Today’s accountants must be adept at data analytics, work on multidisciplinary teams, contribute to operational and strategic management, and focus on a broad range of stakeholders. Yet as the profession undergoes this major transformation, accounting curricula at colleges and universities still focus primarily on the memorization and application of accounting rules and calculations.

To meet the needs of an evolving workplace, it’s more essential than ever for accounting education to reflect the current and future needs of professional accountants. As part of its continuing mission to lead the accounting profession and enable management accountants to add greater value, IMA® (Institute of Management Accountants) formed the Management Accounting Competency Task Force in 2021 to develop recommendations for management accounting competencies in higher education. The timing of the task force’s work coincides with work being done by other professional accounting organizations, including the American Institute of Certified Public Accountants (AICPA), encouraging accounting programs and educators to rethink the accounting curriculum.

The goal of the task force was to take a forward-looking approach to identify the management accounting competencies needed in the future by all entry-level accountants. Task force members possess extensive experience in developing competencies and implementation guidance for accounting education. They put together an initial list of competencies, which was reviewed by academic and practice review panels and then presented for public comment in October 2021. The feedback received during the comment period was reviewed, and changes were incorporated into the document. The final report, Essential Management Accounting Competencies for All Entry-Level Accountants, was published in December 2021.

THE NEED FOR CHANGE

Over the years, new content is often added to the accounting curriculum without taking out older, less relevant content. This has resulted in content overload, with programs struggling to cover everything. This issue has become even more pressing as schools strive to increase their coverage of technology and analytics.

Accounting educators who teach mainly financial reporting, auditing, and tax may mistakenly believe that management accounting courses should be the primary source of technology and analytics education, accompanied by significant reductions in existing management accounting content. While the management accounting curriculum at many schools may have failed to keep up with the evolving practice environment, the remedy should be an updating of that content rather than an overall reduction in management accounting topics. A better approach to including data technology and analytics would be to integrate these competencies as part of every area of study within the accounting curriculum, enabling students to learn how technology is influencing every part of the accounting profession, including audit, financial reporting, tax, and management accounting.

