Competing in today’s economy requires the development and execution of sustainability strategies to create long-term financial value and meet certain sustainability performance standards, including those related to greenhouse gas (GHG) emissions. BlackRock and others are advising companies to put plans in place to support the goal of net-zero emissions by 2050 or sooner. Transitioning to net-zero carbon emissions goals presents both challenges and opportunities for all companies. Research conducted in the Kellstadt Graduate School of Business Strategic Risk Management Lab at DePaul University has studied how companies develop strategies for transitioning toward net zero that will create long-term financial value.

Companies can develop and execute strategies aligned with sustainability using the Return Driven Strategy framework along with three management tools: strategic risk assessment, strategic valuation, and strategic life-cycle analysis. Disciplined sustainability performance measures aligned with long-term value creation are necessary to execute strategies and to gauge whether strategies are actually working. One element of the performance measurement challenge is having accurate, reliable, verifiable, and auditable GHG emissions measures. Unfortunately, uniform emission measures are seriously lacking today as a primary element of environmental, social, and governance (ESG) reporting.

SUSTAINABILITY STRATEGIES

During the last few years, I’ve had the opportunity to work with management teams and board members to help them develop and evaluate strategies for sustainability initiatives using the Return Driven Strategy framework. I’ve also worked with research colleagues on how to use the framework in risk management, strategic valuation, and life-cycle analysis. Here are three applications that represent a sustainability strategy tool kit for CFOs and management accountants (see Figure 1):

1. Strategic risk assessment: In the seven-step strategic risk assessment process, step 1 uses the Return Driven Strategy framework to describe the strategy of the organization (including sustainability strategies) as the logical first point before identifying risks and developing a strategic risk profile (steps 2 and 3). The strategic risk assessment process has been used in assessing and managing cybersecurity risks. Similarly, the process is now being used to assess and manage sustainability-related risks (and opportunities).

Developing a strategic risk management action plan (in step 5 in the process) includes risk reporting with balanced scorecard strategy maps where sustainability strategies can include key sustainability-related metrics. (To learn more, see Mark L. Frigo and Richard J. Anderson, “The CFO and Strategic Risk Management,” Strategic Finance, January 2021.

2. Strategic valuation: In the three-step strategic valuation process, step 1 uses the Return Driven Strategy framework to qualitatively describe how the organization will create future financial value; step 2 uses the framework to describe how it will create value with its intangible assets and resources, describing how intangible assets create value in the business strategy.

Intangible assets can include organizational capital such as managerial skill, knowledge-building culture, and the ability to adapt to forces of change, for example, how an organization adapts to environmental and sustainability issues. Step 3 uses life-cycle analysis to analyze the trend performance of returns on investment (ROIs) and reinvestments in the company, including research and development (R&D) investments and investments in sustainability initiatives. Here companies can develop and refine effective sustainability strategies and related metrics to communicate to boards, investors, and other stakeholders using a three-step strategic valuation process.

These metrics can include carbon-adjusted ROIs as important factors in valuation and in the strategic life-cycle analysis step in strategic valuation. For sustainability strategies, companies can use the strategic valuation process to understand and communicate how zero-carbon strategies can drive more effective innovation, growth, competitiveness, and effective risk management. (To learn more, see Mark L. Frigo, “Strategic Valuation in the New Economy,” Strategic Finance, October 2021.)

3. Strategic life-cycle analysis: The Return Driven Strategy framework is used along with the life-cycle framework to evaluate ROIs and reinvestments in a company or business unit, including its investments in sustainability capabilities. The strategic life-cycle approach can be used to specifically analyze sustainability strategies in this context and to understand how the company is investing in sustainability initiatives and capabilities.

This approach can also be useful in understanding the underlying risks and opportunities in investments in sustainability initiatives in terms of capital expenditure, intellectual property, R&D, organizational capital, achieving corporate purpose, and the role of innovation. Innovation in sustainability strategies can be a positive driving force for achieving corporate purpose, avoiding company risk, and establishing sustainability risk governance. Strategic life-cycle analysis can also consider carbon-adjusted ROIs and the potential risks of carbon price scenarios. (To learn more, see Mark L. Frigo and Bartley J. Madden, “Strategic Life-Cycle Analysis: The Role of the CFO,” Strategic Finance, October 2020.

