Earning both the CMA® (Certified Management Accountant) and CPA (Certified Public Accountant) designations is a huge differentiator for accounting students in today’s competitive and dynamic business environment. Dual certification signifies that holders have a broad and deep range of knowledge, skills, and expertise in accounting and finance beyond auditing, tax, and financial reporting. It also shows prospective employers that the holder is highly motivated, ambitious, and seriously committed to lifelong continuing professional education.

It can also put more money in the pocket of the dual-certification holder. The March 2021 IMA® (Institute of Management Accountants) Global Salary Survey reported that professionals who hold both the CMA and CPA designations earn 149% more median total compensation than their noncertified counterparts.For that to even be possible, students need to pass the requisite exams. In January 2023, the American Institute of Certified Public Accountants (AICPA) finalized and approved significant changes to the Uniform CPA Examination under its CPA Evolution model. These CPA exam changes, effective January 1, 2024, necessitate another update to our comprehensive nine-step model that prescribes a viable path for undergraduate accounting majors to prepare for and pass both the CMA and the “new” CPA examinations.

In 2007, we first proposed a streamlined strategy for undergraduate accounting majors to pass the CMA examination before graduation and the CPA exam within six months after earning their bachelor’s degree. Since the 2007 article, there have been four major sequels: 2010, 2015, 2018, and 2019, each incorporating various changes to the CMA and/or the CPA exams. These changes ranged from modifications of the content (topics) tested and the structure (number of parts on each exam) to the format (time per part and multiple-choice questions vs. task-based simulations) of each exam.

Our premise since 2007 continues to be that undergraduate accounting students who follow our comprehensive nine-step plan can efficiently prepare for both exams when they’re in the ideal position to do so—while they’re still students. As students, they’re used to preparing for and taking examinations. In addition, they can capitalize on the “freshness” and overlap of the topical content covered on each exam.

This article modifies the relevant aspects of our streamlined plan to reflect the “new” CPA exam changes. The modifications include the sequencing, timing, and types of courses we recommend to better align with the two exams.

Once again, we’ve limited our focus to the dual CMA/CPA certification because:

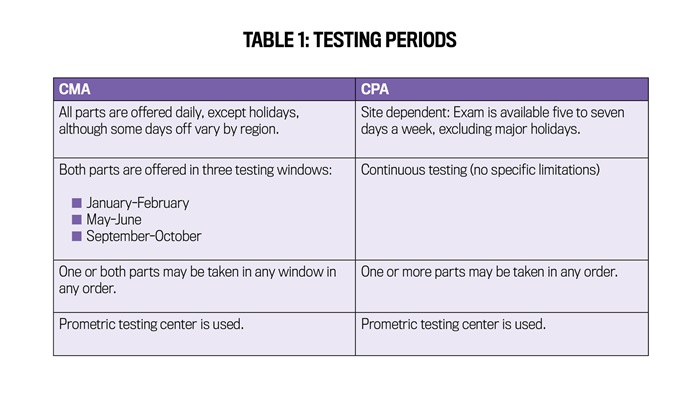

- Both permit candidates to take one section (part) at a time.

- Both are computer-based, using Prometric testing sites. Thus, the modes of delivery and assessment are similar.

