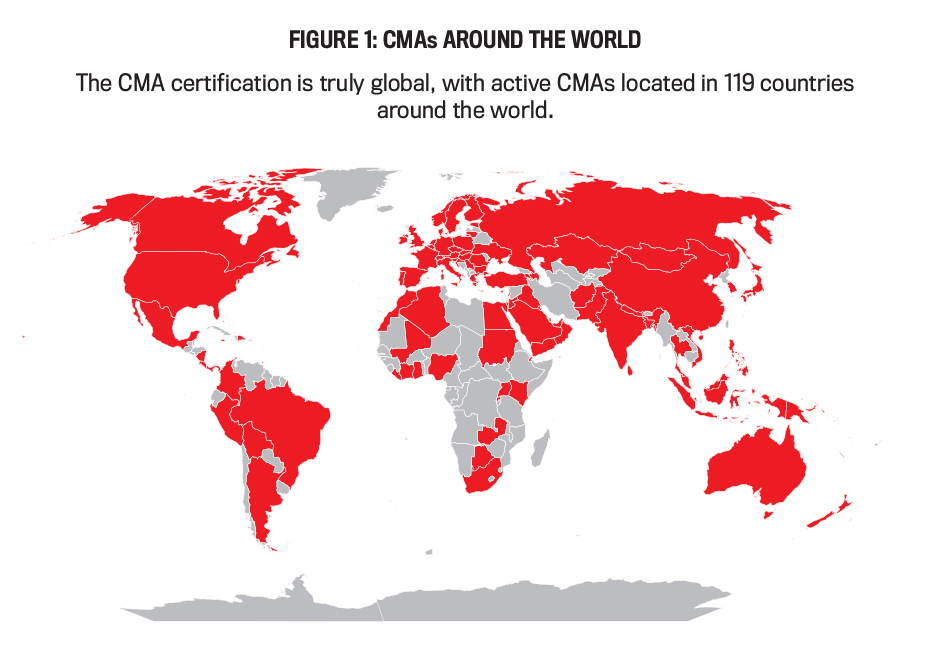

The CMA® (Certified Management Accountant) program has grown exponentially since its earliest days in 1972, attracting professionals from a wide range of industries, countries, career stages, and job titles. Sixty-one individuals passed the first exam in December 1972 and earned the right to call themselves a CMA. In the years since, more than 100,000 individuals have similarly achieved the distinction. What began as a program initially available in about two dozen U.S. cities has grown into something more far reaching and influential: Today, accounting and finance professionals in 119 countries around the world proudly call themselves CMAs (see Figure 1).

The evolution of the CMA reflects the determination of IMA® (Institute of Management Accountants) and ICMA® (Institute of Certified Management Accountants, an affiliate of IMA that oversees the program) to adapt to the changing demands of the profession. It demonstrates the organization’s commitment to fulfill its mission to serve the profession and provide assurance that those who earn the certification possess the skills required to perform exemplary work. It’s a story of resilience, adaptability, and commitment—one that began a half century ago.

ATTESTING TO PROFICIENCY

The idea for a certification that would attest to the qualifications and proficiency of management accountants originated in the mid-1940s, more than two decades after the National Association of Cost Accountants (NACA, as IMA was originally known) was founded in 1919. It took another 20 years for the association and its then-president, Joseph L. Brumit, to appoint a Long-Range Objectives Committee to consider the matter.

Given a time frame of three years, the Committee developed a comprehensive report, unveiled at a national board meeting in June 1968, which included a section titled “Recognition of Educational Attainment.” In six short paragraphs, the initial spark of the CMA was lit: “The Association shall develop and administer comprehensive examinations in the field of business education. Upon the successful completion of such an examination, the candidate shall be awarded an appropriate title.” Also described were the qualifications needed to sit for such an examination and the need to charge fees.

That initial report led to the creation of an ad hoc committee to study the topic, followed by a series of committee meetings where members eventually concluded there was, indeed, a need for an exam program and a body to oversee it. Those two things occurred in January 1972, when the board of the National Association of Accountants (NAA, NACA’s new name) unanimously approved the creation of the Institute of Management Accounting (ICMA’s original name) and establishment of the Certificate in Management Accounting (see “What’s in a Name?”). Shortly thereafter, the Board of Regents, a group of volunteer leaders responsible for overseeing the standards, policies, and procedures of the program, was established.

