This article is based on a study funded by the IMA® Research Foundation.

Effectively realizing corporate purpose requires mediating, integrating, and balancing the interests of different corporate stakeholders and their goals. And the trade-offs that result from such a balancing act need to be acknowledged, measured, and communicated as the organization reports the efforts and performance connected to the creation of long-term sustainable value. Moving from the articulation of a company’s purpose to execution requires strategy and capital allocation with a comprehensive management system able to link sustainability strategies with financial returns. It involves reconciling competitiveness and sustainable growth within the context of an inclusive business model to take advantage of the opportunities and face the challenges of the market.

Importantly, this requires the development of new measurement practices that can capture whole processes of long-term value creation—taking into account the social and environmental externalities produced by its operations and, especially, its products and services, as well as how the multiple and heterogeneous resources provided by the company’s stakeholders contribute to its financial and nonfinancial performance. Today, the investment community broadly recognizes the need to better understand how material environmental, social, and governance (ESG) issues matter to financial performance.

ALIGNING CORPORATE PURPOSE WITH STRATEGY

Executing corporate purpose is likely to be challenging—and, in some cases, even uncomfortable—since it may require going beyond the company’s business-as-usual approach to respond to emerging opportunities for business development. It often requires rethinking the organization as it develops at the intersection of aspiration, inclusion, and action. Aiming to simultaneously address both financial and ESG issues, purpose-driven strategies are perceived as essential to achieve multiple and heterogeneous results expected by a multitude of stakeholder (see “Definition of Terms” for a review of the terminology as defined in this context).

With capital markets increasingly demanding evidence-based, market-informed, and transparent data to deliver long-term value to shareholders while helping secure the future for people and the planet, the challenge for corporate leaders lies in the complexity of pursuing long-term sustainable value creation during a period characterized by uncertainty and ambiguity. Performance management systems should be considered as mechanisms for measuring and monitoring the financial and nonfinancial results of an organization. They are means by which contemporary organizations execute their strategy and pave the way to fulfill the expectations of their stakeholders, including current and potential investors, as well as society at large. Despite their central role within companies’ governance and measurement systems, existing performance management systems have yet to fully deliver.