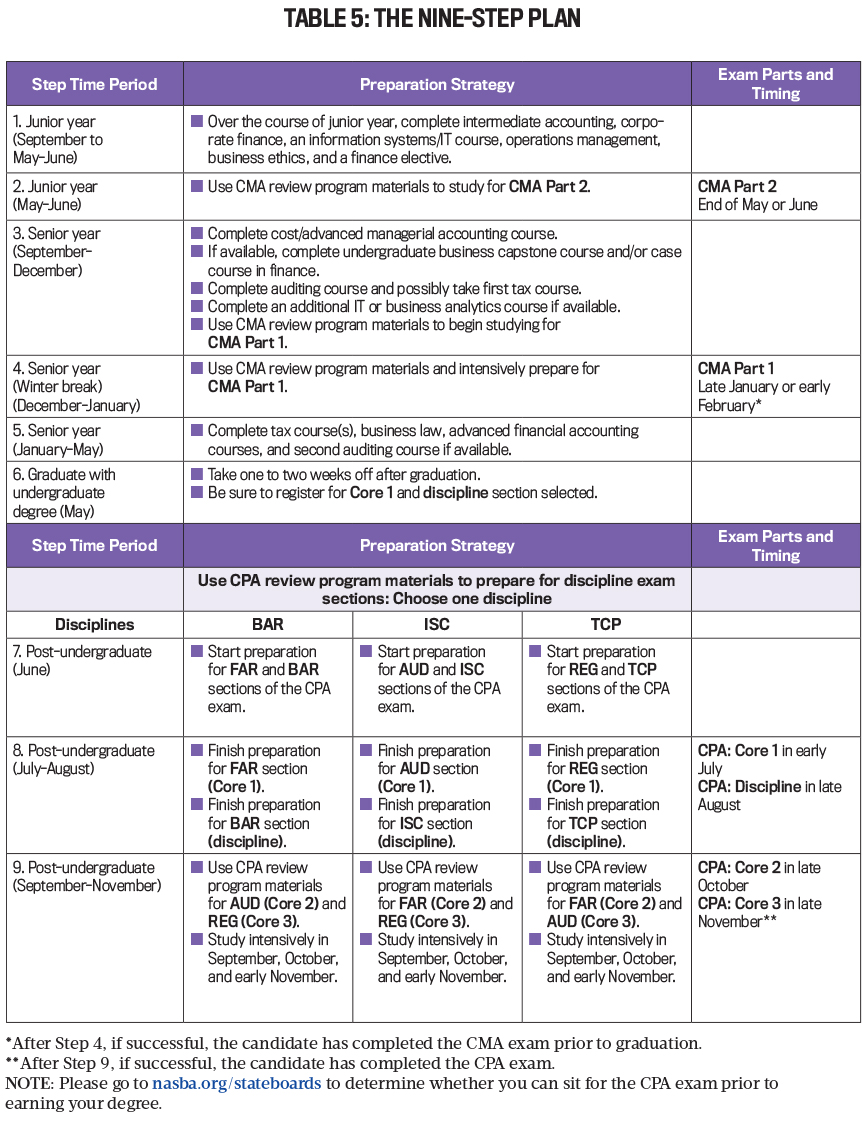

- Both exams provide for flexible scheduling (see Table 1).

- Both require qualifying work experience to earn the designation.

Exam Changes

ICMA® (Institute of Certified Management Accountants) establishes the criteria to sit for the CMA exam and earn the global designation and also administers the exam. Its counterpart for the CPA exam is the AICPA. Both organizations strive to ensure that their certification requirements are relevant, rigorous, and current. Both examinations are regularly reviewed and modified, if warranted, to better reflect the increasing expectations and expanding roles that accounting and financial professionals play in an ever-changing global business environment. For example, and not surprisingly, given the rapid changes in technology, both ICMA and the AICPA continue to place more emphasis on data analytics and information technology (IT) in their respective examinations.Our August 2019 article incorporated the CMA exam changes that were effective January 1, 2020. Those changes are still in place today, as ICMA hasn’t yet instituted any additional CMA exam changes beyond those. The AICPA, on the other hand, has made noteworthy changes to the CPA exam through its Uniform CPA Examination Blueprints. This is known as the CPA Evolution model and is designed to test the knowledge and skills needed for newly licensed CPAs. These changes are effective January 1, 2024.

