Digitization is the process of converting information into digital formats that can be processed by computers. Text, pictures, audio, and video are examples of digitized information that we consume daily on our smartphones.

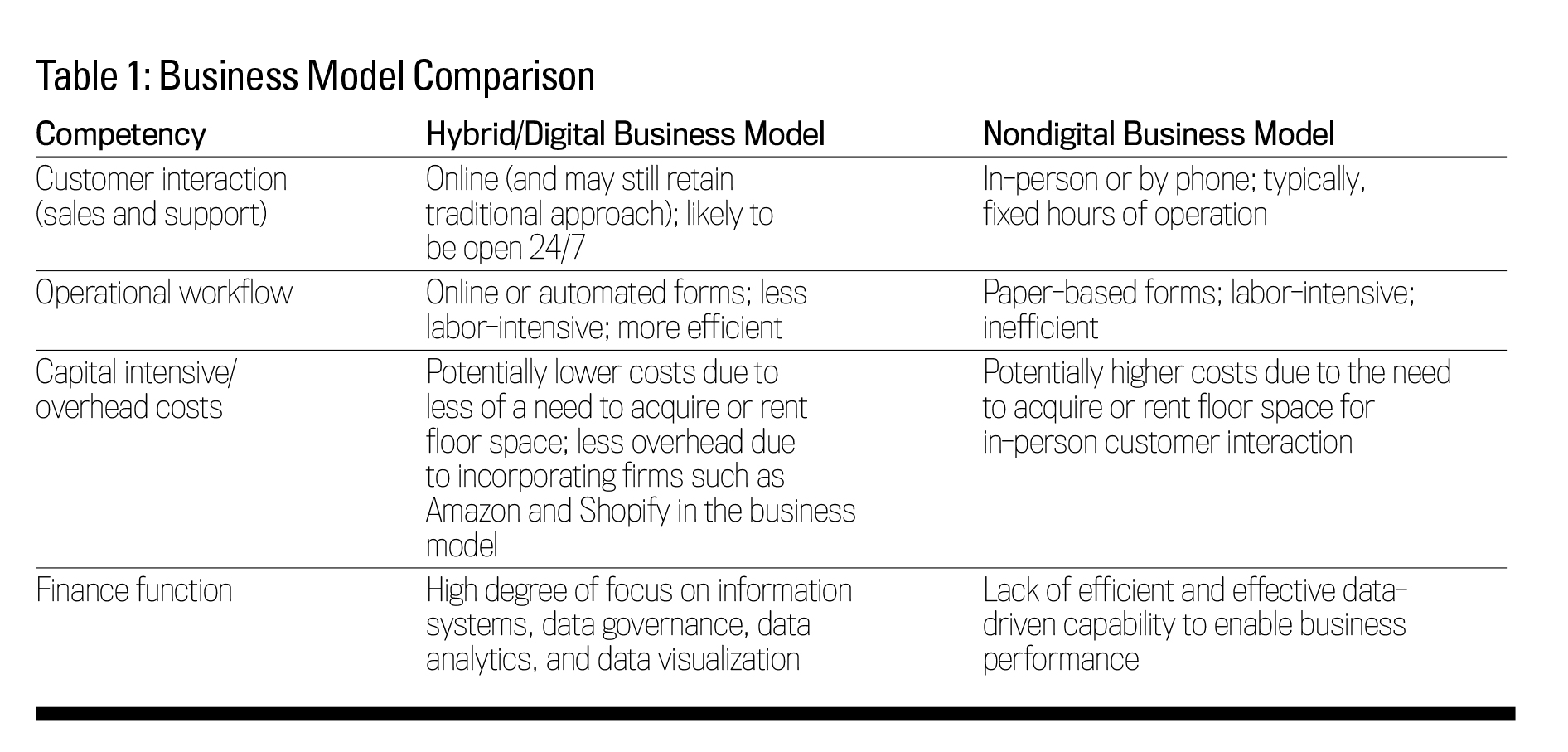

COVID-19 has accelerated digitization but also exposed those organizations that haven’t fully embraced the digital exchange of information. For each business that has failed to adapt, many have emerged with proven digital business models, such as telemedicine. The digitization of the finance function is essential for all businesses to remain competitive, which is why digitization is a central CFO mandate. See Table 1 for a few comparisons between digital and nondigital business models.

REDEFINING "TIMELY”

Legacy finance and accounting activities have been hampered over decades by inefficient and ineffective data aggregation methods to improve decision making. Organizations have hired people to try to overcome these operational hurdles associated with the data-to-information conversion process. These individuals hailed from across the spectrum of financial disciplines such as in financial reporting, financial planning, financial operations, and so on. The digitization of finance has put many of these legacy roles at risk, but it has also enabled a wide range of new opportunities for technology-savvy finance professionals.

Digitization has raised the performance bar so that “timely” now equates to real-time data-driven business intelligence. No matter where they are on the digitization maturity scale, finance executives have a unique opportunity (if not outright mandate) to shape the digital direction of finance as well as the broader business. Lacking digitized information flows, the finance function can’t adequately support business needs. Understanding digital opportunities and threats is vital to survive and thrive in today’s finance function.