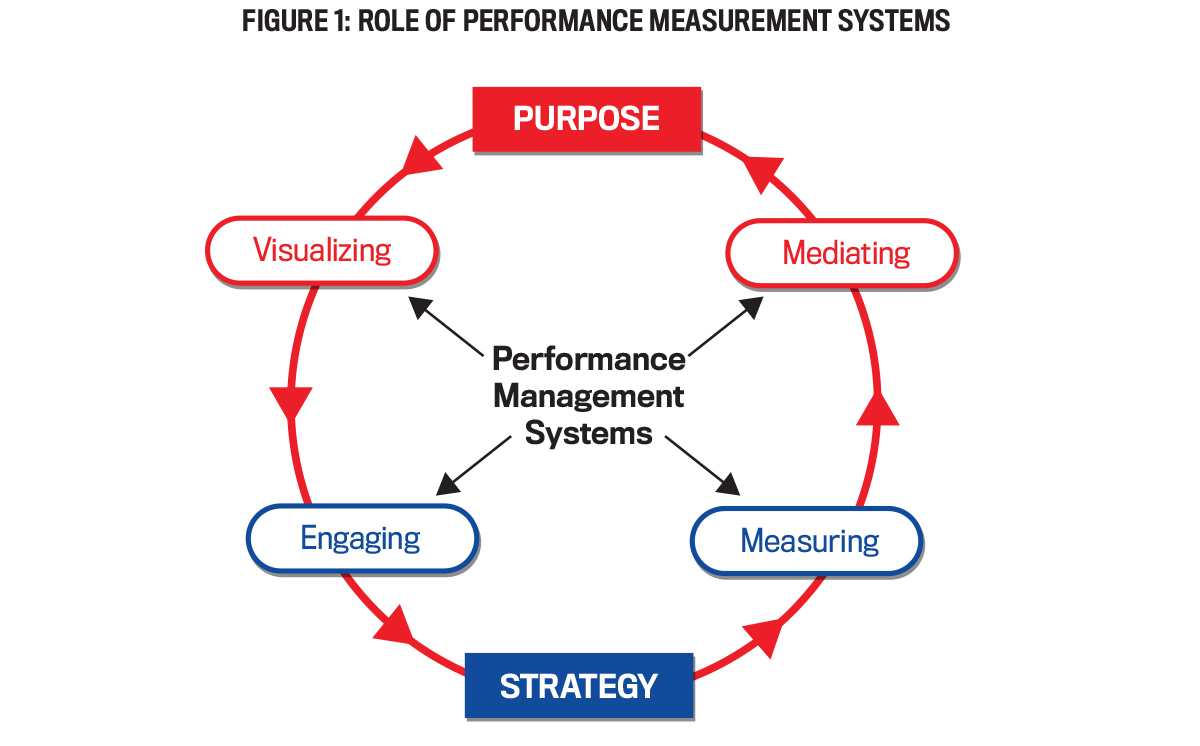

Within this context, Aligning Strategy to Purpose: The Role of Performance Management Systems, a forthcoming IMA Research Foundation study, is relevant to the paradigm shift in corporate thinking, management, and reporting. Performance management systems can play a powerful role in instilling a sense of purpose within the organization as well as in aligning corporate purpose with strategy.An integrated approach to aligning strategy to purpose utilizes visualizing, engaging, measuring, and mediating the process toward long-term value creation for multiple stakeholders. By relying upon the insights offered by three cases—Barilla, AXA, and Enel—we identify the key features of performance management systems for the purpose-driven organization and provide guidelines for management accountants to play a leading role in designing and orchestrating these systems.

PURPOSE OF THE FIRM

In the book Value Creation Principles: The Pragmatic Theory of the Firm Begins with Purpose and Ends with Sustainable Capitalism, Bartley J. Madden introduces the pragmatic theory of the firm, sharing a useful four-part overview of the theory’s role in a market economy and showing how it defuses the conflict between shareholder and stakeholder proponents:- Communicate a vision that inspires and motivates employees to work for a firm committed to behaving ethically and making the world a better place.

- Survive and prosper through continual gains in efficiency and sustained innovation, which critically depend upon a firm’s knowledge-building proficiency. Nothing works long term if the firm fails to earn the cost of capital.

- Work continuously to sustain win-win relationships with all the firm’s stakeholders.

- Take care of future generations, giving particular attention, at the early stage of the design of products and manufacturing processes, to minimizing waste and pollution.

Maximizing shareholder value is best positioned not as the purpose of the firm, but as the result of a firm successfully achieving its purpose. The fundamental determinant of a firm’s long-term performance is its knowledge-building proficiency, which is evident in the three cases we examine.

THE FRAMEWORK

We advocate a four-stage framework to successfully connect strategy to purpose (see Figure 1). Performance management systems are pivotal in this process since they are (1) visually routed based on visualization, (2) methodologically engaging, (3) measurement driven, and (4) a means of mediation and communication.

Visualization entails representing the material elements of purpose and connecting them, as well as visually communicating strategy through purpose. Engagement encompasses articulating purpose from strategy to incentives and enabling commitment and collective work.

Measurement requires translating purpose into shared metrics and enabling wise judgment and confrontation around the impact of these metrics. Finally, mediation involves valuing diversity rather than suppressing differences to maximize opportunities for innovation and sustaining endurance and change. These aspects shape the patterns of training and education of management accounting professionals. The critical knowledge needed to design purpose-driven performance management systems is revealed through the principles of design and the practical case study examples to follow.

ENGAGEMENT AND PURPOSE-DRIVEN PROJECTS

AXA Group, a global insurance group operating in 54 countries, focuses its strategy in core business areas including health, protection, and commercial property and casualty segments. In June 2020, AXA’s corporate purpose was reformulated from “empowering people to live a better life” to “act for human progress by protecting what matters.” According to AXA’s CEO, “This reflects our aim of helping our customers, both individuals and companies, and society as a whole to move forward. It also evokes the notion of protection that’s at the very core of our business as an insurance company, enabling customers to plan for the future with peace of mind. And in times of crisis, like the one we are experiencing now, this purpose throws light on the direction we need to take, providing a framework for our action.”

