Last year was a grueling year for the global economy. China’s zero-COVID strategy only eased toward the end of the year and put global supply chains under severe strain even as they struggled to recover from the damage caused by the pandemic. Russia’s invasion of Ukraine further disrupted these supply chains, an event that sent geopolitical uncertainty skyrocketing and signaled our entry into a new and potentially more threatening world.

The resulting energy crisis in Europe has presented a huge challenge to policy makers there. And while the United States has been relatively insulated from the worst effects of soaring oil and gas prices, it hasn’t avoided the worldwide bout of inflation that has moved key central banks into hawkish policy stances that are likely to continue long into 2023.

Yet despite the forbidding macroeconomic backdrop, the fundamental choices facing businesses haven’t changed: Maintain a strong balance sheet and anticipate, model, and prepare for future scenarios.

One key lesson of the last few turbulent years is that the breadth and nature of scenarios that need to be modeled have changed. A number of recent events were largely not taken into consideration by business leaders, from China’s persistent lockdowns to the war in Ukraine to a radical uptick in inflation—with COVID-19, of course, representing the “big one.”

But each one of these events has yielded lessons in how to prepare for black swan events—or indeed “gray swan” events that are predictable and unlikely, but very great in their impact.

These include some shifts to bedrock assumptions that may or may not be permanent but must be factored into any decision-making process for at least the medium term. For example, the balance of power has shifted from buyers to suppliers as long as current conditions persist. Depending on the nature of your industry, confidence in the viability of Just-in-Time inventory management has likely taken a hit as time lags between ordering and consumption lengthen. Taking a longer view, it’s clear that the global energy market is taking a different shape.

What other gray swans can we anticipate? Among the list, there could be another pandemic, one potentially of a disease even more dangerous than COVID-19. It’s also feasible that climate change could result in food shortages or rapid shifts in global population distribution.

Challenges lie ahead, however, while many businesses focus solely on the next 12 months. As we move further into a year where there is consensus among analysts that we will face a global recession, companies can adhere to five key best practices to manage tough times: Follow the recession playbook, embrace technology, prioritize sustainability, embed long-term planning into your management structure, and optimize working capital.

1. Follow the Recession Playbook

The word “recession” can intimidate, but there is a tried-and-tested set of actions that business leaders can take to ride out tough times. First and foremost is prioritizing the preservation of capital on the balance sheet. There are a wide variety of strategies to achieve this.

A key is conservatism in deploying resources: budget freezes or cuts, hiring freezes, and ensuring recent investments start to earn a return before investing in new initiatives and the streamlining of your product offering.

As you prepare for a potential reduction in demand and/or increases in costs, it’s sensible to forecast and model scenarios for different proportions of change—20%, 40%, or even more—and build contingency plans for each one. There are leading indicators that can give some indications of what you can expect, such as numbers of leads generated, visits to your website, or number of meetings booked. It’s also wise to come up with plans for what to do in the event one of your key suppliers ceases operations. You need to model scenarios that were unthinkable in the past.

Avoid sentimentality. If individual business units are significantly underperforming as the recession proceeds, you should restructure them before any contagion can spread. And, depending on your industry, there are typically segments of any market that hold firmer in a recession than others—be aggressive in targeting them while potentially stimulating demand with discounts.

At the same time, there are financial actions you can take that should smooth your ride through any downturn. These include carefully managing cash flows, including accounts receivable and accounts payable, to the fullest extent possible while preserving key relationships. It’s wise to lock in any pending debt or equity transactions.

After a significant period of inflation, pricing is in question as we move toward a recession. Many businesses will have increased prices in response to rising supply costs, but you may find that your customers have reached their limit and higher prices could begin to dent demand. This becomes an even bigger challenge should inflation continue as the recession hits, creating an unforgiving environment of “stagflation.”

One response to this would be to adjust prices in a flexible, nondogmatic way. Instead of increasing prices across the board, use strategically targeted increases to preserve your margins while offering other incentives to your customers, for example, volume guarantees, bundled projects, or service levels on a sliding scale.

Another approach to managing your passage through a recession is to actively seek to reinforce your customers’ relationships with you, regardless of your industry. They’ll be reviewing their spending and considering alternatives: Strong customer engagement will help you impede that decision. Money you save from, for example, automating processes can be redeployed to build the kind of business intelligence that can help you identify customer segments and delineate them by vulnerability to the downturn and openness to competitors. You’ll then be able to both target them in your marketing and adjust your product offer to meet their evolving demands.

