Despite efforts taken to mitigate workplace misconduct, it still happens. Compliance programs are essential to managing a company’s exposure to the risks of workplace misconduct. Traditionally, they’ve fallen under the purview of legal departments, but technological advances and heightened complexity in the business landscape have prompted calls for a more integrated approach to addressing organizational compliance. That’s where management accountants, working alongside executive leadership, can play a valuable role in ensuring corporate compliance.

When an organization is investigated for a potential ethics violation, a prosecutor will always ask whether the company has a well-designed compliance program in place. The prosecutor will examine how the organization has identified, assessed, and defined its risk profile and the degree to which the compliance program devotes appropriate resources to the risks. For those in the United States, the Department of Justice (DOJ) outlined in 2020 three key questions to assist prosecutors in evaluating an organization with a potential ethics violation:

1. Is the corporation’s compliance program well designed?

2. Is the program being applied earnestly and in good faith?

3. Does the corporation’s compliance program work in practice?

To meet the needs of the complex business landscape, changes must be made to current compliance programs. Research by Hui Chen and Eugene Soltes shows that two key factors inhibit compliance program effectiveness (“Why Compliance Programs Fail—and How to Fix Them,” Harvard Business Review, March-April 2018). First, compliance programs are often driven by a check-the-box approach, focused on fulfilling requirements on paper without adequately understanding the impact they have on employee behavior. Second, many organizations continue to rely on the same core tools—hotlines, codes of conduct, and traditional training—despite evidence of their limited effectiveness.

Management accountants can help mitigate the risk of corporate misconduct by modeling and monitoring employee behavior. Long regarded for their compliance, control, and risk management skills, management accountants are also esteemed for their ability to model ethical and professional conduct, including compliance with relevant laws and regulations, and their expertise in strategy formulation and implementation. The following three strategies will help management accountants contribute to the revamping of internal compliance programs:

1. Using data analytics to gain insights that enhance the effectiveness of compliance programs.

2. Designing incentive programs to increase internal reporting of fraud and misconduct.

3. Increasing engagement and knowledge retention in compliance training through storytelling and gamification.

GAIN INSIGHTS THROUGH DATA ANALYSIS

The technological advances of the Fourth Industrial Revolution, such as AI, 3D printing, robotics, the Internet of Things, and quantum computing, are key catalysts for management accountants’ accelerated data analytics skills development, according to Chen and Soltes. As Chris Mishler, a past chair of the IMA® (Institute of Management Accountants) Technology Solutions and Practices Committee, said, “Data analytics skills are a critical pathway for management accountants to know the right questions to ask and how to get the answers their organizations need to succeed.” Finance functions now marry financial and nonfinancial data when implementing leading-edge analytics, which can drive down costs, improve decision making, and maximize customer value.

Many organizations strive to become data-driven, but most haven’t achieved that objective yet. The 2021 Big Data and AI Executive Survey of 64 C-suite technology and business executives from Fortune 1,000 companies (including American Express, Bristol Myers Squibb, and McDonald’s) found that 76% of survey participants have yet to forge a data culture, and 59% admit that they aren’t competing on data and analysis.

For organizations that come under DOJ scrutiny, prosecutors are now asking various teams across the organization that are involved in investigations whether they have access to the right data. If management accountants are fully integrated into the compliance program, their holistic view of the organization and its existing information systems can aid in the design and execution of compliance programs. From utilizing Big Data and embracing data visualization platforms to implementing automation and voice recognition, data analytics options can be utilized to mitigate risk and ensure organizational compliance.

INCENTIVIZE INTERNAL REPORTING

One effective way to teach employees about compliance is to lead with a values-based culture—specifically, a values-based compliance culture. According to the Society for Human Resource Management (SHRM), a values-based culture is shaped by a clear set of ground rules establishing a foundation and guiding principles for decision making and actions, along with a sense of community.

An essential feature of values-based compliance is a commitment to facilitating “open reporting” or mechanisms for raising concerns. Characteristics of values-based compliance programs include:

- Clear policies and expectations

- Engaged employees who own and actively participate in the program

- Use of metrics and data analytics

- Knowledge sharing of lessons learned throughout the company

- Ongoing training programs that are current and interesting

Organizational incentive programs can help empower and engage employees to report misconduct. According to the National Whistleblower Center, rewards for internal reporting are effective because “(1) they promote positive behavior by employees who witness wrongdoing, and (2) they create a deterrent effect within the market through large award payments.”

