When the U.S. Securities & Exchange Commission (SEC) settled actions in September 2020 against Interface, Inc., and Fulton Financial Corporation for “violations that resulted in the improper reporting of quarterly earnings per share (EPS) that met or exceeded analyst consensus estimates,” it represented the first charges arising from the SEC Division of Enforcement’s new EPS Initiative. But they won’t be the last. Companies in the United States that fall under the authority of the SEC should consider the possible implications stemming from this new initiative.

The EPS Initiative—a risk-based data analytics program that flags companies for investigation—is particularly interesting because some financial professionals believe that earnings management is an acceptable practice. But the SEC is taking a clear position on the matter, which has implications for management, board members, auditors, and others charged with governance and oversight.

Similar to other SEC initiatives, such as Operation Broken Gate, eXtensible Business Reporting Language (XBRL) tagging, Accounting Quality Model (AQM), and Share Class Selection Disclosure, the EPS Initiative expands the SEC’s scope in ensuring proper financial reporting and pursuing violators. An extension of these prior initiatives, this new initiative demonstrates that the SEC continues to evolve, using new tools and programs to expand its reach and identify fraudulent financial reporting.

This expanded vigilance and oversight was acknowledged in a September 28, 2020, press release regarding the EPS Initiative. Stephanie Avakian, then director of the SEC’s Division of Enforcement, stated, “We will continue to leverage our internal data analysis tools to identify violations, including evidence of earnings management and other accounting or disclosure improprieties.”

WHAT IS EARNINGS MANAGEMENT?

Financial managers at public companies are responsible for providing projections and expectations to key stakeholders including shareholders, the SEC, and the public, among others. Earnings management occurs when a company underreports or overreports results of operational or accounting measures in an attempt to meet these financial targets. This often involves an acceleration or delay of revenue or expense recognition and may be achieved by managing revenue, net income, EPS, and other metrics.

Curtis Verschoor noted in 2015 that the balancing act between meeting projections and remaining ethically sound is often a gray area wrought with potential complications (see “The Trouble with Earnings Management,” Strategic Finance, December 2015). Management may misrepresent earnings for many reasons, including pressure to obtain bonuses by meeting profitability goals, performance reputations, and a need to improve company stock price. Additionally, according to Verschoor, poor earnings quality can lead to a higher cost of capital due to “lower price-earnings ratios, negative attitudes of analysts who follow the company, and effects on bid-ask spreads.”

THE NEW INITIATIVE

Statements from SEC officials indicate that earnings management, specifically EPS that meet or exceed analysts’ consensus estimates, may become significantly more scrutinized. Reinforcing the importance of correctly reporting EPS, Anita B. Bandy, an associate director in the SEC Division of Enforcement, stated in a September 2020 speech that, “while difficult to detect, improper quarterly adjustments can have a material impact on reported EPS and how investors view a company’s reported financial results. Public companies must have accounting and disclosure controls sufficient to provide reasonable assurance that quarter-end adjustments comply with GAAP [Generally Accepted Accounting Principles] and do not hide weaker than expected performance.” That same month, Avakian also emphasized the SEC’s commitment to a single, enveloping principle, saying, “Vigorous enforcement of the federal securities law is critical to combat wrongdoing, compensate harmed investors, and maintain confidence in the integrity and fairness of our markets.”

While specific details regarding the EPS Initiative are being held closely by the SEC, the 2020 Annual Report by the Division of Enforcement shares insights into the effort by noting the initiative “uses risk-based data analytics to uncover potential accounting and disclosure violations caused by, among other things, earnings management practices to mask unexpectedly weak performances.”

Reasonable assumptions may be made regarding the program based on knowledge of prior SEC initiatives. The SEC’s AQM, introduced in 2013, is one such example—and may be the foundation of the EPS Initiative. The AQM is an early warning system that takes advantage of the required XBRL tagging of both financial and nonfinancial (disclosures) information included in reports filed with the SEC. Known colloquially as “Robocop,” AQM provides fast and efficient computerized analysis of this tagged information. The SEC is now capable of employing the AQM in the search for EPS warning flags.