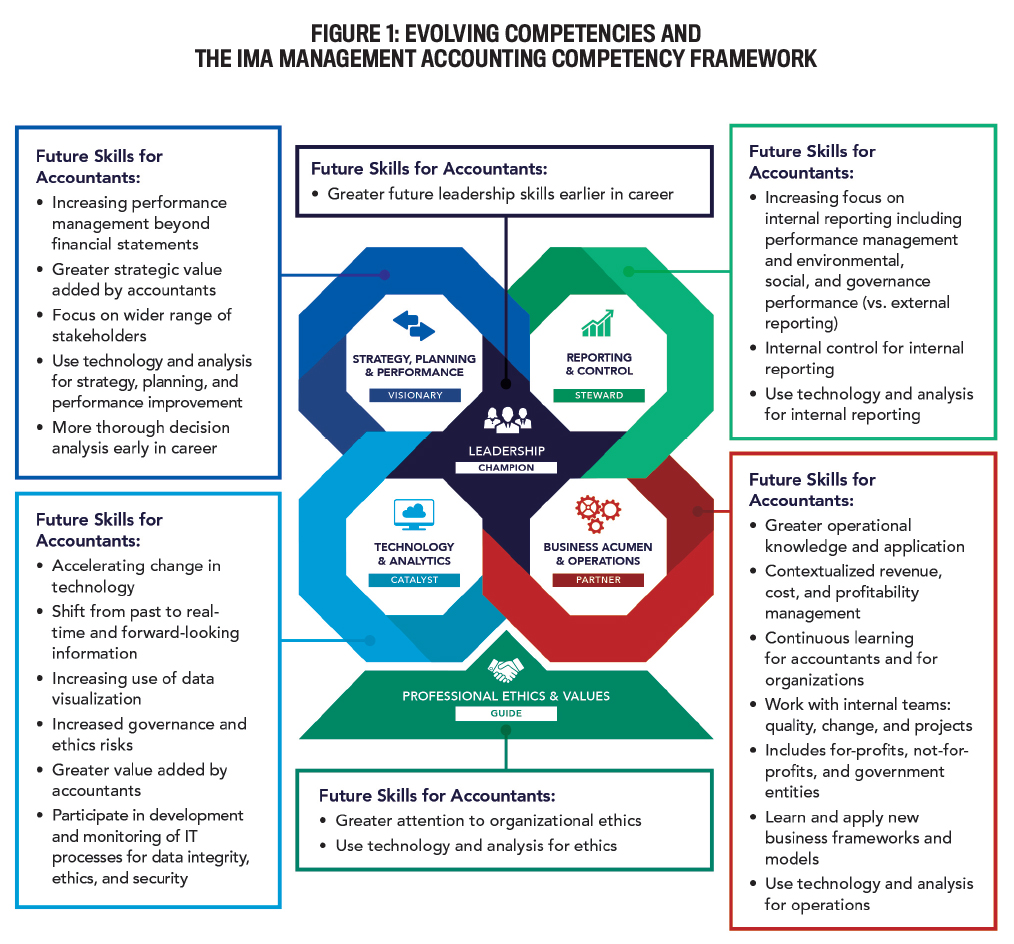

In the evolving practice environment, it will continue to be important for all students to develop core management accounting competencies. As accountants increasingly add value as strategic business partners, these competencies will be more essential for all entry-level accountants regardless of whether they work in public or private accounting. The study of management accounting provides students with a holistic, integrated understanding of accounting, as illustrated by the IMA Management Accounting Competency Framework (see Figure 1).

A VISION FOR MANAGEMENT ACCOUNTING EDUCATION

In most accounting programs today, the first accounting course focuses on financial accounting and incorporates some topics related to assurance and perhaps taxation. The second accounting course traditionally focuses on management accounting but emphasizes the methods used for financial accounting. Even the subsequent intermediate course in management accounting—traditionally called “cost accounting”—focuses primarily on costing methods, budgeting, and performance management through a financial accounting lens.

Given the traditional design of introductory and intermediate management accounting courses, it’s no surprise that accounting programs might be motivated to alleviate coursework overload by reducing management accounting content. Unfortunately, the outdated course design fails to support the need for accountants to add greater value to their organizations.

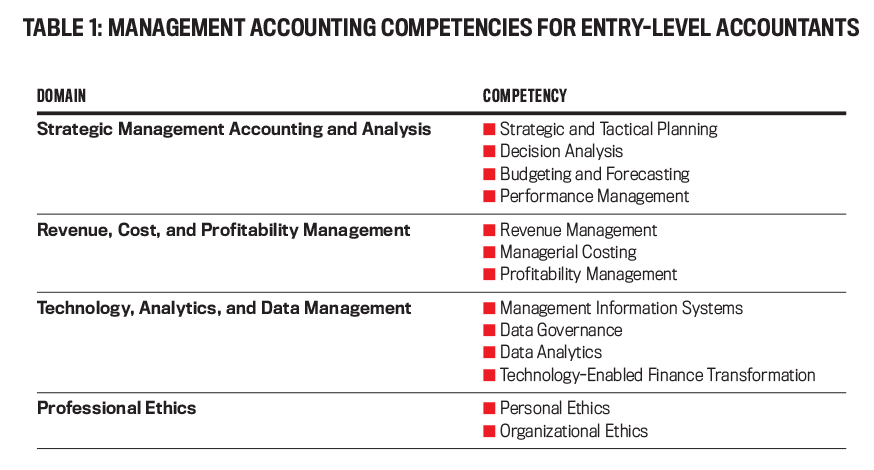

Table 1 provides an overview of the management accounting competencies that the task force identified for tomorrow’s entry-level accountants. These competencies are necessary for accountants to serve as strategic business partners, which requires the ability to understand and address the diverse factors impacting organizational success. Essentially, this list reflects a new vision for management accounting education.

While professional accountants need a wide range of competencies, the task force focused on identifying critical management accounting competencies—particularly those that are likely to be taught in management accounting courses. The task force excluded or reduced from its list competencies that are often included in today’s management accounting courses but are likely to be of less value in the future.

Why is this vision of management accounting essential to all accounting majors, regardless of their planned career path? As automation and AI gradually diminish the traditional work of accountants in public and private accounting, the future of the profession will demand greater sophistication and understanding of the management accounting perspective when solving cross-functional business challenges using financial and nonfinancial data, modeling, and causal relationships.

