Along with catastrophic health impacts, the global economy suffered a dramatic contraction of 4.3%. Trade volumes fell by more than 10%, and the price of oil fell to $41 per barrel, its lowest level since 2004.

While some sectors serving healthcare, technology, home shopping, and the Internet of Things did well, others like the hospitality and airline sectors fell into near ruin. While we aren’t out of the woods just yet, CFOs and other economy watchers are mildly bullish on a return to growth in the third quarter of fiscal year 2021.

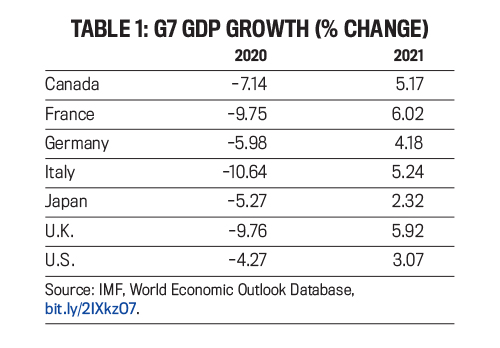

The International Monetary Fund (IMF) predicts the global economy will grow at 5.4% year over year. Of the G7 countries, France is expected to have the strongest rebound in 2021, followed by the United Kingdom, Italy, and Canada—though it’s important to note that these countries also suffered the greatest losses among the G7. In the U.S., gross domestic product (GDP) is expected to grow by 3.1% to $21.92 trillion in 2021, climbing from $20.80 trillion year over year.

Expectations for recovery are closely linked to an end, or at least a reduction, of COVID-19 along with the gradual reopening of economies around the world. As John Graham, a professor at Duke University and author of the quarterly CFO Survey, points out, senior finance executives in the U.S. see a light at the end of the tunnel by October 2021, with optimism benchmarks returning to more normal levels should COVID-19 get under control. “On a scale of 0-100, CFO optimism is roughly at 61%, which on average is typical for the U.S. economy,” says Graham. “To me, that means CFOs are seeing over the dark clouds right now and aren’t so seized up with anxiety or uncertainty that they can’t see a reasonable future on the horizon.”

The CFO Survey is a collaboration of Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta and was conducted in September 2020. Third quarter 2020 survey results show that CFOs expect company revenues to grow by 8.7% in 2021, compared to a decline of 0.2% in 2020. Similarly, full-time employment is expected to recoup most of its losses from 2020, with companies indicating that the number of full-time equivalents (FTEs) will grow by 2.2% in 2021.

Yet, as Graham explains, we’re likely to see some permanent structural shifts in employment by the end of the year, mainly reflecting the ability of large companies to redeploy work and apply enterprise-wide labor-saving technologies. (More than one in five companies will be investing in labor-saving technologies in 2021.) “Interestingly, if you look at small companies vs. large companies, small companies actually expect employment to be higher, and large companies, a little bit lower. Larger companies have the wherewithal to do two things—one is to buy more robots to automate and, therefore, not rehire [employees], whereas small companies don’t necessarily do that,” he notes. “If you have 10,000 employees, you could probably move people around or restructure jobs to more efficiently implement permanent job cuts.”

ATTRACTING AND RETAINING THE RIGHT TALENT

For CFOs, attracting and retaining the right talent will remain a priority and, as of October 2020, was the second most frequently cited concern for CFOs next to revenue and sales growth, according to the CFO Survey. For finance teams, the top talent CFOs are looking for are those with financial planning and analysis (FP&A) skills, explains Judy Munro, senior managing director at Robert Half. “For 2021, FP&A skills will continue to be at the forefront of demand. There’s no question about it.” She adds, “COVID continues to put pressure on CFOs to have any number of contingency plans in place for related impacts on demand, and scenario planning requires special skills.”

Because of COVID-19, more and more internal customers need greater insight into their numbers and a better understanding of profitability under various scenarios. At the same time, the ability to understand how to scale operations and tightly manage resources while companies contract and expand has become even more critical, Munro notes. “Companies are looking for people who have experience in managing under volatile situations, with change and transformation management in their backgrounds,” she says. “COVID has certainly highlighted the need and the importance of those kinds of skills. People are expected to be able to zig and zag and pivot through uncertain times, particularly in the area of liquidity and cash flow management.”

