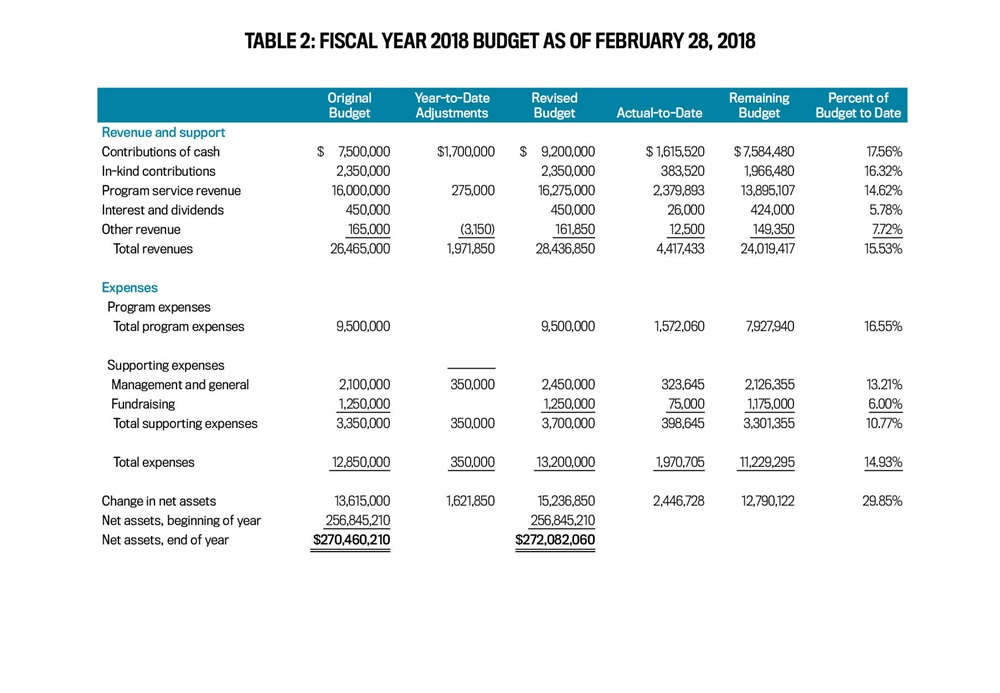

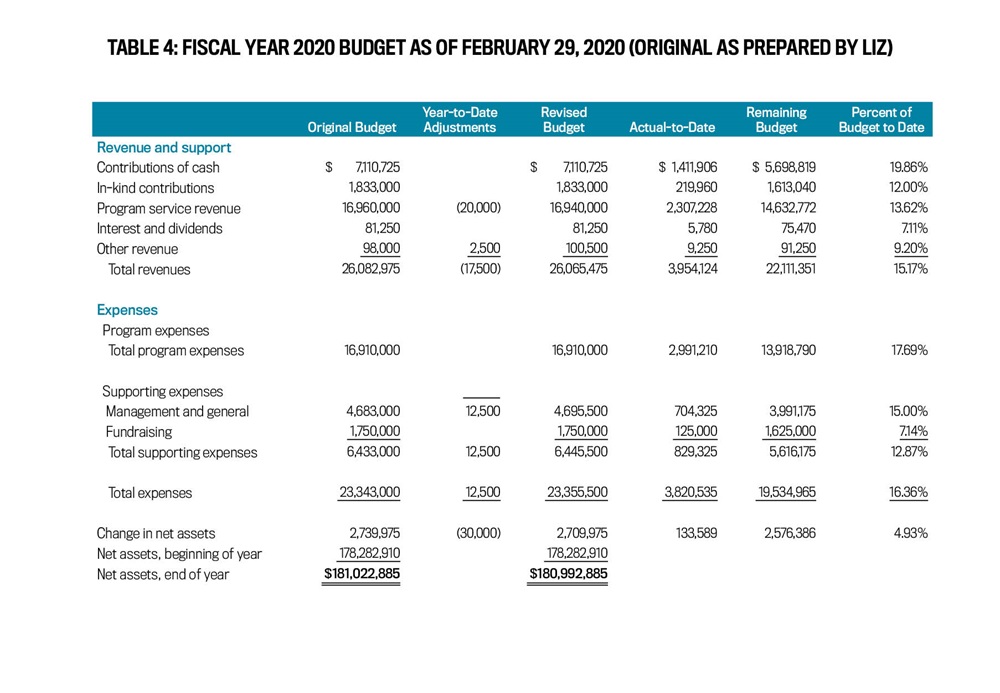

Liz had always prepared reports for the board of directors for each quarterly meeting. Starting in 2020, however, she has been asked to make several alterations to them. Many were gradually changed so substantially since then that Liz feels they no longer represent what they’re supposed to—and she fears they’re misleading board members. When James was executive director, Liz had prepared board materials with the operating budget to date, comparison to actual, detailed analysis of the cash balance, and comparative year information (see Table 1 and Table 2). But the detailed analysis of the cash balance report has been removed. Instead, board members are given a total cash balance at the bottom of the statements that includes restricted and unrestricted cash combined. The board members don’t know how much of the cash is unrestricted and available for use.

ALTERED REPORT

The first signs of trouble with the reports began a few days before the March 2020 board of directors meeting. Amrita, the CFO, emailed Liz new projections for Liz to use in her report. The projections were materially different than hers were: The projected revenues were $2.2 million higher than hers. Liz asked Amrita for the supporting documentation so she could make the changes. Amrita said she didn’t have any documentation and that Sam had sent the projections to them and requested that Liz make the changes.

Liz told Amrita that she didn’t feel comfortable changing her numbers without sufficient support and rationale. She explained the projections were lower than originally expected due to a downturn in economic conditions and the COVID-19 pandemic. Revenues were lower, and expenses were increasing. There was a lot of uncertainty due to the pandemic.

Liz also explained her position as a CMA® (Certified Management Accountant) and her duty to maintain the credibility of her reports. Amrita said she understood and asked Liz to send the reports without the changes for the board meeting (see Table 3 and Table 4). Liz was perplexed by the request to change the projections and was hopeful that the rationale and support would be sent to her soon.