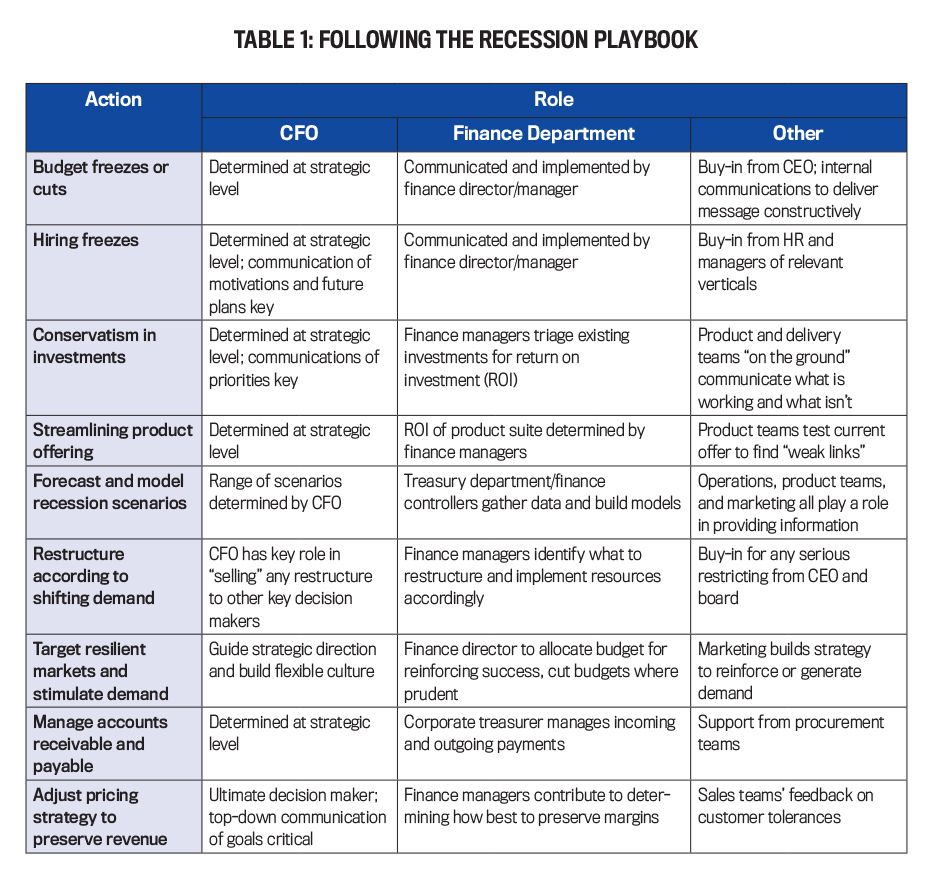

Finally, are there any areas of your business that are outperforming as the downturn progresses? Explore investing in them further to reinforce success. This is also the time to be open-minded. For example, are there merger or acquisition opportunities in the broader market? See Table 1 for an overview of the recession playbook.

2. Embrace Technology

In a recent survey of financial decision makers across key global markets, financial technology company Taulia discovered that 37% of businesses are investing in either automation or supply chain technology in response to concerns over inflation and a potential recession. Of the respondents, 43% of U.S. companies reported prioritizing investment in automation, while 41% are putting first either cutting costs or implementing new supply chain management technology. Meanwhile, companies in Singapore were more likely to invest in supply chain management technology (46%) or automation (44%) than they were to prioritize cutting costs (37%).

What does this embrace of technology actually deliver? Companies don’t pursue updated technical solutions for their own sake. Very often, technology can act as a source of or conduit for better information reaching an organization’s leaders. And better information means better decisions.

Good data and good analytics enable more efficiency in your operations, greater visibility across your entire supply chain, and the identification of fluctuations in supply and demand before they occur; it’s no exaggeration to say analytics should be the bedrock of your decision making. This not only better empowers businesses to ride out any recession, but any technology investment can lay the foundation for resilient future growth as the economic cycle turns.

Potential actions you can take include investing in automated solutions that can take on manual processes like invoice processing or creating purchase orders and expense reports. Scaling automated solutions across your organization could cut costs significantly, reduce the instances of human error, free up human resources, and free up capital to invest in your key priorities as the downturn progresses.