And it’s the availability of data that’s facilitating that, she says. “The software that is out there now is all about efficiency—gaining efficiencies in analysis and gaining efficiencies in processes. It’s now easier than ever to adapt cloud-based applications to ERP [enterprise resource planning] systems. That’s a huge focus for CFOs that I see continuing in 2021,” she says.

What’s important to note, according to Munro, is that what was once an advantage for big companies is now available to smaller companies across all sectors. “The biggest companies are already there, but because the software has become so affordable, smaller private companies are rapidly moving to the cloud. Once they’ve got that platform, the world of FP&A opens up to them, along with all kinds of business intelligence, data extraction, and process automation tools.”

Finally, in terms of how COVID-19 has impacted the finance team, the remote workforce has increased the demand for people who understand cyber risk, security, and data privacy, says Munro. For companies that don’t have a separate cybersecurity and data security department, it often falls under the role of the finance leader. “This is really bringing the expanding role of the chief financial officer in smaller companies into focus, and COVID has moved this whole conversation forward very quickly.”

UPS AND DOWNS: INVESTMENTS IN 2021

Respondents in the CFO Survey also indicated that companies in the U.S. will be realigning their investment strategies, reflecting a trend toward downsizing office space, excess production capacity due to the downturn in demand, and the need for liquidity. In roughly 70% of companies surveyed, CFOs expected no increase in investment in land and buildings, while 63% said they will be undertaking new investments in equipment and machinery. Of those companies that aren’t planning any additional investment in either area, a little more than half said they saw no need to expand capacity, with 46% citing uncertainty and the need to preserve cash as the reasons for no new investment.

For John Exline, CFO at Clark Investment Group, a private real estate development and investment company based in Wichita, Kan., this means a halt to increasing Clark’s holdings and projects in industrial, office, retail, and hospitality real estate. “We have no plans for hospitality or retail investment currently, due to COVID,” he says. “We still have one hotel in the San Francisco area, and it isn’t doing well at all. It’s at about 25% occupancy, and the cash just isn’t flowing.”

While unwinding Clark’s position in the hospitality and retail space would be ideal, the demand isn’t there yet. “It’s a tough time to try to sell hospitality right now, so as finance chief I’m tasked with coming up with some creative ideas. For example, one of the counties in California is looking at buying our hotel as an alternative for state housing.… Not a great sign of the times, though,” he adds.

With particular expertise in self-storage, however, the company has seen a positive fallout from the new consumer spending patterns that were supercharged because of the pandemic. Clark has developed more than 100 storage facilities, with more than 65,000 rental units, and is the largest private source of equity capital for storage development in the U.S.

“We’ve actually seen a rise in demand in that vertical,” Exline says. And it’s the online shopping that’s created the surge. “From the standpoint of the big retailers with online shopping platforms like Amazon and Walmart, for example, they’re scrambling for warehouse space. As CFO, I’m constantly looking for deals in that space.” Yet competition is intense, and prices are high. Exline says, “We’re being really picky, not just doing deals for the sake of it. I think we’ve looked at 75 deals this year and accepted one, where we usually look to do between four and six each year.”

For Plastic Technologies, Inc. (PTI), COVID-19 has meant expediting investment in machinery and equipment to keep up with a surge in demand. PTI is a midsized, privately owned company based in Northwest Ohio that designs and manufactures plastic packaging solutions, including home and personal care packages, and serves markets around the world. “Our revenue picture has been quite positive during COVID, particularly in the packaging of hand sanitizers,” explains J. Stephen McNally, PTI’s CFO (and Chair-Elect of the IMA® Global Board of Directors). “While we already had a strategy in place to increase investments in injection molding and blow molding equipment and technology, we upped the timing of those investments just to try to keep up with demand.”

As COVID-19 lingers into 2021, McNally notes, the greatest financial management challenge will be ongoing uncertainty around demand. “I’m bullish on our outlook for 2021, especially in our packaging operations, which in 2020 offset some declines in other areas like R&D [research and development],” he explains. “With COVID, however, there’s always uncertainty around how it will impact our customer base. You want to place some bets, but you also want to place smart bets.” Since COVID-19 began, explains McNally, “We have significantly upped our game in terms of overall budgeting and forecasting. We’ve done a better job engaging the cross-functional team and proactively identifying opportunities and risks.”

