To encourage greater environmental, social, and governance (ESG) investments, particularly human capital, and to ensure that corporations don’t neglect these issues in the name of short-termism, we wanted to provide an update to that article, including updated evidence that shows a correlation to long-term corporate value.

LINKING ESG TO CORPORATE VALUE

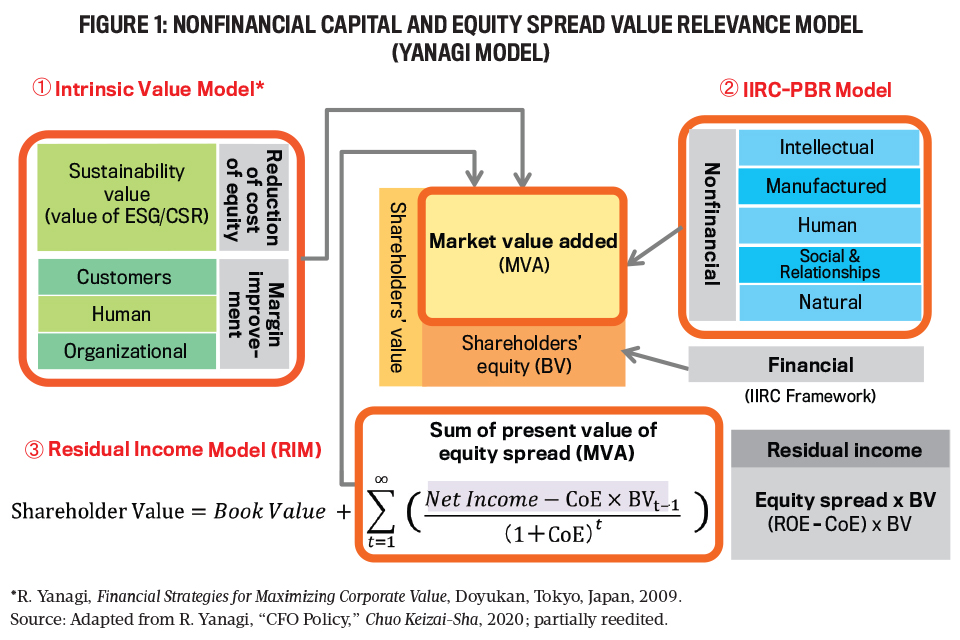

Figure 1 shows the model (the Yanagi model) we presented in the January 2018 article. The model helps illustrate the relationship of intangibles (i.e., ESG investments) and financial equity spread (i.e., via corporate value as defined by the price-book value ratio, or PBR). Using this model, it can be hypothesized that future financial value creation based on equity spread over the long term can be synchronized with ESG.

In the center, you can see that shareholder value is defined as market value added (MVA) plus the book value of shareholders’ equity (BV). The model is then broken down into three surrounding components:

- In the Intrinsic Value Model section, MVA is equal to the portion that exceeds PBR of 1, which in turn is assumed to be the value of ESG (Organization value + Human value + Customer value + ESG / Cost of capital reduction effects).

- The IIRC-PBR model aligns the six types of capital under the International Integrated Reporting Council (IIRC) framework to shareholder value.

- By using Ohlson’s residual income model (RIM), MVA equals the sum of the present value of equity spread (ROE - Cost of equity).

Previous studies have provided multiple pieces of quantitative evidence in support of this conceptual framework. Through such studies, it has been demonstrated that ESG factors do have an impact on corporate value, thus lending support to the model in Figure 1. Thus, ESG (i.e., intangibles) can be synchronized with future ROE (equity spread) via MVA on a long-term basis. (See Yoshikazu Tomizuka, “Are Non-financial Capitals Connected with Corporate Value? Empirical Research on Japanese Healthcare Sector,” Kigyo Kaikei, May 2017; R. Yanagi, H. Meno, and T. Yoshino, “Study of Synchronization for Non-financial Capital and Equity Spread,” Gekkan Shihon Shijo, November 2016; R. Yanagi and T. Yoshino, “Relation between Human/Intellectual Capitals and Corporate Value (PBR),” Gekkan Shihon Shijo, October 2017.)

