Prompted by an ever-changing external environment and increased demand for advanced analytics, the finance function must commit to greater collaboration, timely delivery of data-backed insights, and tailored decision support to meet current and future business demands. Already in need of a holistic approach to continuous improvement and sustainable transformation (from data stewardship to value creation), some finance function leads are benefiting from embedding and leveraging agility as they transform with the goal of becoming an agile finance function.

As part of this journey to develop greater agility, many finance functions have begun to adopt processes and approaches based on the Agile software development life cycle that focuses on iterative, incremental, and adaptive delivery by self-organizing, cross-functional teams. Adapting Agile to project management and operational delivery presents an innovative opportunity to increase efficiency and enhance value as the finance function undergoes a significant transformation—in other words, using Agile to become agile.

Let’s take a look at the journey toward becoming an agile finance function.

AGILITY DURING TRANSFORMATION

Finance functions in organizations of all sizes and industries, spanning healthcare and energy to professional services, government, and nonprofit, recognize the need for transformation. Long relied upon for traditional reporting and control activities, teams are now required to continue this delivery, only with a greater focus on strategy, critical decisions, and analysis. Resource constraints, manual processes, and siloed operations, however, limit transformation progress and place teams at varied stages of their transformation journeys—in most instances, they aren’t as far along as they’d initially hoped.

Gartner defined agility as “the ability of an organization to sense environmental change and respond efficiently and effectively to it.” This attribute is precisely what finance functions need to make meaningful progress with their transformation efforts and ensure that the end result positions their teams to make greater contributions to the organization’s strategic objectives.

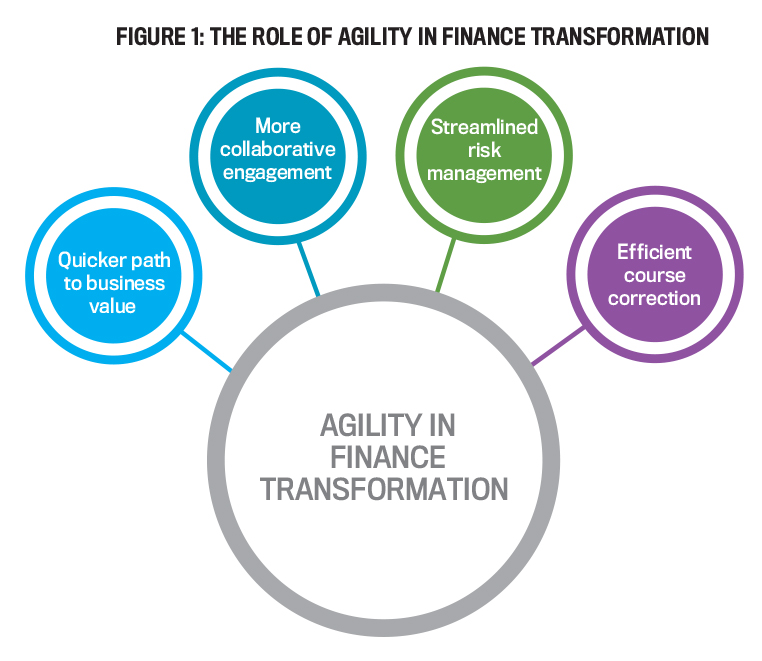

Integral to leveraging agility during functional transformation is remaining laser-focused on maximizing the business value to be delivered by the transformation effort itself (see Figure 1).

A key objective of the finance function transformation is to regularly deliver timely analysis and insights that inform strategic decisions, predict performance and behavior, and propose data-backed action to prepare for and respond to change. Tactically, this means nimble, multidisciplinary finance teams should have frequent engagement with internal customers (business and operational teams supported) to deliver projects and recurring activities with an iterative, incremental cadence. Teams like these are able to experience how agility yields a quicker path to business value, more collaborative engagement, streamlined risk management, and efficient course correction. These benefits, when reaped while transforming, nurture the agile culture that’s essential to the transformed finance function.