The Return Driven Strategy framework is comprised of tenets and foundations that can be used to develop and analyze sustainability strategies. Here are three areas where the framework can be applied to sustainability strategies.

1. Ethically create wealth: Tenet 1 involves “adhering to the ethical parameters and values as a company’s constituents define them.” Constituents include customers, employees, investors, suppliers, partners, and other stakeholders. The company’s constituents define ethics, not the company.

How does the word “ethically” in this tenet apply to ESG initiatives and sustainability strategies? ESG initiatives can help companies avoid doing things that could disrupt long-term value creation and impair the brand and reputation of the companies. This applies to sustainability strategies to address the net-zero/carbon issues. ESG and sustainability performance reflect the ethical values of a company’s constituents, which can be demonstrated in the way the company defines wealth creation and how it measures and rewards performance.

2. Map and redesign the entirety of the value chain: Tenet 8, “Map and Redesign Processes,” in the Return Driven Strategy framework can be applied to mapping and redesigning processes throughout the entirety of the value chain. This includes processes from upstream suppliers to downstream customers and end users of the products. Tenets 4, 5, and 6 in the framework involve changing how the offerings are produced/delivered, innovated, and branded to better fulfill customer needs and expectations, such as positive sustainability performance. This approach can be applied to sustainability initiatives because it makes the connection between a value chain redesign and customer preferences and financial value creation.

3. Disciplined performance measurement and valuation: This is the foundation of Return Driven Strategy (and the bedrock of any workable sustainability strategy). Unfortunately, this is the source of one of the biggest problems in the area of sustainability strategies. What is needed are accurate, reliable, auditable measures of emissions. Carbon-based metrics currently being used in our research include a broad spectrum of metrics such as carbon-adjusted ROI, emissions/sales, emissions/gross investment, carbon-adjusted fixed charge coverage ratios, and carbon-adjusted leverage ratios. It’s a good idea to use carbon-related metrics (carbon emissions, carbon intensity, carbon-adjusted ROI, carbon price scenarios, and other carbon-based metrics), but these metrics are subject to a potential fatal flaw in the basic carbon emissions on which they’re derived. Consider a new way of accounting for climate change.

ACCOUNTING FOR CLIMATE CHANGE

In a recent Harvard Business Review article “Accounting for Climate Change,” Robert Kaplan and Karthik Ramanna described a rigorous approach for companies’ ESG reporting, especially as it pertains to GHG emissions measurements and reports. I spoke with them about the key elements of this approach: its benefits, the pathway forward to implementation, and the role of CFOs and management accountants in the process.

As background, the GHG Protocol (GHGP) defines three types of GHG emissions. Scope 1 is the direct emissions from sources owned or controlled by the company, such as its production and transportation equipment. Scope 2 is for emissions at facilities that generate electricity bought and consumed by the company. Scope 3 involves emissions from upstream operations in the company’s supply chain and from downstream activities by the company’s customers and end-use consumers.

