Thankfully, for teams that leaned into procurement automation and adopted technology along the way, the positive results and new capabilities will almost certainly outlast the pandemic.

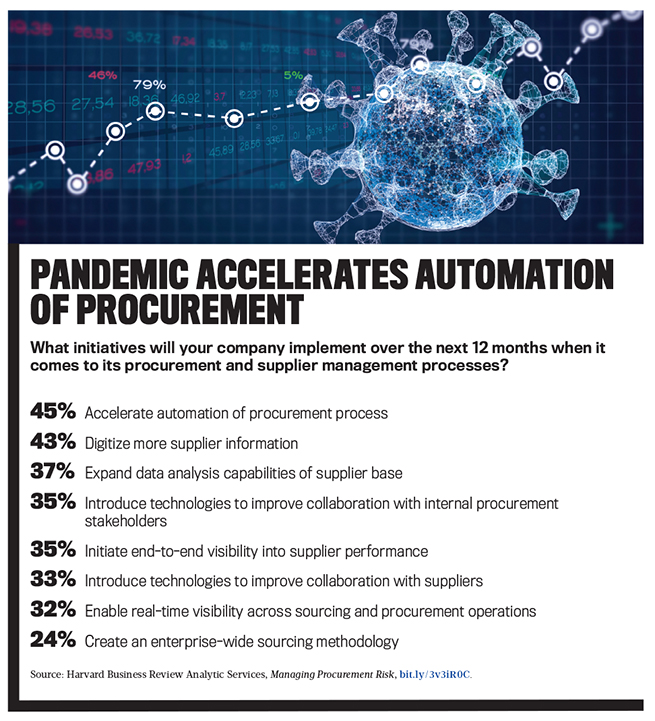

In a study conducted by Harvard Business Review Analytic Services, Managing Procurement Risk, 95% of surveyed executives reported that the pandemic resulted in significant disruptions to their global supply chains. Six in 10 executives said that as a result of these pressures and uncertainty, their businesses have fast-tracked plans to upgrade and automate their sourcing and supplier management processes (see “Pandemic Accelerates Automation of Procurement”).

In the report, Adam Andolina, chief procurement officer at KeyBank, noted that his organization is thinking about sourcing and procurement more strategically than ever. The executive team recognizes that leveraging tools for automation is an essential part of doing business today. “The pandemic has shown the value in having more redundancy in the supply chain. If we are going to have more redundancy, we need to have better tools to manage that bigger volume,” said Andolina. “Our goal is to leverage third-party tools to get a better view of our suppliers’ financial health, information security risk, etc. That will require companies to get more out of their procurement technology investments.”

The journey to automate procurement processes isn’t an easy one. In the survey, 92% of respondents described the digital maturity of their existing supplier management processes as “less than best-in-class.” Approximately 13% admitted to still using legacy systems such as email, spreadsheets, and offline document repositories, resulting in countless hours of manual work to piece together fragmented data—a task truly meant for automation rather than human hands.

DIGITAL PROCUREMENT INVESTMENT

When sourcing teams are empowered with the appropriate technology, procurement leaders can bring visibility to their strategic work and better establish the connection with overall corporate goals. Automating repetitive, transactional tasks also means that people can focus on higher-value-adding activities like negotiating contracts with suppliers or making subjective judgments aligned with an organization’s appetite for risk. The visibility that digitization brings not only results in better cost containment and greater savings, but it also improves enterprise-wide efficiency, business agility, risk management, and strategic decision making.

Organizations that have adopted agile, digitized sourcing technologies can unlock the untapped potential of sourcing and procurement teams, driving significant business impact across the entire enterprise. In the 2020 report Connected and autonomous supply chain ecosystems 2025, PwC surveyed more than 1,600 supply chain executives and found that “digital supply chain champions” continue to reap the benefits of investments in digitizing supply chains long after implementation. These “digital champions,” according to PwC, are companies that have invested in and adopted advanced supply chain management technologies, leverage sophisticated digital capabilities, and actively manage programs to upskill employees.