This new corporate purpose informs AXA’s sustainable value creation and business model. This was captured and communicated visually through AXA’s 2019 integrated report, where sustainable value creation was represented by linking key resources (related to customers, investors, employees, distributors, partners, government, and regulators) to its business model (articulated through protection, health, asset management, savings, property, and casualty) and impact (on customers, investors, employees, distributors, partners, government, and regulators). Through an AXA integrated report, which communicates externally much of the company’s financial and nonfinancial performance, corporate purpose can be visualized as the overarching framework that combines and integrates in the same whole all elements of the AXA business model.

The strategic pillars of AXA’s corporate purpose are shared among all local entities and are then articulated by each local entity into long-term plans, projects, actions, and objectives through an iterative top-down and bottom-up process. The strategic objectives for each pillar of corporate purpose are shared with the local entities through a letter of objectives. Within AXA Italy, this letter is then articulated further into more detailed letters at the various managerial levels and areas. This process is led by the CEO and is facilitated by the chief strategic officer (CSO), with the support of the CFO and the management committee.

As part of this process, key projects are identified and proposed by top managers across the different areas and in relation to the strategic pillars of the corporate purpose. The CSO orchestrates this process by attending key meetings and ensuring that projects are formulated and proposed in line with the priorities of corporate purpose. Following this preliminary discussion, projects are then examined by the management committee, including the CEO, CSO, CFO, chief customer officer, human resources director, and claims and customer operations director. This discussion lends coherence and consistency to the projects before the letters of objectives are finalized for all managers.

Purpose-driven projects and initiatives are then articulated into financial and nonfinancial key performance indicators (KPIs). Financial KPIs are monitored by the finance office, working closely with the strategy office and the transformation office, who are both in charge of monitoring the nonfinancial KPIs. Every three months, top managers meet to discuss and check the progress toward the strategic priorities of corporate purpose. Also, every month all projects, along with their KPIs, are monitored and revised. The progress made toward the strategic priorities of corporate purpose is reported to AXA headquarters at least twice a year and is fully incorporated into managers’ performance assessments and incentive system.