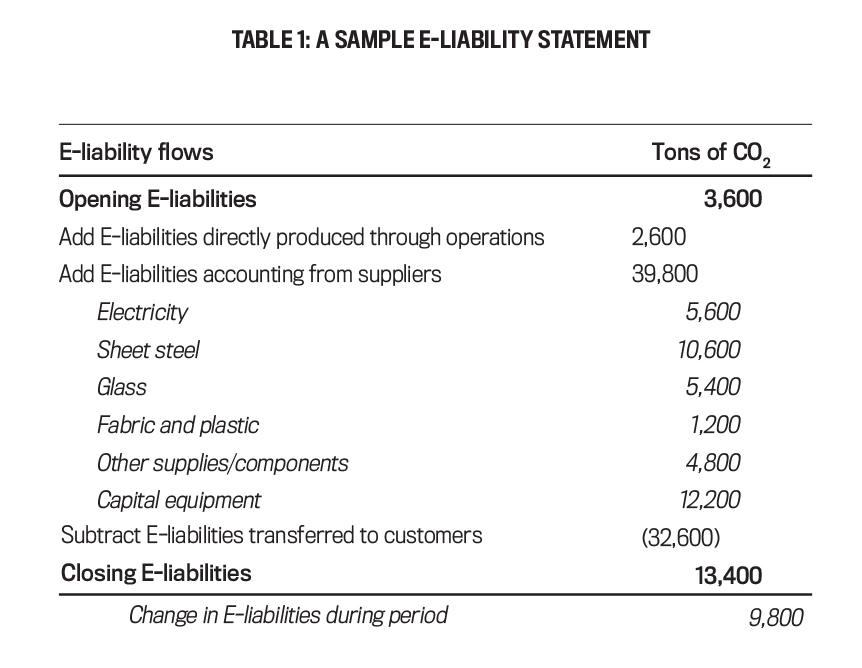

According to Kaplan and Ramanna, the current standards for scope 3 emissions reporting have fatal flaws that introduce high-measurement errors and opportunities for bias and manipulation. A new accounting system to solve these problems requires two basic steps: (1) Calculate the net E-liabilities the company creates and eliminates each period plus those it acquires from suppliers; and (2) allocate the net E-liabilities, produced and acquired, to the units of output it produced during the reporting period. This process captures all the upstream and scope 1 emissions of a company, assigns them to the company’s outputs, and transfers the acquired and produced E-liabilities to its immediate customers that purchase the company’s products and services.

THE BENEFITS OF THE NEW SYSTEM

Frigo: In your article, you describe a way of accounting for GHG emissions. What led you to develop this system? How would you describe the primary benefits of your system?

Kaplan/Ramanna: In January 2021, we participated in a seminar, hosted at Oxford’s Saïd Business School, that discussed current developments in ESG reporting and auditing. Independently, we each commented on the absence of a coherent framework for measuring ESG, and this began our collaboration to remedy the flaw. We noted that unlike other acronyms, ESG isn’t a single concept: Measuring environmental performance is different from measuring societal performance, and both are different from measuring governance since governance is a process, not an outcome. The only feature common across E, S, and G is that none has its roots in financial measurement. We decided to explore this issue more deeply and to start with “E” reports since these could be based on objective, physical measures and, therefore, should benefit from measurement and reporting concepts already being used by financial accountants to trace the quantities of cash that companies produce and consume.

We studied the concepts and practice of GHG accounting and concluded that scope 1 reporting was in good shape: Many companies are already doing a good job estimating their scope 1 emissions. But unless you’re a cement, steel, glass, or other high fossil-fuel burning company, your scope 1 emissions are, on average, about 15% of total emissions across all three scopes. So, getting scope 3 measurement correct is really important. But the GHGP standards for scope 3 measurement produce multiple counting of the same emissions and allow companies to use industry averages rather than the actual emissions generated in their supply and distribution chains. This is analogous to the FASB [Financial Accounting Standards Board] or the IASB [International Accounting Standards Board] allowing companies to use industry average gross margins when preparing their financial reports, rather than the actual margins realized from their purchasing, production, and selling decisions. Not surprisingly, most companies and users of GHG reports ignore scope 3 numbers entirely, leaving a core issue with GHG measurement in corporate value chains invisible and unresolved.

Fortunately, we determined that accountants already knew how to accurately measure and audit the GHG emissions across corporate value chains. Just shift the unit of analysis for GHG calculations from the corporation to its outputs of products and services. We can then use basic cost and inventory accounting to trace the flow of GHG emissions through even the most extended and complex corporate supply chains.

IMPLEMENTING THE NEW SYSTEM

Frigo: Your proposed new accounting system requires two basic steps: (1) Calculate the net E-liabilities the company creates and eliminates each period, adding them to the E-liabilities it acquires and has accumulated, and (2) allocate some or all of the total E-liabilities to the units of output produced by the company during the reporting period. How would a company accomplish this?