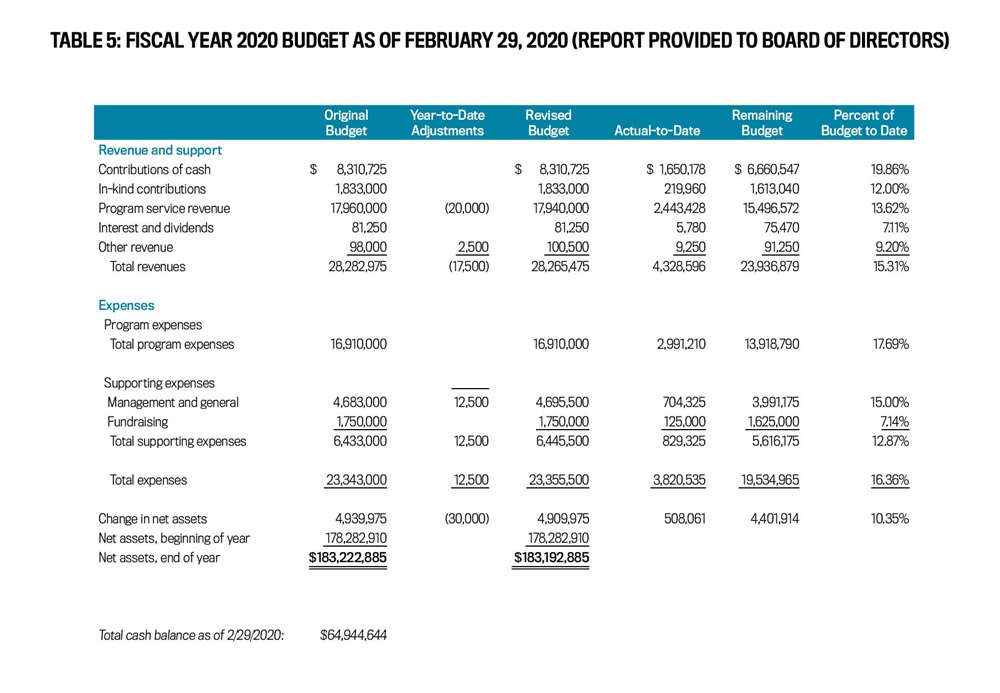

A few days after the board of directors’ meeting, Liz reviewed the board meeting materials. This was standard procedure for her, as she always downloaded and saved the materials, then added her notes with her reports. When Liz reviewed the report, she was shocked. Her numbers had been changed (see Table 5). The projected revenues were $2.2 million higher than her original report. Liz immediately contacted Amrita, who sternly said Liz should have reported what she was told to report. She then told Liz that the CEO wasn’t required to share with her his rationale or his supporting documentation.

They had a heated discussion, with Liz explaining her responsibilities under the IMA Statement of Ethical Professional Practice. She told Amrita that she wasn’t trying to be difficult, but she was scared she would lose her certification if she made changes without any understanding of the basis for them. At the end of the conversation, Amrita said she understood and agreed that if they changed her numbers again, they would put the caveat at the bottom that the numbers were prepared by management. This was supposed to imply that Liz, the budget director, didn’t prepare them.