Interestingly, only 9% of the 1,600 companies surveyed fall into this category, but the outcomes of these champions speak volumes. In 2019, these digital champions realized operational savings of 6.8% annually across supply chain costs, a figure well ahead of less-advanced companies. These champions even saw a 7.7% revenue increase, while 28% of the champions reported that their investments in advanced supply chain capabilities resulted in benefits extending across the business, namely more effective risk management.

SUPPLY CHAIN MANAGEMENT

Even prior to the disruption and uncertainty of the pandemic, major market trends were shifting and influencing procurement. McKinsey & Co. found that value chains were “becoming more complex and volatile, with increased risks and opportunities” (see Shifting the dial in procurement). Recognizing the implications of this volatility, almost one-quarter of respondents to a 2020 IDC Supply Chain Survey indicated that their main priority is to improve supply chain visibility. Whether responding to a global pandemic, a trade bloc’s dissolution, a natural disaster, or a ship lodged in the wrong place at the wrong time, supply chain and procurement leaders must be prepared for unpredictable circumstances and must be able to pivot quickly.

The good news is that technology can help. McKinsey & Co. estimates that more than 40% of sourcing and procurement tasks can be automated, freeing procurement leaders to make fast decisions, and the percentage of automatable tasks will continue to rise. Elouise Epstein, a partner at the consulting firm Kearney, echoed these predictions in A New Paradigm for Procurement and showed optimism for an expedited innovation timeline. “Digital technologies are on pace to automate most routine procurement processes within three to five years,” she said.

Acknowledging the potential impact these technological developments can have on business processes, procurement teams have begun adopting tools to prepare for the future of work. As this technology trajectory continues, procurement teams will continue to evolve in a variety of ways:

Become more strategic. Less time dedicated to routine, transactional work means procurement practitioners will be able to focus on higher-value activities including liaising with business stakeholders, negotiating contracts, partnering with suppliers for product innovation, and ultimately turning supplier capabilities into competitive advantage.

In A New Paradigm for Procurement, Shashi Mandapaty, chief procurement officer for the corporate group at Johnson & Johnson, said his job is to establish a procurement plan that helps the enterprise to realize its strategic vision for the next decade. “Procurement is already working with our business partners at a much more strategic level,” he said. For Mandapaty’s team, top priorities include investing in the digital strategies and talent that will be necessary to make Johnson & Johnson’s critical projects a reality. “As we look out five years from now, we see a procurement function that will increase our focus on creating total value for the company in partnership with the business,” he said.

In another instance of innovation, A New Paradigm for Procurement noted that BlueCross BlueShield of Tennessee, which is automating supplier contract requests for new and existing relationships, plans to leverage the cloud for fast-tracking strategic decisions. With cloud-based sourcing and contract management capabilities, the procurement team plans to show executives and the office of finance all contracts that expire in the coming three, six, nine, or 12 months and to automate the task of asking which ones they want to renew, which they want to renegotiate, and where the company should be seeking new suppliers.

BlueCross BlueShield of Tennessee’s director of corporate procurement, David Geyer, shared in the report that the procurement organization is now able to capture financial data using supplier management tools and develop more timely reports for the strategic planning team, the CFO, the treasurer, and the business units. Before this reporting and visibility, every transaction seemed like it was “stuck in procurement.” Geyer said, “We can now show [executives and stakeholders], from a planning perspective, how a course of action will affect the bottom line. We can capture that data at the front door and give real-time visibility to our third-party spend.”

Increase analytical capabilities. According to the Managing Procurement Risk survey, only 21% of companies currently have strong data analysis capabilities for supplier information, but 37% plan to expand these capabilities. In fact, investing in the area of supplier analytics was a top priority for procurement leaders. This investment focus was only preceded by accelerating procurement automation and digitizing supplier information, both of which are prerequisites for increasing analytical capabilities.