The essence of management accounting is internal decision support, which will ultimately impact the internal and external stakeholders of an organization and, consequently, influence the areas of financial reporting, audit, and tax. Management accounting seeks to reflect and provide deep insight into the underlying relationships among resources, processes, customers, economic conditions, and financial and nonfinancial outcomes. The goal is to enable an organization to use information that’s meaningful and timely for creating long-term strategic value.

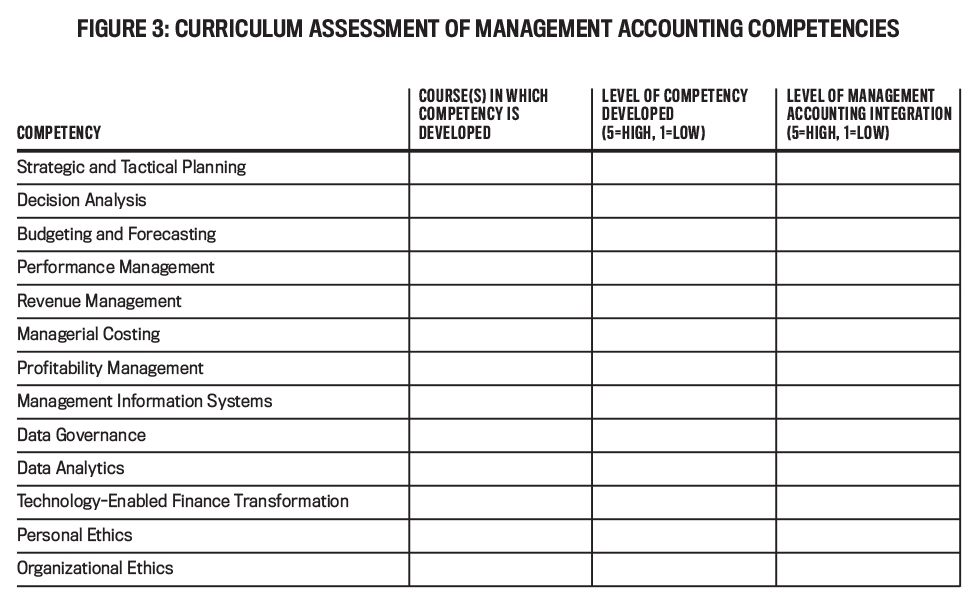

For each management accounting competency, the task force report recommends learning outcomes and learning objectives, broken out into two required management accounting courses (introductory and intermediate) and one elective course (advanced management accounting). While all the details can’t fit in this article, Figure 2 provides the task force’s recommendations for one of the competencies: Strategic and Tactical Planning. Figure 3 can be used to help assess whether a school’s program adequately covers the essential management accounting competencies.

THE NEED FOR MANAGEMENT ACCOUNTING COURSES

A key question for accounting programs is whether all entry-level accountants need to take management accounting courses. Management accounting is inherently an interdisciplinary field, overlapping in functional domain with every other business discipline. In an effort to streamline curricula, some business schools have eliminated or reduced their number of management accounting courses, choosing to teach the content elsewhere. For example, marketing courses might take over the practical application of microeconomics topics such as cost behavior, breakeven analysis, and customer profitability. Operations courses might assume responsibility for topics such as supply chain, automation, costing, and, more generally, performance measurement and management—particularly below top-management levels.

As another example, most business degree programs require a strategy course, which will almost certainly address operational, strategic, tactical, and contingency plans. Would the learning in a strategy course be sufficient for this aspect of management accounting?

The best curriculum design may vary from school to school. The adequacy for management accounting depends on two key aspects of the strategy course: (1) the level of competency developed during the strategy course in this topic area and (2) the level of integration between strategy and management accounting for this topic. Accounting programs can use the checklist shown in Figure 3 to help evaluate the adequacy of their strategy course for this aspect of management accounting competency. But it’s understandable that an operations or marketing course will focus heavily on its own domain instead of management accounting. Similarly, relying on a strategy course or other courses to cover necessary management accounting fundamentals is likely to be inadequate.

The extent of student learning in a topic area such as strategy might or might not provide adequate competency in management accounting. For example, the strategy course taken by all business majors probably addresses operational, strategic, tactical, and contingency plans. But does it also address value chain analysis, supply chain analysis, and critical success factors? How deeply are these topics addressed? And how well is management accounting integrated into these topics?