An Agile approach to transformation. Finance transformations are comprised of several individual initiatives that include implementing emerging technologies, standardizing and automating processes, upskilling staff, and improving ways of working, to name a few. In most finance functions, transformation programs are complex, require the input of multiple internal and external stakeholders, and have undefined details of the specific solutions to be implemented. The complexity, cross-functional nature, and opportunity to shape the outcomes make an approach based in Agile incredibly effective.

In an Agile approach, each individual initiative might be assigned to an overarching backlog housing the corresponding value and effort estimates for each project. The initiatives would be prioritized, and small cross-functional teams would be formed to deliver individual (or groups of) projects based on the team’s capabilities. A component, or increment, of the individual projects (an individual or group of backlog items) is delivered by the teams at the end of a predetermined period (e.g., every one, two, three, or four weeks).

This approach can be applied to all projects under the transformation umbrella—from automating invoice processing or automatically populating a dashboard enabling real-time access to financial results to implementing new controls in accounts payable procedures, responding to ad hoc analysis requests, or fostering greater connectivity between relevant finance teams.

Minimum viable product. To ensure value is delivered as soon as reasonably possible for complex, multifaceted projects dependent on end-user feedback, teams leveraging Agile often employ the concept of the minimum viable product (MVP). With software development, MVP is seen as the smallest combination of final product features needed to deliver value to the end user and enable you to gain enough feedback to learn if the customer will buy or use the final product. If the customer wouldn’t use the product, the objective becomes learning what adaptations are needed to ensure the final product will be purchased and valued by customers.

In large transformation programs, MVP might be a combination of automation initiatives that adds up to a target financial value and doesn’t compromise the control environment. Success with this subset of processes would serve as the green light to continue scaling use of the technology across other processes. Note, the product, in these instances, is the outcome of the initiative—automated invoice processing for large vendors, new fields added for enhanced filtering to a system-based report, a new revenue recognition policy, etc.

In less complex initiatives, the time or resources needed to employ MVP might outweigh the benefits of the final product, in which case, simply delivering a usable, valuable, and inspectable increment of the final product during each iteration is sufficient. In all cases, adopting an iterative approach while soliciting feedback will significantly increase the likelihood that business value will be created and delivered well before project completion.

AN AGILE FINANCE FUNCTION

With transformation efforts under way, CFOs and controllers should nurture a culture of agility with hope that the traits developed throughout the transformation journey will translate into a sustained path to continuous improvement and greater value.

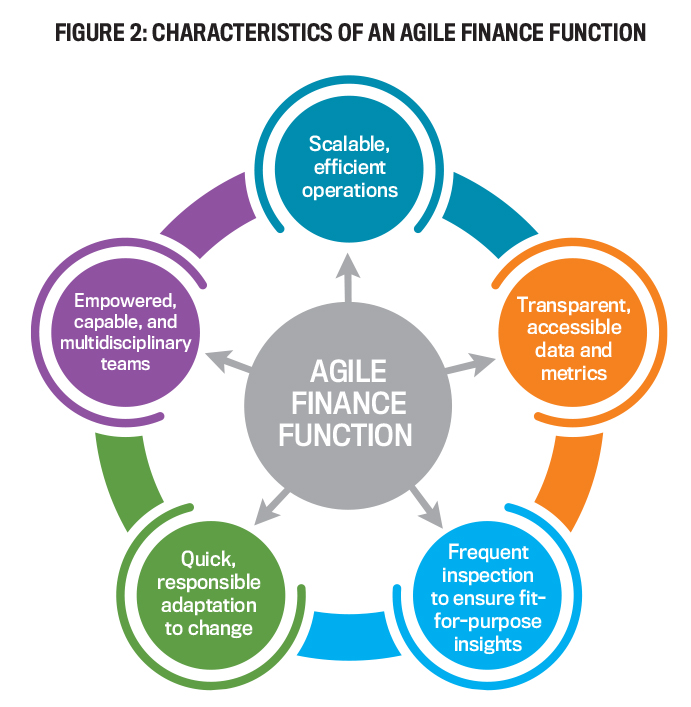

As seen in Figure 2, an agile finance function focuses on creating value through the following characteristics:

- Scalable, efficient operations: Leveraging automation and other digital technologies that can be applied widely, across multiple persons or teams, enables greater standardization, a strengthened control environment, and sustainable time and cost savings.