Kaplan/Ramanna: Each company, when it purchases a good or service, not only gets possession of the item, but also acquires the accumulated GHG emissions, what we call the item’s E-liability, from the item’s cumulative production and distribution processes up to that point in the supply chain. This is the E-liability analogue of the inventory accounting system for financial reporting. The company records the quantities of CO2 [carbon dioxide] and CH4 [methane] associated with a given purchased item in a parallel set of nonfinancial accounts (a separate account for each GHG you want to track) in addition to the item’s purchase price, which is recorded in an inventory account on the purchaser’s balance sheet. During the company’s production process, the GHG emissions produced in that process are added to the emissions embedded in the purchased products and services (raw materials), and then the total is assigned to each output produced.

The last step is analogous to the ABC [activity-based costing] cost accounting component. The finished goods account for the outputs now includes an entry for its total cost (raw materials + conversion cost + assigned indirect costs) and for its total accumulated E-liabilities (quantities of GHG used in the output’s extraction, production, and distribution processes to date). When the company sells one of its outputs, it credits its finished goods inventory account for the accumulated cost of the item sold and also debits the product’s E-liability as it transfers the products’ accumulated GHG emissions to the customer purchasing the item. In retrospect, it seems obvious that this should be the method for each company to be accountable for its own (scope 1) emissions plus those produced in its supply chain for purchased goods and services.

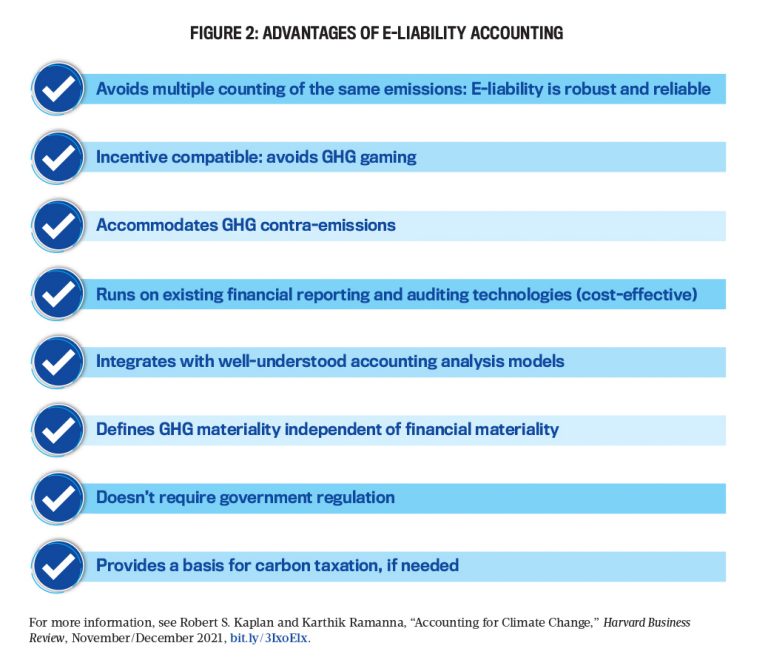

Without having an E-liability system already in place, high scope 1 emitters bear all the opprobrium for their emissions while their customers escape accountability. The E-liability method motivates all companies to be transparent about the total GHG content of their products and services. Downstream companies now have an incentive to lower the carbon content of their purchases. They could, for instance, require suppliers to use recycled—rather than “virgin”—raw materials. We were amazed that people hadn’t realized such an obvious solution already existed, based on decades if not centuries of financial and cost accounting practice, to trace emissions down a supply chain. (Figure 2 outlines the advantages of E-liability accounting, and Table 1 shows an example of an E-liability statement.)

THE ROLE OF CFOs AND MANAGEMENT ACCOUNTANTS

Frigo: What roles can CFOs and management accountants play in implementing your new accounting system? What are the initial steps CFOs should take to start the process?

