Audit teams had to figure out the best ways to perform their procedures remotely, and the roadblocks created by manual close processes and undocumented institutional knowledge became even greater impediments than before.

But we live in the Digital Age, and while the transition to a virtual professional world isn’t easy, it is possible to leverage what may seem like chaos into strategic advantage. And doing this successfully comes down to using the right technology.

The World Wide Web was essentially born in August 1991. The first true smartphone came the next year, followed by other technologies and solutions that have helped the finance and accounting function adapt to working remotely, such as Skype and Zoom. All these tools emerged within the last 30 years, yet it’s hard to imagine how we would have navigated the pandemic without them. So why then would you continue closing the books using spreadsheets and manual processes?

The electronic spreadsheet is more than 40 years old, and the framework of a general ledger hasn’t changed for more than 500 years. Yet so many finance and accounting teams still rely on spreadsheets and time-consuming, manual processes to close the books every month, every quarter, and every year.

Meanwhile, technology solutions that are purpose-built for accounting and finance are driving digital transformation for leading organizations around the world, and these solutions have become even more vital during this unprecedented time.

It is significantly more challenging to close virtually and perform remote audits when dependent on manual processes. Companies that already had the right finance automation solutions in place have been closing virtually on time and with confidence since the pandemic began.

It isn’t too late for you and your teams to update your accounting technology and unify data and processes, automate repetitive work, and drive accountability through visibility during this crisis and beyond.

ELEVATING ACCOUNTING WITH AUTOMATION

Traditional manual accounting processes are unsustainable—something that became even clearer as many finance and accounting teams began working remotely at the start of the pandemic. To thrive amid heightened uncertainty, risk, and accelerating change, organizations must move to modern accounting—which begins with adapting to changing circumstances through collaboration, visibility, and control.

For decades, accountants have been tackling the month-end close with manual processes tracked with checklists. Until recently, repetitive, brute-force effort was the only option. But now, innovative technology is automating those repetitive tasks and workflows with rules-based logic, and the sophistication of these solutions is growing with robotics, machine learning, and AI.

According to Deloitte’s State of AI in the Enterprise survey, 74% of adopters agree that AI will be integrated into all enterprise applications within three years. Additionally, 67% of all respondents are already using machine learning, and 97% are either using or planning to use it within the next year.

Here are five areas in which technology is helping equip finance and accounting teams to move to modern accounting and thrive in this virtual world.

1. Record-to-Report Is Done in Real Time

Gartner research shows that 72% of companies plan to leverage the cloud for financial applications in the next three years. Data from The Hackett Group shows that more than 70% of finance organizations that have adopted cloud-based solutions have achieved or exceeded their business expectations.

