The Intergovernmental Panel on Climate Change (IPCC), the United Nations body responsible for assessing the impact of science on climate change, released the Working Group II report, Climate Change 2022: Impacts, Adaptation and Vulnerability, in February 2022. This report issued a dire warning about the consequences of climate change. U.N. Secretary General António Guterres said the report is an “atlas of human suffering and a damning indictment of failed climate leadership.” Society’s and future generations’ welfare is at risk if sustainability of natural resources and ESG policies aren’t embraced by businesses and organizations.

To combat climate change risk, environmental, social, and governance (ESG) accounting is emerging as the criteria used by organizations to report nonfinancial risks and opportunities. According to NASA, the risks include increased drought and water crises, extreme weather events, more frequent wildfires, and more severe tropical storms. The severity of these events may result in material economic threats to an organization’s sustainability. Increasingly, disclosure of these threats is required by stakeholders including investors and regulators.

IMA® (Institute of Management Accountants) President and CEO Jeff Thomson predicts that 2022 will be the year of the management accountant to address these threats because of the spotlight the 2021 Conference of Parties 26 (COP26, the 26th conference of the parties under the U.N. Framework Convention on Climate Change) placed on climate change, the International Sustainability Standards Board (ISSB) timeline to develop baseline sustainability disclosure guidelines, and comprehensive proposed climate change and ESG disclosures released in March 2022 by the U.S. Securities & Exchange Commission (SEC). Responsible leaders agree that time is running out to address climate change risks and that management accountants must step up to provide leadership and expertise to address the challenges. And to meet this challenge, higher education must integrate ESG accounting into the accounting curriculum.

CALLS FOR CHANGE

Management accountants understand how to integrate ESG strategy with finance and accounting to address innovation, risk management, and resource allocation decisions, the keys to effective ESG initiatives. But to best prepare students, ESG needs to be included in the accounting curriculum to a greater degree. In fact, there are increasing calls for higher education to include ESG in the accounting curriculum. The Association to Advance Collegiate Schools of Business (AACSB) includes sustainability in its accreditation standards and emphasizes the importance of including ESG and sustainability in its members’ business and accounting curricula. Paul Juras, professor of accounting at Babson College and a former IMA Chair, supports including ESG in the curriculum. In 2021, he said, “[Academics] must prepare students to be future-ready to face the unknown and develop resiliency…. Beyond their role with students, academics also provide an important function for practitioners. Practice is looking to the future” (“The Impacts of Academics,” Strategic Finance, May 2021).