So what value is added by management accounting courses if much of the content is covered elsewhere in a business school curriculum? In general, the following issues arise when considering how well management accounting topics are addressed by courses in other disciplines:

- Significant elements of management accounting need to be taught by management accounting specialists. Management accounting instructors have expert knowledge that can’t be replicated easily by faculty in other disciplines. The subtleties of the field are crucial to fully prepare entry-level accountants.

- Essential management accounting knowledge isn’t likely to be taught in other domains. Although other business fields use some management accounting information, not all the essential topics will be addressed—and those that are will likely be taught without the depth and breadth that can only be provided in management accounting courses. Examples include budgeting theory and application, costing and allocation techniques, profitability analysis of organizational segments, responsibility center management, and activity-based costing and management.

- Rather than viewing the inclusion of management accounting-related topics in the curriculum as a “division” of topics among courses, it should be recognized that there is an “indispensable complementarity” of management accounting knowledge with everything else business students learn. Content overlap provides students with a valuable opportunity to see the “big picture” and the cross-functional nature of business. For disciplinary depth, however, the overlap alone is insufficient. The key to success for student learning is that each discipline presents the topic with its unique focus.

THE FUTURE OF THE PROFESSION

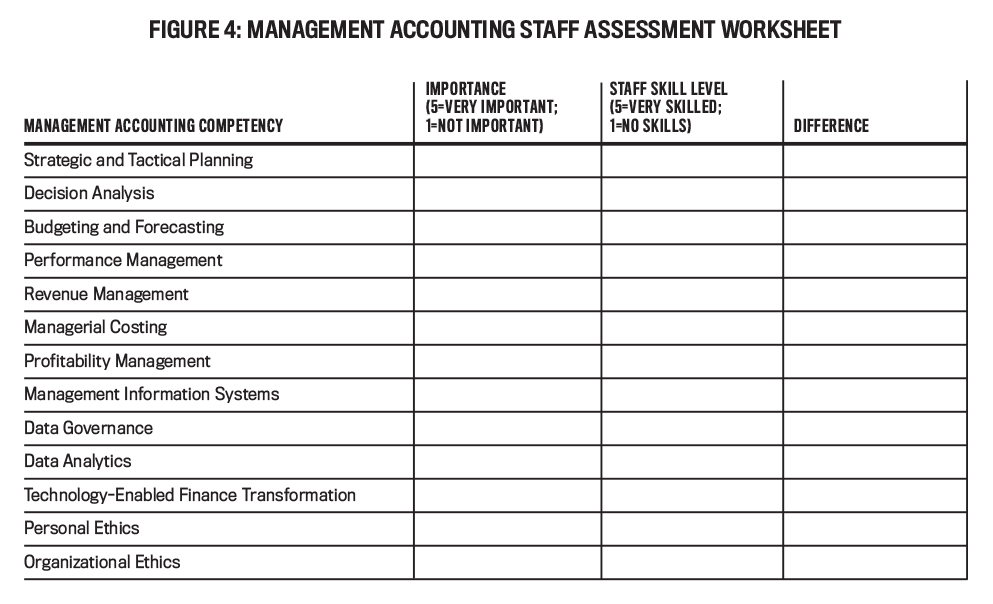

If you’re an accounting or finance practitioner, what does the work of the IMA task force mean for you? Given the rapid change in workplace requirements, accounting staff—and those who manage accounting staff—might be interested in assessing workplace readiness for the management accounting competencies.

First, you should assess whether you and your staff (either individually or as a team) possess the competencies needed to meet the evolving demands required of the business you support (Figure 4 can help in making that assessment). Any gaps should be addressed with additional training for existing staff or included as a priority when selecting new hires.

Second, you can talk to the colleges and universities with which you have recruiting, alumni, or other relationships to ascertain whether they understand the management accounting competencies needed by today’s professional accountants and are providing that training.

The future of the accounting profession is dependent upon sound, adequate training in essential management accounting competencies. The study of management accounting will prepare future accounting professionals to work in cross-functional business teams as strategic business partners. We call upon accounting faculty to ensure adequate exposure to these competencies for all accounting students and for practitioners to emphasize the importance of these competencies in discussions with their partner universities. At this pivotal point in the profession’s transformation journey, those who represent the future of our profession—undergraduate accounting students—deserve access to all the tools needed to ensure their long-term success as well as that of the profession.

February 2022