The 2023 outlook looks stormy: Economic downturn, continued inflation, volatile foreign exchange rates, and a sustained higher level of uncertainty are all on the horizon. The ongoing pandemic, especially in China, coupled with geopolitical conflicts and trends in deglobalization, have struck global supply chains, bringing instability and higher costs to many economies. Supply chain disruptions are putting long-standing operational models at risk, from offshoring to Just-in-Time, with potentially unforeseen consequences. This scenario hasn’t been seen by business leaders in many years.

Amid this environment, a meaningful way to improve financial performance is through a more effective demand planning process. But accurately planning demand under these volatile market conditions is tough, making it challenging to positively impact financial results. It doesn’t have to be this way. There are several best practices companies can follow to improve demand planning and drive better financial results.

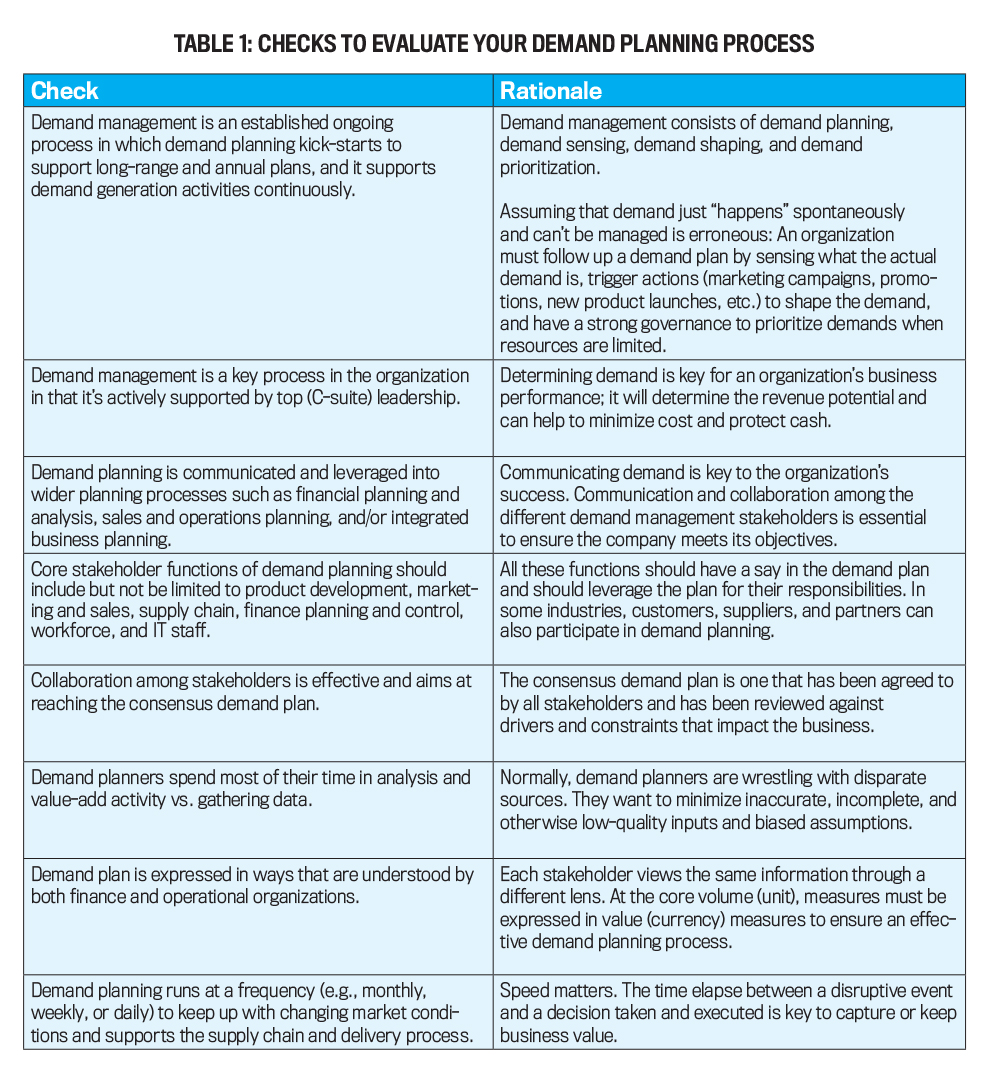

Developing the most accurate forecast for the future demand of a product or service is critical to optimizing performance and business results. Nevertheless, most organizations struggle to accurately forecast and plan for demand under current circumstances. And the consequences of those complexities are forcing organizations to face higher inventory levels and costs, unsatisfied customers, and missed market opportunities. More effective demand planning can help to unlock improved financial performance. But organizations must first understand the inhibitors to accurate demand planning in the current environment. (See Table 1 for more on evaluating your demand planning process.)