With automated reporting and analytics, procurement organizations and the enterprises they support will be better positioned with accurate data to make fast strategic decisions. For example, according to A New Paradigm for Procurement, Carlsbad, Calif.-based Gemological Institute of America (GIA) now uses cloud-based procurement tools that enable spend analytics updated on a weekly basis—a practice that yielded some “surprising maverick spending discoveries for executives overseeing GIA’s business.” Joe Patchett, director of global procurement at GIA, reported that, “Before, [procurement] engagement was based purely on interpersonal relationships with our executives, but now procurement is empowering them by putting relevant, up-to-date information at their fingertips so that they can make better-informed decisions.”

Improve process transparency. To be a genuinely agile organization, sourcing and procurement must have full visibility into each step of the source-to-pay process. Procurement teams must be able to quickly assess, triage, and respond to business project requests, and they also must be able to accelerate or dial back the pipeline of planned spend as necessary. Indeed, more than half of PwC’s digital supply chain champions noted that transparency was a high or the highest priority for procurement.

Technologies that enable this visibility allow employees to better track and manage sourcing milestones and projects. Neil Aronson, Uber’s global head of strategic sourcing, contingent labor, and logistics, acknowledges the impact this visibility can bring in the area of business continuity. “It’s impossible to drive effective global collaboration using a standard spreadsheet,” he said, adding that “having a sourcing solution in place is critical, because there’s always attrition. If you’re only using email to manage sourcing events, you’ll lose a lot of history when someone leaves—but having that history and visibility in a single, searchable repository can drive substantial long-term value” (see High-Performance Sourcing and Procurement).