- Transparent, accessible data and metrics: Granting relevant team members with access to real-time data and metrics (in compliance with company policies) leads to more informed decisions, greater confidence in results, and fewer surprises.

- Frequent inspection to ensure fit-for-purpose insights: A culture that allows for regular inspection by end users fosters constant communication with stakeholders and ensures that the insights or project outcome delivered is tailored for current needs.

- Quick, responsible adaptation to change: Streamlined processes and a culture that enables timely adjustments to new developments empower delivery of relevant insights when needed and without increasing the organization’s risk profile.

- Empowered, capable, and multidisciplinary teams: Diverse teams with the autonomy and space to shape how they deliver results, along with the skills and capabilities needed to meet current and future demands, best position finance functions for innovative value delivery.

Digital tools; value-creation-centric strategies; and an inclusive, collaborative culture combine with these characteristics to enable finance functions to generate efficiencies; enhance offerings to the organizations they support; and foster continuous improvement, innovation, and inclusion among functional and operational teams.

AGILE AND SCRUM IN FINANCE

To translate the characteristics of an agile finance function into improved operational delivery, some finance leaders equip and empower their teams to perform tasks and execute projects by adopting Agile and the Scrum Framework (Scrum), one of the branches of Agile most easily adaptable to business processes. Let’s take a look at examples of Agile and Scrum in action in finance and accounting.

Partnering with IT. Organizations of all sizes and industries are increasingly becoming more digital, yet IT departments are still regularly tasked with delivering more with less. Consequently, many have adopted Scrum and other branches of Agile to deliver projects with greater efficiency and client satisfaction. Accounting and finance teams serve as internal customers of IT teams and business partners of the IT function.

As finance functions embrace digital technology through broader transformation efforts, close partnership with IT teams is critical. In most organizations, IT departments are leading technical enhancements of accounting and finance systems to automate repetitive tasks, migrating financial and nonfinancial data to data lakes or data warehouses to improve data accessibility, and implementing emerging digital technologies such as robotic process automation and AI for finance and accounting processes.

Currently, the most frequent application of Scrum by finance team members is in support of IT-led initiatives. To collaborate effectively with IT teams and contribute to digital initiatives that directly impact finance processes, finance teams need to be conversant in Scrum terminology, familiar with the Scrum process, and actively engaged as a stakeholder or scrum team member. To strengthen cross-functional relationships and increase efficiency and value, agile finance functions are embracing Scrum while partnering with IT by serving as scrum team members (scrum master, developer, or product owner) and key stakeholders. Accountants and financial professionals most commonly hold the role of product owner on the scrum team because they’re best positioned to estimate value and prioritize initiatives and components on the backlog that will benefit their teams.

