At the approximate one-year anniversary of the pandemic spreading worldwide, six CFOs speak about how their roles and responsibilities have changed in the face of COVID-19 and how their finance function and overall organization have had to adapt to overcome the various challenges presented by the shifting business landscape.

LAMENTABLE ANNIVERSARY

The pandemic has forced many senior executives, including CFOs, to move the health and well-being of employees to the top of the priority list. Dan McSherry, CFO of Bankers Healthcare Group (BHG), said that the potential for a sudden global event to impact the entire business in such a short amount of time became a reality in 2020.

“My responsibilities as CFO evolved from a focus on the financial aspects of the company to considering the effects that the pandemic would have on both the business and all of our employees,” he said. “While I had been used to focusing on major events impacting our economy, a significant health concern across the broader population and throughout our employee base was new to a lot of us.”

Today, CFOs are expected to play a more strategic role across their organizations, working more closely with different departments to understand their priorities and develop plans based on various financial scenarios given the uncertain environment. Coupled with this broader role is the increased need to ensure organizations are compliant with regulatory changes.

“As a human capital management software company, we needed to make 13 tax-related changes to our clients’ payroll systems over the past nine months as new COVID-19 regulations were released,” said Brandon Grinwis, CFO of Ascentis. “CFOs have a significant role in this compliance effort and need to continually understand what is changing in the regulatory environment and its impact on their respective organizations.”

For most CFOs, the pandemic has changed their role in a number of ways, including an increased need to be agile and to adapt to the reduction in cycle times, which has impacted everything from reporting to employee workload. Migrating to an entirely remote workforce was a big change.

“More than ever, it’s critical to share up-to-date information and work with my team to deliver reporting on a weekly basis,” said Shane Hansen, CFO of Planful. “The shift to remote work has been felt by all of us.

“I personally used to think finance, accounting, and FP&A [financial planning and analysis] needed to be physically together to be efficient, but I’ve realized during the pandemic that my team can be incredibly effective in a remote environment,” he said.

This shift has also made it clear that CFOs and other leaders need to take employee morale and mental health into account. This isn’t just an HR concern—it’s important for all leaders to proactively check in with their teams and discuss these topics.

“I have spent a lot more time on remote employee engagement and ensuring that our managers have the tools they need to manage a completely remote workforce effectively,” said Scott Craighead, CFO of Quovant. “Additionally, the time I have spent analyzing the economy, potential downside scenarios, and the impact on our business has increased dramatically.”

Naren Goel, CFO of Ephesoft, said the pandemic has caused many CFOs to prioritize building deeper relationships and providing proactive communication with all of an organization’s key stakeholders.

“This includes investors, banking partners, customers, suppliers, and employees,” he said. “The pandemic introduced a lot of uncertainty in the outlook for the business, and these relationships were critical in ensuring that we successfully maneuver through an ever-changing landscape.”

The last year has been like a roller coaster, said Omar Choucair, CFO of Trintech. The office of the CFO must respond swiftly and strategically to any crisis.

“Coming out of the gate, the office of the CFO was the nerve center for all the strategic planning, and the number and the frequency of financial models and financial questions exploded,” he said. “It put a tremendous amount of strain and [additional] work on the office of the CFO—and whether you’re looking at liquidity, debt covenants, supply chains, or capital spend, all those got thrown for a loop.”

EVOLVING FINANCE FUNCTION

The pandemic has changed the CFO’s role significantly. For one, it’s forced senior finance professionals to be more adaptable and to become better managers. Leaders had to become more understanding after so many companies transitioned to having employees work from home.

“CFOs and CAOs [chief accounting officers] have had to really work on adapting and changing their management style because they have to be more empathetic,” Choucair said. “We’ve got employees who have kids, and others have family members who got sick.

“It’s a completely different ball game managing folks on a remote basis vs. six feet away, so it really draws out the amount of trust and responsibility that you have to have with your lieutenants,” he said.

Ephesoft introduced several programs, including weekly “working from home check-ins” and “remote fun events” to help minimize the strain on employees. In addition, management increased its flexibility to ensure that employees can manage childcare and other family needs.

