Anyone who has booked a flight or compared hotel prices has experienced revenue management from the customer’s perspective. Revenue management systems involve the price customers are given, the availability of the product or service they want, how the company innovates to “refresh” the product they’re buying, and any incentives used to adjust the timing of when they receive the product. It’s the combination of these four powerful revenue management levers—pricing basis, inventory allocation, product configuration, and duration control—that are at work when a company successfully deploys a system for growing and sustaining revenue.

In partnership with those in marketing and sales functions, accounting and finance professionals can evaluate a business’s current approach to revenue management, and then continue to improve the business’s revenue management system with optimal analytics and metrics to support the strategic objectives involving revenue. Using the four levers, they can expand the role of accounting in business by implementing and improving revenue management in their organization.

DRIVING REVENUE MANAGEMENT

Revenue management is based on optimizing resources by selling the right product or service to the right customer at the right time. Although this sounds simple, establishing strategies, processes, and management control systems that support effective revenue management is more complicated. What’s the role of accounting in revenue management? We can start with traditional financial performance analysis.

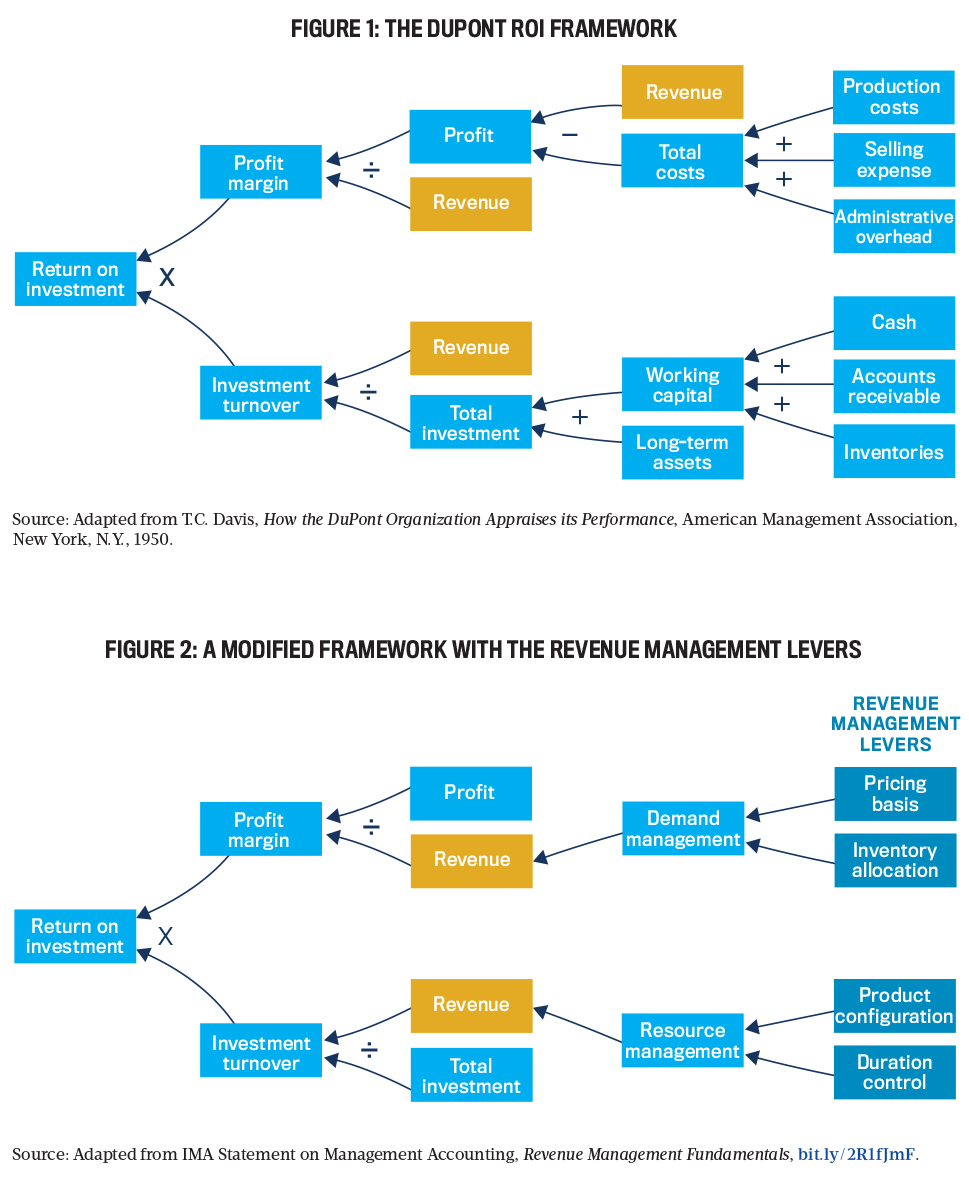

Remember the DuPont ROI Framework (also known as the “DuPont Model” or “DuPont Analysis,” among other names)? Shown in Figure 1, it’s a model for drilling down the return on investment (ROI) computation to specific mathematical components that DuPont and other organizations used throughout the 20th Century to focus management on key metrics involving costs and investments. As the figure shows, revenue is central to the framework. Less obvious is that a core purpose of costs and investments is to support and sustain revenue. Rarely is the framework used to delve into revenue management.

Click to enlarge.

Figure 2 presents a modified framework that includes the four key levers of revenue management:

- Pricing basis: Setting prices by how customer segments perceive specific value to the product or service, rather than based on costs or by reacting to competitor prices.

- Inventory allocation: Deploying the business’s capacity of goods or service depending on demand conditions and prices accepted by customer segments.

- Product configuration: Efficiently customizing or innovating goods and service offerings to meet the expectations of different customer segments while optimizing price points in each segment.

- Duration control: Optimizing resource constraints to meet the demand of customer segments by internally managing bottlenecks or externally influencing customer behavior.

Pricing basis and inventory allocation are focused on effectively increasing the level or volume of revenue flowing into the organization by segmenting and optimizing customer groups, while product configuration and duration control focus on efficiently positioning resources and investments to support the volume of revenue flow. Let’s take a closer look at each lever.

Pricing basis. The core principle of the four revenue management levers is customer segmentation, which is the practice of defining the distinct types of customers who are served by the business in terms of the goods or services they purchase, the price they’re willing to pay, the quantity they demand, and any additional activities needed to service their needs.

Purchasing an airline ticket is a good example of how customer segmentation works with pricing basis. Using this lever, airlines charge each customer according to their willingness to pay. The result is that airlines are able to better utilize capacity by adjusting prices based on how a customer segment perceives the value received from the ticket purchased.

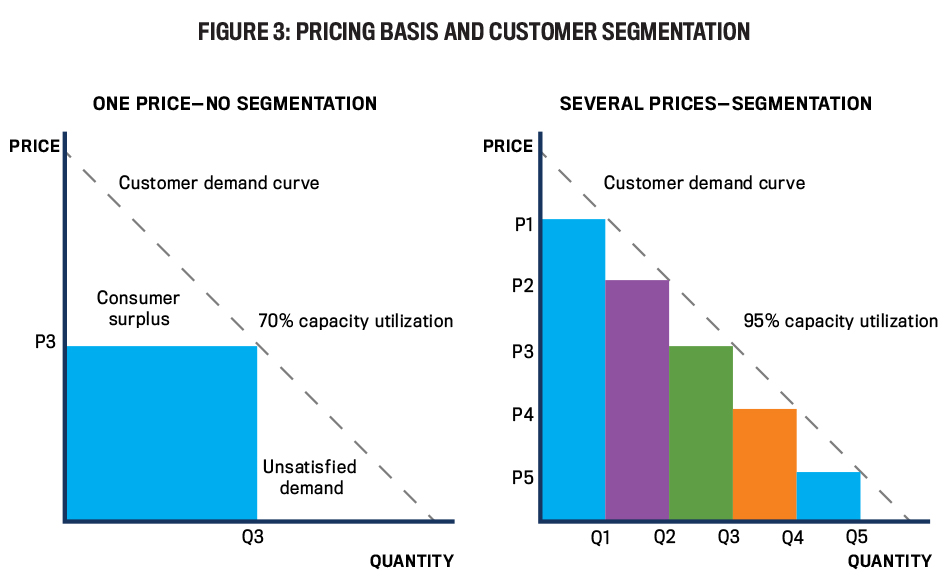

Figure 3 illustrates the impact of using the pricing basis lever across customer segments. In the left-hand chart, only one price is charged by the business and only customers willing to pay that price (or higher) will purchase the product. This results in unsatisfied demand by customers who would purchase the product, but not at the price offered. It also results in a consumer surplus, representing revenues lost to the business when consumers pay a price that’s less than the value they place on the product or service.