Going forward, McNally will continue to keep a close eye on cash flow—assessing key drivers on a more granular level as well as tightly managing receivables. “As a small to midsized company, cash matters. And we’re looking at it every day,” he says. “Companies are increasingly asking for extended terms, some up to 150 days. As CFO, it’s been my job to explain to our large clients what the implications are for a smaller company’s cash flow position. The smaller fish have to work much harder to negotiate reasonable terms on both ends, and we’ve put in place a strategy going forward to much more aggressively monitor receivables and proactively follow up with customers.”

M&A OPPORTUNITIES…AND CHALLENGES

CFOs will also be deep in the weeds of dealmaking and post-merger and acquisition (M&A) integration in 2021. Dykema’s 16th Annual Mergers & Acquisitions Outlook Survey found that company executives and M&A advisers are the most optimistic they’ve been in the 16-year history of the survey. The 225 survey respondents represent a cross section of executives and M&A advisers engaged in more than a dozen sectors, including automotive, energy, food and beverage, healthcare, retail, technology, industrial/manufacturing, and financial services.

Some notable results include:

- 71% of respondents say they are bullish about U.S. dealmaking over the next 12 months (through October 2021),

- 87% expect M&A activity involving privately owned businesses to increase over the same time frame, and

- 72% say their company (or one of their portfolio companies) will be involved in an acquisition in the next year.

According to Dykema, the rationale behind the numbers is that “both financial and strategic buyers see opportunities in a hobbled economy, and with significant uncertainty ahead, business owners may view this as an opportune time to cash out.”

According to Howard Johnson, managing director and Canada market leader at Duff & Phelps, it’s also an abundance of cash that will be driving the M&A agenda for many CFOs in 2021. “Right now, there’s about $3 trillion in cash sitting on the balance sheets of S&P 500 companies, and there’s a further $1.3 trillion of dry powder available among private equity firms, and that needs to be deployed,” Johnson said. “We’ll see some distressed activity in the sectors that have experienced hardship due to COVID, like hospitality, restaurants, and tourism, and possibly oil and gas. As a result we’ll see some discounted valuations there,” he adds. “On the opposite side, many companies have done quite well, like the tech companies, healthcare, and even consumer goods and services, and I expect those to be very active corporate acquirers.”

While each company will have its own objectives for M&A in 2021, most will be looking for top-line growth, explains Johnson. “They’re typically looking for new customers, new products, higher market share, and higher sales,” he notes, “as opposed to putting two companies together to reduce overhead and make a quick profit.”

For 2021, many CFOs will be focused on post-M&A integration in an entirely new environment. With COVID-19, explains Johnson, this poses unique challenges. “Poor post-acquisition integration is often cited as the principal reason for transaction failure,” he says, “and it comes down to the ability to integrate people and cultures.... When you’re dealing with people working remotely, it may be more challenging to obtain that post-transaction cultural fit, so many companies will be facing enhanced integration risk.”

Another side effect of COVID-19 could be on transaction values, says Johnson. “I think CFOs will be more cautious around the size of transactions they’re willing to do. So the large transformative acquisitions that really change the business are likely to be put on hold in 2021 until we see a return to more normal market conditions. But the smaller bolt-on transactions are likely to get a lift because they’re less risky in terms of deal failure.” Johnson goes on to add, “At the end of the day, CFOs will be looking ahead strategically as they always have, so even though there may be enhanced volatility over the next 12 months, CFOs will need to properly manage that risk.”

THE CFO’S ROLE IN 2021 AND BEYOND

Clearly the fate of companies in 2021 will depend on many unknowns. While the majority of CFOs see light at the end of the tunnel, cautious optimism prevails. Some companies will be holding off on expansion, while others will be scrambling to increase production due to continued demand driven by COVID-19. The pandemic has tested the mettle of most CFOs, regardless of what industry they work in, and it has permanently changed their roles. As Judy Munro explains, COVID has underscored the need for FP&A talent in the finance department, spearheaded by access to data. “The CFOs are embracing technology in a big way to gain the insights they need in highly volatile times.”

At the same time, explains Steve McNally, the job of the CFO is now more strategic than ever. “With COVID, our role as business partner has truly been elevated,” he says, “and for me, as a management accountant, the tools I have in my tool kit have proven invaluable. I love rolling up my sleeves and understanding operations, whether it be on the manufacturing side or on the engineering side. The more we, as senior finance executives, can understand the business, our customers, and suppliers, the more effective we can be as strategic partners.”

©2021 by Ramona Dzinkowski. For copies and reprints, contact the author.

January 2021