It has been a tough transition for many accounting and finance professionals, particularly as it relates to receiving customer payments and paying vendors. Many companies still receive and make payments via paper checks. “As soon as we went fully remote, we doubled our efforts to convert as many customers and vendors to electronic transactions as possible, but we’re still not 100%,” Craighead said.

The lack of face-to-face interaction has been a huge adjustment for many people who are used to having in-person meetings.

“Virtual meetings quickly got old, so there’s an ongoing challenge of keeping people engaged and working efficiently,” Craighead said. “We established an employee engagement committee about two months after the pandemic began with the goal of identifying and planning activities that kept employees active and engaged.”

Teams that used to come together at the office are now fully remote. It’s important for managers to remember that the isolation that we’re all experiencing affects people in different ways. Planful implemented more one-on-one check-ins and virtual team meetings to foster a sense of community, even from a distance.

“When you think of accounting and finance, you may think of a back-office role with one person in a cubicle, but that’s not the reality of it—finance professionals are typically very collaborative,” Hansen said.

The changing paradigm where normal finance activities, including monthly close, forecasting, and annual audit, are now completed across a disparate workforce has caused CFOs to pivot to ensure deadlines are met and priorities are aligned across their team.

Grinwis said CFOs also need to continually focus on team morale and communication to ensure alignment across the team. This makes it more likely that all members understand any changes to the strategy and priorities, enabling them to do their job better and feel more connected to the organization.

As BHG shifted its operations to 99% remote practically overnight, a number of considerations came directly to the forefront for its accounting and finance teams. BHG had just begun construction on a new state-of-the-art building in Syracuse, N.Y., which will still be completed eventually but has been put on hold temporarily.

“As we navigated the early stages of the pandemic, the reality of a more cost-efficient, work-from-home business model caused us to reevaluate our building plans,” McSherry said. “Similar to many firms, we were concerned that there would be a loss of production when operating offsite.

“Fortunately, our preliminary results have told us that our productivity hasn’t dropped off and, in some cases, it’s actually increased,” he said. “While the loss of a proven on-site culture is something that will be more difficult to replicate, we’ve made efforts to keep our people connected and engaged even while working remotely.”

Employee health and wellness have gone from routine checks and balances to a more comprehensive approach to developing preventative measures. Conscious of the mental impact of the pandemic as much as the physical toll it’s taken, BHG offers health-focused remote programs.

IMPACT ON HIRING AND PAY

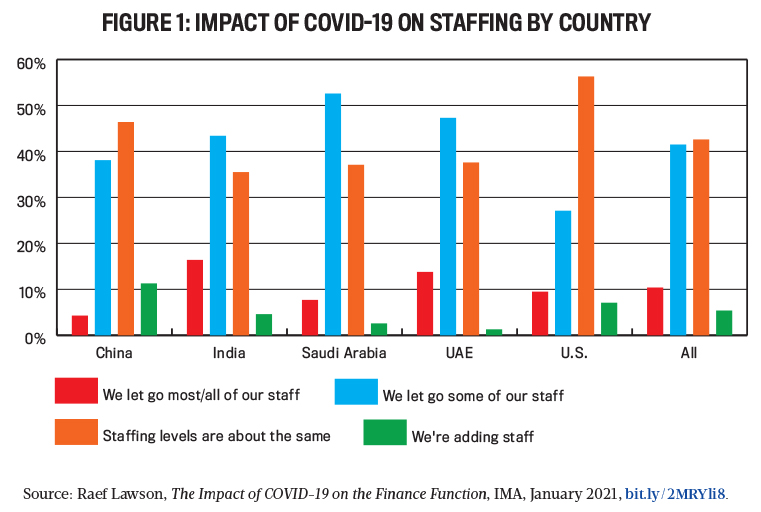

According to recent IMA® (Institute of Management Accountants) research, approximately half of the companies surveyed worldwide have let some of their staff go. Yet only 36.6% of U.S. respondents said their organization let go some or most of their staff, compared to China (42.4%), India (59.8%), Saudi Arabia (60.3%), and the United Arab Emirates (61.1%), which were most likely to have reduced staff size (see Figure 1). And changes to the respondents’ compensation since the pandemic began varied by industry (see Figure 2).