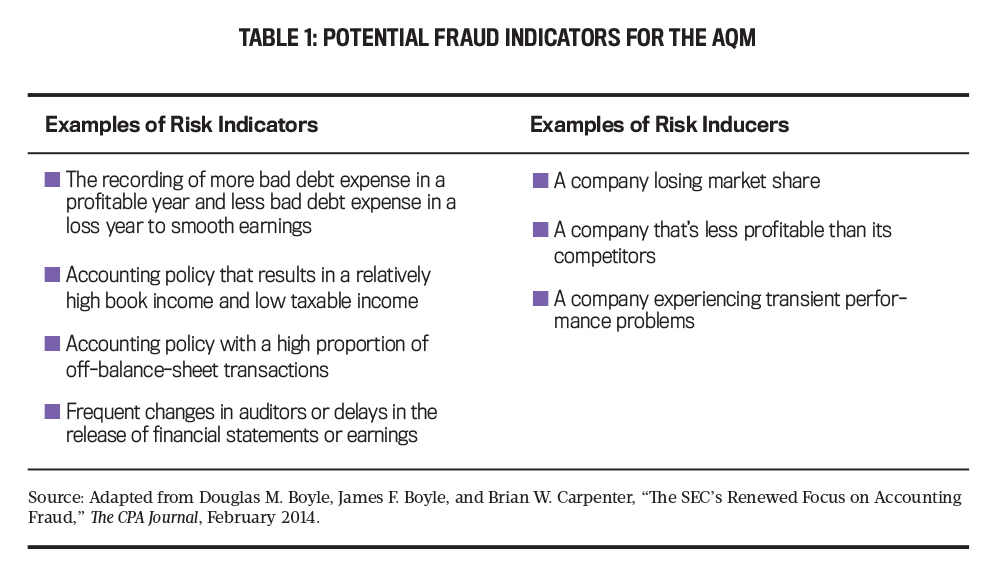

In their article, “The SEC’s Renewed Focus on Accounting Fraud,” Douglas M. Boyle, James F. Boyle, and Brian W. Carpenter examined insights into certain items that may raise red flags under the AQM, including a well-known earnings management model called the Jones Model (The CPA Journal, February 2014). The Jones Model, which originated in the early 1990s, is used to locate potential aggressive earnings management through the analysis of discretionary accruals, which can identify both understatements and overstatements.

As Boyle, et al., note in the article, it’s essential for auditors to understand this model and the dual directionality because auditors typically test in only one direction. Therefore, auditors should test all material differences whether or not they result in an overstatement or understatement of earnings. Additionally, the Jones Model relies on accounting research to determine potential fraud indicators. Table 1 summarizes the Jones Model and presents example risk indicators that could cause a filing to be “flagged.”

Again, while the specifics of the EPS Initiative are unknown at this time, management should be aware of these risk indicators when preparing quarterly and annual reports. While the SEC hasn’t disclosed whether Robocop is the backbone of the new EPS Initiative, it stands to reason that it’s being used in some capacity to flag potential EPS violations.

INITIAL ENFORCEMENT ACTIONS

Three investigations into EPS violations under this initiative have resulted in settled actions and penalties. The SEC detailed the first actions from investigations initiated by the Division of Enforcement’s EPS Initiative in September 2020. Those actions involved the earnings management practices of improper reporting of quarterly EPS by two public companies, Interface, Inc., and Fulton Financial Corporation. Then a third company, Healthcare Services Group, Inc., agreed in August 2021 to settle charges that “the company engaged in accounting and disclosure violations that enabled the company to report inflated quarterly earnings per share that met research analysts’ consensus estimates for multiple quarters.”