GROWING DISSENT

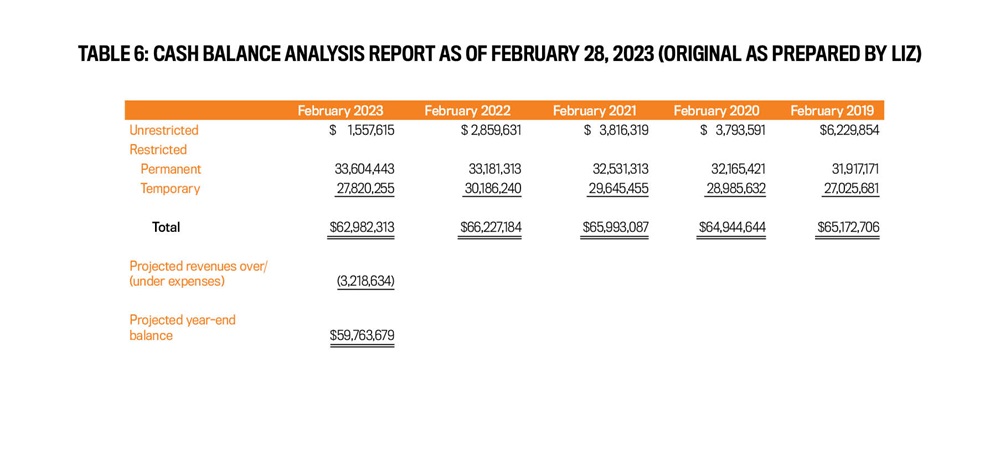

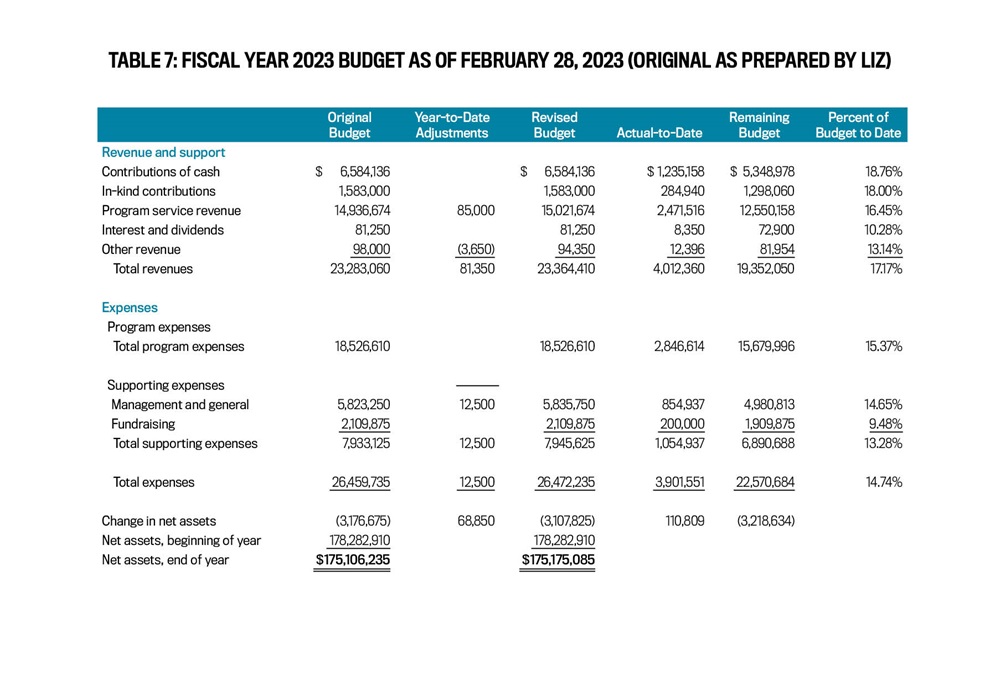

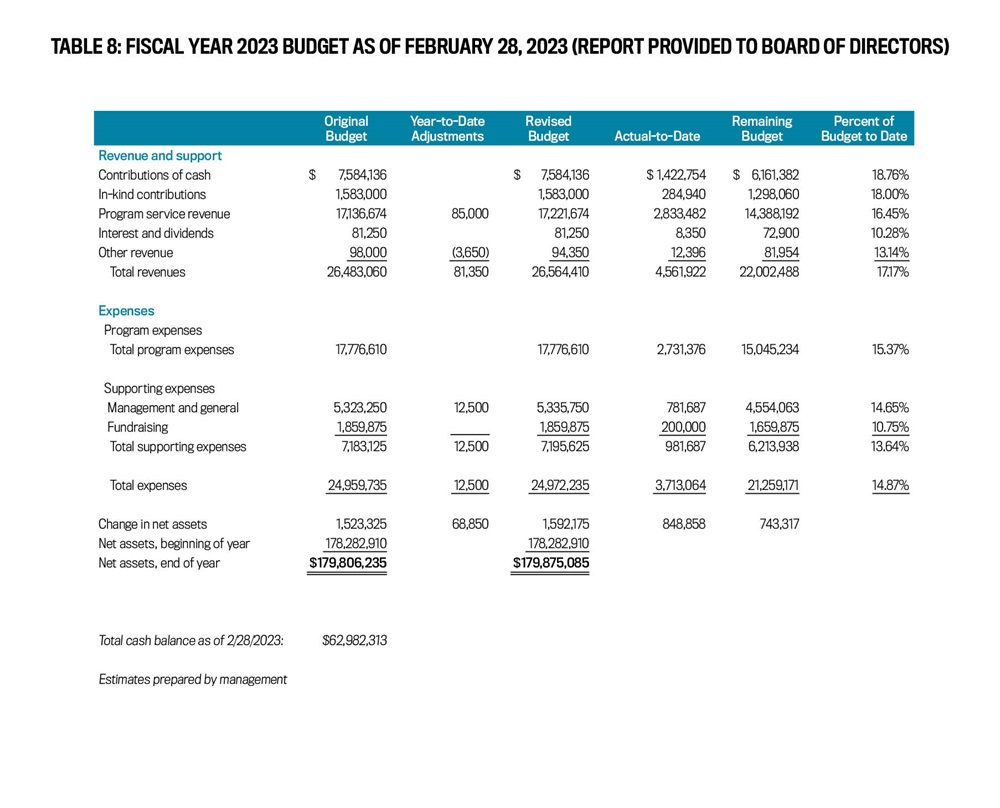

That was three years ago. In the time since, Liz’s dissatisfaction grew, and she continued to worry about the credibility of financial information distributed to the board of directors. She’s again faced with a report going to the board of directors that was altered to show projected revenues $3.2 million higher and projected expenses $1.5 million lower than her original report (see Table 6, Table 7, and Table 8). Amrita continues to withhold explanations and supporting documentation for the changes. Liz has given up hope that she will ever understand the rationale for the changes.

Spending in the past few years has reduced the unrestricted cash to $1.5 million. Sam approved a major renovation of all the buildings, built two new housing developments, built a new executive suite, and hired a major marketing firm. While these were all good improvements, the pandemic caused major increases to expenses while revenues declined. The company was unable to fill the rooms in the new housing developments due to the market.

Liz’s budget for 2023 shows that the expenses this year would exceed revenues by more than $3 million. In the past, BFR could have covered this budget deficit with the unrestricted cash saved. Now it didn’t have enough saved to cover the shortfall. Worried about cash flow, Liz voiced her concerns to Amrita, who told her it was under control. In fact, the report that was distributed to the board of directors showed revenues exceeding expenses by more than $1 million. But it didn’t offer any further explanation or the basis for those changes.