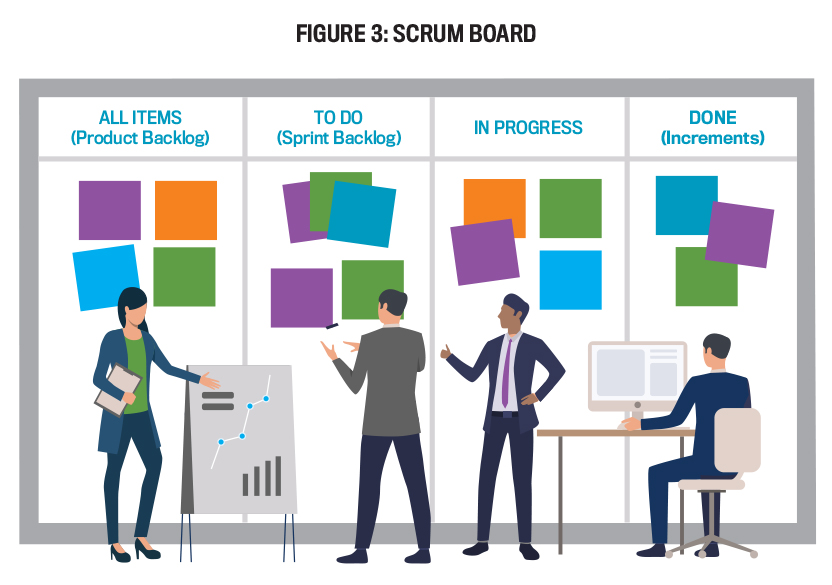

Finance and accounting operations. Common finance and accounting processes like accounts receivable, accounts payable, reconciliations, and month-end close are all great candidates for Scrum adaptation. Monthly activities such as processing invoices, closing the financial ledger, and reconciling financial accounts could be assigned to a common backlog on a digital or physical scrum board that all finance and accounting team members can access (see Figure 3).

The work to be performed can be arranged in weekly sprints (time-boxed periods of regular delivery throughout the project), and the conclusion of each sprint would naturally deliver value because these activities contribute directly to organizational value delivery.

As teams seek to normalize continuous improvement, improvement initiatives could also be added to a central backlog, perhaps managed in three-week sprints. Three weeks might allow functional team members to form smaller working groups, or scrum teams, across departments to progress opportunities that will ultimately contribute to the function’s transformation while still having time to carry out their regular operational tasks or responsibilities. One or more initiatives, or increments of the final product (backlog items), would be delivered at the conclusion of each sprint.

Internal audit. Another important function within the management accounting arena is internal audit. Typically, a linear, sequential, and phased approach is applied to audits. Prior to beginning the audit, significant time is spent planning the audit engagement. Once the audit begins, the team commences fieldwork. And upon conclusion of the audit, the reporting phase begins, at which time the audit report is drafted and ultimately delivered weeks or months following the audit. If delivered using Agile and Scrum, however, internal audits could yield more regular delivery of findings, opportunities for teams to close gaps quicker, and greater stakeholder engagement.

An Agile or Scrum-based approach to internal audit wouldn’t reserve the audit report drafting for the end of the audit engagement. First, a backlog would be prepared to identify all areas for which assurance must be provided at the audit’s conclusion. The scrum team (the audit team, in this scenario) would determine how the assurance and evidence thereof is provided.

Some audit teams have seen success employing two-week sprints, at the end of which an increment is delivered. The increment would be comprised of a written description of the positive assurance, control gaps, and other detailed audit findings and accompanying corrective action plans, where appropriate. This increment could be considered done when the draft includes references to evidence, the team has reviewed the draft, the relevant approver has signed off on it, and the work paper is logged in the audit system.

With this approach, business teams can remedy control gaps much quicker than they would in the traditional model because they receive findings at the end of each sprint rather than after the conclusion of the audit. Scrum could even be applied to the continuous audit approach, employing continuous monitoring, investigating, and reporting activities during sprints on an ongoing basis to enable real-time fraud or error detection and, ideally, prevention of financial loss or misstatement. Similar benefits can be reaped by external audit teams that elect to adopt an Agile approach to delivery.