In comparison, the right-hand chart represents a business that segments its customers by charging prices aligned with how each segment perceives value in the product or service. Using the pricing basis lever results in better use of capacity through reaching more customer segments with lower prices and capturing consumer surplus (revenue) with higher prices.

Inventory allocation. Successfully deploying a pricing basis lever involves another revenue management lever: inventory allocation. This lever is focused on better matching productive resource capability with customer demand. The definition of inventory here comes from yield management, which includes both the traditional concept of goods available for sale and the concept in services industries regarding units of capacity to serve customer demand. Inventory allocation practices shift inventory availability and speed of delivery to match changes in demand.

The inventory allocation lever operates by reserving product and service capacity for more profitable customer segments or by changing prices to align demand with scheduled inventory levels. Inventory allocation scheduling systems assist in maximizing the revenue earned from a limited supply of products or services by prioritizing supply to the most profitable customers. Note that accurate measurement of customer profitability is critical to prioritization.

Product configuration. Most businesses will experience constant pressure to update the features of a service or product usefulness or to tailor the fulfillment and delivery aspects of their products and services. The product configuration lever involves innovating or differentiating product or service features to better meet the evolving demands of customer segments for the value they expect.

Product configuration practices focus on targeting and controlling customization of the product or service to customer segments in alignment with pricing basis and inventory allocation practices. By designing the range of product or service characteristics to target different customer segments, this lever assists in the use of differential pricing and discouraging customers from buying cheaper products that don’t completely satisfy their expectations.

Many businesses use physical attributes and custom processes to differentiate their products or services in the marketplace. For example, an airline might provide some seats with more legroom, or a hotel might provide some rooms with king-size beds and others with double beds. This results in the need for resources that can be quite expensive. Alternatively, a business can use nonphysical attributes to differentiate products or services, such as customized labeling, terms of sale, or distribution channels. When the product configuration lever is applied to nonphysical attributes, the resources required are often significantly less expensive than those necessary to redesign and redeploy fundamentally different products or services. For example, imposing restrictive terms and conditions on an airline ticket is less costly than providing extra legroom.

Duration control. Businesses often experience variability in how long it takes to serve different types of customers. Organizations that employ the duration control lever focus on how the total process time and variation in delivery time are managed for particular products or services as demanded by specific customer segments. These management practices can increase the number of customers that can be served using a fixed level of capacity. When the focus is internal, duration control practices often involve bottleneck management that identifies a key constraint and then exploits that constraint by subordinating the rest of the process to that constraint.

The duration control lever can also have an external focus that works by incentivizing or nudging customer behavior to be more predictable or to self-schedule for an optimal inventory allotment. If you’ve ever committed to regularly receive lawn treatment from a landscaping company or arranged your schedule to attend a discounted movie matinee, you have responded to an external duration control lever.

IDENTIFY AREAS FOR IMPROVEMENT

Nearly all for-profit companies can benefit from better revenue management practices. Revenue management models originated in airlines and have since migrated to other industries with similar market and company characteristics, such as hotels, car rentals, railways, rideshares, advertising, recreational resorts, and digital channels (like Amazon or Google). The industries where revenue management practices initially evolved are characterized by cost structures that have high operating leverage (high fixed costs and low variable costs). But the four revenue management levers can be adapted for businesses of all sizes and in all industries.