Whether you’re a seasoned finance executive or a recent finance graduate, embracing digitization is paramount to success. Those operating in a mature digital environment are more likely to maintain a competitive advantage. Technology has been redefining business and the management accountant’s role at an unprecedented speed. To keep pace with the changing business environment and advances in technology, IMA® (Institute of Management Accountants) analyzed the emerging competencies needed by management accountants and updated the IMA Management Accounting Competency Framework.

TECHNOLOGY AND ANALYTICS

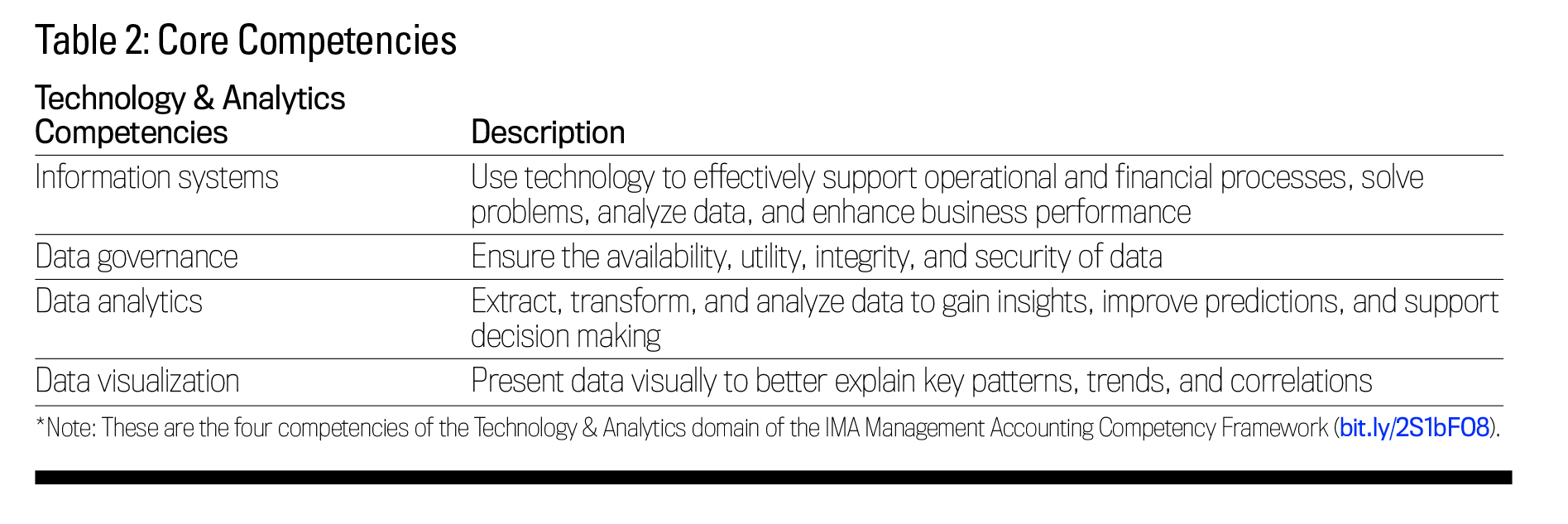

The enhanced Competency Framework identifies six domains of core knowledge, skills, and abilities that finance and accounting professionals need to remain relevant in the Digital Age and perform their current and future roles effectively. One of these domains is Technology & Analytics. It focuses on building and maintaining knowledge, skills, and abilities around four competencies required to manage technology and analyze data to enhance organizational success (see Table 2).

Information systems: The design, implementation, and use of an effective information system involve a deep understanding of critical data inputs and outputs to achieve a variety of business objectives. This involves the use of technology to effectively support operational and financial processes, solve problems, analyze data, and enhance business performance.

Data governance: Data is the fuel that runs through any information system, so it’s critical to ensure its availability, utility, integrity, and security. Digital transformation doesn’t exist without trusted digital data. Getting trusted digital data to the right person at the right time is a central component of any data governance strategy.

Data analytics: The ability to extract, transform, and analyze data to gain insights, improve predictions, and support decision making is a central theme to advancing in today’s business. Whether basic knowledge leveraging Excel to manage data or more advanced solutions using SQL, Python, or R, the ability to manage data to achieve analytical objectives is key to digital success.

Data visualization: Among the vast amount of data available, effective data visualization should enhance the messaging of information using visual displays. This visual presentation of data should help explain key patterns, trends, and correlations. The conveyance of information requires knowledge of the data and what visualization tools may be most effective, as well as business knowledge—what information is critical to business decision making. Key members of leadership, operations, and finance need to participate in the formation of business intelligence visualization design.

As you consider your future in management accounting, know that digitization, leadership, operations, accounting, and strategy among other domains are intrinsically linked. The Competency Framework effectively integrates many concepts so that you have resources and tools at your disposal to help manage your professional development.

March 2021