ASSESSING AGILITY

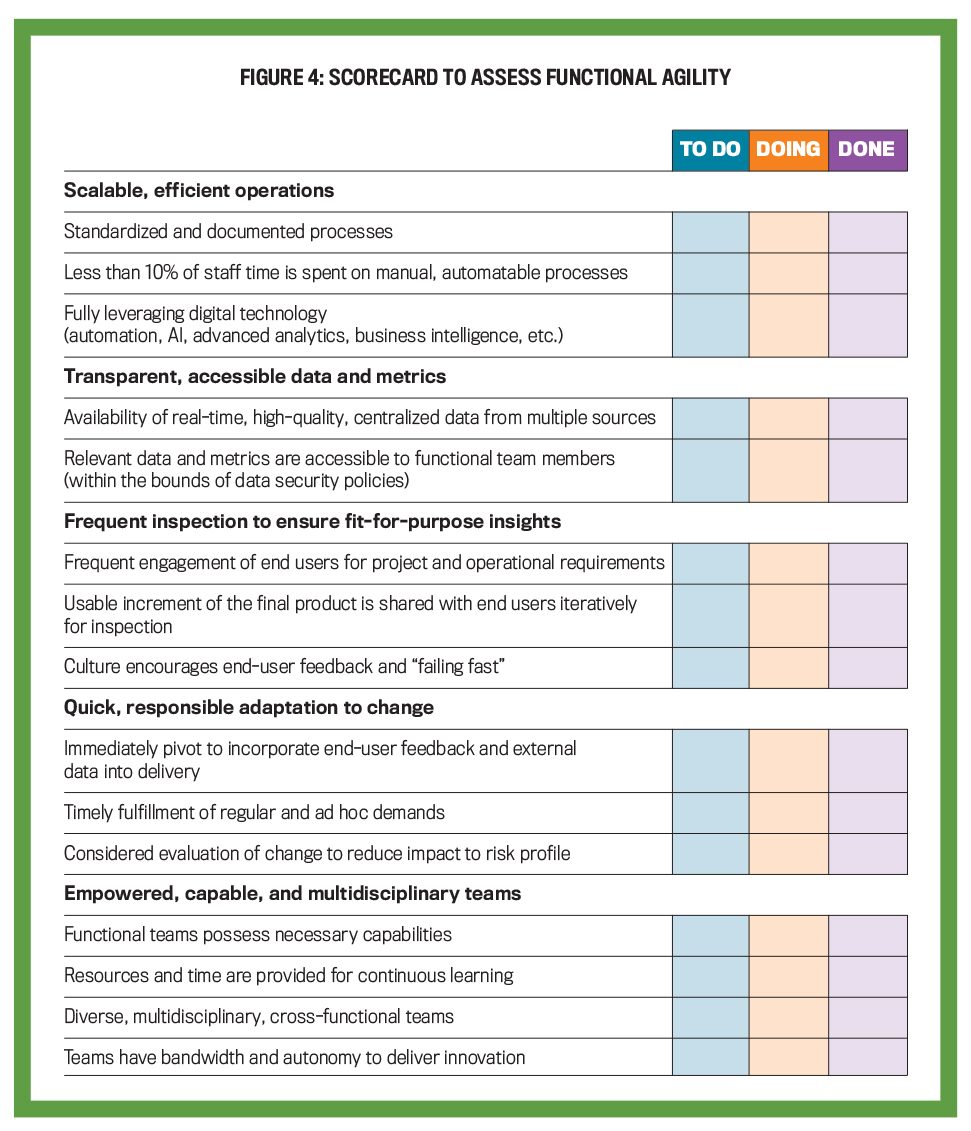

Figure 4 provides a scorecard that can be used to assess the agility of your company’s finance function in relation to each of the five characteristics of agile finance functions.

To employ a 360° approach to this self-assessment, members at all levels of the finance function should be engaged in the scoring. Initially, they should conduct this evaluation on their own. Leaders are likely to find that there is misalignment between their view and the functional team’s view of the amount of progress made in specific areas. These discrepancies are important to identify early on because they can ensure the entire functional team begins the journey toward agility from the same starting point, allowing for more resources to be directed toward areas in greater need of improvement.

An agile finance function is about more than ensuring you can check “done” for the full list of characteristics. It involves ensuring that those characteristics indicate that your function’s organizational culture rewards innovation, removes impediments to efficient delivery, provides room for growth and development, fosters collaboration, creates value for the organization, and visibly encourages the notion of failing fast.

Leaders who encourage their teams to fail fast without fear of repercussions are approachable and have measures in place to prevent team members from being penalized for innovative ideas that don’t present sustainable solutions. They also hold their leadership team members accountable for ensuring staff feel comfortable to share ideas and challenge the status quo. Failing fast is less about encouraging failure and more about expediting the learning and adaptation process, leading to a quicker path to the value-added solution.