UNDERSTANDING DEMAND MANAGEMENT

Companies perform demand planning to ensure that they have the right materials to produce the right products, in the right quantities, delivered to the right location, at the right time in order to meet customers’ expected service levels. The duration of this cycle is often referred to as the supply chain lead time (or sourcing lead time, production lead time, or distribution lead time). Companies can’t wait for customer orders before they start planning; they must use demand planning to anticipate future demand and then plan their supply chain activity accordingly.

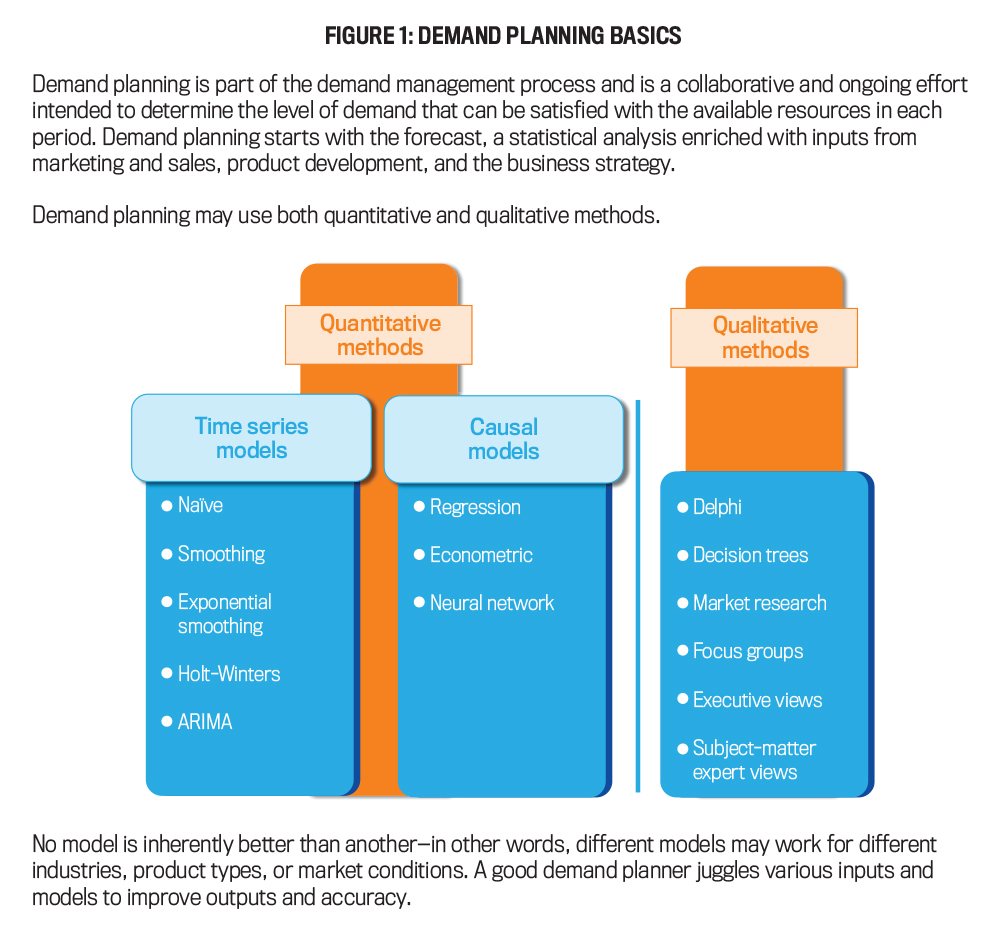

Demand planning is part of the demand management process that has been in use since the 1950s. In recent years, demand planning has been gaining sophistication as Big Data, analytics, AI, and machine learning technologies enable greater refinement in demand modeling and lower the entry barrier for more organizations. Demand planning has a strong forecasting component but involves much more than just statistics. When done well, demand planning considers the inputs from various sources and experts to build the right assumptions to be used in forecasting models. (See Figure 1 on p. 28 for an overview of the methods involved.)

PLANNING DEMAND TODAY

Even in normal times, gaining an understanding of how the market will react to new products and services, promotions, or price changes is difficult—and it’s much more difficult under current market conditions. For many business leaders, figuring out price elasticity and its impact on demand is becoming an obsessive pursuit for a simple reason: to help with decision making. For example, a premium beverage manufacturer would need to know how sensitive consumers are to a price increase in order to prevent them from shifting to lower-priced drink options. But the manufacturer also needs to protect margins from surges in ingredient and energy prices.