The rise of remote workforces has impacted hiring and compensation and reduced the importance of geographical proximity in screening candidates. Traditionally, BHG has focused its recruiting efforts close to its physical areas of operations in south Florida, upstate New York, and New York City. With this model, cost-of-living adjustments to compensation are quite common. As the company transitions to a permanent model that will include remote work, the landscape for recruiting talent has widened to include the entire world.

“Technology has proven to eliminate the difference between someone working down the street to someone working in another country,” McSherry said. “If you aren’t physically in the office, it shouldn’t matter where you are, and the convenience of working from home will level the playing field in terms of compensation.”

There continues to be a talent war in finance. While the pandemic caused some to consider new opportunities, it also created fear and uncertainty for high-potential individuals, causing some to hesitate in considering new opportunities, Grinwis said.

“This has resulted in CFOs turning to temporary labor for specific needs or engaging in prolonged searches for critical roles on their team,” he said. “Moving forward, one way to mitigate this constrained environment for talent is to define succession plans for key positions and cross-train team members so individuals know how to perform different responsibilities if needed.”

With multiple COVID-19 vaccines now being deployed, Craighead believes that the economic outlook is improving, but he expects a prolonged, slow recovery. There are still many uncertainties, including the policies of a new presidential administration in the United States, social unrest, and virus mutations, that will make many companies reluctant to add head count.

“Due to the high level of unemployment, I don’t anticipate employee compensation increasing much in the near term,” Craighead said. “Onboarding and training new staff have changed dramatically and are still works in progress.”

Ephesoft is hiring currently but has contingency plans in place for any unforeseen macro factors. “The focus, attention, and readiness for the contingency plans have increased in light of the pandemic,” Goel said.

The levels of hiring activity and compensation depend on the sector. Certain verticals have done very well, while others have struggled. Trintech is also still hiring. “Unfortunately, we have customers that haven’t done as well given the sector that they’re in, whether it’s in the energy, oil and gas, entertainment, and travel—those folks have had a different mind-set [toward hiring],” Choucair said.

STRATEGIC PLANNING CHALLENGES

CFOs are tasked with balancing short-term initiatives with longer-term strategic plans, but that becomes more difficult during times of crisis.

“During the pandemic, our short-term initiatives became even shorter in nature,” McSherry said. “Financing the business while evaluating every piece of the outstanding loan portfolio became weekly focus areas.”

BHG’s finance team performed a SWOT (strengths, weaknesses, opportunities, and threats) analysis on smaller segments of the business to help the company identify areas of risk that would otherwise go unnoticed.

“We’ve developed routine checks and balances that will make us a stronger company in the future,” McSherry said.

Organizations that would typically do strategic and financial planning as an annual exercise toward the end of their fiscal year have been forced to change their mind-set. Given the pace of changes and challenges over the past several months, the planning cycle is now an ongoing process at most organizations, including Ascentis.

“We’re increasing the frequency of discussing and evaluating our strategy and goals,” Grinwis said. “Each month we do pulse checks to evaluate if changes are needed to our planning based on a number of drivers, including the overall macro environment—COVID-related shutdowns, competitor trends, market demand—as well as company-specific challenges—inventory constraints, labor disruption.”

The pandemic has made it very clear that yearly or quarterly reporting won’t cut it. Planful embraced a continuous-planning approach that allows the finance team to be more agile and adaptable.

As the CFO, Hansen used to spend the bulk of his time on operational and tactical issues. Now he finds himself spending more time on strategic guidance and focusing on the long-term vision, including product and go-to-market plans.

“We’ve been focusing heavily on scenario planning to guide our strategy and effectively prepare our company to be ready for any market shifts that may take place,” Hansen said. “Laying a solid foundation at the onset of the pandemic, when it was unclear just how long it would last, allowed us to ride out the storm of 2020 and position ourselves for success as we head into 2021.”