Kaplan/Ramanna: CFOs can start by taking the scope 1 emissions they currently measure at a site level and drive them down to all the outputs produced at that site. They don’t even have to purchase additional software to do this. Just run a parallel version of your existing cost accounting system, and, instead of denominating the flow in currency units such as dollars, euros, pounds, or yuan, use kilograms of CO2, CH4, and other GHGs. The CFO should partner with environmental and chemical engineers to get a reasonably accurate measurement of site-level GHG emissions and with management accountants who can help assign these emissions to the multiple outputs produced at the site.

The CFO can next partner with suppliers, particularly those selling products and services with high GHG content, and do a joint project with them, helping them do their own site- and product-level E-liability estimates, which may involve additional work further upstream in the supply chain. For direct suppliers that are low scope 1 emitters, the CFO should demand accurate reports of GHG emissions in the inputs the supplier purchases further upstream, particularly inputs with high fossil fuel consumption. For example, retail and distribution companies today report, as their scope 3 emissions, only the fuel used by their suppliers when they drive trucks around warehouses and production facilities. They often ignore the GHG used to produce the iron, steel, aluminum, glass, plastic, and other ingredients used to produce each of the thousands or hundreds of thousands of products they sell.

On the downstream side, the CFOs should also begin speaking to two or more large, environmentally sensitive customers. You want the customers, if you’re able to supply them with validated lower GHG-content products and services, to be willing to have you become a preferred supplier, increasing your account share with them, perhaps even at a higher price.

This dynamic of estimating the GHG purchased from suppliers and transmitted to customers should reveal how many of the 181 companies, whose CEOs signed the Business Roundtable Statement on the Purpose of a Corporation a couple of years ago and more recently declared net-zero targets, really are prepared to “walk the talk.” Basically, we expect companies with competitive advantages in emissions to be quick to embrace the accuracy of the E-liability method since it allows them to credibly distinguish themselves from the “scope 3 crowd” that uses industry-average emissions.

MOVING FORWARD WITH ACCOUNTING FOR CLIMATE CHANGE

Frigo: What are your plans in developing active discussions with companies, regulators, and standard setters, attempting to have them understand that this system is far superior to the confusing and unauditable scope 3 standard in the GHG protocol? Will you be starting some pilot studies with companies to validate the concept and demonstrate how to implement it in practice?

Kaplan/Ramanna: Since late October 2021, we’ve had dozens of calls with companies, regulators, standard setters, and policy makers. None has stated that the E-liability method is in error or infeasible to estimate. We hope to start projects with industry leaders who are adopting dramatically lower GHG technologies for the production of steel, cement, concrete, glass, tires, and agricultural outputs. These projects are complex to launch since they involve identifying and then collaborating with several suppliers and customers who also want to establish a competitive advantage through lower emission production and distribution processes.

The discussion with standard setters and regulators is going slower, we suspect, because of political pressure from companies that are already in compliance with the existing GHGP scope 3 standard. These companies, using industry-average data, benefit from the emissions-reduction work of their competitors, and they’re reluctant to give up such a sweet deal. While the GHGP standard states that primary data, such as that produced by the E-liability system, is preferred, it allows the use of secondary data, i.e., industry and regional averages.

Shifting to an E-liability approach will take about three years, by our estimate, so eliminating the option to use secondary data at once isn’t feasible. But we’re advocating that regulators and standard setters establish a three-year horizon at which time they eliminate secondary data sources as an acceptable option for measuring corporate supply chain emissions. This sunset provision will get the attention of public companies and, we hope, private companies; large nonprofits, such as universities and hospitals; and government agencies as well. For-profit, publicly traded companies aren’t the only organizational entities that produce GHG emissions and purchase products and services with high GHG content.

Frigo: CFOs and management accounting professionals can play a vital role in how companies develop and execute value-creating sustainability strategies. Using the three management tools—strategic risk assessment, strategic valuation, and strategic life-cycle analysis—can position the CFO and finance organization to build the strategic skills and capabilities necessary for competing and creating long-term sustainable value.

April 2022