The COVID-19 pandemic exposed supply vulnerabilities and challenged OEMs to explore new products and sales channels. For some, the crisis served as a turning point for change, prompting leadership teams to evaluate manufacturing models and product portfolios.

If ever there were a time to reimagine supply chains, this is that moment. Contract manufacturing, also known as outsourced manufacturing, is one type of supply chain link. It takes many forms. CFOs and finance teams must be ready to support their organizations in outsourcing decisions.

WHY CONTRACT MANUFACTURING?

OEMs consider outsourced manufacturing for many reasons. The list of possibilities is extensive (see “Reasons to Consider Outsourced Manufacturing” for just some examples). Every OEM is different, with unique factors driving its decision to consider an outsourced manufacturing model.

Likewise, contract manufacturing organizations (CMOs) differ greatly from one to the next. OEMs need CMO partners whose capabilities align with their outsourcing objectives. For some, the solution is finished goods procurement, working with a contractor who delivers a product to the OEM’s specification, managing the entire supply chain. For others, the answer is outsourcing the manufacture of a component or subassembly. Others turn to a CMO for converting processes, such as the following:

- Slitting and rewinding

- Cutting, stamping, or perforating

- Printing

- Finishing

- Assembling

- Embellishing

- Labeling and packaging

Depending on the relationship, the CMO might manage the full transfer of the OEM’s product from prototype to mass-scale production. Some OEMs also rely on contractors for raw materials sourcing and quality control, warehousing, and inventory management. Other OEMs prefer to use their own purchasing power to drive the best materials pricing. The terms and conditions for every OEM-CMO partnership vary.

THE CFO’S INVOLVEMENT

The CFO’s team should be involved in all outsourcing decisions, including CMO selection and management. Throughout the selection process, the CFO provides leadership and a framework for evaluating decisions and expected results from a cash and operational risk perspective. Perhaps most importantly, finance professionals help evaluate costs, calculate what-if scenarios, and analyze the risks and rewards of different production or logistics options.

The CFO identifies relevant costs, drilling down into details such as inbound freight, labor, overhead, capital, and inventory. “The people within the OEM organization trying to sell the outsourcing project to the next level up need good financial data in hand,” said Chad DesMarteau, president and owner of Advantage CFO & Controlling Services, LLC—and a CMA® (Certified Management Accountant)—in a blog post titled “Make or Buy? Either Way, Understand Your Risks and Opportunities.”

“One of the primary responsibilities of finance is to safeguard company assets; you want to maximize cashflow and mitigate risk at the same time,” DesMarteau said. “If you are an OEM evaluating an outsourcing decision, you are expecting it to benefit you somehow—saving money, reducing risk, improving revenue, enhancing quality or speeding time to market.”

Likewise, Anthony Freeman, president of A.S. Freeman Advisors, LLC, discussed the increasing role of finance professionals in outsourcing decisions at an October 2020 virtual symposium produced by Medical Product Outsourcing (MPO). During his presentation, “Resilient Supply Chains: Changing Requirements in Changing Times,” Freeman said he thinks OEM financial analysts will have a strong voice at the table as companies plan for the next five years.

“A lot of this will be driven by financial analysts within OEMs,” he said. “Over the years, they’ve been the biggest allies of manufacturing outsourcing. Basically, their mantra is greater return on equity through risk reduction—by taking risk out and making revenues and cashflows more certain.”

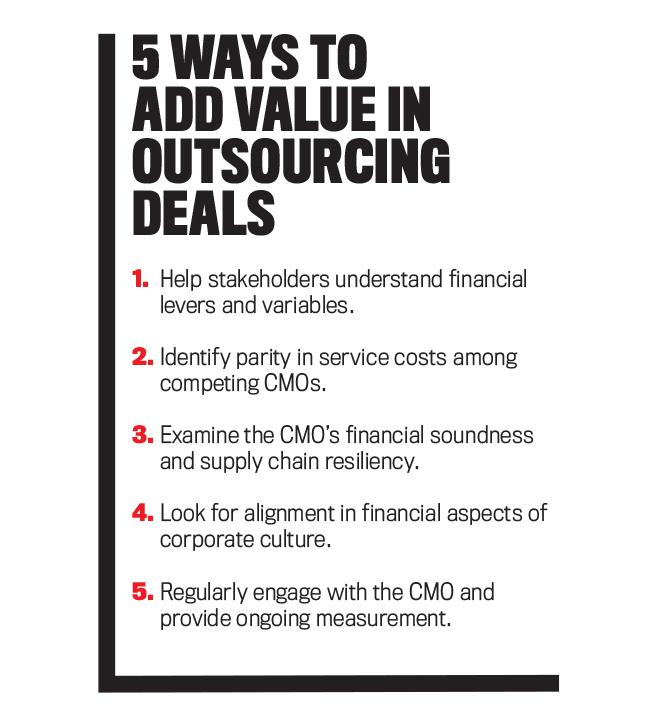

Let’s take a look at five ways that the CFO and finance team can add value in outsourcing deals with CMOs.