Yet striking a balance between supply and demand, at the right price point, with this level of variability is hard. High forecasting error rates can cause a significant impact to a company’s profitability. When the demand plan is inaccurate, either excess or obsolete inventory is stockpiled, or, on the contrary, having insufficient inventory will cause stock-outs, resulting in negative revenue and reduced customer loyalty.

Given all of that, why is effective demand planning one of the top priorities for business leaders looking to persevere in current market conditions? Because accurate demand planning directly impacts and strongly correlates with financial results. Here are some examples:

- Profit and loss (P&L): increased revenue and market share, enhanced margins from effective assortment planning and marketing, and reduced reactionary spending on emergency actions (premium expedited freight, labor overtime, etc.)

- Balance sheet: improved inventory and working capital efficiency; asset and resource optimization by aligning purchasing, production, and distribution plans with demand planning

- Cash flow: improved capital allocation to high-demand, high-margin items; improved days inventory outstanding (DIO) resulting in lower interest expense

Helping demand planners to tame forecast bias and suppress error levels is critical to optimizing business results. Why, then, is demand planning so hard?

THE DIFFICULTY OF DEMAND PLANNING

Let’s examine three of the top challenges of demand planning. The first challenge is planning demand under high-variability conditions like those that exist today. A simple way to understand this is by looking at the Organisation for Economic Co-operation and Development (OECD) passenger car registration figures for the United States for the last few years (see Figure 2). For 2020—the year the COVID-19 pandemic emerged—the chart shows a drastic decline from February to April 2020 followed by a rapid recovery in the subsequent months. If this decline isn’t considered in the model as an outlier—and thus excluded—quantitative methods would yield less accurate results in the annual forecasts for future periods.

Therefore, to improve prediction quality, businesses must continually review and adapt their demand planning to constantly changing market conditions. The challenge is that there are many statistical models available and a broad range of quantitative and qualitative methods that need to be combined and used depending on the circumstances and specific characteristics of what’s being analyzed. The most complex statistical method doesn’t always provide superior results. Rather, the quality of the results ultimately depends on the frequency with which data is being ingested, the ability to effectively use various internal and external business drivers to enrich the training of these models, the product characteristics (e.g., an upgrade vs. a totally new product), and more. With higher market volatility, the forecasting and planning error rate grows and trust in the demand planner’s results diminishes.

Second, demand planning is hindered by organizational disarray. Demand planning is a key step in sales and operations planning and integrated business planning. These processes are underpinned by cross-functional collaboration between leadership, finance, sales, marketing, supply chain, operations, and other functions. Yet in most organizations, these business units operate in isolation from one another and occasionally act on contradictory assumptions and conflicting targets. There needs to be further unification of these functions.

Even if demand planners generate solid forecasts, those forecasts are neither followed nor trusted. Why? Because the demand forecasts aren’t supporting the planning assumptions of every business unit. And that results in each function using its own self-generated forecast, creating different views of a shared reality across functions.

Another organizational concern is the placement of demand planning within the overall organization, both functionally and hierarchically. There’s no straightforward answer to the question of where demand planning should be placed, and the options are diverse. Logistics, marketing, sales, finance, strategic planning, supply chain operations, or an independent team—any of these functions can own the demand planning mission. Not to mention, demand planning that’s untrustworthy or excluded from the C-level agenda also tends to get pushed down in the hierarchy.

Finally, many demand planners are working with obsolete technology. Using legacy technology may sound paradoxical in the Digital Age when technology is ubiquitous and data is abundant, but it happens. In today’s world, a wide variety of planning tools are available alongside abundant expertise and insights to input into the demand planning activity. While these factors should raise the accuracy of demand planning, the results are quite the opposite many times. Why is that? Because demand planners often need to handle a mix of different data sources and tools. This mix includes spreadsheets, paper-based reports, and flat files that must be uploaded manually to the planning tools.

Sometimes there’s a direct integration to a source system, but data management and transformation may be required when preparing data to feed into statistical models—and that takes time. If the planning and modeling tools aren’t suited to blend all this data intelligently, more manual manipulation will be required by the demand planner or technical expert. That added manipulation will then create a bottleneck and create more risk for potential errors.

Consolidating all these disparate inputs is what consumes most of the time and effort of demand planners, leaving little time for modeling, analyzing, and interpreting the results. Therefore, demand planners are forced to make a suboptimal compromise: to discard some input sources and simplify the analysis or miss critical deadlines. If the demand planning process is overly cumbersome or time- consuming, the probability of that forecast being appropriately refreshed is unlikely.