In addition, qualitative evidence supports such empirical research. For example, according to a global investor survey (n=140) conducted by Ryohei Yanagi from January 2021 through March 2021, 74% of investors asserted that ESG value should be totally or mostly factored into PBR (MVA).

THE IMPACT OF ESG INVESTMENTS

Until now, it was difficult for a single company to verify the relationship between ESG and corporate value due to the unavailability of large and consistent amounts of data, an insufficient number of samples, and the lack of the establishment of a multiple regression model. The IMA® (Institute of Management Accountants) report CFO as Value Creator: Finance Function Leadership in the Integrated Enterprise notes that French-based Schneider Electric and German-based SAP are increasingly reporting the expenses and performance for employee-related metrics, but those cases are usually simple linear regression analyses.

Yanagi, one of the authors of this article, is the CFO of Eisai. He’s provided evidence of the delayed penetration effect of the company’s ESG investments on PBR and, more importantly, Eisai has disclosed this information with details in its Integrated Report 2020. In his empirical analysis, a multiple regression analysis was performed on Eisai’s ESG key performance indicators (KPIs, 88 types in all) as of July 2019 to verify a positive correlation between ESG factors and PBR. The time-series data, extracted from the previous 12 years, amounted to more than 1,000 entries on average. With that, a staggered analysis was followed to observe how many years later the impact of Eisai’s ESG KPIs would be seen on PBR (delayed penetration effect) by comparing each ESG input with 28 years of PBR data.

The data showed that ESG KPIs belatedly had a significant, positive correlation with consolidated PBR. Nearly 20 kinds of Eisai’s ESG investments have a delayed impact that affects long-term corporate value with statistical significance over a period of 5 to 10 years.

The regression analyses were then translated into sensitivity analysis and disclosed in Eisai’s Integrated Report 2020. As shown in Figure 2, at a 95% confidence rate (p < 0.05), if Eisai invests an additional 10% in human resources, PBR will go up about 14%. It would create approximately 300 billion yen incremental and delayed value in five years. Likewise, if Eisai invests an additional 10% in research and development (R&D), it would be able to generate long-term value of approximately 200 billion yen over a period of 10 years.