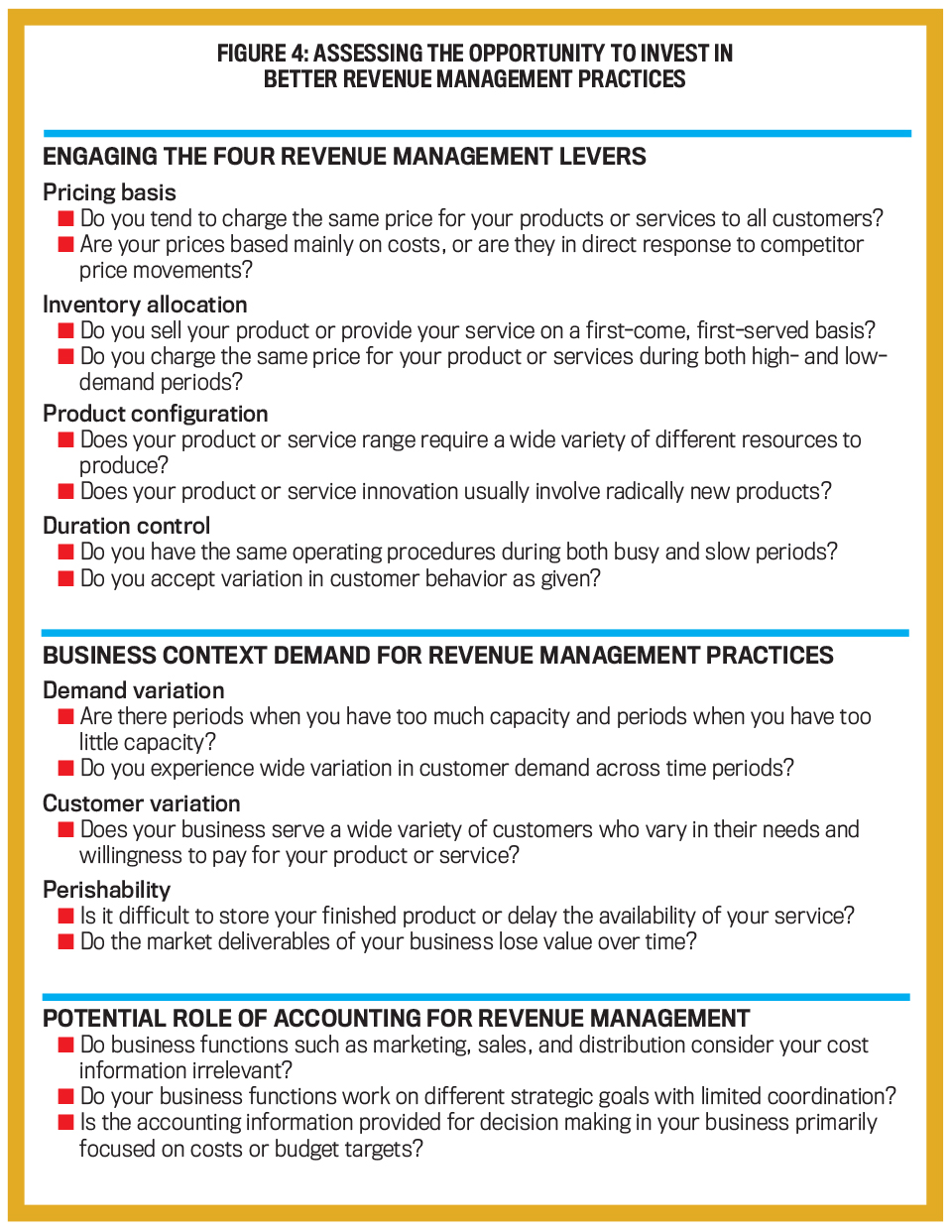

Figure 4 outlines a quick self-assessment process for evaluating your business to identify and motivate targeted investment in specific revenue management practices. The assessment is organized by the four levers of revenue management, the business setting, and the role of accounting and finance to support revenue management decision making. Answer “Yes” or “No” to each question. More “yes” responses indicate the greater importance and value for your business of investing in revenue management practices.

Most businesses can benefit by critically reviewing their revenue management approaches and determining how management accounting information can support these approaches. An assessment such as this can help accounting and finance professionals obtain early buy-in from top management on the need to develop an organization-wide revenue management system. As the role of the management accountant is to partner with other business functions, this buy-in is critical.

ONE SIZE DOESN’T FIT ALL

Just as different customers have different needs, so do businesses have different revenue management needs. Revenue management isn’t a one-size-fits-all solution. The four levers of revenue management should be deployed to recognize and support the different environments in which companies operate as well as different organizational structures and objectives. While not every business needs the same intensity of revenue management sophistication, management accountants should be on the lookout for opportunities to adjust the intensity level if the payoff is positive.