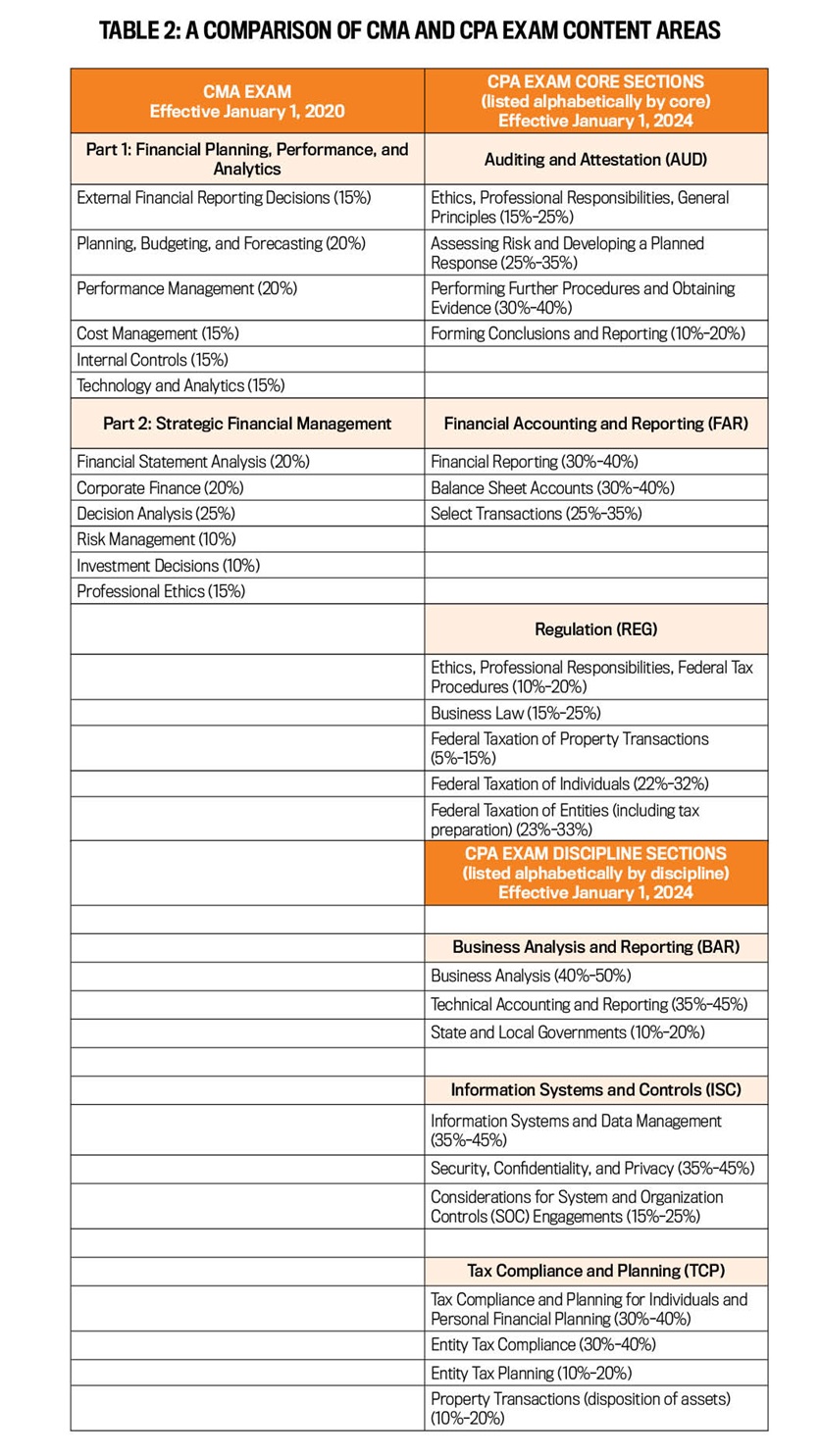

Although the CPA examination remains in four parts, all candidates must now take the same three “core” parts and select one of three “discipline” parts.

The core parts include:

1. Auditing and Attestation (AUD)

2. Financial Accounting and Reporting (FAR)

3. Taxation and Regulation (REG)

The discipline parts include:

1. Business Analysis and Reporting (BAR)

2. Information Systems and Controls (ISC)

3. Tax Compliance and Planning (TCP)

The core areas are similar to the existing CPA exam parts. In fact, the same acronyms (AUD, FAR, and REG) are still being used; however, the weighting of certain topics in the core parts has changed, and some topics have been moved to the discipline parts. For example, accounting for state and local governments is now tested in the BAR discipline section.