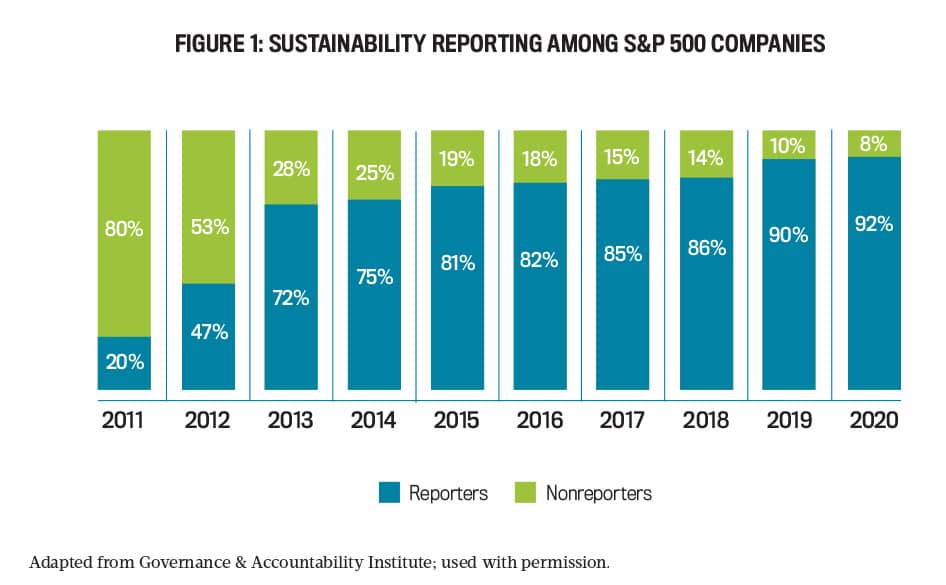

Additionally, corporate performance reporting is moving from financially focused reports to reporting nonfinancial disclosures about ESG and sustainability. Figure 1 shows that 92% of companies (465) on the S&P 500, a leading benchmark of stock performance, prepared sustainability reports in 2020, up significantly from 2011 when only 20% (100) of companies prepared the reports.

The global activities and initiatives supporting ESG accounting and reporting are accelerating as evidenced by the dramatic increase in sustainability reports prepared by S&P 500 companies. The current development of International Financial Reporting Standards Sustainability Disclosure Standards by the ISSB; the SEC’s March 2022 proposed climate reporting disclosure rules; and the European Commission’s April 2021 Corporate Sustainability Reporting Directive, which mandates that large European companies disclose how they address ESG issues, reinforce the case to educate today’s students about ESG.

But many accounting programs are hesitant to add new material to an already full accounting curriculum, believing the addition of topics requires cutting others. While a discrete, stand-alone accounting course would comprehensively address ESG accounting topics, the learning objectives and course activities presented in this article are applicable to other accounting courses such as management accounting, financial accounting, international accounting, auditing, the accounting capstone, accounting ethics, and data analytics for accounting.

The bottom line is that higher education accounting programs have a responsibility to integrate ESG accounting into their curriculum to equip today’s accounting students with the skills to face climate change challenges. Higher education programs can integrate ESG accounting into their curriculum, as shown in the learning objectives, example assignments, and resources to support stand-alone or independent modules for other accounting courses that follow.

ESG ACCOUNTING LEARNING OBJECTIVES

Instead of focusing on technical pronouncements and calculations, the “nuts and bolts” of accounting addressed in courses like auditing and intermediate accounting, ESG accounting content focuses on building an awareness of ESG issues and applying the lessons learned to students’ current and future organizations. Table 1 summarizes learning objectives focusing on the management accountant’s role in facilitating and supporting sustainability reporting, developing an awareness of the need for ESG accounting, the current state and trends driving ESG reporting, and how to apply ESG accounting in an organization. Because most students have limited prior exposure to the topics, objective 1 provides history and background. Objective 2 focuses on the compelling science of sustainability and the root causes of climate change risk. Objectives 3, 4, and 5 address the rapidly changing global ESG accounting environment, including the difference from traditional financial reporting, emergence of ESG reporting frameworks, and the development of reporting standards. Objective 6 examines the management accountant’s role in ESG reporting, while objective 7 provides guidance for developing business cases for investment in ESG initiatives to address climate change impact. Objectives 8 and 9 examine analyzing and evaluating ESG performance. Finally, objective 10 explains how to progress through the stages of development of an ecological self and an ESG ethical consciousness, an awareness that can also be applied to an individual’s organization.

DELIVERY OPTIONS AND LEARNING ACTIVITIES

ESG accounting content is suitable for undergraduate and graduate accounting programs. Course delivery methods include traditional classroom, online, and hybrid models. A hybrid class with several classroom meetings and the balance online provides a seminar environment. Classroom meetings provide facilitated discussion of topics, interaction with guest speakers, collaboration on in-class assignments, and student presentations. All can be achieved in online courses depending on the instructor’s online teaching experience and skill level. Guest speakers are valuable because they present real-world experiences and examples, add additional perspectives to the course, and facilitate student dialogue. The emergence of chief sustainability officers and ESG managers allows accounting faculty to reach out and invite professionals from their local area to speak to their classes in person or virtually. Lectures addressing the science of sustainability, the threat of climate change, frameworks for ESG reporting, how to develop and measure ESG objectives, and how to develop cost-benefit analysis for ESG initiatives are effective topics. Ted Talks and YouTube videos are rich resources to summarize content and to initiate discussions. For example, the late Ray Anderson, former CEO of Interface, Inc., a flooring manufacturer, adopted sustainability strategic initiatives in 1994 to reduce the use of petroleum products (see the instructive and inspirational video, “The Business Case for Sustainability”).