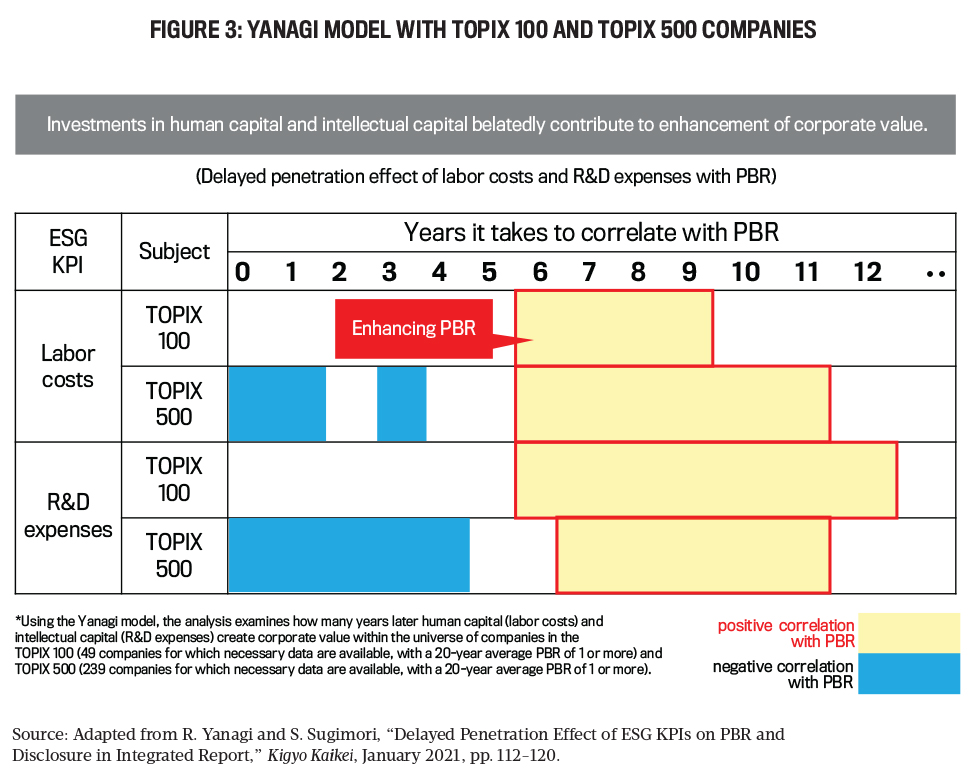

The Yanagi model, i.e., delayed penetration effect of ESG on PBR (or corporate value), was shown to have similar correlation for Japanese companies as a whole, not just Eisai. Empirical research using the same multiple regression model for Tokyo Stock Price Index (TOPIX) 100 and 500 companies shows the robustness of the model (see Figure 3).

The outcomes showed with a 99% level of confidence (p < 0.01) that Japanese companies could, on average, belatedly enhance long-term PBR by 1% to 3% in 6 to 10 years by investing in human capital and R&D now. In the short term, there will be some negative correlation for TOPIX 500 companies in view of increased personnel and R&D costs. But the research has demonstrated that, in the long term, such investments correlated to delayed and long-term creation of corporate value. We hope this data encourages more companies to try to emulate Eisai.

PROMOTING HUMAN CAPITAL INVESTMENTS

We have several practical suggestions for management accounting and finance professionals who would like to follow Eisai’s example and report how increases in human resources capital lead to corporate value.

1. Use technology to visualize human capital’s contribution to value. Once you and your organization decide on the conceptual framework that links ESG with corporate value, the next task is to find a digital platform that could process and visualize large amounts of data. Quantifying and accurately ascertaining the relationship between various ESG KPIs and corporate value requires the latest technology.

Eisai teamed up with ABeam Consulting and used the ABeam Digital ESG Platform, which is designed to transform ESG metrics into quantifiable numbers to be used for decision making, information disclosure, and stakeholder engagement. In this way, Yanagi was able to demonstrate that enriching human capital will contribute to delayed corporate value and could incorporate the data in Eisai’s integrated report.