The Business Environment and Concepts (BEC) section of the pre-2024 exam will no longer be a part of the CPA exam. But the content areas covered on BEC will still be tested, to varying degrees, in the following sections of the new CPA exam: AUD, FAR, BAR, and ISC. In addition, some of the topics previously tested on FAR and REG will now be covered in BAR and TCP, respectively.

The three core areas are designed to test the key fundamental concepts in each of the respective parts, whereas the discipline parts take a much deeper dive into more expansive and complex concepts. A candidate may select only one discipline part. If a candidate doesn’t pass the discipline part, however, they may select a different discipline.

Note that, because of the newly established discipline parts of the CPA exam, our streamlined plan is modified to incorporate all three discipline parts.

Educational Requirements

Although the CPA exam is uniform across all licensing jurisdictions, each state board mandates the specific education requirements for a candidate to be eligible to sit for the exam. All licensing jurisdictions have adopted the 150-credit-hour requirement (the equivalent of a master’s degree) to ultimately obtain the CPA license. But in most licensing jurisdictions, the CPA candidate must complete a bachelor’s degree (with the requisite number of accounting and business-related credits) to take the CPA exam. Thus, undergraduates can’t sit for the CPA exam. (Note: Several states are permitting CPA candidates to sit for the exam once they’ve earned 120 semester credits—even if the degree hasn’t yet been conferred.) The candidate’s licensure doesn’t take place until the completion of 150 credits and one year of qualifying work experience. It’s important to note that working under a CPA in private industry now counts as qualifying CPA work experience (and CMA experience); the work no longer needs to be in the attestation (audit) area.

CMA candidates, on the other hand, don’t have to complete their bachelor’s degree to be eligible to take the exam. This means that they can sit for the CMA exam while they’re still undergraduate students, provided they’re registered for six credits per semester during the academic year. Globally, more than 30% of CMA candidates are students. ICMA doesn’t specify any number of accounting or business-related credits to take the CMA exam, but the candidate must complete a bachelor’s degree, in any area, from an accredited college or university within seven years of passing the exam. Two years of qualifying work experience is also required.

Our updated nine-step streamlined approach capitalizes on the fact that students can take the CMA exam while they’re still in school and then sit for the CPA exam immediately after they graduate (or immediately after completing 120 credits in some states). By strategically scheduling and sequencing coursework to align with the topics tested on the exam parts, students can prepare for both exams more efficiently and benefit from the content overlap between the CMA and CPA exams.

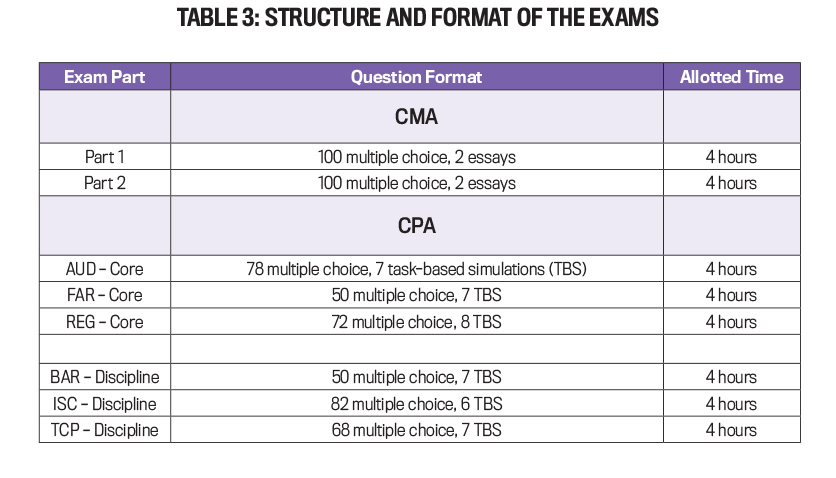

The current content areas tested on each exam, incorporating the changes to the CPA exam that will become effective on January 1, 2024, are summarized in Table 2. To earn both designations, a candidate must pass a total of six parts (see Table 3 for the structure and format of these exams).