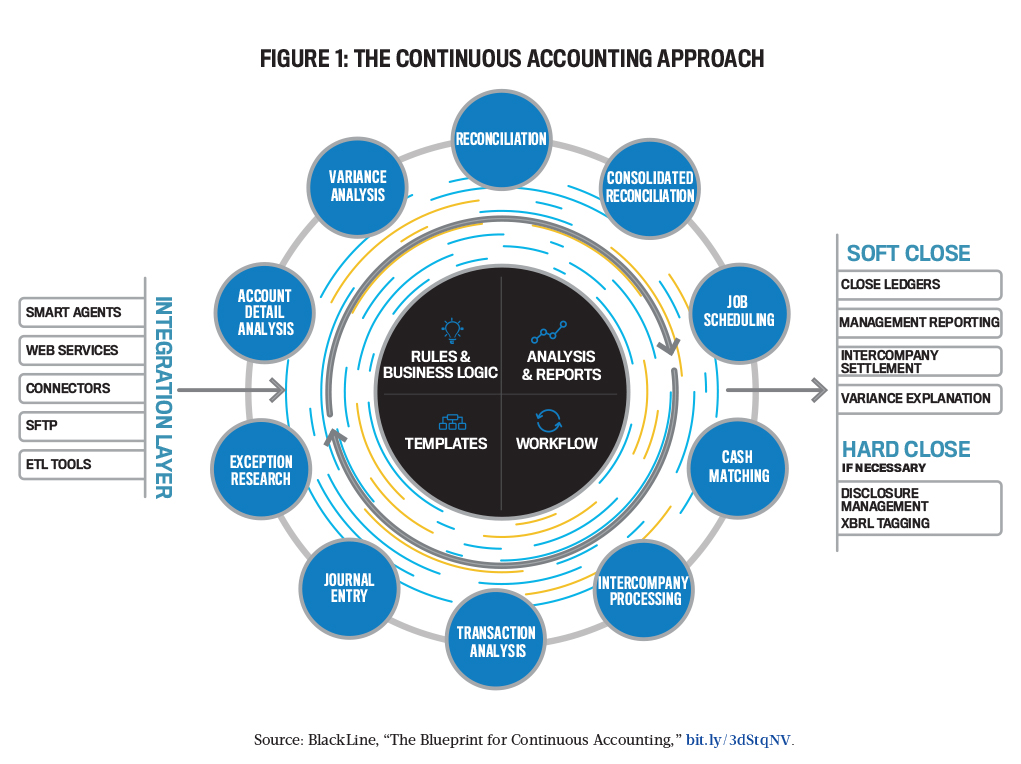

Powered by in-memory and cloud-scale computing, Continuous Accounting is an approach that embeds automation, control, and period-end tasks within day-to-day activities, thus enabling most accounting processes to happen in real time instead of creating a crunch at the end of the period. This aligns the accounting calendar more closely with the broader business, resulting in a more efficient close, a more accurate and complete set of financials, and a more effective organization fueled by real-time data and deep analytics. (See Isaac Tucker, “The Blueprint for Continuous Accounting,” Strategic Finance, May 2017.)

Continuous Accounting shifts teams from the heavy end-of-the-period workload of the traditional record-to-report calendar to a more balanced cadence (see Figure 1), creating more time to focus on exceptions and judgment-intensive activities.

Accuracy and integrity increase exponentially, and traditional roles can finally evolve because of the elevated skill set that’s now required. Analyzing real-time data and reporting is also more critical now than ever before as business environments continue to change rapidly.

Effectively implementing Continuous Accounting requires a holistic approach, combining a mix of technology, process, and people to realize continued improvements across the accounting organization.

Using technology to automate month-end processes enhances the benefits of process optimization while increasing the overall productivity of accounting team members. Optimized processes will reduce risk, improve accuracy, and increase efficiency, benefiting the entire accounting and finance function. (See here for more on where to start.)

2. Accounting Is Shifting to Analytics

Accountants tend to be underappreciated by the business. But when the most tedious, time-consuming processes are automated, they finally have the opportunity to showcase their value. As they begin driving business outcomes instead of reporting on what happened four weeks ago, they’re more likely to garner recognition.

We live in the age of analytics, and the demand for finance professionals who can interpret data will continue to increase. McKinsey predicts that two million to four million jobs created over the next decade will involve interpreting machine insights—and the demand is set to far exceed the number of qualified professionals.

Additionally, as accounting professionals provide deeper business insights, they can become more proactive and manage risk better by identifying it in the early stages. This leads to a career shift that many accountants strive for: becoming a strategic partner on every level.

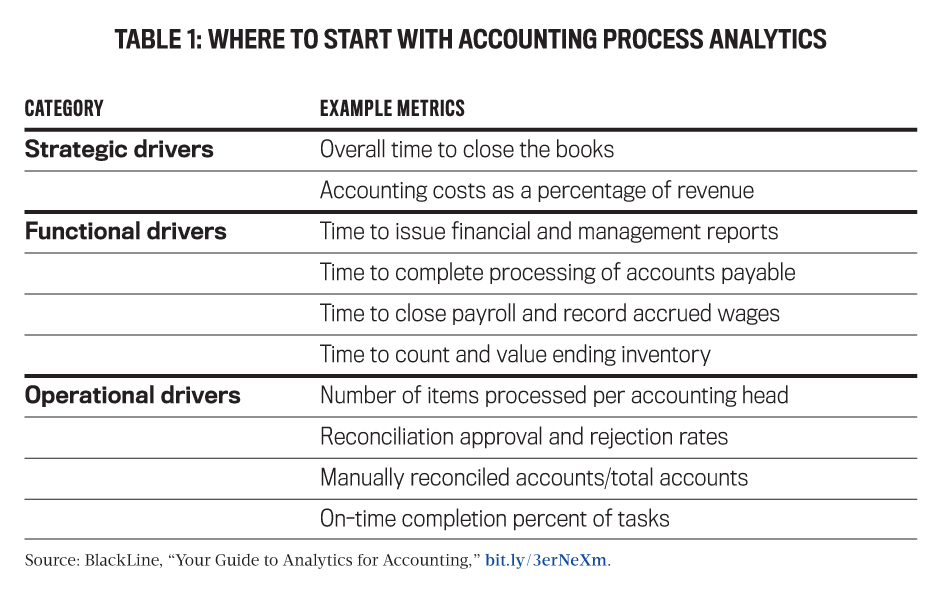

To begin the shift, start with a top-level measure of success such as time to close. Functional drivers provide the next level of drill-down—so link them back to your overarching metrics. Operational drivers provide the deepest level of process insight and are the jumping-off point to take action (see Table 1).

Rolling forecasts and continuous planning projects driven by financial planning and analysis (FP&A) require a steady stream of financial information. Accounting initiatives like cutting days to close with techniques like Continuous Accounting, or even moving to a virtual close, can provide FP&A with earlier or real-time access to financial results.

3. Finance and Accounting Are Embracing Business Partnering

Business partnering has been on the accounting and finance agenda for years. But double-checking the financial statements, tracking down reconciliations, certifying controls, and supporting audits have all rightly taken precedence—as these tasks require substantial, if not all-encompassing effort.