There are platforms on the market now that offer consolidated dashboards that surface real-time data on spending and other financial information. There’s also a growing number of platforms that can facilitate sophisticated enterprise resource planning (ERP) systems. Perhaps most usefully, they can act as a single source of truth for your organization—something that can add significant value, especially the larger and more complex your operations are, and markedly smooth internal communications.

Meanwhile, innovative new inventory management solutions are available that will allow you to distribute resources, personnel, and assets more efficiently and can open up opportunities to find efficiencies in intricate supply chains that may not be immediately apparent on the surface.

Before embarking on any large-scale program of investment in technology, however, there are multiple factors you should take into consideration. For instance, what legacy systems do you wish to keep—if any? Which of your team members will need training on the new platforms, and how? How will any new solution integrate with your existing operations and those of your external stakeholders and suppliers? Will you need to convert your existing data? If so, how will you define, examine, and analyze your existing data sources, and avoid the delays and increased costs associated with poorly managed and executed data conversion? And, finally, will you require an external third party to support you as you find answers to these questions? See Table 2 for further tips on embracing technology.

3. Prioritize Sustainability

As we head toward a likely recession, one notable change to the business landscape compared to recessions prior to the pandemic is the radically expanded importance of sustainability as a consideration in business operations.

Sustainability truly is at the core of the future economy. Unless decision makers across the private and public sectors make it central to their thinking, the long-term picture becomes a dark one. As such, whatever shape global supply chains take after this period of disruption, all stakeholders are highly likely to make sustainability a priority.

For all the breadth and scale of its impacts, it’s easy to forget that COVID-19 was, at its core, a natural disaster (of a kind). There are serious arguments that its global scale and brutal damage to business activity served to dampen illusions that we’re invulnerable to shocks emerging from the natural world.

Therefore, keeping sustainability top of mind in future strategy is a core element of any effort to embed long-term resiliency to any business. This is easier said than done, but there are a number of potential actions available that will make your organization truly sustainable.

Culture comes first: If sustainability has until now been an abstract idea rather than a reality for your company, embark on a cultural transformation project with the mandate of finding any structural obstacles to sustainable business practices.

Having done so, you’ll be in a strong position for making a company-wide commitment to finding innovative new ways to improve your sustainability posture. This means you’ll be able to embed ethics, values, and a sense of mission into your culture alongside, more practically, an organization-wide understanding that sustainability-related risks are material and not optional to manage.

Building ambitious diversity, equity, and inclusion (DE&I) strategies will allow you to include diverse new perspectives in this conversation and find solutions that may not have immediately presented themselves to your leadership team.

Turning to practical applications, you could explore strategies for incentivizing stakeholders in your supply chain to embed sustainable practices in their activities, perhaps by offering a supplier finance program. Gathering and leveraging accurate and actionable data around sustainability-related issues is critical—and this data could potentially be integrated into your ERP platform.

For your staff, there’s an educational opportunity to develop both broad and deep knowledge of any existing or new regulations across your business. You could embed sustainability criteria into your teams’ key performance indicators (KPIs) and incorporate them as you structure your leadership teams’ incentive packages.

The CFO has a vital role to play here. The unique nature of the role means that you have the opportunity to act as a node for the sharing of information on sustainability questions throughout your organization and developing new accounting frameworks that take into account nonfinancial KPIs. The CFO also has a real voice in the setting of strategic goals and developing the finance strategy that will meet them, managing the compliance and control systems that will ensure sustainability targets are being met, and identifying and relating any connected risks that can (and will) emerge. A CFO can catalyze change, steward success, and take responsibility for the intermediate steps between.