CLASS ASSIGNMENTS

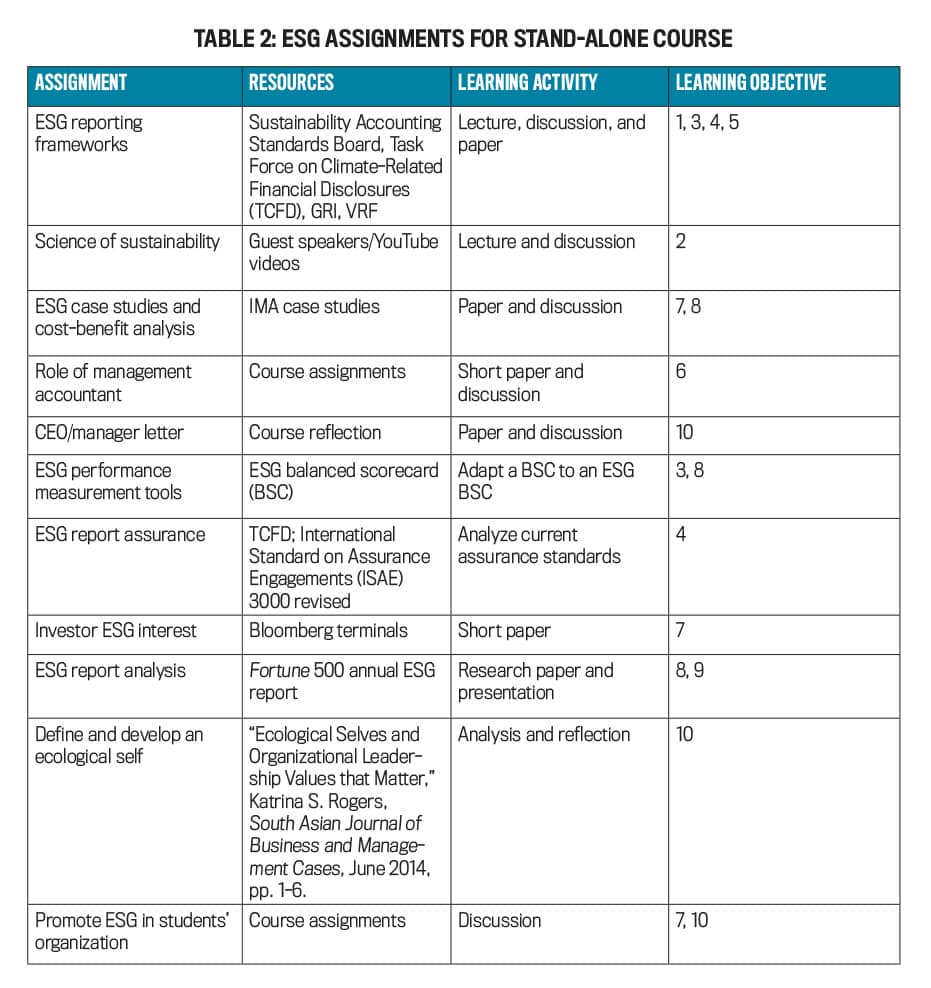

Table 2 summarizes assignments used in a stand-alone course. These case studies include a cost-benefit analysis to evaluate ESG investments and strategies. The science of sustainability is addressed to explain the risk and consequences of climate change. A short research project is assigned to identify innovative initiatives to reduce carbon emissions such as Shell plc’s investment in the production of low-carbon fuels, solar and wind power, and hydrogen to reduce carbon emissions to achieve net zero emissions. The drivers behind increased investor ESG interest are examined.