Interface, Inc. The SEC found that, in multiple quarters in 2015 and 2016, the Georgia-based modular carpet manufacturer “made unsupported, manual accounting adjustments that were not compliant with GAAP.” The order also stated that “these adjustments were often made when Interface’s internal forecasts indicated that the company would likely fall short of analyst consensus EPS estimates.” The order found that “the adjustments boosted the company’s income, making it possible for Interface to consistently report earnings that met or exceeded consensus estimates.” The order also found that the controller and chief accounting officer directed the unsupported adjustments, with the former CFO causing the controller to direct some of those unsupported entries. According to the SEC’s order, the company and executives violated certain antifraud provisions of the Securities Act of 1933 and violated the books and records provisions of the Securities Exchange Act of 1934. Without admitting or denying the SEC’s findings, Interface and its executives agreed to cease and desist from future violations and pay civil penalties of $5 million and $115,000, respectively. Interface’s controller, Gregory J. Bauer, and CFO, Patrick C. Lynch, also agreed to be suspended from appearing and practicing before the SEC as accountants. This includes not participating in the financial reporting or audits of public companies. The SEC’s order allows Bauer and Lynch to apply for reinstatement.

Fulton Financial Corporation. A Pennsylvania-based financial services company, Fulton was found to have “inaccurately presented its financial performance in late 2016 and early 2017.” During those two quarters, Fulton was on track to meet or beat analyst consensus EPS estimates, yet the order found “Fulton’s public filings included a valuation allowance for its mortgage servicing rights that was at odds with the valuation methodology described in the same filings.” In addition, the order noted “in mid-2017 Fulton belatedly reversed the valuation allowance, increasing its EPS by a penny in a quarter when it otherwise would have fallen short of consensus estimates.” It was Fulton’s disclosure that created the misleading appearance of consistent earnings across multiple reporting periods. The SEC’s order against Fulton found that the company violated the reporting, books and records, and internal controls provisions of the federal securities laws. Without admitting or denying the SEC’s findings, Fulton agreed to cease and desist from future violations and to pay a $1.5 million penalty.

Healthcare Services Group, Inc. The most recent order was brought against Healthcare Services Group, Inc. (HCSG), a Pennsylvania-based provider of housekeeping, dining, and other services to healthcare facilities. The order found that the company “failed to timely accrue for and disclose material loss contingencies related to the settlement of private litigation against the company, as required by U.S. Generally Accepted Accounting Principles.” This allowed HCSG to report “EPS that met to the penny or came close to meeting research analyst consensus EPS estimates and reported multiple quarters of EPS growth, including then-record-high EPS.”

In addition, the order found that “HCSG’s former CFO John C. Shea failed to direct the recording or disclosure of the loss contingencies on a timely basis” and that the company’s controller, Derya D. Warner, “made other accounting entries that were not supported by adequate documentation as required by company policies.” The SEC’s order finds that HCSG and Shea violated the financial reporting, books and records, and internal controls provisions of the Securities Exchange Act of 1934. The order further finds that Shea caused HCSG’s violations, and Warner caused HCSG’s books and records and internal controls violations.

Without admitting or denying the SEC’s findings, HCSG, Shea, and Warner agreed to cease and desist from future violations of the charged provisions and pay civil penalties of $6 million, $50,000, and $10,000, respectively. Shea also agreed to be suspended from appearing and practicing before the SEC as an accountant, which includes not participating in the financial reporting or audits of public companies. The order permits Shea to apply for reinstatement after two years.

BROAD IMPLICATIONS

Based on these actions, it’s evident the SEC is focused on continued vigilance and oversight of earnings management through EPS. This effort has implications for managers, board members, auditors, and others charged with governance, including preparers of corporate financial statements. These parties are in the best position to identify potential risk factors, such as compensation incentives (e.g., bonuses and stock options) to meet analysts’ EPS consensus estimates, which may represent risk inducers. Companies consistently meeting these earnings targets might indicate earnings management or an increased risk.