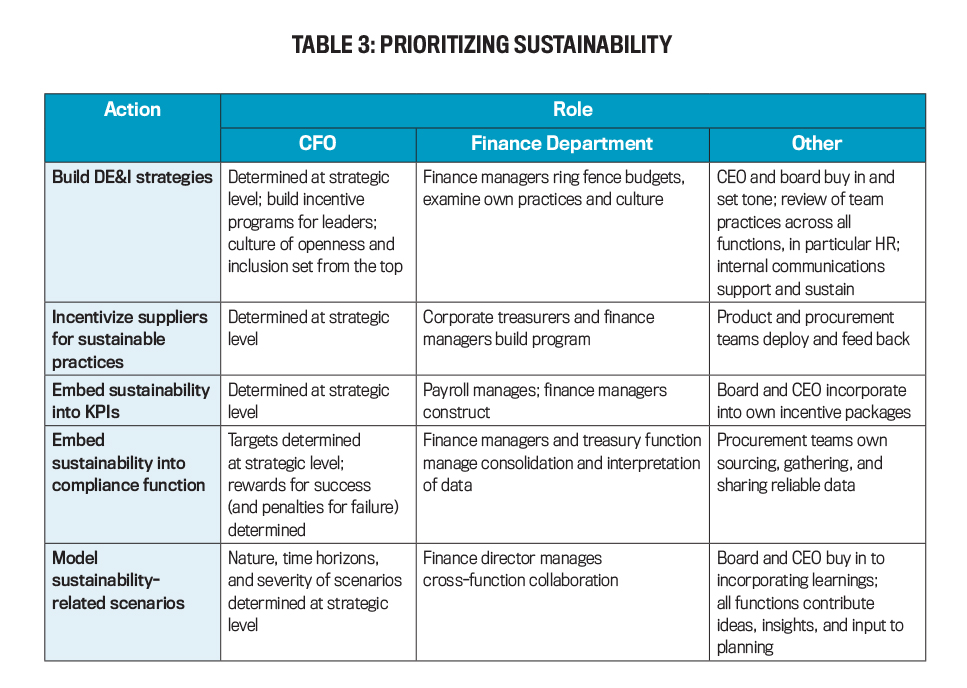

In terms of scenario planning, there are any number of sustainability-related scenarios to take into account in long-term planning. Climate risk is the most obvious, but everything from sudden shifts in regulations to the viability of a factory’s water source to the integrity of a supply of raw materials are just a small selection of material risks connected to sustainability issues. See Table 3 for suggestions for centering sustainability in business operations.

4. Embed Long-Term Planning within the Management Structure

It can be tempting as we move toward a likely economic downturn to think only in the short term, with even medium-term planning in danger of becoming considered a luxury. This is a mistake: Recessions are tough, but they do offer the opportunity to innovate and retrench for the future and can serve as a stress test of the resiliency of business practices.

The challenges mentioned already around sustainability and the broader economy won’t address themselves, yet neither is there a simple ready-made solution. Giving your leadership teams the semipermanent mission of long-term scenario planning—creating teams specifically for this purpose—will move you out of a purely reactive stance and allow you to take control of your business’s future.

There’s no right or wrong way to do this, but there are several approaches that can orient your company to the future. There are solutions available now that can enable you to build digital twins of critical parts of your supply chains for detailed scenario planning, which is useful for both long- and short-term planning. Almost every organization, regardless of size, is siloed to some extent—seek out opportunities for productive data sharing to make these models as powerful as possible.

Again, much of the success in long-term planning will likely be culturally determined. You can encourage a culture of long- and not short-termism by reviewing incentive structures for management accordingly and making it routine to extend time horizons for planning to five years or even longer. Innovation will be happening outside of the business, too—promote detailed research about consumer and business trends that could come to define your industry. You might just spot them before the competition.

On a practical level, an option is to separate forecasting from annual budgets. Rather than managing crises—and provided you can afford to—allocate capital in ways that are aligned with a long-term strategy.

Even during a recession, the most obvious but nevertheless most important way in which a business can orient itself to the future is in how it invests. Redefine what’s core to your operation and what could play a role in the emerging trends so the business is well-placed to benefit as the market evolves.

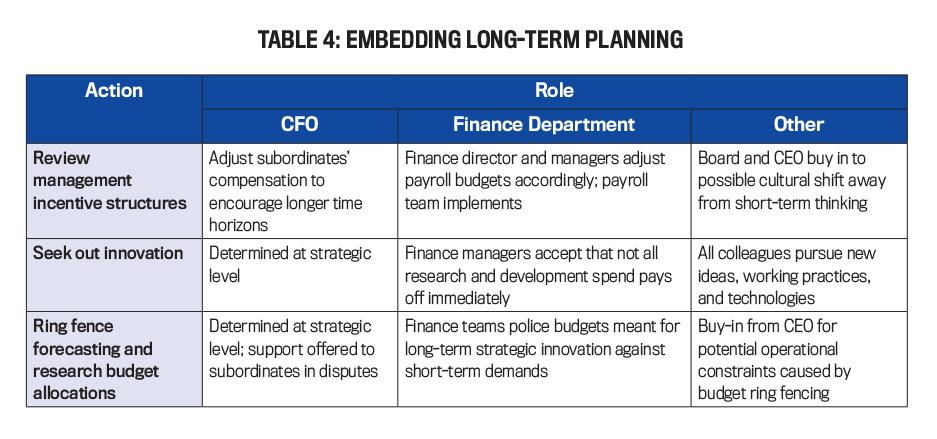

Recognize, however, that not all of these will be totally successful. Some will fail outright. This requires skillful stakeholder management, especially if your company culture is one that isn’t used to the iterative nature of experimentation and incorporating the learnings gained along the way. Table 4 presents ideas for long-term scenario planning.