MEASUREMENT AT BARILLA

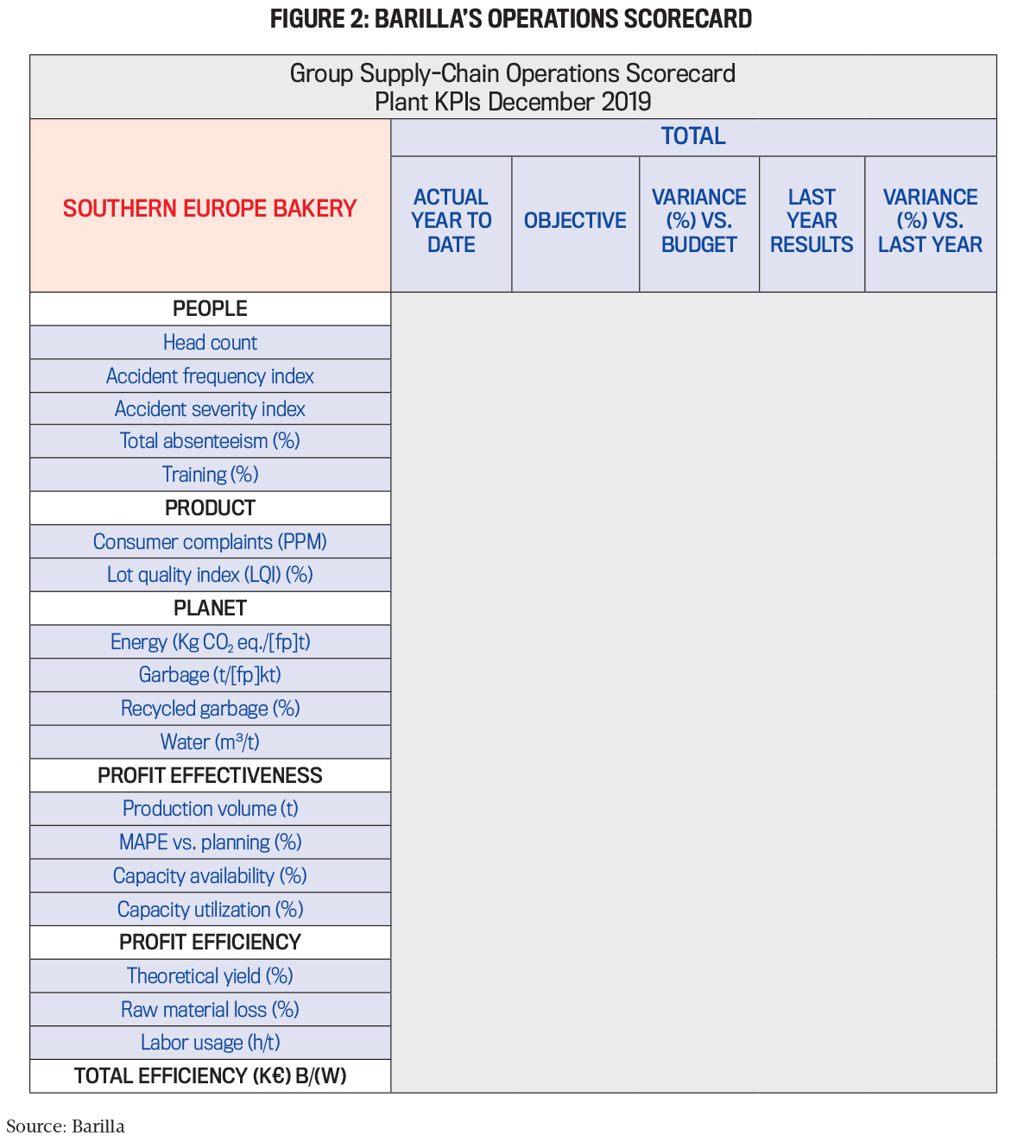

Barilla is a global Italian family-owned food company established in 1877 that operates in more than 100 countries. The group is recognized worldwide as a symbol of Italian food. From 2013, the purpose of Barilla has been captured in the statement: “Good for You, Good for the Planet” (also referred to as GYGP, which has recently been redefined as “The joy of food for a better life”). Barilla has adopted an integrated operations scorecard to support the alignment between brand/local strategies, corporate strategies, and the GYGP purpose through operations. This tool provides for a method for integrating financial and nonfinancial KPIs related to Barilla’s corporate purpose within a platform shared across Barilla’s group.

The scorecard is divided into a number of key dimensions, reflecting the purpose of Barilla (see Figure 2). Each dimension has the same weight:

- People, including health and safety, training, absences, injuries, and accidents

- Product, including product quality and customer complaints

- Planet, including waste, recycling, and energy and water consumption

- Profit effectiveness, concerning asset usage effectiveness

- Profit efficiency, concerning asset usage efficiency

These dimensions are then linked to further performance metrics on capital expenditures and working capital. For each dimension, the scorecard shows the year-to-date (YTD) actuals, objectives, variance (%) from the budget, last-year (LY) results, and variance (%) from LY.

The operations scorecard (group level) is then articulated at the regional level (e.g., Europe or United States). Each regional scorecard is further articulated into product category (e.g., meal or bakery) and then into further geographical zones, and a zone is then articulated according to different production sites/plants. Through this articulation, the operations scorecard provides for a shared platform through which all operations managers can monitor the performance of each plant in each region, in line with the key dimensions of the GYGP purpose.

The operations scorecard for all plants is fully accessible and shared within the group. This makes it possible for managers from different plants to compare targets and results, identify best practices, and discuss opportunities for learning and improvements, sharing best practices across plants. Every year from September through December, the targets are set in the scorecard for the subsequent year to ensure a process of continuous improvement. Specific (nonfinancial) targets are proposed by operations managers at the plant level following a process of analysis and data collection. Targets are then discussed and aggregated at the operations level, ensuring consistency with the strategy and with financial KPIs.

The full visibility of the scorecard across the group facilitates the alignment of KPIs across the different units. Financial KPIs are managed by the finance unit, with finance managers working closely with operations managers in each plant. Nonfinancial KPIs are managed by operations managers at the factory, brand, and region level. Every two or three months, reports from the scorecard are discussed at the supply-chain level. Every month, they’re discussed at the plant level, examining variances and opportunities for improvement. The operations scorecard is the most relevant tool used to monitor each month whether operations are moving in the right direction toward the achievement of the planet, people, product, and profit objectives, in line with the GYGP purpose.