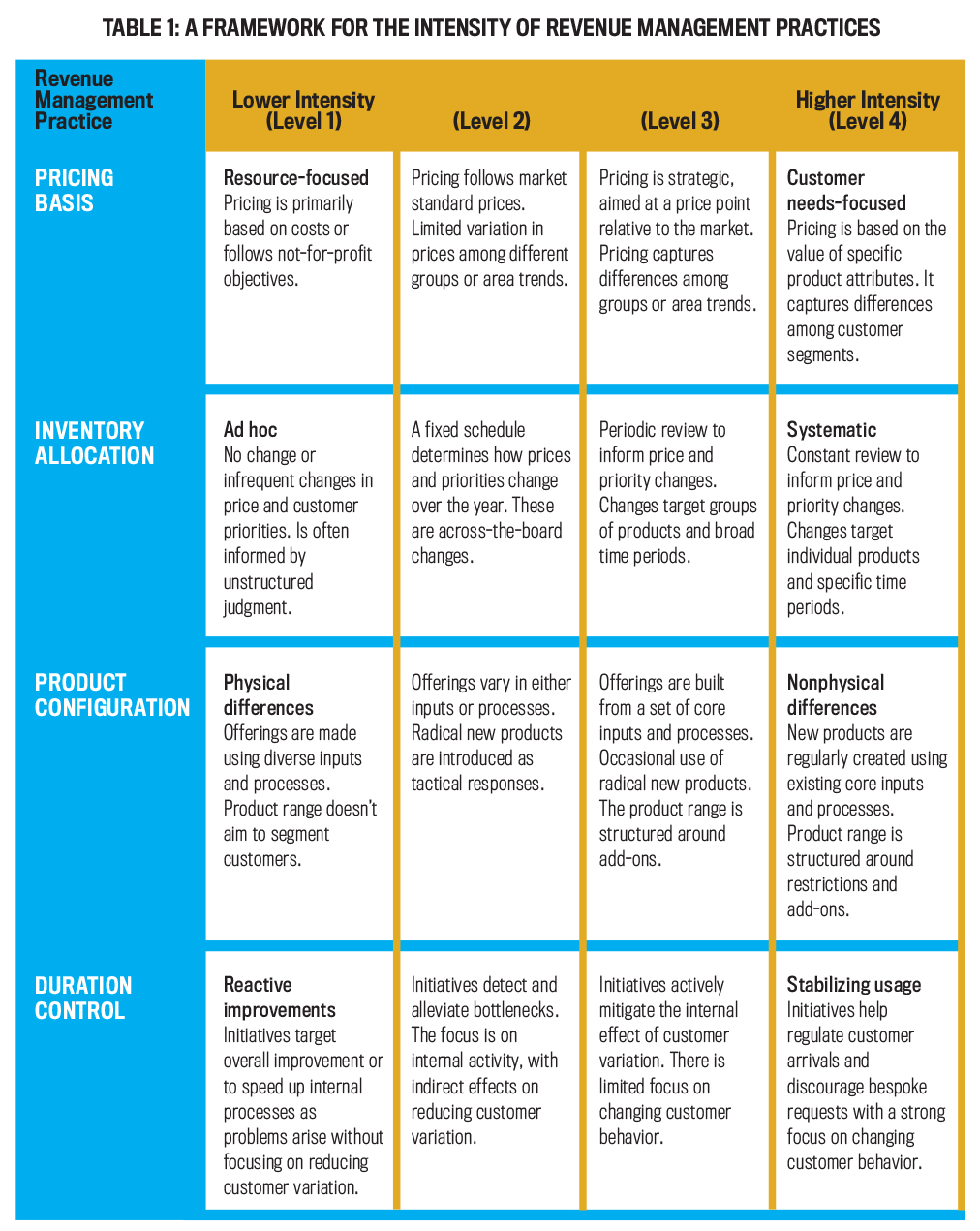

The intensity framework in Table 1 applies across different business models, industry settings, and organizational structures. The scales (from lower to higher intensity) provide a comparative view of how organizations choose to engage in management processes across the four levers. Each lever is anchored at two ends of a continuum representing the “intensity” of revenue management. A higher intensity of practice isn’t always best. Accounting and finance professionals should work with managers to consider the organization’s strategy and resources with respect to customers and competition in order to determine an “ideal” level of practice for each revenue management lever.