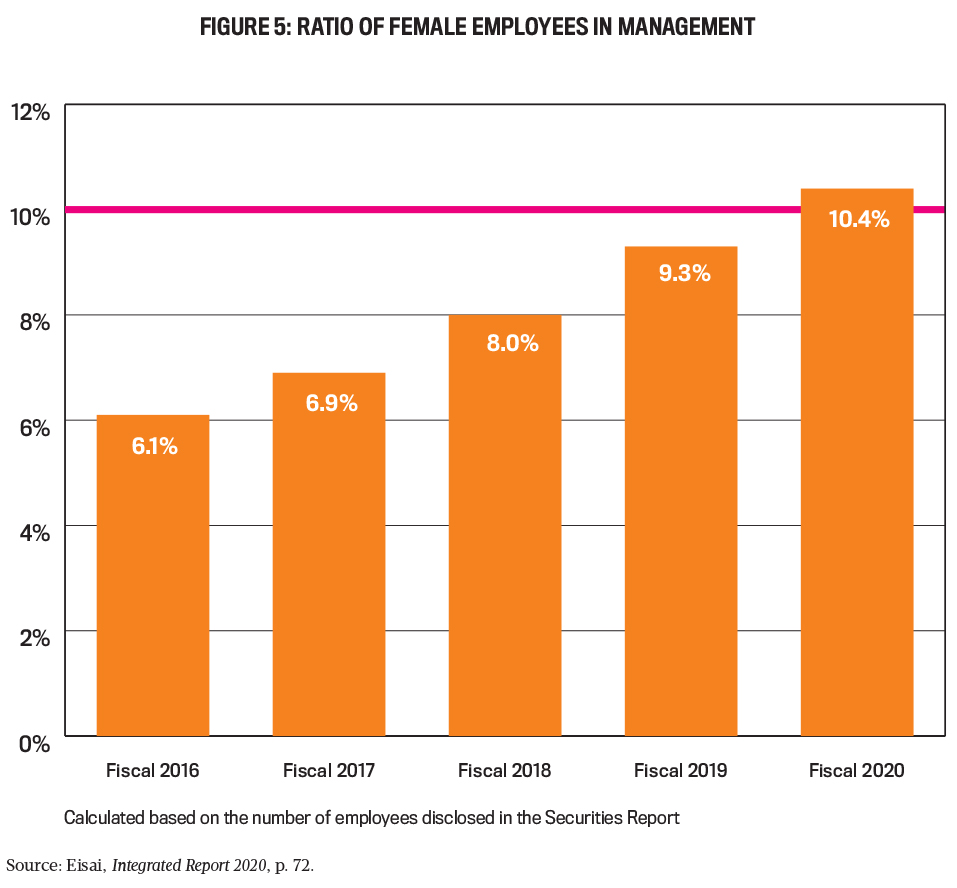

The data showed Eisai that the employment rate percentage of people with disabilities and consolidated personnel expenses were particularly significant, with a p-value of less than 1%. In addition, investing in employees’ health (e.g., the percentage of employees receiving medical examinations) and advancing women (the percentage of women managers as well as the support for working parents, such as the number of employees using the shortened working hours program for new parents) also had a significant positive correlation with PBR, with a p-value of less than 5%.

This result is in part due to the large amount of HR-related data in the types of ESG KPIs available, but it also confirms the often-quoted maxim, “A company is its people.” From another perspective, this is also consistent with Yoshikazu Tomizuka’s work, which suggests that, among the IIRC’s five nonfinancial capitals, human capital is the most positively correlated with PBR.