MEDIATION AT ENEL

Enel, an Italian energy company with a presence in more than 40 countries on five continents, identifies its purpose as: “Open Power for a brighter future. We empower sustainable progress.” The strategy developed by the company aims to create sustainable long-term value by managing the energy transition through decarbonization and electrification. Within Enel, sustainability is the driving force that connects the purpose-driven strategy with innovation. The innovability (innovation and sustainability) function, which reports directly to the CEO, manages all activities from the perspective of sustainability and innovation.

Listening to stakeholders, knowing the territory, and measuring the sustainable value created through innovation is a must for Enel. At Enel, the path for applying such an inclusive community relations model started in 2015 with the adoption of a creating shared value (CSV) model that integrates social-environmental factors into business processes and along the entire value chain.

The dissemination of this method required a consolidation path within the company on a cultural and operative level. In 2016, a specific internal policy, “CSV process definition and management,” was published. It defines how sustainability must permeate company processes across the board, making it a shared responsibility. This policy was supplemented by issuing an operating instruction labeled “project portfolio management system,” which represents the approach along Enel’s entire value chain in terms of project identification and characterization, management of the quality assurance process, calculation of beneficiaries, and evaluation of project impact.

RECOMMENDATIONS FOR MANAGEMENT ACCOUNTANTS

Performance management systems can play a powerful role in instilling a sense of purpose within the organization as well as in aligning corporate purpose with strategy. By relying upon three case studies, as well as on prior research in the field, we identify the key features of performance management systems for the purpose-driven organization. Visualization, engagement, measurement, and mediation are the pillars of our framework for understanding the way in which contemporary organizations align strategy to purpose through performance management systems. Finance professionals, and management accountants in particular, can play a leading role in this journey by making the integration of strategy with purpose happen in practice.

In terms of visualization, management accountants have the opportunity to contribute to the representation of the material elements of corporate purpose; connect them to the vision, mission, and values of the organization; and communicate the integration between strategy and purpose through a series of interconnected objectives and initiatives. As the link between purpose and strategy gets reinforced, finance professionals can rely on the company’s performance management system to visualize the objectives of the business and the way to accomplish them in line with the expectations of the stakeholders. Overall, visualization enables management accountants to keep an open conversation with business leaders and key stakeholders, and therefore build on materiality assessment to capture the financial relevance of material issues and their consequences for the company’s bottom line.

As for engagement, finance professionals can manage the opportunities that may open discussion and appropriation. This can be done by linking purpose-driven strategy to individual objectives and expected targets as well as by identifying the resources, activities, drivers, and stakeholders that are involved in the development and execution of the business model of the company. Commitment by individuals can be enhanced by overcoming, for example, the capital budgeting limitations that fail to account for the project’s ESG intangibles and developing better methodologies to assess and incorporate long-term value creation into decision making. By engaging with other professionals, management accountants can lead the collective process of knowledge construction that, supported by performance management systems, leads to a collective understanding of the value-creation process.

Measurement is the traditional key area for the finance function. The opportunity here is to lead the metrics-based process of judgment concerning the impact of purpose on strategy execution and business performance. In doing so, management accountants are asked to design a portfolio of financial and ESG measures that will be employed to test and assess corporate purpose in practice. In doing so, the finance function will be required to recognize and manage the multiple trade-offs, interests, and risks that characterize the value-creation process as it unfolds across multiple and heterogeneous stakeholders. This process involves the scrutiny and understanding of new ways of aligning strategy with purpose. By providing insightful information to decision makers, performance management systems can work in harmony with other business systems to recognize different viewpoints and leverage the richness of stakeholder engagement.

Finally, mediation requires management accountants to value diversity rather than suppressing differences, supporting the opportunities for innovation and change that emerge along the value chain. When opportunities for discussions emerge, different viewpoints can develop and legitimate doubts can be raised. Compromise across multiple and heterogeneous perspectives requires finance experts to understand trade-offs and their consequences within processes of innovation and change. Productive tensions can raise insightful questions and generate new knowledge. The role of management accountants is paramount here: While purpose must be aligned with strategy, such an alignment will affect the existing links among the organization’s internal and external stakeholders, therefore stressing and testing the effectiveness of the organization’s enduring reason for being in practice.

November 2022