Click to enlarge.

Pricing basis intensity. When pricing is resource-focused, prices are established based on internal measures of standard costs or on observed standard market patterns. As the focus shifts toward customer needs, differential pricing can be implemented based on customer characteristics. For example, as a restaurant moves further from a standard menu with fixed prices to employing loyalty discounts, seasonal adjustments, and community event promotions, it’s moving from pricing based on its resources to pricing that connects to the expectations and experience of specific customer segments. Note that increasing the intensity of the pricing basis lever in your organization will likely require significant research to identify customer segments and their value preferences as well as investment in more advanced data capture enterprise resource planning systems.

Inventory allocation intensity. In a business using an ad hoc inventory allocation practice, there are limited adjustments during the period with respect to how capacity is deployed across different types of customers. If adjustments are made, the changes occur in an unstructured manner.

A business with more intense inventory allocation employs frequent and systematic monitoring of inventory utilization, with dynamic adjustments made based on sophisticated modeling of customer demand. More intensity in this lever requires tracking and analyzing data to maintain a clear view on customer segments and how their value beliefs respond to the pricing basis lever.

Product configuration intensity. Many businesses will differentiate or “refresh” products or services in the marketplace by making periodic adjustments to the physical product features or the core aspects of the process. By focusing the adjustments solely on physical or core attributes of the product, the differentiation can’t be targeted specifically to key customer segments. While this approach may be appropriate for some organizations, this low-intensity product-configuration tactic often increases the need for more capital investment and other resources to support product development.

Conversely, using nonphysical distinctions (e.g., varying the terms of sale, reconfiguring labels or packaging, or establishing dedicated distribution channels) to differentiate products or services that are physically similar in their core structure is a higher-intensity tactic. Greater intensity in product configuration practices should result in more agility to serve specific customers segments, which then sustains or enhances revenue in that customer segment. Further, the organization deploys its capital and resources more efficiently by standardizing the core physical attributes for all products or services.

Duration control intensity. The duration control lever supports the other levers by optimizing process constraints and by making customers more predictable. Where a business relies on reactive improvements, duration controls only change in response to external events or when the business redesigns its systems. Accordingly, adjustments made are often immediate and temporary. In addition, structure improvements tend to occur infrequently without a clear connection to the strategy of engaging with specific customer groups. In businesses that seek to stabilize customer usage, duration controls are specifically designed to change customer behavior in order to reduce variation in customer arrival times or in the average time it takes to serve customers.

Like the product configuration lever, intensifying the duration control lever doesn’t necessarily require a great investment in resources. To the contrary, by stabilizing processes around constrained resources (bottlenecks) and using incentives or “nudge” structures to stabilize customer behavior, organizations can more efficiently deploy resources that are intended to sustain or enhance revenues.