The objective of the final paper is to analyze a Fortune 500 company’s annual ESG report. This assignment provides students an opportunity to analyze the company’s ESG disclosures within the context of an ESG framework. A letter to the student’s manager, CEO, or instructor provides the opportunity to share the student’s ideas for ESG initiatives. Developing an ecological self and evaluating ethical implications of ESG reporting help students learn how to develop an ethical ESG culture in their organizations. [caption id="attachment_30226" align="alignnone" width="660"]

ASSIGNMENT ACROSS THE CURRICULUM

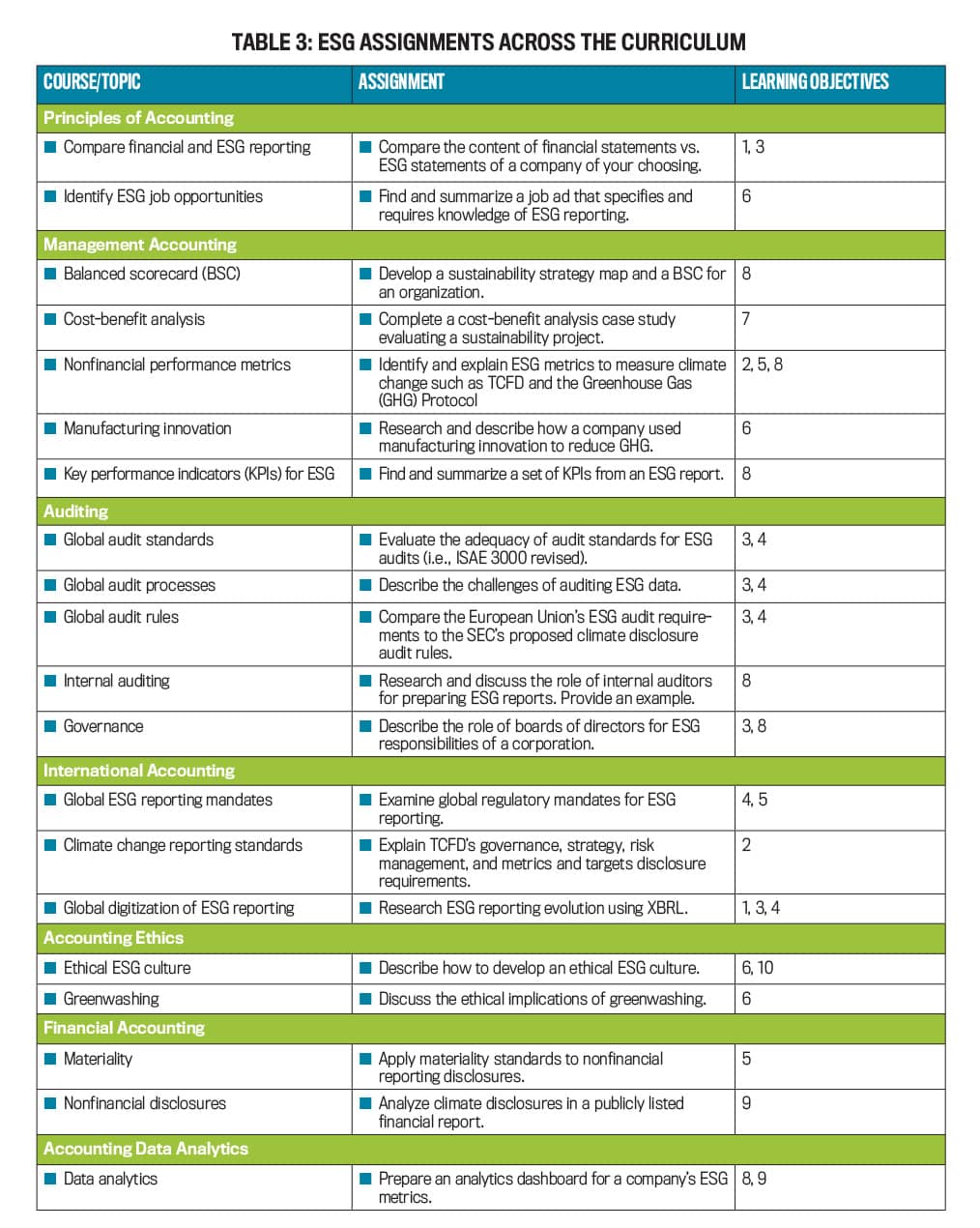

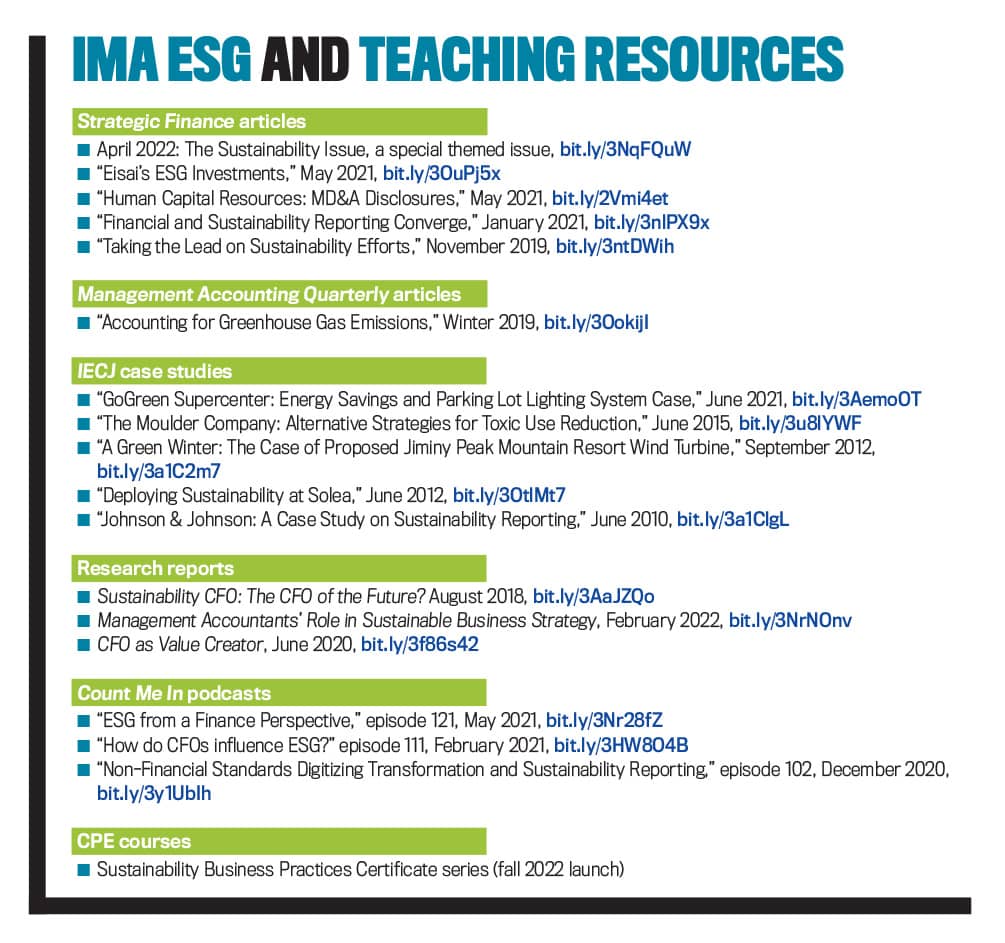

In addition to offering a stand-alone ESG accounting course, instructors can include ESG-focused assignments in other accounting courses. Table 3 shows courses and topics with example assignments and the corresponding learning objective from Table 1. These assignments are suitable for stand-alone courses too. ESG accounting textbooks are limited because the topic is emerging and changing rapidly. The gap shouldn’t handicap teaching either a stand-alone course or integrating the material in other accounting courses. Instructors may need to update assignments more frequently than traditional courses to reflect new developments and to keep the material timely. IMA continually produces ESG resources that can be used in teaching the subject, including Strategic Finance and Management Accounting Quarterly articles, IMA Educational Case Journal (IECJ®) case studies, research reports, podcasts, and continuing professional education (CPE) courses (see “IMA ESG and Teaching Resources”).