When businesses don’t refresh their technology to capitalize on the rich and abundant data sources available, demand plans are delayed, erratic, incomplete, or lacking the required level of detail. And whatever the effect, it diminishes the value added to the overall business planning process.

Modern, cloud-based demand planning technologies must therefore be leveraged to handle the growing number of internal and external business drivers, factors, and data volumes. Now is the time for businesses to elevate demand planning as a critical activity to conquer complexity, uncertainty, and risk.

A BETTER WAY

Organizational and technological issues in demand planning aren’t new. The current market conditions, however, highlight the impact these issues are having on business performance. Understanding the issues hindering demand planning and the importance of making the process more effective is critical for businesses seeking to optimize financial performance.

Fortunately, as organizations deal with increasing turmoil, technology is making steady progress. Big Data analytics, AI, and machine learning offer good examples, and these technologies are now making an impact in demand planning and forecasting.

AI and machine learning can help drive more effective demand forecasting by ingesting higher volumes of varied data, determining the relationships between drivers (features and events) and their impact on the forecast, and executing thousands of forecasting models at a fraction of the time required with prior methods. The time saved frees up the demand planner, allowing for more trials with different forecasting methods in a shorter time frame. The benefit? AI solutions can execute far more simulations and recommend to the planner which statistical method drives the most accurate prediction for a given product and business context.

What, then, can organizations do to improve the effectiveness of demand planning? A preliminary step is to identify the root causes of demand planning not yielding accurate results. Organizations can then rank the causes by severity and the effort required to resolve them. Through this process, organizations may gain valuable insights for building the business case for change.

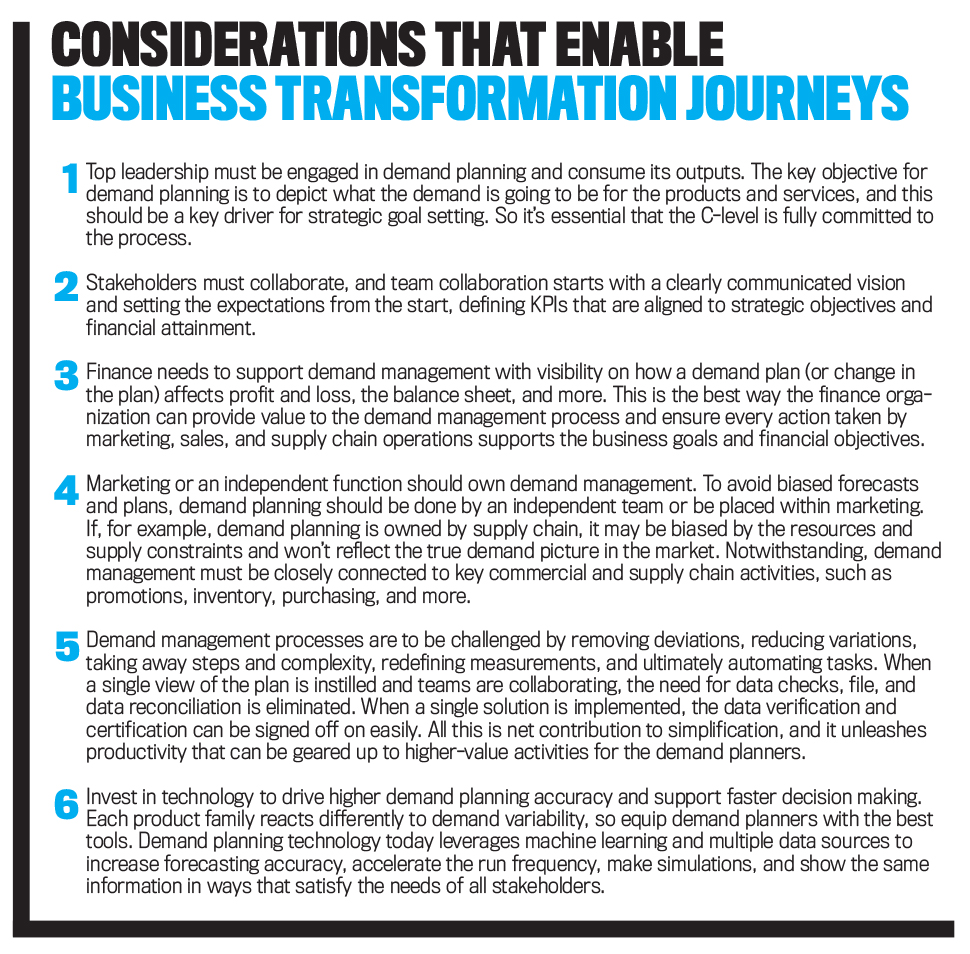

A few important considerations will allow businesses to shape their own transformation journeys and serve as guardrails along the way once an organization is determined to revamp demand planning.