When the business looks to accounting and finance for support and to provide timely insight into key financial figures, it needs that data to make decisions now—not after the month-end crunch is over and the reporting is complete. And in a virtual world full of uncertainty, timely and accurate insights from accounting are essential as business decisions carry significant weight for future performance.

With the rise of technology and intelligent data analysis, the finance function is in a unique position to deliver valuable insights for the future of the business it serves. Leading organizations are rebalancing accounting’s role by applying the technology that leads to business partnering benefits.

In a survey of accounting and finance leaders titled Finance business partnering: Making the right move (bit.ly/33cBva4), Deloitte identified commercial acumen and decision making, customer focus, strategic thinking, and relationship management as the top skills that every finance professional should strive to add to their competencies (see “Top Competencies for Business Partnering”).

Adding business skills and being more proactive around identifying business risks are both essential to adding a partnering element to your team’s skill set. And achieving this requires freeing up workloads and changing accounting processes to make room to nurture the change.

A modern accounting platform processes month-end tasks in real time, over the accounting period, not just at month end—shortening the close and freeing up time for more partnering.

4. Technology Enables Efficient Remote Audits

Audits can be a painful ordeal and a recurring burden for accounting teams under normal circumstances. With most companies operating with a remote, distributed workforce, it’s inevitable that conducting audits this way will follow suit.

The challenges facing auditors will only increase now that audits are done virtually—from being able to access basic information and supporting documentation to conduct the audit or quarterly review all the way to being able to attest to or assess the accuracy of the financials, which is an entirely different situation.

But stress and anxiety don’t need to be a part of the audit process, and an efficient remote audit is possible. Companies that utilize financial close technology move through audits faster and with better results, and they have stronger, more transparent financial management throughout the year.

To do so, it’s critical for finance and accounting teams to have the right technology in place. Use this question as a starting point: Do you and your auditors have an integrated Provided by Client (PBC) list where both parties can access items, directly link supporting documentation, and review real-time status without having to set up meetings to discuss? If not, it’s time to begin exploring the technology that can get you there.

Technology creates transparency, and transparency builds trust—which extends across all levels of both accounting and audit teams, from staff to senior executives. It’s a win-win relationship that will pay dividends well beyond the COVID-19 crisis.

5. Top Talent Is the Future of Finance

Thriving during and beyond this crisis hinges on retaining and attracting top talent. In Architecting the Future Finance Workforce, Accenture says that “together with analytical skills, the Finance workforce of the future needs an appetite for risk, a stomach for ambiguity, and the guts of a savvy business advisor. Attracting, retaining, and building these skills means profound changes to finance talent strategy—because the work of Finance, who does it and how, will never be the same.”

Successfully embracing change and navigating uncertainty begins with developing a culture that attracts top talent and enables your people to compete on a whole new level. This looks like automating rote processes and moving to a modern accounting approach, so your highly skilled accountants have the time they need to serve as a business partner.

We’re at an inflection point for change that will elevate the accounting and finance organizations that embrace and effectively prepare for it. Those who successfully build their skill set for the rising tide of intelligence will be rewarded.

Morale has always been a key to retaining and attracting top talent. Right now, it’s essential to take care of your people, appreciate them, and understand their circumstances.

Ask yourself:

- Are my employees feeling concerned about their jobs? Are they challenged by working from home while managing personal and family commitments?

- Are my employees engaged in and motivated by the work I’m asking them to do?

- Can I retain them with the current processes?

- In a few years, will I be able to successfully attract and recruit digital natives to a world full of spreadsheets, manual processes, and inefficient practices?

Purpose-built technology is key to shaping the way you work now and into the future, ensuring that you’ll attract and retain your top talent.

THRIVING IN THIS VIRTUAL WORLD

These are unprecedented times, and the COVID-19 pandemic has disrupted accounting and finance in ways we never thought possible. No one can predict how long this will be our new normal, but one thing is certain: We all have a choice in how we respond to this crisis.

We can focus on the roadblocks—and there are many—or we can choose to adapt and find the opportunities, and these are abundant, too. Organizations that become more strategic and adaptable by making the move to modern accounting and implementing the right technology will thrive in this virtual world.

As a starting point, focus on these two areas:

- What can I do to help my organization embrace and accept new technology?

- What can I do to position myself right?

Building your skill set to help you capitalize on the disruption that will inevitably continue is how you can truly thrive during and well beyond this season of so much change and uncertainty.

Aimee Leishure, former senior vice president of business transformation at Laureate Education, Inc., says, “I’ve run many transformations in my career and have seen how resilient people are. We will get through this moment in our history and come out better on the other side.

“People and organizations might not look the same as they did [at the beginning of this year], but we will overcome and business will come back even stronger. People will adapt to change and improve the future.”

June 2021