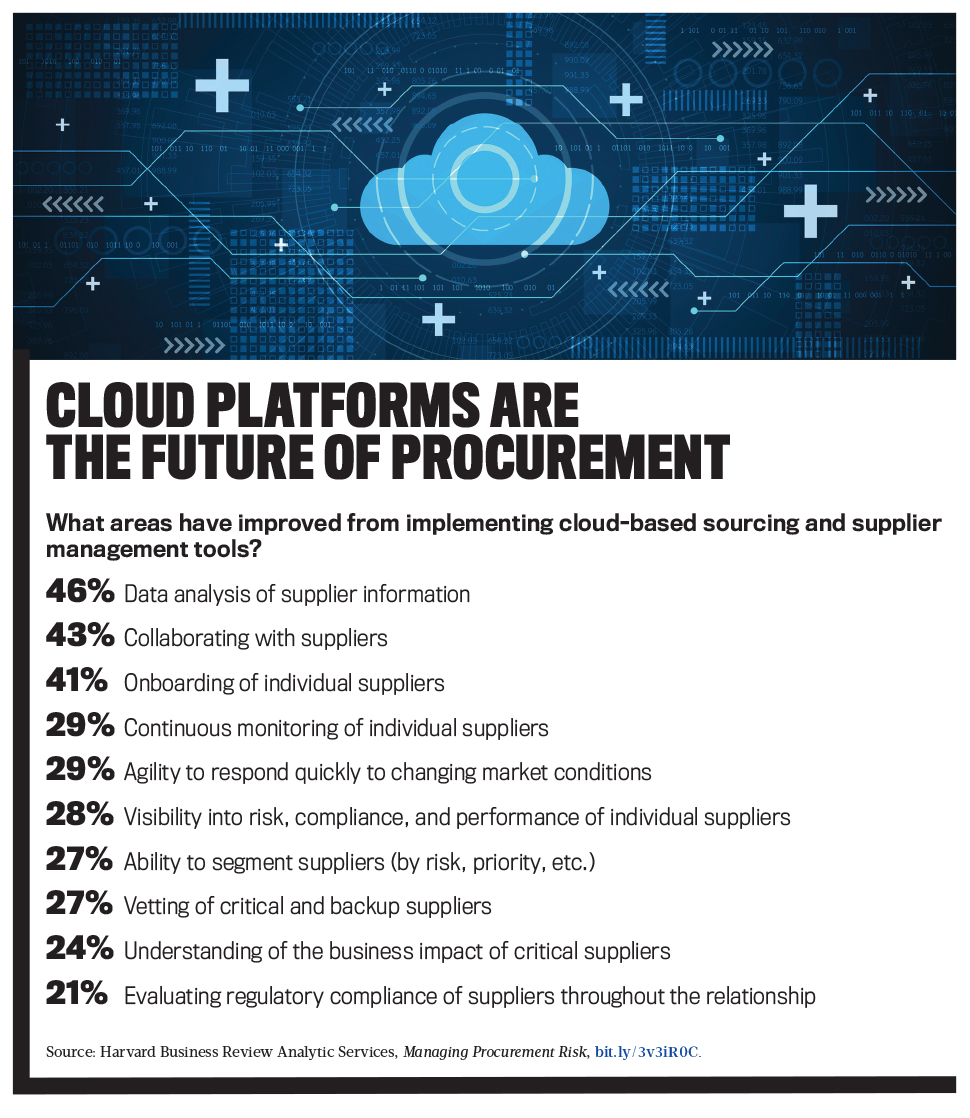

Furthermore, this visibility is essential to driving and managing supplier performance. A key challenge to achieving optimal visibility into supplier performance is that when procurement systems aren’t integrated with the rest of the business, this supplier information is commonly siloed among business functions or lines of business. With information centralized in a cloud-based system with secure access for all who need it, the organization will enjoy enhanced financial control and planning for the whole business (see “Cloud Platforms Are the Future of Procurement”).

Support greater agility. Businesses empowered with automation and analytics will be better able to continue their digital acceleration journey. Continuous planning tools, for example, can easily be integrated into procurement and related systems to provide live views into what’s happening after an order is placed and whether the process is flowing according to plan.