Commitment to confidentiality is crucial for some, if not all, employees to decide to speak up. If confidentiality isn’t an option, incentives can be an effective way to inspire employee reporting. Employee incentives can include monetary and nonmonetary rewards. Monetary rewards include “spot awards,” which are bonuses that are distributed close to the time of the action that prompted the bonus, rather than through an annual or traditional performance cycle. Nonmonetary incentives could include positive performance feedback, rewards based on personal interest, flexible hours, penalties for retaliation, and, if appropriate, internal recognition through organizational communications.

Whistleblowers—people who report an alleged dishonest act—are the most effective information source in fraud detection, according to the National Whistleblower Center. They provide valuable firsthand information that may not otherwise have been discovered. These high-quality leads are crucial to protecting stakeholders and recovering ill-gotten gains.

A 2021 survey of 2,000 office staff across the U.S. and the United Kingdom conducted by Vault Platform found that 75% of U.S. office workers have witnessed some form of workplace misconduct during their careers. Of those who experienced workplace misconduct in the 12 months before the survey was published, 14% ended up leaving their jobs. Workers who took time off in 2021 due to their experience with workplace misconduct missed, on average, six days of work, or a total of 43 million sick days. This resulted in a $8.54 billion loss for the U.S. economy.

In addition, more than two-thirds of employees who observed misconduct didn’t report it. The reasons are obvious: In 82% of fraud cases where the whistleblower’s identity was revealed, the person reportedly was fired, quit, or had their responsibilities significantly altered (The Trust Gap: Expectation vs Reality in Workplace Misconduct).

Organizations with whistleblower programs that seek to incentivize individuals often provide high-quality tips that lead to successful enforcement actions. Since the inception of the U.S. Securities & Exchange Commission (SEC) whistleblower program in 2010, the SEC has recovered more than $2.5 billion in financial remedies from whistleblower tips. The program has significantly improved the SEC’s ability to detect fraud schemes domestically and abroad, thereby significantly improving investor protection. It’s worth noting that the SEC has received tips from whistleblowers in 123 countries outside the U.S. and made substantial payouts to foreign whistleblowers.

ENHANCE COMPLIANCE TRAINING

Organizations struggle with compliance training for a variety of reasons, including:

Too much, too soon. Many organizations attempt to combine compliance training with onboarding new employees. Consequently, they spend a minimal amount of time on compliance concepts. Although incorporating compliance into onboarding sends an important message that compliance is important within the organization, it typically isn’t the right time. In order to retain the information, employees need to spend time learning the rules and regulations. Trying to cram it into the onboarding process when employees are also learning about other ins and outs of the organization reduces retention and understanding.

SOLUTION: Start with the compliance topics that matter most to your organization. Leveraging a holistic understanding of overall business processes and many compliance regulations, management accountants can play active roles in compliance topic selection and prioritizing compliance course content and timing to aid in retention of important information.

The courses are too long. Long courses tend to be boring and lack the necessary engagement to influence future behavior.

SOLUTION: Research by University of California Irvine computer sciences professor Gloria Mark found that the average human attention span is 40 seconds before it switches to another task. Yet many organizations rely on text-heavy slides to convey important compliance topics. Utilize “microlearning” strategies so courses can be broken into bite-size lessons that answer one question at a time. Microlearning is an organizational training method that delivers short bursts of on-demand content for learners to study at their convenience. Learners are more likely to retain information presented in this way. Microlearning courses can employ various media forms such as images, infographics, text, videos, and games to ensure engagement throughout the course.

The courses don’t allow for application. Employees need to put compliance training into practice before an issue arises, but they often don’t have the opportunity to do so. Allowing learners to see themselves immersed in the scenario will contribute to greater knowledge retention.

SOLUTION: Gamification allows employees to practice compliance issues and utilize scenario-based learning. Scenario-based learning is an instructional strategy that uses interactive scenarios as the basis for learning. These scenarios imitate real-life situations and train the learner in complex decision making via simulated work challenges. Ethics and fraud scenarios make for excellent scenario-based learning courses.