The next task was to identify someone to helm the certification program and develop the exam. NAA found the ideal person in James Bulloch, an accounting faculty member in the University of Michigan’s Graduate School of Business Administration. Bulloch was an experienced educator, consultant, and leader of executive development programs. As the first managing director of the CMA program, Bulloch, with help from Karl Reichardt, director of examinations, created the original CMA framework and wrote the first exam.

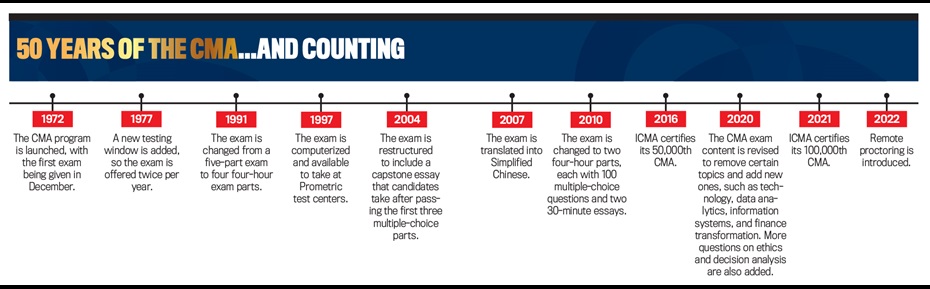

The exam created by Bulloch was first administered in late 1972, given over three consecutive days—December 6, 7, and 8—in 22 locations across the United States. There were five parts, each three-and-a-half-hours long and consisting of multiple-choice questions, essays, and problems.

In total, 520 individuals registered for that first exam, 410 candidates sat for it, and just 61 passed all five parts (see “First Test Takers”). Of those, 54 also met the experience requirement, and they were awarded the first CMA certificates in June 1973 at the NAA Annual Conference in Dallas, Texas. The remaining seven individuals received their certificates at a later date after fulfilling the experience requirement.

TECHNOLOGY SPURS CHANGE

A lot has changed in five decades: Technology has revolutionized the way we work, and the world has shrunk and become increasingly interconnected. As the world has changed over the past 50 years, so has the CMA exam.

Among the areas where the exam has significantly changed are its timing and administration. As the program expanded, it quickly became apparent that administering the exam just once during the year was no longer feasible. In 1977, the exam started being offered twice per year—in June and December (this was expanded again in 2009 into three testing windows: January/February, May/June, and September/October).

The paper-and-pencil format, with essays that were hand graded by professors and practitioners, remained in place until the mid-1990s, when advances in technology helped spur the use of computer-based testing across various disciplines. In September 1995, the Board of Regents approved a computer-based test, which was implemented in December 1997. ICMA challenged itself to be the first accounting association to fully computerize its certification exam—a challenge it met (and within budget, too). Since December 1997, the CMA exam has been offered in computerized format at Prometric test centers.

Most recently, there’s now the option of taking the test remotely. Starting in January 2022, candidates in nearly all parts of the world can take the exam from the comfort of home, provided certain technology and space considerations are met. This move was made only after it was clear that the technology was in place to ensure the security of the testing process. Those who live in areas with limited access to a Prometric test center can now take the exam.

REMAINING RELEVANT

One of the most important roles of the ICMA Board of Regents is to ensure that the content of the exam remains relevant. Over the past 50 years, the content of the exam has been revised to address changes to the profession. As Rick S. Thompson, then-Chair of the Board of Regents, and Dennis Whitney, ICMA senior vice president, wrote in Strategic Finance 10 years ago: “Like all professions, management accounting evolves and improves over time. New insights and breakthroughs result in changes in practice. Advancements in technology, changes in regulations, increasing globalization, and growing complexity result in changes in the work of the management accountant. With these changes in the job come new requirements in terms of knowledge, skills, and abilities. The CMA program must keep pace with the profession and evolve as well” (“The CMA Turns 40!” September 2012).