1. Help stakeholders understand financial levers and variables.

In a make vs. buy decision, finance is in the best position to provide visibility to an OEM’s overall costs for producing a component or finished product. The CFO’s responsibilities require an in-depth understanding of cost of materials, payment terms, inventory valuation, and labor rates. Therefore, finance will be able to support colleagues from operations, sourcing and procurement, quality, engineering, and other disciplines engaged in the CMO decision and search process. For example, if the outsourcing terms specify that the CMO will own raw materials or finished goods inventory until the product ships, finance can calculate how this arrangement will affect working capital.

The finance team also can call out a variety of other risks and opportunities related to proposed outsourcing deals. For example, there can be added costs for monitoring CMO compliance with the U.S. Foreign Corrupt Practices Act and local labor, environmental, and safety regulations. There generally is more risk, and therefore more complex monitoring requirements, when CMOs are located in different countries than the OEM, including developing nations.

To protect their reputations and ensure that supply chains meet their corporate ethical standards, OEMs often hold contractors to higher standards than those encoded into local laws. Many seek contractors with a track record for—and documented processes in support of—corporate social responsibility (CSR), workplace safety, and compliance with Current Good Manufacturing Practices (CGMP). Certifications from the International Organization for Standardization (ISO) and other regulatory or certification bodies also reduce the risk profile for a CMO and influence how much expense is budgeted for CSR-related monitoring.

The finance team also helps OEM stakeholders understand the tax and accounting ramifications of prospective outsourcing deals. Taxes inevitably are more complex when an OEM contracts with a CMO based outside of the OEM’s headquarters country. What accounting standards does the CMO follow? Will the OEM get credit for taxes paid in the CMO’s country? How might lower manufacturing costs and higher reported profits increase taxes?

If a CMO is offshore, the OEM might need to reconcile transactions using International Financial Reporting Standards. If a CMO is located in the same country as the OEM, both parties adhere to the same tax laws and similar accounting standards, simplifying the outsourcing relationship from a financial reporting perspective.

2. Identify parity in service costs among competing CMOs.

During the request-for-quote stage, finance professionals can collaborate with purchasing, operations, and other peers to be sure the process captures the appropriate details from a financial decision-making perspective.

In bid analysis, the CFO helps to measure the true comparable worth of contractor bids. For instance, did all CMO candidates include their freight costs? Are tariffs and duties factored in? How about lead time? Has the OEM been clear about inventory carrying costs? Who will buy the raw materials? When will the OEM assume ownership of the formatted material or finished product?

Terms and conditions are incredibly important in outsourcing agreements. If there’s ambiguity over the terms, or if a CMO hasn’t provided accurate or complete costs, these issues can lead to major problems—and make or break profit-and-loss assumptions around a deal. The entire search team, but especially the CFO, should ask tough questions, raise doubts, call out risks, and, most of all, demand detailed data, schedules, commitments, and concrete proposals. Outsourcing agreements shouldn’t be built on handshakes and hearsay.

3. Examine the CMO’s financial soundness and supply chain resiliency.

OEMs want to reduce risk of partnering with a CMO that will fail to meet demand or, worst case, go out of business. After all, the OEM’s entire supply chain is on the line if that CMO is responsible for a mission-critical component or process. In this way, the CMO’s success or failure is intricately intertwined with the OEM’s relationship with its customers. A CMO failure could mean OEM failure to deliver to the end customer. To avoid such complications, the CMO search committee should conduct a thorough evaluation of potential contractors (see “Due Diligence Considerations”).

In his MPO Symposium presentation, Freeman said OEM financial analysts look for the following components of a resilient supply chain: communication, transportation and logistics, financial resilience, product complexity, and organizational maturity.

Communication. Strong communication is necessary within the company itself as well as the supplier network, including a central source for trusted information. Connected information technology systems between the OEM and CMO can provide a good conduit for regular, automated communication about shipment status, work in process, and other updates.

Transportation and logistics. Plan for coping with disruption, including identifying alternate ways to get products where they’re needed. The weeklong Suez Canal blockage in March 2021 caused serious supply chain problems for companies without backup supply sources and transportation plans. Does a CMO have redundant manufacturing facilities, multiple warehouses, and secondary transportation options in case of an interruption with its primary path? The level of redundancy will vary based on the predictability of manufacturing capacity required as well as level of maturity in product design.