REVENUE MANAGEMENT IN PRACTICE

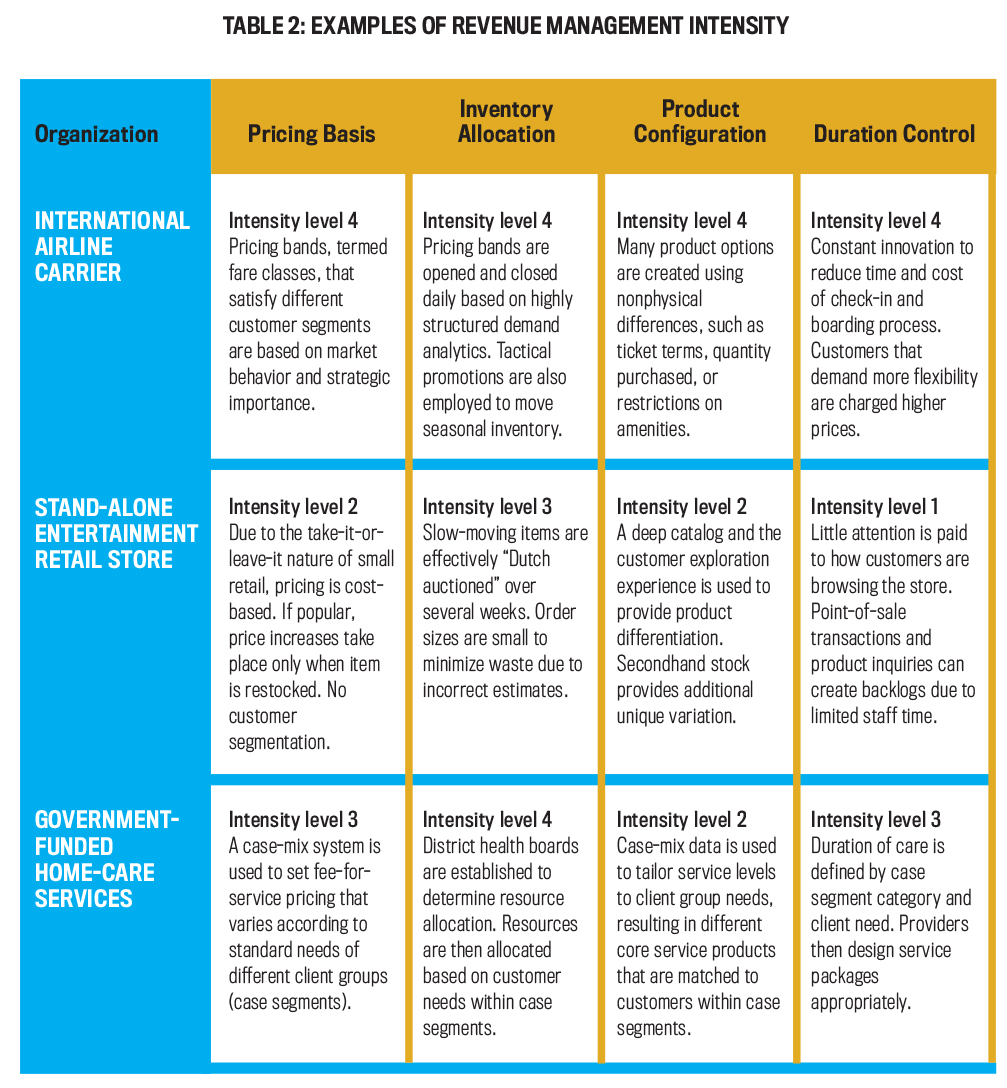

Some members of our author team have conducted research to examine how different types of businesses engage in revenue management practices. Table 2 contains three illustrations from that research, including ratings of the organizations’ intensity levels for each of the four revenue management levers.

The international airline carrier represents the traditional type of organization that invests in high-intensity revenue management practices. Complex pricing and inventory allocation is possible through real-time matching of ticket prices and allocations to fluctuating customer demand. Product configuration employs high levels of nonphysical product options, which support customer segmentation, and duration control is often managed through charging higher prices for higher customer flexibility.

In contrast, the small, stand-alone retail store is prepared to sacrifice some revenue growth opportunities to retain a simpler system. Pricing basis and inventory allocation are focused on the highest and lowest demand products, and product configuration options are provided by maintaining a wide-ranging inventory that includes new and secondhand products. In this business, duration control relies only on customer queuing.

In the large, government-funded home-care services organization, pricing basis and inventory allocation are done to match customer demand with home-care services based on customer needs. The use of customer groups based on needs supports the development of packages of care that reflect these needs and allow for better use of available resources.

These diverse examples showcase how revenue management levers apply in all manner of settings but are established in different forms according to the organization’s competitive needs, internal resources, and management structure. The diversity of revenue management intensity reflects the competitive environment and strategy for each organization and how much it’s willing to invest in their revenue management systems. Airlines need high levels of revenue management intensity to compete. On the other hand, the retail store, with less competition and its particular product specialization, requires lower levels of revenue management intensity. The government organization had little to no competition but was strategically determined to provide clients with services based on best practices.

These examples and the self-assessment can help as you begin to evaluate the state of revenue management practices in your organization, determine the levels of intensity that best fit, and develop an approach and system going forward that incorporates metrics and analytics that support your organization’s strategic objectives. For more insight and specifics on this evolving discipline, see the IMA Statement on Management Accounting, Revenue Management Fundamentals, which includes a six-step methodology that can be used to develop a revenue management approach that accounting and finance professionals can use to partner effectively with other business functions.

November 2021