Companies are turning to cloud software solutions at a higher rate than ever before. The Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2018-15 (ASU 2018-15) specifically to address accounting for cloud-computing software. This update requires companies to capitalize certain costs associated with implementing a cloud arrangement.

Historically, companies have expensed cloud-computing costs as the costs were incurred, whereas internal-use-software costs have been capitalizable. The FASB initially issued Accounting Standards Codification 350-40 (ASC 350-40) to align the accounting for cloud-computing implementation costs with the rules for internal-use software. Entities reached out to the FASB for clarification, indicating ASC 350-40 didn’t adequately specify which costs associated with cloud-computing agreements could be capitalized. The FASB issued ASU 2018-15 to provide this clarification.

WHAT’S CAPITALIZABLE?

For context, there are traditionally three phases of software implementation.

- Preliminary project phase. An entity determines the system requirements for software.

- Application development phase. If the software to be used requires customization or changes to the configuration or infrastructure, development work will be conducted at this time. Costs can include manual data conversion, design, development, testing, and training.

- Post-implementation phase. This phase begins when the software is placed in service. Costs may include maintenance, additional training, upgrades, or enhancements.

Within these phases, implementation costs incurred in a hosting arrangement are fees incurred by the customer to get the hosted service implemented, set up, and ready for use.

- If a software license existed, the license might be capitalized and all other costs expensed.

- If no software license existed, the entire service contract was expensed.

In some instances, the FASB leaders believed this discouraged companies from evaluating cloud computing as a potential solution to business needs. ASU 2018-15 provided two main clarifications to ASC 350-40: guidelines for which specific implementation costs could be capitalized, whether a software license existed or not; and guidelines to determine, for capitalization purposes, what the asset is. One criterion considered, for example, is whether or not the cost provides a benefit to the organization over time.

CAPITALIZATION CONSIDERATIONS

Capitalization allows for allocation of cost over the life of the asset. Generally, entities look at capitalizable costs more favorably because it reduces the impact to net income for the period incurred. For public companies, a smoother impact on earnings can be critical. Capitalization depends on the phase of the project in which the costs are incurred as well as the nature of the costs.

Only costs incurred in the application development phase qualify for capitalization. While training, manual data conversion, and maintenance and support costs are noncapitalizable, software, software licensing, third-party software development fees, external materials, and coding and testing fees are all capitalizable.

Under ASU 2018-15, the effective reporting dates for annual and interim reporting periods began after December 15, 2019, for public business entities. The annual reporting periods for all others began December 15, 2020.

EXAMPLE OF APPLICATION AND IMPACT

Let’s say Company ABC has recently expanded into a new global line of business. Prior to this, it had only operated in one country. Its internal accounting system would require a major overhaul to be able to account for multiple currencies and global reporting requirements. Vendor DEF offers a cloud solution that will interface with ABC’s accounting system and provide the necessary global solution. Implementation work will be required to build a proper interface before the solution can be placed in service. The costs associated would be as follows:

- $8.7 million three-year service contract, which must be paid up front.

- $6 million software license (software returns to vendor if agreement terminates).

- $2.7 million for maintenance costs associated with the existing solution and new integration.

- $0.6 million for configuration work and manual data conversion, costs to be incurred during preliminary project phase.

- $2 million to contract with a third-party vendor to design, develop, code, and test the integration work.

- $0.7 million to train ABC’s employees to utilize the new solution.

- $12 million total cost, and the three phases of implementation will take the first six months of the three-year contract period (one month preliminary, four months development, one month post-implementation).

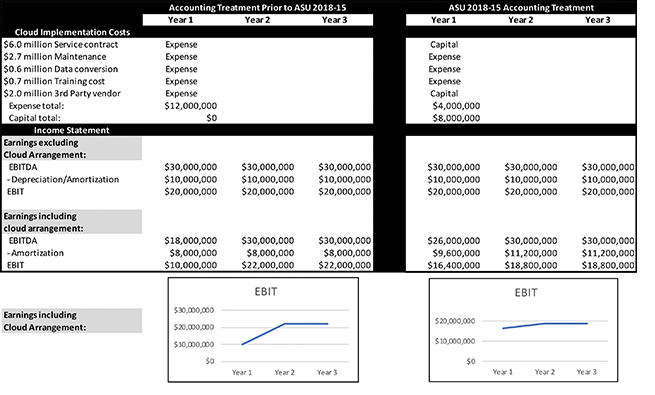

The new rules result in the $6 million attributable to the software license and the $2 million of application development costs with the third-party vendor to be capitalized and amortized over the life of the agreement. While Figure 1 only includes a visual graphic for earnings before interest and taxes (EBIT), note that there’s an even more significant impact on earnings before interest, taxes, depreciation, and amortization (EBITDA). The impact of the ASU 2018-15 clarifications can be material and significant. In this example, amortization of the $8 million capital is spread straight-line over two years and six months, the remaining life of the contract once the integration work is completed and the asset is placed in service.

The clarifications provided by FASB in ASU 2018-15 benefit entities in evaluating and accounting for cloud-computing arrangements. Generally Accepted Accounting Principles (GAAP) don’t specifically address the accounting for implementation costs of a hosting arrangement that’s a service contract. Accordingly, the amendments in this update improve current GAAP because they clarify that accounting and align the accounting for implementation costs for hosting arrangements, regardless of whether they convey a license to the hosted software. ASU 2018-15 has brought the accounting for cloud-computing arrangements more in line with the rules for internally developed software and should encourage companies to more readily consider cloud solutions as an alternative when evaluating business software needs.

November 2021