Financial resilience. The CMO must be able to handle delayed revenues and unplanned expenses and to survive downturns. An OEM and its products are at risk if a CMO has poor financial health. For example, if the CMO doesn’t have enough cash on hand or credit available to purchase raw materials, it might not be able to fulfill an order on time. Alternately, it might not be able to purchase new equipment necessary to increase production volume and keep up with growth. The OEM also needs to look at intellectual property and may desire to own the capital equipment so that there’s control over the property and perhaps flexibility in the future.

Product complexity. More complex products are at greater risk in outsourcing partnerships because there are more details and parts to manage. This is especially true with a product that is highly regulated or approved by a government agency such as the U.S. Food and Drug Administration (FDA). Manufacturing protocols and reporting must be strictly adhered to.

Experienced CMOs offer strong capabilities for technology transfer, a process that can help simplify some of this complexity. They advise the OEM on the best processes, materials, and material formats to efficiently manufacture a product at a large scale. OEMs and CMOs have an opportunity to collaborate on materials planning to help avoid parts shortages and production interruptions.

Organizational maturity. Sufficient expertise is needed to prudently alter operations, often with incomplete or evolving information. A CMO with in-depth experience in an OEM’s market and products will be able to anticipate and adapt to changing demands and requirements. This flexibility is critical in new product introductions as changes happen frequently.

Freeman also noted that OEM financial analysts seek the following from an ideal contractor:

- Good price, consistent quality, and on-time delivery over time (five to seven years on newer products).

- One-stop shop—a broad and expanding service set and the ability to manage a satellite supply chain so the OEM manages only one contractor.

- Financial resources and working capital to cover ongoing investment in new capabilities and automation. This includes investment in a strong IT infrastructure, new equipment, facilities, skilled associates, and talented, capable leaders.

4. Look for alignment in financial aspects of corporate culture.

Corporate culture affects the overall OEM-CMO relationship. Finance teams for both parties may have cultures of their own that reflect their organizations’ ownership, priorities, and broader corporate culture.

When there’s alignment between the financial cultures—and capabilities—of the OEM and CMO, there’s a better likelihood for a successful relationship. For example, if the OEM is a large, publicly traded business, it’s accountable to shareholders and authorities for regular financial reports. This type of OEM may require a high level of transparency into the contractor’s operations to fulfill its reporting requirements. It could need real-time visibility into raw materials inventory, work in process, and finished goods. Additionally, large, publicly traded companies are under increased scrutiny related to diversity, sustainability, CSR, and safety. Does the selected CMO have strong values along with policies and procedures to address these concerns?

At the same time, other ownership models might have different financial cultures. Private equity investors put a lot of emphasis on rapid return on investment (ROI). Their finance leadership will expect counterparts on the CMO side to prioritize ROI and provide frequent status updates and metrics related to meeting ROI targets.

When it comes to corporate finance cultures, the most important thing is for the OEM and CMO to understand how both their businesses benefit from the relationship and to have a sense of financial equity for both organizations’ stakeholders. An “our way or the highway” culture from either camp isn’t conducive to a healthy partnership. Open, honest, and frequent communication is key to long-term successful relationships.

5. Regularly engage with the CMO and provide ongoing measurement.

After a CMO partner has been selected and outsourcing is in process, there still are important ways for the CFO to add value and make the partnership a success. Occasional site visits between OEM and CMO finance personnel help build relationships. These visits also offer an opportunity for the OEM CFO to meet periodically with CMO operations management. The CFO also can proactively ask those in operations, sourcing, quality, and other areas if there are areas in which financial expertise is needed.

One of finance’s greatest roles will be to help OEM management continue to measure how the outsourcing relationship is adding value to the bottom line. “If you think about a business in terms of the way information flows through it, or through an ERP [enterprise resource planning] system, ultimately, finance is just the big rain bucket at the bottom,” said DesMarteau. “Whether you are outsourcing or manufacturing in-house, the costs all end up in your system somewhere. The dollars are real. The CFO ensures you account for costs accurately, but more importantly have visibility to and understand what those are, and how results compare to expectations.”

REASSESSING SUPPLY CHAINS

Riding the wake of 2020, with its supply chain disruptions and business stressors, OEMs are looking at their organizations in a fresh light in 2021. Manufacturing models might need refinement to add flexibility, reduce risks, and increase responsiveness. Outsourced manufacturing is an option some OEMs are exploring to position their businesses for success.

As with any major business decision, outsourcing to a CMO requires careful consideration and thorough evaluation from different angles. When they involve active participation from the CFO, outsourcing partnerships benefit from a clear understanding of costs, risks, and rewards.

June 2021