Finally, because state rules change, students should regularly verify CPA state licensing requirements with the National Association of State Boards of Accountancy.

The Nine-Step Approach

We recommend a nine-step plan to students who are serious about obtaining professional certifications but who may or may not end up pursuing a career in public accounting. Our recommendations are based on the assumptions detailed below and are applied to a student candidate who’s an undergraduate accounting major attending a college or university that has a two-semester academic year. Accordingly, the student candidate will:

- Take one exam part at a time to keep the workload manageable and increase the chances for success on that part.

- Use some form of a CMA and CPA review preparation program and materials (such as a review course, software, etc.) in addition to coursework.

- Take additional finance credits and/or minor in finance.

- Take a separate business analytics course and an additional IT course if available. This is valuable to the CPA candidate taking the ISC discipline.

- Take additional undergraduate or graduate tax courses if a CPA candidate selects the TCP discipline.

- Complete the CMA exam while still a student.

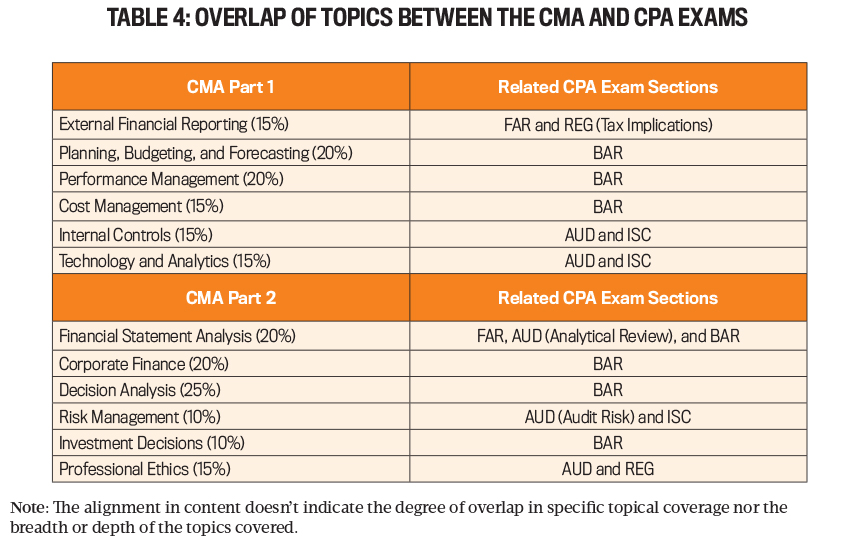

The alignment in content areas between the CMA and CPA examinations is illustrated in Table 4. This allows a candidate to readily follow our recommended strategy for sequencing coursework and related CMA and CPA exam parts. It’s important to note the significant overlap in content areas (but not necessarily breadth and depth of topical coverage within these areas) on Parts 1 and 2 of the CMA exam and the AUD, BAR, and FAR sections of the CPA exam.

The CMA exam has long used Bloom’s taxonomy. The levels tested on the CMA exam are Level A, introductory knowledge and comprehension; Level B, application and analysis; and Level C, synthesis and evaluation. Level C topic areas may also contain requirements at Levels A and B. All content areas in Parts 1 and 2 of the CMA exam are tested at the C level.

Bloom’s taxonomy was slightly tweaked, and the CPA exam adopted it to better capture the higher-level thinking that’s needed for entry-level accounting professionals. The “blueprints” to the Uniform CPA exam use Bloom’s Revised Taxonomy to assess four skill levels on each section of the exam: remembering and understanding, application, analysis, and evaluation. Each section of the exam tests the first three skill levels at varying degrees: Only the core AUD section tests at the evaluation level.

A student who pursues a minor in finance or takes additional credits beyond the traditional required corporate finance course will be better prepared for both exams because advanced-level finance courses typically incorporate case analyses, which require the use of higher-order thinking skills such as application, analysis, synthesis, and evaluation. Since most undergraduate accounting curricula include some free electives, taking additional coursework in finance, business analytics, and IT is advisable. Furthermore, additional coursework in information systems or income tax would be ideal for a CPA candidate pursuing the ISC or TCP disciplines, respectively. These additional credits will count toward the 150-credit-hour requirement for CPA licensure.