ESG DATA SOURCES

Several comprehensive ESG data sources are also available. ESG Book is a platform created by Arabesque in 2018, supported by an alliance of financial institutions, including HSBC, Deutsche Bank, and Swiss Re Group, as well as the Global Reporting Initiative (GRI). ESG Book benefits both investors and report issuers, enabling individuals or institutions to explore the ESG performance and disclosures of companies listed across all the world’s major stock indices and empowering companies to be custodians of their own data, provide framework-neutral ESG information in real time, and promote transparency through ESG Book’s digital platform.

Within the university accounting curriculum, ESG Book can be integrated into student assignments, for both individual and group projects. Access to the ESG Book digital platform is free and requires signing up via the ESG Book website. Once signed in, students, professors, and IMA members have access to a very powerful, freely available database of continuously updated ESG data. Student assignments can be created to focus on the ESG scores of a specific company or a portfolio of companies. In addition, ESG Book provides multiple filters that can be utilized and explored, such as region, country, market cap, sector, and industry. ESG Book provides a hands-on, technology-based experience for students that should help increase interest, engagement, and career skills.

Another resource is Calcbench, a financial and nonfinancial reporting data platform designed for detailed financial research. Its data source is linked directly to the SEC’s corporate financial eXtensible Business Reporting Language (XBRL) data repository with access to more than 12,000 publicly listed companies. Data access is fast, and because the data source is XBRL, the data is comparable across companies. Students can use the search function to access numbers and text (including footnotes) to identify ESG and climate disclosures for analysis. While the SEC currently has no ESG reporting mandate, when its proposed disclosures are adopted, Calcbench’s search function will facilitate disclosure access and comparison to other companies. Students and practitioners are eligible for a free two-week trial to research a company’s disclosures typically reported in the risk analysis section of Form 10-K and the proxy statement.

Because many global companies produce an annual ESG or sustainability report, corporate investor relations websites are also an excellent resource. Delta Air Lines, BP, and Ball Corporation are examples of companies that make reports and ESG initiative information available.

ESG CAREER OPPORTUNITIES

The demand for accounting for sustainability professionals is accelerating. As noted earlier, the percentage of S&P 500 companies issuing sustainability reports increased from 20% to 92% between 2011 and 2020, a dramatic increase signaling the obvious need for accounting professionals to participate in companies’ ESG initiatives. In 2021, PwC announced plans to invest $12 billion by 2026 to create 100,000 new jobs to address the talent gap for ESG engagements. The investment is planned for recruiting and talent development. Management accountants possess the skills and training to participate in data gathering, report preparation, and analysis of information; thus, ESG provides a rich career opportunity for them. Students and accountants with an ESG background and skills will enhance their professional opportunities by obtaining an ESG certification. For example, the Value Reporting Foundation (VRF) offers a two-part Fundamentals of Sustainability Accounting Credential. Level I focuses on principles and practices; level II focuses on application and analysis. Higher education accounting programs must include ESG accounting in their curriculum. The dramatic impact of climate change on global organizations and its corresponding challenges and risks provides management accountants with an opportunity to define and support strategic initiatives, serve as strategic partners, and comply with emerging ESG reporting mandates. The views expressed in this article are those of the authors and do not necessarily reflect the official policy or position of the Air Force, the Space Force, the Department of Defense, or the U.S. Government. Distribution A: Approved for Public Release, Distribution Unlimited. USAFA-DF-2022-573.

August 2022