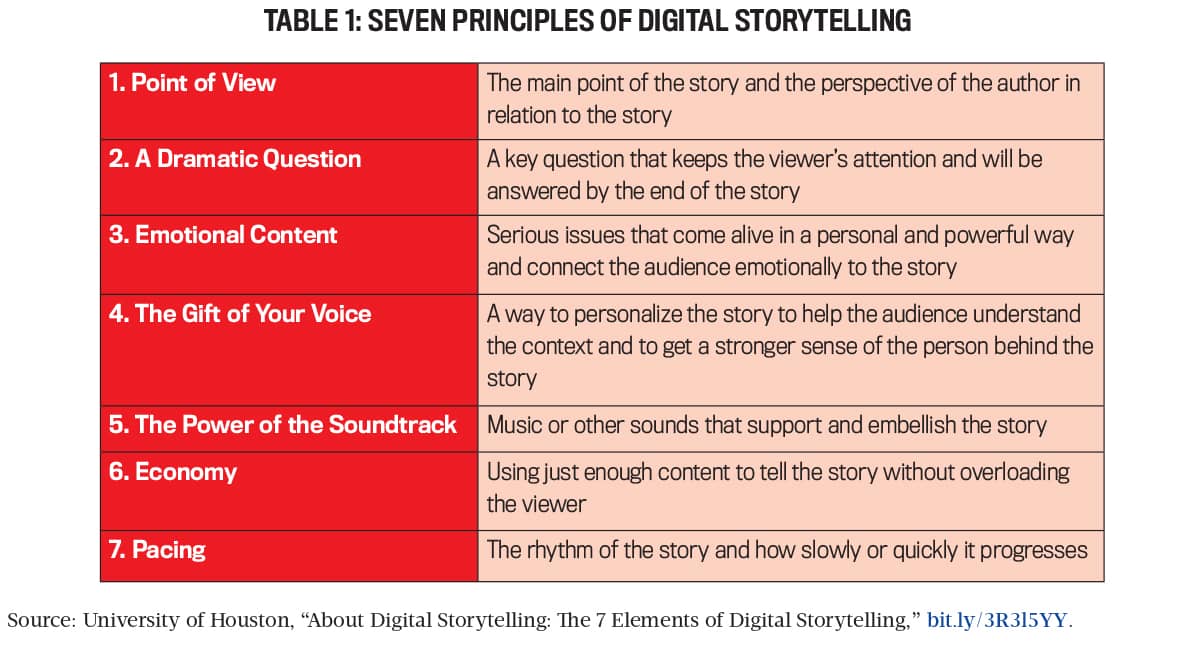

Storytelling and gamification are two methods that management accountants can use to recharge internal compliance programs that are suffering from the previously mentioned issues. Given that our brains are hardwired to respond to stories, story-based training can be an effective, cost-efficient way to upgrade internal employee training programs. Specifically, digital stories have the added advantage of being potentially multimodal (words, images, sound, and movement) and easily shared within an organization. When developing engaging content, it’s important to consider the seven principles of digital storytelling developed by Joe Lambert in his book Digital Storytelling Cookbook (see Table 1). Utilizing storytelling and gamification as training techniques can invigorate a traditional compliance program.

Management accountants can leverage existing expertise to contribute to the betterment of compliance training initiatives through these approaches. Although many people might not consider management accountants to be natural storytellers, storytelling is an integral component of the management accountant’s role. Part of their job is to tell the story behind financial and, often, operational data, and they’re increasingly relied upon to do so through data visualization tools. Their experience in telling the story behind the numbers, combined with knowledge of the business and familiarity with compliance regulations and controls, positions management accountants to help create stories that communicate key policies or cultural aspects.

Much of what can go wrong with compliance training has to do with the use of antiquated, inflexible training methods, like daylong seminars with a lecturer who delivers content from static slide deck presentations. Alternatively, games, branching scenarios, and simulations allow for storytelling where dangers and disasters can be framed as “adventures.”

Games in which learners are required to assess risk profiles, recommend risk mitigation strategies, identify potentially fraudulent activity, and report corporate misconduct can increase the likelihood that employees understand actions they’re expected to take and feel more comfortable taking those actions. Additionally, badging (awarding digital badges at course completion that can be featured on social media platforms) can allow employees to share and celebrate their accomplishments, as well as reinforce commitment to a positive compliance community.

When attempting to incorporate gamified training content, consider the following:

- Choose real-world case facts to gamify.

- Provide learners with the option to solve the game by providing clues throughout the learning experience to increase engagement.

- Ensure the game introduces a realistic conflict so that an emotional connection is made between the dilemma and the learning objectives.

The DOJ’s 2020 memo recommended that compliance officers have access to all data. The new demands of compliance professionals present an opportunity for accountants and financial professionals to offer value-added guidance to aid in ensuring organizational compliance. Upskilled management accountants equipped with data analytics capabilities can better analyze real-time data to help direct compliance teams to areas of concern. An incentivized employee population can encourage more people to come forward if they have witnessed questionable practices, and more innovative training can energize employees and help promote a positive work environment.

December 2022