Our updated plan is outlined below and summarized in Table 5.

1. During junior year, the student completes the intermediate accounting sequence (usually two courses), corporate finance, an information systems/IT course, operations management, business ethics, and, if possible, a relevant finance elective. We expect that most accounting majors will have completed coursework in economics and quantitative methods (statistics) by the end of their junior year. The CMA exam assumes that a candidate has knowledge in business economics, time value of money concepts, statistics, and probability. This completed coursework covers a majority of the topics tested on Part 2 of the CMA exam and is invaluable in preparing for this part of it.

2. After the junior year is complete, the student uses the CMA review program materials to prepare intensively for Part 2 of the CMA exam, Strategic Financial Management. The student takes this part of the exam in late May or early June and then recharges in the months of July and August. We suggest starting with Part 2 since this will provide the student with more time to take coursework in business analytics and IT if available.

3. During the first semester of senior year, the student typically completes cost/advanced managerial accounting, auditing, an additional IT or business analytics course, and the undergraduate business capstone course if available. Typically, capstone courses are case-oriented and require application and integration skills (Level C) to examine budgeting, forecasting, performance, and control issues, which are invaluable in preparing for Part 1 of the CMA exam, Financial Planning, Performance, and Analytics. If such a capstone course isn’t required or available, the student should look for an elective case course in finance. At this point, the student will have completed more than three years of college in an accounting program and should have a solid foundation in most of the topics tested on Part 1 of the CMA exam.

4. Over the winter break (December-January), the student uses the CMA review program materials to study for Part 1 of the CMA exam, with the intention of sitting for this part in late January or early February. We recommend this timing because it’s early in the spring semester and most likely before major course assignments are due. If the student is participating in an internship in the spring semester, we suggest that they request that it begin in late January. If successful up to this point, the student will have completed the CMA exam prior to graduation in May or June. This is quite an accomplishment and should serve as further motivation to aggressively pursue the CPA exam once the student graduates. It’s also a tremendous confidence builder—the student now knows that they can pass a rigorous professional examination.

Note: Obviously, the total amount of study time needed to pass these two parts will vary per candidate. Based on our prescribed timing and sequencing of coursework, most of the topics covered in the required and recommended courses are quickly reviewed and reinforced in a timely manner with the CMA review program materials. As a result, we expect the total study time to be less than it would otherwise be if the student took these two parts after graduation.

5. During the second semester of senior year, the student schedules tax, business law, and advanced financial accounting courses. If this isn’t possible, they should take the advanced and/or tax course in the first semester of senior year. Ideally, the student should take two tax courses: individual taxation and business entity taxation. If available, one tax course could be taken per semester. Although it isn’t common, adding a second auditing course (IT auditing, for example) would also be useful.

6. After graduation in May (with a degree in hand and the CMA exam completed), the student candidate immediately applies for the CPA exam, then takes one to two weeks off. To capitalize on the synergy and related content areas (and frameworks) between specific CPA core and discipline sections, steps 7 through 9 will differ based on the candidate’s selection of discipline area. For example, the FAR (core) and BAR (discipline) sections both have substantial coverage of technical financial accounting and reporting matters. Therefore, studying these two sections together is likely more efficient, as the candidate is focusing on related content and frameworks. The same rationale holds for AUD (core) and ISC (discipline), as well as REG (core) and TCP (discipline). In all cases, we recommend that the candidate take the core section first (since it tests the key fundamentals in that section), followed by the related discipline section, which takes a much deeper dive into the topical areas.

Note: Steps 7 through 9 vary according to the student’s choice of discipline: BAR, ISC, or TCP. For each of the remaining steps, A relates to BAR, B relates to ISC, and relates to TCP.

7. In June, the candidate uses the CPA review program materials to prepare for their core (Core 1) and related discipline section.