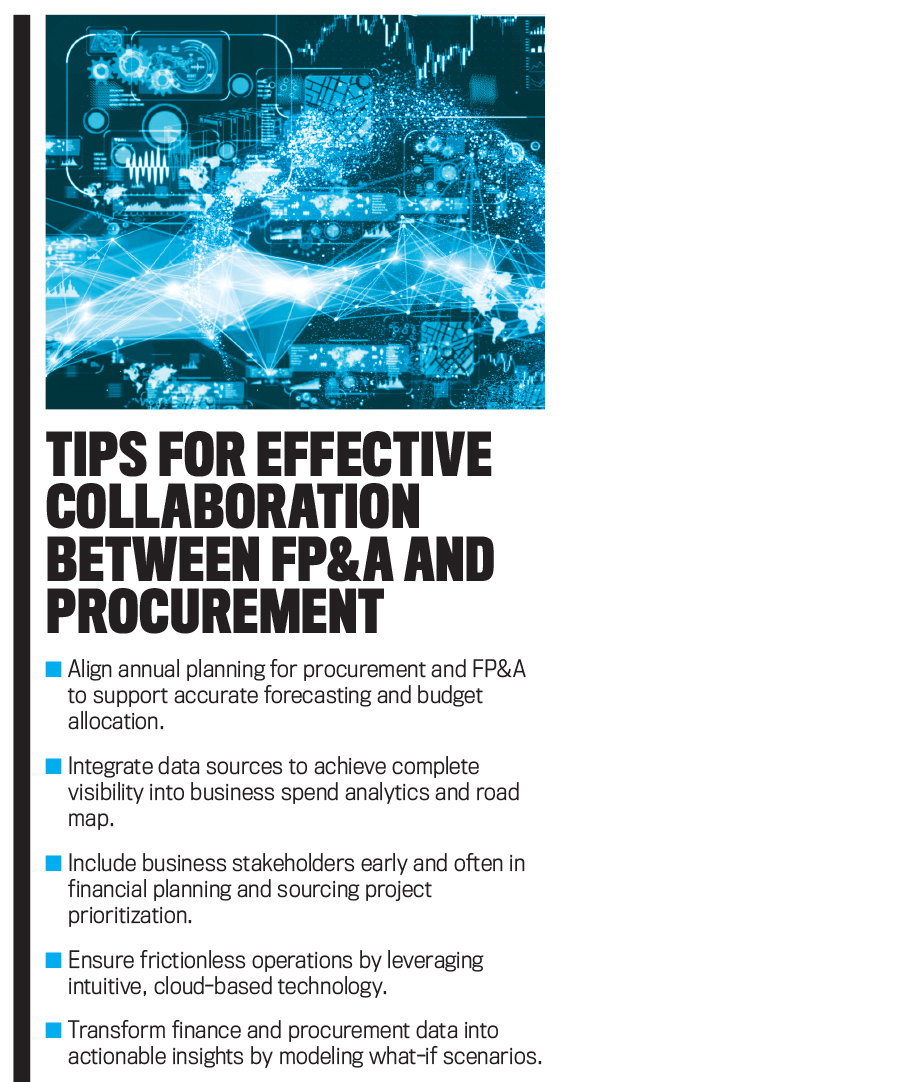

In High-Performance Sourcing and Procurement, a procurement executive at a large technology enterprise noted that, “It’s important too for sourcing and FP&A [financial planning and analysis] to work together on the front end of the annual planning process, to ensure everyone understands how projects will be funded and that there’s visibility into expected cost streams. It’s important for us to understand the business units’ road maps for sourcing, including upcoming projects, in a form that we can share and track with FP&A to make sure there’s a tie into their system. Financial surprises continue in this world for all kinds of reasons, and one needs to have a robust connection between sourcing and FP&A in order to mitigate some of those.” (See “Tips for Effective Collaboration between FP&A and Procurement.”)

As the pandemic revealed, rapid changes impact the entire global network of supply chains, and businesses must adjust, plan, and replan. While the pandemic is an extreme example of disruption, it isn’t a stretch to say procurement organizations must be prepared to handle a myriad of uncertainties—from trade restrictions to natural disasters to general market volatility. Being able to adjust on the fly and make decisions with accurate data will be critical.

PROCUREMENT’S FUTURE IN INNOVATION

Because procurement has historically been viewed by the business as a cost center, investment in the digitization of its processes has often lagged behind more revenue-centric areas such as product development or customer relationship management. This perception is changing as more and more business leaders recognize the exponential impact procurement can have in helping to accelerate innovation and transformation. The events of 2020, particularly the pandemic, have underscored the importance of elevating the sourcing and procurement organization alongside finance to become a truly strategic partner for the whole business.

Interestingly, procurement is already being called upon to unlock innovation. McKinsey & Co. found that 88% of surveyed enterprises have either begun or plan to begin joint innovation projects with suppliers to help create new opportunities. In A New Paradigm for Procurement, Epstein reflected that, “With all of the supplier management procurement has been doing, procurement professionals have developed an exquisite set of skills that have prepared them to expand to broader third-party orchestration. They understand how to manage their suppliers, what it takes to onboard, avoid risk, build relationships, and innovate with partners. Procurement, done well, creates value—both bottom-line improvements and enhanced top-line growth.”

For Greg Tennyson, chief procurement officer and vice president, corporate services at VSP Global, procurement strategy, and its role in innovation, is simple. “Think of the outcome you’re driving toward,” he said in High-Performance Sourcing and Procurement. That outcome should be “more spend under management, greater business impact from sourcing and procurement activity, and enhanced collaboration with suppliers to provide important sources of innovation.”

The same report notes that Owens Corning, the world’s largest manufacturer of fiberglass composites, measures every part of its global sourcing function against a “value creation index” that tracks cash and working capital metrics, including discounted cash flow along with hard savings. “It’s our annual ritual to establish goals for value creation,” said Gregg Focht, global IT sourcing leader at Owens Corning. “They’re generally stretch goals, and we’re constantly looking for new and creative ways to meet them.” Indeed, this focus on value has added up to impressive results. In 2016, the Owens Corning sourcing team was able to contribute millions of dollars of hard savings to the company, helping the organization achieve record levels of adjusted EBIT (earnings before interest and taxes) and free cash flow.

If there’s one certainty amid the many unpredictable circumstances in business, it’s that procurement is no longer a simple matter of logistics, transaction management, and cost containment, as many enterprises have historically viewed the practice. Going forward, enterprises that are most prepared to succeed will be leading the field in empowering sourcing and procurement with digital technologies. These are the enterprises that will help shape and optimize shifting business models and, most importantly, outperform the competition by leveraging new opportunities created throughout the value chain.

July 2021