Overall, Quovant’s process for strategic planning hasn’t changed significantly, but the finance team has started to ask themselves: What are the permanent or lasting changes due to this pandemic, and how will it impact our clients and prospects?

“Based on what we believe those impacts are, how do we evolve our business model to ensure our long-term success?” Craighead said. “Using our relatively small size, how can we be more agile than our competition, make quicker decisions, and act on those to win in the marketplace?”

Ephesoft’s processes around strategic planning include projections of high, low, and most likely scenarios. The company also sets alignment and functional objectives through a process that includes SWOT analysis.

“This level of planning was instrumental in our ability to quickly react and implement revised plans once the pandemic hit early in 2020,” Goel said. “Contingency planning and readiness are in the forefront as a focus area going forward.”

In the last 12 months, so many CFOs and CEOs have almost exclusively focused on short-term objectives. Whether that’s liquidity, capital investment, or mergers and acquisitions, all too often that’s taken priority over five-year models, longer-term planning, and all the routine work that leaders would do in a normal year.

“The focus has been more short-term, in terms of ‘What is your forecast and your plan, what are you going to invest in, and what can you do in the next 12 to 18 months?’” Choucair said. “[Some countries] are in a lockdown, and so long-term planning has become a second priority to short-term planning.”

TEMPORARY OR PERMANENT?

Some pandemic-induced changes to the role of CFOs are here to stay. An October 2020 McKinsey global survey of executives found that more than half of the respondents believe that the following changes would most likely remain through the recovery from the pandemic: changing customer needs or expectations (62%), increase in remote working and/or collaboration (54%), increasing migration of assets to the cloud (54%), increasing customer demand for online purchasing and/or services (53%), and increased spending on data security (53%).

“Think about short-term focus on cash management, liquidity, and cost management; most companies have completely eliminated travel and a lot of expense that’s going to come back into the business, and CFOs need to make decisions related to real estate if you have only a third or two-thirds of your workforce who are going to work either full-time or on a rotating basis,” Choucair said.

Working from home as a flexible option will most likely be here to stay, Goel said. Craighead agreed that many finance organizations have learned how to operate remotely and be effective, and as a result, he expects a large percentage of accounting and finance professionals to remain remote even after the COVID-19 crisis is over. “Even for those not fully remote, I anticipate those who choose to work in the office will not do so five days a week,” he said.

While many workers will go back to the office at some point, most companies will embrace a more hybrid model in the future. The finance team may no longer need a weekly cash forecast, but it will have the tools to do that when needed—continuous planning will be necessary.

“These days, finance leaders not only want to but also need to be able to plan from anywhere at any time—increased collaboration, remote or not, is here to stay,” Hansen said.

Finance and other teams will eventually go back into offices, maybe not daily but with some consistency. Many organizations have expensive office space with multiyear leases; getting employees back into offices does provide many efficiencies, but employees will expect a flexible work schedule that allows some remote working each week.

“Many organizations have built the muscle to continue working remotely, and shifting that back to the other side of the pendulum to require employees in the office each day may not be received well and could cause team morale issues,” Grinwis said. “The concept of ongoing planning, as well as CFOs expanding their roles across their organization to include risk mitigation, is here to stay.”

As a result, CFOs will be expected to play a key role in forming an organization’s strategy and to work with different teams to understand their priorities and mitigate risk.

The role of a CFO places an emphasis on understanding the current and future financial stability of the company. This has become more challenging than ever with so much uncertainty and so many variables to consider.

“I’ve wanted to ensure that the business had multiple sources of financing and the decisions made were beneficial to the long-term viability of the company,” McSherry said. “I believe the reality that unforeseen events can challenge the staying power of the business will have a lasting impact on my career. Planning for the unknown is something that comes with any leadership role, and this recent pandemic has made that painfully obvious,” he said.

There may not be many aspects of the finance function and the overall organization that were changed due to the pandemic that will revert to the ways the workforce operated in pre-pandemic days. In all the destruction that this global health crisis has caused, McSherry said that businesses and finance professionals have made positive changes that will be effective in a number of environments after we move past the COVID-19 pandemic.

March 2021