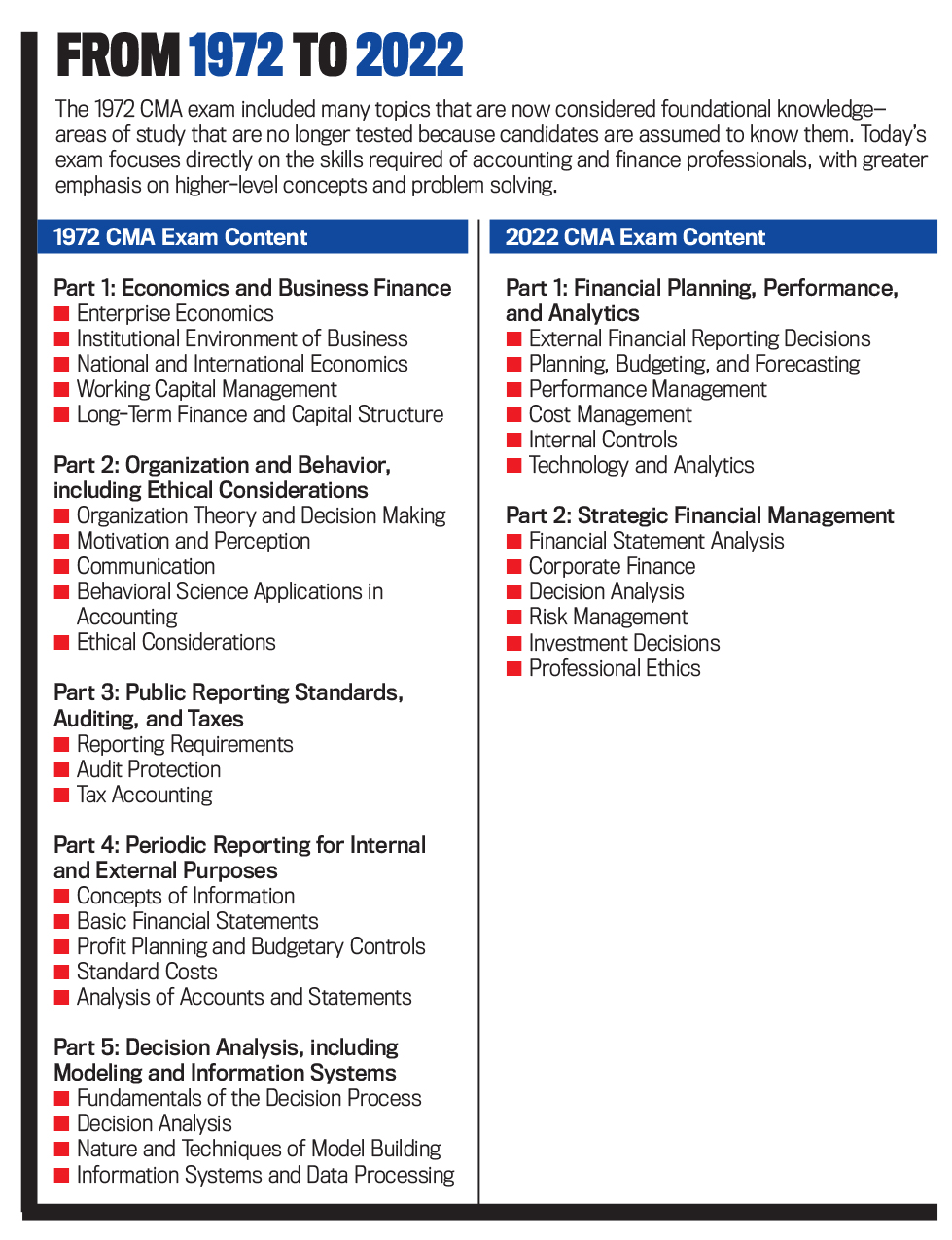

The earliest exams covered a broad range of topics—economics, linear programming, even institutional environment of business—and ICMA’s commitment to ensuring that the exam tests what really matters to accountants has sparked several rounds of revisions.

The first came in June 1991, when the exam structure was changed to four parts, with each lasting four hours. Another significant change occurred in 2004 following a job analysis study in 2003. The four parts of the exam became three multiple-choice sections and one capstone essay. The parts were also realigned to be grouped according to the skills and abilities accounting and finance professionals use in analyzing, managing, and evaluating business solutions.

In 2010, the exam was revised, following another job analysis study, into two parts consisting of 75% multiple-choice questions and 25% essay questions. Topics were added to cover the core knowledge and skills needed by management accountants, while other topics, considered foundational knowledge, were eliminated.