Liz wonders why the board of directors wasn’t asking more questions and if the directors have enough information to know that there are issues. The board was only given the CEO’s revised budget, with no comparative year-over-year information or cash balance details. The total cash figures given included unrestricted and restricted cash. The restricted cash couldn’t be used for operating expenses. Yet the board wouldn’t know the breakdown and may assume that the cash is all unrestricted. Board members also didn’t have comparative information to see the fluctuations over time. Unless the board members were pulling prior years’ reports themselves, they may not know there’s an issue.

TURNING POINT

Jim Gallagher, a BFR board member, stopped by Liz’s office this morning with his most recent board meeting materials. He had a question about the budget and wanted to know how the performance was when the market had been hit hard by the pandemic. He also wanted to know why he and the other board members weren’t being given the budget-to-actual figures and the breakout of cash balances anymore.

Jim also wanted clarification about the caveat disclosing that the report was created by management, as he didn’t recall seeing it in the past. He asked Liz, “Wasn’t the report always prepared by management?” Jim explained he hadn’t been able to dedicate a lot of time for review of the information the past couple of years due to the struggle of the pandemic on his own company. But he was there now, at Liz’s desk, demanding explanations.

Liz explained to Jim that she had an appointment in a few minutes. She asked if they could discuss it another time. Jim told her he would be back tomorrow morning at 10 a.m. Now Liz is panicking. She’s fearful that the reports were altered due to the failure to meet projections and that the budget-to-actual comparison, cash details, and prior-year information were removed so the board couldn’t make the connection. But she had no proof.

It’s possible that Sam and Amrita know something she doesn’t. Sam is in charge of the company, and, surely, he’s coming up with a solution. Liz is scared to voice her concerns to Jim because it could mean losing her job if she’s wrong. She also isn’t sure if the changes are considered fraud or even illegal because they’re internal reports going to the board of directors, not published financial statements.

But if Sam doesn’t have something else in the works and Liz doesn’t voice her concern, the company could be at risk of failing. If BFR runs out of cash, it won’t be able to pay expenses, no one will have a job, and BFR won't be able to continue its mission.

Liz is reviewing the IMA Statement of Ethical Professional Practice and has called you, a fellow CMA, for advice on what to do. Based on the IMA Statement, advise Liz of her options and discuss whether the changes to the reports and decrease in transparency are considered fraud or illegal, and/or are in violation of the IMA Statement.

July 2023