A. FAR (Core 1) and BAR sections of the CPA exam (remaining cores: AUD and REG)

or

B. AUD (Core 1) and ISC sections of the CPA exam (remaining cores: FAR and REG)

or

C. REG (Core 1) and TCP sections of the CPA exam (remaining cores: FAR and AUD)

Because the candidate recently studied for the CMA exam, the preparation time for the two CPA sections selected is shortened since the student is familiar with the testing materials, study plans, and exam question layouts (multiple-choice questions and task-based simulations). The candidate schedules their Core 1 section in early July.

8. For the remainder of July and early August, the candidate uses the CPA review program materials for their discipline section choice. If they’ve completed relevant coursework in the senior year as we recommend, much of the material will be relatively fresh in their mind, reducing the amount of study time needed. The candidate schedules their discipline section at the end of August.

9. While steps 1 through 8 were challenging, the real test of the candidate’s dedication, motivation, and commitment is now at hand, particularly if the individual is starting their career in the fall after graduation. Starting in September, candidates must maintain their focus for three to four more months and use the CPA review program materials to prepare for their Core 2 and Core 3 sections, then schedule and take those remaining parts. For example, if FAR is the student’s Core 1 and BAR is their discipline, then AUD is Core 2 and REG is Core 3. Recall that the candidate has already completed one of the core sections (Core 1) and the corresponding discipline section.

A. AUD (Core 2) and REG (Core 3) sections of the CPA exam

or

B. FAR (Core 2) and REG (Core 3) sections of the CPA exam

or

C. FAR (Core 2) and AUD (Core 3) sections of the CPA exam

With the emphasis on external financial reporting, technology, and analytics in Part 1 of the CMA exam, the candidate will have reviewed and been tested on many intermediate accounting topics covered in FAR. Furthermore, many of the analytics, financial ratios, and professional ethics covered in AUD were tested on both parts of the CMA exam. Additionally, if the candidate completed the business law and tax courses in their senior year as we advised, 75% to 90% of the content tested in the REG section should be relatively fresh in their mind.

The candidate schedules Core 2 in late October and Core 3 in late November (or early December). This timing is desirable because it’s before calendar year-end corporate closings and public accounting’s “busy season.” If successful, the May accounting graduate will complete both exams by late November (or early December), six months after graduation.

Stand Out, One Step at a Time

Candidates following this nine-step plan will take one exam section at a time (two while a student and four shortly after graduation), thereby capitalizing on the timing of their coursework, test-taking ability, and professional exam experience. All of this should improve their chances of success on both the CMA and CPA exams. That said, we recognize that this nine-step plan is extremely ambitious and may not appeal to all accounting students—even though it’s a viable choice for those who are highly motivated and dedicated (honors students, for example). It may also appeal to students who plan to go straight to graduate school to earn their 150 credit hours. Students majoring in accounting and taking additional coursework in finance and analytics are ideal candidates.

To promote and encourage students to take the CMA exam, IMA established the CMA Scholarship in 2012. It’s designed for high-achieving students who attend an accredited college or university. At each institution, faculty can nominate a maximum of five students per academic year, and all student nominees will earn the scholarship.

Recipients of the CMA Scholarship will receive a comprehensive package of benefits enabling them to study for and take the CMA exam at no cost. The benefits include:

- IMA student membership for three years,

- Entrance fee to the CMA program,

- Exam support package—an assessment tool that can help assess the content covered on the CMA exam,

- Registration fees for the first attempt at both parts of the CMA exam, and

- Gleim course provider review material for one year (all regions except China).

IMA accepts applications from September 1 to June 30.

Nominating students for the CMA Scholarship is an investment that has a triple future payoff. First, improved success rates on professional accounting exams are direct assessment measures for assurance of learning in undergraduate accounting programs. Second, students are more likely to endorse accounting programs where they received such encouragement and goodwill. Third, those students who successfully follow our plan will have passed the CMA exam before they start their employment or graduate studies, making them more valuable to their employer, which leads to a higher demand for the institution’s accounting graduates. In short, everyone wins!

August 2023