- Unify all planning activity and identify demand planning as a pivotal piece. Planning doesn’t work well when done in silos. Why? Because doing so creates redundancy, ring-fences the impact of the plans, and blurs the vision. Unifying planning across business lines and functions instead offers a single view of the business that removes organizational bias and provides agility in return. In an ideal world, demand forecasting should be one of the first steps in overall business planning.

- Seek sponsorship from finance leadership. Under a unified approach to planning, the CFO and the finance organization can better support demand prediction and align it with other planning activities. Financial planning sets the organizational targets, but how realistic is a revenue target when the demand forecast is falling short? Demand planning acts as a check-and-balance step against the financial targets by providing business context to the financial ambitions of an organization. Therefore, the CFO should have a vested interest in supporting demand planning.

- Align demand planning key performance indicators (KPIs) with financial objectives. Higher demand forecasting accuracy is essential to helping optimize replenishment and safety stocks, but how does that affect financial performance? What if demand scenario modeling could be checked right away against the P&L, balance sheet, income statement, and cash flow statement? Providing that visibility to the business would accelerate the assessment and selection of the operational planning scenario that optimizes both business and financial performance. The demand forecast must be expressed both in value (dollars) and volume (number of units) to serve as a connector between finance and operations.

- Make use of the best data sources available. Modern demand planning technology allows planners to plug in different data types with high frequency—structured and unstructured; internal and external; financial, operational, and transactional—to inform the forecasts. Adding more sources helps incorporate market trends, seasonality, and cyclicity where applicable. But there’s a caveat: Sometimes access to new data sets is difficult or restricted. For example, having access to point-of-sale data is key for the consumer goods industry. Yet most of that data is proprietary to retailers and wholesalers, who may not be eager to share it. In this case, using weather data to forecast demand of certain consumer products can help improve demand forecast accuracy.

- Incorporate more demand forecast modeling capabilities. A one-model-fits-all type of system for demand forecasting has never been a good approach—and certainly not when the demand plan must cover a variety of product types and categories, disparate markets, and demand segments. Thus, a good demand planning practice is to constantly look for alternative models to plan for the same product and expand the toolbox with techniques and technologies that broaden the spectrum of modeling methods.

A good example is a supermarket chain changing its mix of dairy products. Rather than relying on historical forecasting models, the chain should test other models, especially when new products are placed on the shelves, new data sets become available, new promotions are run, or factors that influence consumer behaviors change. That doesn’t mean statistical models have an expiration date. Rather, the more models tested on a specific demand set (product, price, data, etc.), the better the chances that errors can be contained or reduced as market conditions change.

- One version of the numbers isn’t debatable. Having one version of numbers is hard, no doubt, because organizations are broken down into multiple functions and business lines. Accordingly, the systems at hand can only produce limited and incomplete plans. But it shouldn’t be this way. Software solutions exist today that can unify all the planning and forecasting activities within one platform and with one data model. Utilizing a data-first approach to planning should be the first step to consider for an organization looking to reach consensus demand agreements and reduce bias.

WHERE TO START

Improving demand planning is a tactical starting point for leaders who are interested in unifying financial and operational planning, and a specific way to deliver a positive impact on their business. Instead of marginalizing such planning because current market dynamics may increase errors, organizations should view demand planning as a key mechanism for optimizing business performance. Getting leadership sponsorship is critical. And pursuing a data-driven approach that can produce demand planning models connected to financial objectives can considerably improve results.

A data-first approach provides a unique and unquestionable view of the numbers. In turn, that view will serve as the glue to connect and keep all functions and business lines rowing in the same direction. And the benefit comes in the form of saving time in costly organizational design and culture changes that sometimes don’t last very long.

Business and finance leaders who want to take advantage of new opportunities in uncertain market conditions should consider effective demand planning as a critical capability to improve financial performance. A simple question helps clarify the benefits: If demand planning errors are reduced, how much would that imply in terms of the following?

- $M savings from lower inventory or obsolete stock write-offs.

- $M cost avoidance by reducing last-minute decisions in purchasing, freight, and manufacturing.

- % market share gained due to timely and complete product availability.

The way forward to realizing those benefits starts with CFOs and finance teams partnering with the demand planning organization.

February 2023