Oversight is critical, especially when boards of directors have been criticized for not adequately monitoring or addressing earnings management. Many legislative and corporate reforms have increased the responsibilities and tasks of the audit committee—which, as Liesbeth Bruynseels and Eddy Cardinaels note, serves as the watchdog for financial reporting quality and the audit process (“The Audit Committee: Management Watchdog or Personal Friend of the CEO?” The Accounting Review, January 2014). Amidst the increase in advisory and governance tasks, board members are now called to understand the new Division of Enforcement’s EPS Initiative.

Those charged with governance responsibilities should ensure additional oversight is performed on a routine basis. This includes setting the tone at the top and creating an environment of transparency, ensuring open communication between those charged with governance. In addi- tion, an organization’s internal audit department should be engaged appropriately to investigate key, high-risk areas. Audit committee best practices, such as those outlined by Douglas M. Boyle and Daniel J. Gaydon in “SEC Whistleblower Program Expands” (Strategic Finance, November 2019), could be applied toward earnings management, including meeting regularly; having appropriate independent, financial, and industry experts; and engaging specialists when necessary.

With the SEC’s increased attention on the issue, board members should also renew their focus, intentionally communicating with management regarding reviewing the quarterly reports that show EPS. Audit committee members can use this information to better determine the kinds of inquiries they should be making of management and the external auditors and to help auditors in the planning and performance of their essential audit work.

Another group whose participation is critical is auditors. They play a crucial role in informing companies, audit committees, and boards about key elements that might come under increased scrutiny. For example, auditors, who are aware of the renewed SEC focus on identifying and investigating fraudulent financial reporting, including potential outlier discretionary accruals, can advise clients regarding key areas susceptible to increased scrutiny. As Boyle, et al., wrote in their 2014 article, “Once potential discretionary accrual outliers, risk indicators, and risk factors have been identified, public company directors, audit committee members, and auditors should analyze the underlying reasons for the findings.”

Auditors can also test outlier discretionary accruals that may have the potential to be flagged as earnings management and then subject them to additional examination. Various analytical procedures can be performed, such as using industry benchmarks to compare key performance ratios to peer companies. As part of the consideration of fraud risk factors, auditors can use risk indicators and risk inducers during the external auditors’ planning session and to aid in discussion with those in corporate governance. This assessment may help reevaluate previous accounting adjustments by taking a step back and discussing any rationalization of possible negative outliers. This thought process and discussion can positively impact audit and reporting quality, not to mention prove beneficial if the organization is ever the target of any SEC financial reporting investigation.

STRENGTHENING ENFORCEMENT

The EPS Initiative is yet another indication of the SEC’s continued endeavors to protect the integrity of the markets and its intolerance toward violations. While there are hundreds of enforcement actions filed every year for misconduct (see Figure 1 for some examples), we may expect more findings related to EPS as the new EPS Initiative continues. These actions are meant to punish wrongful acts, deter future misconduct, protect and compensate harmed investors, and remove unethical parties from the market by imposing fines, suspending or revoking licenses, seeking injunctions, and making recommendations for criminal prosecutions.

The SEC has responsibility for ensuring that investors have reliable information. Statements from the Division of Enforcement suggest that the stringent oversight and disclosure of earnings management will continue. Companies and investors can expect greater penalties and consequences for misreporting under the EPS Initiative.

The SEC invites comments on Proposed Rules, Concept Releases, Self-Regulatory Organization Filings, Public Company Accounting Oversight Board (PCAOB) Rulemaking, as well as other releases. It recently requested comment on earnings releases and quarterly reports, showing this area is on the forefront. Therefore, it’s of utmost importance that everyone involved understands the importance of the EPS Initiative and how they can respond appropriately in their respective roles.

With the expansion of SEC scrutiny, all who play a role, including management, auditors, boards, audit committee members, and those in the financial information preparation and reporting process, can help protect the integrity and accuracy of financial information critical to the functioning of our capital markets.

May 2022