The most recent iteration, which is the exam candidates take today, continues to reflect this commitment to relevancy (see “From 1972 to 2022”). The most significant changes, implemented in 2020 based on the latest job analysis study, included a new section in Part 1 covering emerging topics such as information systems, data governance, technology-enabled finance transformation, and data analytics. In Part 2, new topics such as sustainability and social responsibility were added, while others—such as bankruptcy and off-balance-sheet financing—were removed.

Despite these changes, some things have stayed the same. All revisions to the exam have aimed at testing a candidate’s ability to go beyond mere knowledge and rules to also analyze and evaluate complex data to make better decisions. Further, the subject of ethics has always been tested on the exam. That isn’t surprising in itself as ethics has long been a priority for IMA, with the Committee on Ethics being among the first standing committees created at the organization’s founding in 1919. Most recently, ICMA and the Board of Regents decided the exam should place even more emphasis on ethics, which now composes 15% of Part 2 of the exam, up from 10%. In addition to the experience requirement needed to earn the designation, there has always been a requirement for CMAs to take continuing professional education (CPE) each year to keep the certification. Today, CMAs must complete 30 hours of CPE annually, with two of those hours focused on ethics.

EXTENDING THE REACH

The early leaders of IMA envisioned a global organization that could have far-reaching impact and influence on the industrialized world. The CMA certification was one instrument in establishing and cultivating that influence. CMAs could offer critical strategic insights and analysis, help drive business value, and contribute to the overall goals of their organizations and society.

Extending the reach of the CMA is the work of a variety of IMA staff and volunteer teams. Efforts in areas such as corporate development, marketing, public relations, and advocacy—aided by the work of IMA chapters, individual volunteer leaders, and review course providers—seek to build the brand recognition of the CMA program and encourage accounting and finance practitioners to earn the certification. IMA’s research and publications teams also help to advance the management accounting profession and increase awareness of the CMA program through groundbreaking research studies and practitioner-relevant articles.

In the early days of the exam, the organization focused on broadening the reach of the CMA exam to Canada and Latin America due to their proximity to the U.S. But such international growth remained slow.

After some fits and starts (including the introduction of the CMA exam in Europe, in the Netherlands, in 1992), IMA’s global development team sought ways to bring the CMA exam to regions that were experiencing rapid economic expansion. These efforts culminated in a decision by the ICMA Board of Regents in 2007 to translate the exam into Simplified Chinese. That change brought in thousands of members who were now able to take the exam in their local language.

Another target region became the Middle East and, more recently, India—areas that are also experiencing economic growth. IMA opened offices in these regions to assist with these efforts and partners with local review course providers to help promote the CMA program and prepare candidates for the exam. IMA also uses print media, advertising, events, direct mail, and direct selling to help increase the penetration of the CMA program in these and other target markets.

Efforts to grow the program also have come through the corporate market. Through a variety of programs, such as in-house review programs, discounted group memberships and program fees, and study cohorts (with live instructors), the CMA has become a sought-after way for leading companies to provide leadership development and training to their accounting and finance teams.

While international and corporate expansion has been a priority, so has extending the reach of the exam beyond the professional market. One key area of focus has been students, who are able to sit for the exam while still undergraduates, unlike the requirements for the CPA (Certified Public Accountant) exam. Further, students usually study many of the topic areas covered in the CMA exam in their accounting and finance coursework. After passing the exam and graduating from an accredited institution, students need just two years of relevant work experience before they can officially earn the certification.

The CMA Scholarship program has successfully attracted students around the world to prepare for and take the exam. Launched in 2012, the scholarship program enables outstanding undergraduate and graduate students to pursue the CMA certification for free. To date, more than 20,000 students globally have received scholarships, representing more than 2,000 colleges and universities from around the world, and totaling more than $35 million.

At the institutional level, IMA also created the IMA Higher Education Endorsement Program, which recognizes educational programs that provide the rigorous curriculum needed for students to prepare for the CMA exam. Since kicking off the program as a pilot in 2013, IMA has endorsed more than 100 institutions of higher learning around the world as part of the program.

From a program that began 50 years ago in 22 locations in the U.S., the CMA has grown to become a truly global certification. Recently, the program crossed a historic milestone: certifying its 100,000th CMA, a remarkable achievement that the founders of the program only hoped could be possible. What’s in store for the next 50 years? Only time—and opportunity—will tell!

June 2022