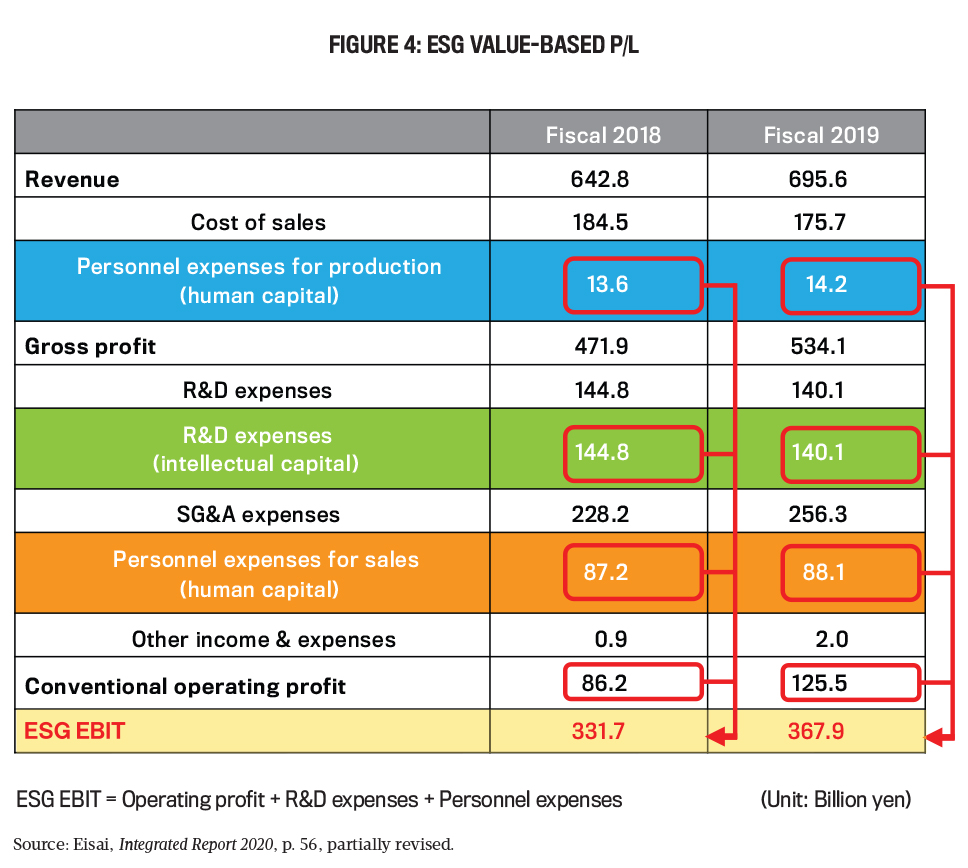

2. Consider personnel costs not as expenses, but rather as investments. As Eisai has been able to demonstrate that personnel expenses create corporate value after five years and R&D expenses increase value after 10 years, such expenses should rather be considered as “investments” in intangible assets that will generate future value. Therefore, intangible investments should be capitalized rather than expensed.

Eisai disclosed “ESG EBIT” in its Integrated Report 2020 as a value proposition (Figure 4). ESG EBIT (earnings before interest and taxes) refers to the ESG operating profit with the costs of HR and R&D added back to conventional operating profit. For example, while Eisai’s GAAP (Generally Accepted Accounting Principles) operating profit in fiscal 2019 was 120 billion yen, ESG EBIT has tripled to 360 billion yen. This policy has received support from long-term investors in Japan and abroad, including Tokio Marine Asset Management, Mitsubishi-UFJ Trust and Banking Corporation, Nikko Asset Management, Federated Hermes in the United Kingdom, and BlackRock in the United States.

In a bid to further explore such “ESG accounting,” Yanagi with Eisai launched joint research with George Serafeim of Harvard Business School (HBS) as a part of the Impact-Weighted Accounts Initiative (IWAI) Project focusing on employee impacts.

3. Advocate ESG investments both externally and internally. The findings only demonstrate proof of correlation. Further disclosure of specific ESG projects and dialogue will be crucial to explaining any causal relationship. Yet the empirical research suggesting a relationship between ESG and corporate value will give more impetus to supporting initiatives, such as promoting diversity, equity, and inclusion efforts and the advancement of women. As seen in Figure 5, Eisai is committed to follow through and to provide in its integrated report more in-depth disclosures about its performance on the promotion of women to managerial positions.

In addition, Eisai has also been engaging outside stakeholders such as global investors and media about the empirical evidence. The company is committed to further strengthening the dialogue with external investors about the importance of a long-term orientation to reach long-term corporate value as opposed to a short-term view in terms of personnel and R&D costs.

In order to cascade this message internally, the global CFO of Eisai shares the empirical research with local CFOs of all the Eisai subsidiaries in the U.S., U.K., and Asia at periodical global Eisai finance meetings. The idea is that all finance directors can disseminate the same message. In addition, empirical research showing positive correlation coefficient between Eisai’s ESG KPIs and PBR was also explained to the board of directors, which unanimously approved the research and reiterated the importance of human capital and intellectual capital. The information also was presented to the representatives of Eisai’s labor union. Eisai employees worldwide are even more motivated with the empirical research and will indirectly contribute to enhancing the corporate value long-term.

COMMUNICATING ESG VALUE

There is no better time than now to promote ESG investments, especially human capital investments—not for marketing and branding reasons or because stakeholders and investors are increasingly looking for them, but rather because such investments are tied to greater long-term business value. Even if it’s just positive correlation, the evidence shows companies can have actual numbers on future long-term corporate value resulting from ESG investments. This could hopefully lead to more ESG investment and give more confidence about such investments to shareholders and investors.

The examples aren’t just limited to Eisai, either. In Corporate Resilience and Response During COVID-19 (HBS Working Paper Series, 2020), Alex Cheema-Fox, Bridget LaPerla, George Serafeim, and Hui (Stacie) Wang showed that the stock prices of companies that emphasized valuing human capital outperformed competitor stocks during the COVID-19 pandemic.

As the world begins to move into the post-COVID era, future-proof organizations will look to be leaders in human capital issues such as diversity and inclusion or employee caring and protection. What better way to educate your stakeholders about the importance of investments in people by connecting them to corporate value and company growth? It’s our hope that with more efforts like those at Eisai, companies will move beyond vague debates on ESG and, through empirical evidence and disclosure, manifest their potential ESG value to increase corporate value in the long term.

May 2021