BECOMING AGILE

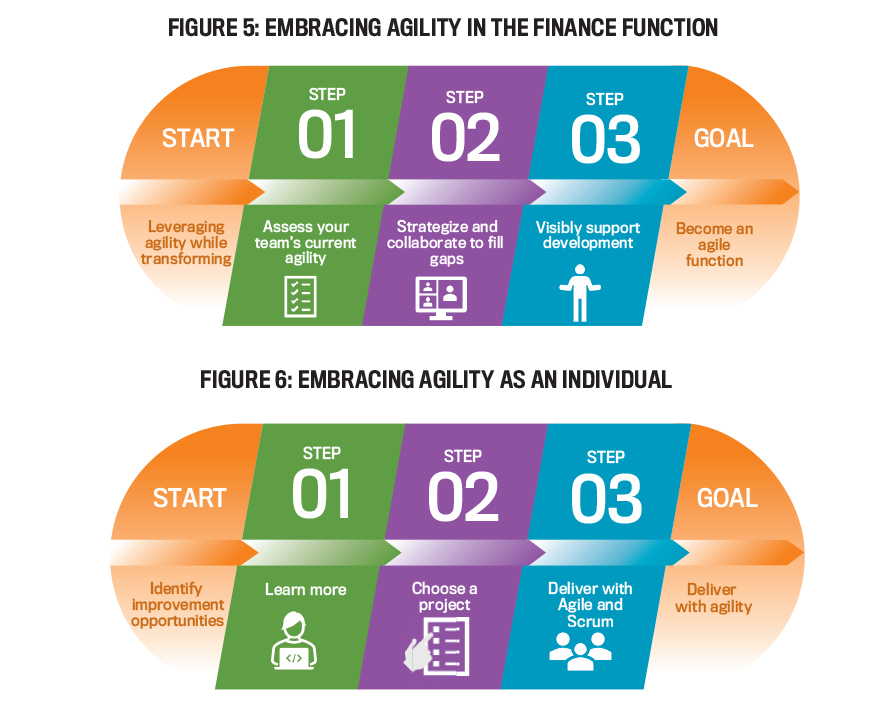

As shown in Figure 5, there are three steps that finance function leaders can take to embrace agility:

- Assess functional agility: Invite finance and accounting leaders and team members to use the self-assessment scorecard to report their perspective on the current agility of the finance function. Collaborate with team members to aggregate the findings and identify gaps to address.

- Fill gaps: Strategize and collaborate with your leadership team to fill those gaps. Each gap should be assigned to a specific leadership team member who will be held accountable for closing the gap and empowered (with resources and autonomy) to close the gaps.

- Visibly support development: Personally learn more about Agile and Scrum, then partner with IT leaders and require leaders within your function to create bandwidth for team members to participate in training in this area.

There are also several steps individual finance team members can take to embrace agility (see Figure 6). It begins with learning more about Agile and Scrum to help them deliver with greater agility. They should review the characteristics of agile finance functions and identify ways to incorporate some of those attributes into their personal ways of working or those of their immediate team.

The second step is to put it into practice themselves by choosing a project. At a minimum, team members should be able to identify a single improvement opportunity that can provide benefit. It should be a project that will require the involvement of multiple individuals and for which the solution isn’t yet defined.

That leads to the third step, which is delivering a pilot use case. After choosing a project, team members form a scrum team that then creates and prioritizes a backlog and employs the Scrum process. (For more details on these steps toward delivering with Agile and Scrum, see the IMA® (Institute of Management Accountants) Statement on Management Accounting An Agile Approach to Finance Transformation.)

The long-term viability of the finance function is dependent on the extent to which agility becomes embedded within its functional culture. Thus, it’s imperative that finance functions not only embrace agility but employ an Agile approach to finance transformation itself. An agile finance function is prepared to provide assurance for financial results and contribute to strategic decisions in the face of evolving market conditions, the accelerated pace of change, and the introduction of unforeseeable circumstances—all likely to arise on any given day.

October 2021