5. Optimize Working

From supply chain finance to dynamic discounting programs, CFOs have a number of options available to them for getting as much value as possible from their working capital arrangements.

Management teams tend to default to focusing on profit and loss figures at the expense of the rest of the balance sheet, and not many companies manage their liquidity as attentively as they manage their costs. This can be a mistake, especially during a recession, as adroit management of working capital can free up liquidity to the extent that companies may be able to avoid cutting staff numbers or restructuring operations.

To do this successfully, build a team of key internal stakeholders, from treasury to procurement to IT to accounting to legal, and ensure communication structures are in place to bring them along with the program and ensure their buy-in at every stage.

Next, identify any areas of opportunity that immediately present themselves. In managing receivables, encourage rigor in collections management and tracking any slippages. In managing payables, improve the supplier payment process, reform their timings, adjust the terms to a position beneficial to your business, and seek what efficiencies present themselves.

Distinguishing between strategic and tactical working capital optimization is important. A tactical approach—using tools like reverse factoring or procurement cards in isolation—can enable companies to address specific issues, such as alleviating the impact of extended payment terms on suppliers and giving suppliers greater certainty on when they will get paid.

Yet tactical measures can’t deliver the full potential of the supply chain opportunity. You’ll need to be clear on your financial position. That means accurate data is vital, and a degree of flexibility is required in your approach. This will enable the business to at once secure better returns on excess cash, improve margins, and de-risk its supply chain, while retaining the capacity to adapt to shifting sources of funds as business needs change.

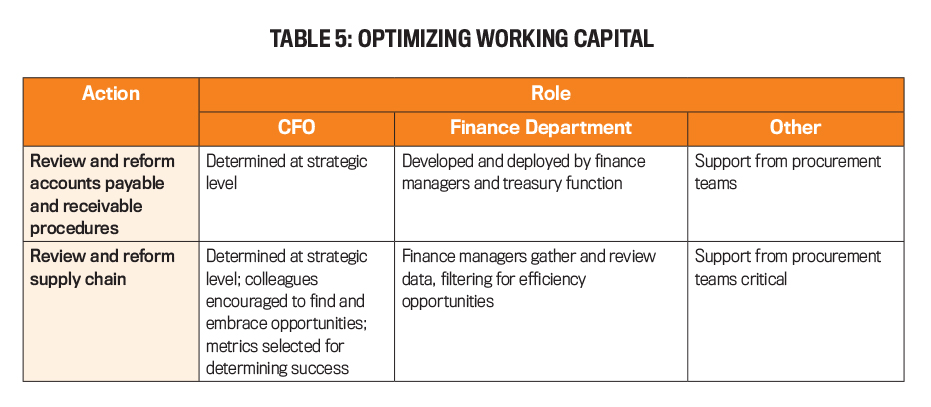

Many companies choose to pursue a working capital optimization program in partnership with a third party, but either way requires reaching out to suppliers to bring them along and choosing the right metrics to measure the program’s success. Table 5 is an overview of options for improving working capital arrangements.

PREPARING FOR FUTURE SUCCESS

The pandemic may be largely over, but we aren’t yet clear of its disruptive effects on the global economy. Analysts agree that 2023 holds in store both more inflation and recession in most developed markets. Leveraging the recession playbook of rigorous attention to costs and creative ways to manage falling demand should enable businesses to ride out the storm.

Embracing the wide range of technological solutions now available to support business practices will both cut costs and place you in a strong position going forward. At the same time, sustainability is critical to any business’s long-term success; sensible decision makers should put it at the core of their decision making.

The best way to manage short-term challenges is to think long-term and use the opportunity of a recession to adjust and evolve your practices in ways that favor long-term planning. Optimizing your working capital can unlock value hidden on your balance sheet and potentially free up liquidity that can help you avoid difficult decisions.

April 2023