THE PURPOSE OF ACCOUNTING

Since its inception, accounting has taken as its purpose the delivery of information to help enterprises steward their precious resources. This purpose underlies the global movement toward sustainable business. A common definition of “sustainability” from the 1987 Report of the World Commission on Environment and Development, Our Common Future (often referred to as the Brundtland report), is “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”

Today, as wildfires rage and biodiversity losses release novel pathogens, both the notion of sustainable business and the consequences of its absence are manifesting within a single generation. As a result, proper identification, measurement, and management of an entity’s precious and finite resources are critical. It also enables the global community, speaking through governments and policy makers, to assess the impact an organization has on the commons and to develop sustainable economies.

Since the development of modernized accounting systems in the 1930s, infrastructure also developed to help corporate reporting professionals monitor regulations and standards, gather and summarize data, and produce reports. But the last step of the process, delivery to users, remained painstakingly antiquated. Even as technology advanced to electronic delivery, professionals have continued to deliver information created by accumulating data from multiple internal and external sources, feeding it into a spreadsheet or text document, creating an electronic version, and providing it to users. In parallel, receipt of this information by users has required stripping the information, re-inputting it into spreadsheets or platforms, and analyzing it with proprietary and commercial models.

In observing this highly inefficient process holistically, thought leaders have advocated for machine-readable systems that utilize tagging. Powerful technology applying defined taxonomies has enabled the efficient flow of accounting data from source to user. For example, the U.S. Securities & Exchange Commission, beginning in 2005, has mandated a widely accepted version of this tagging system, eXtensible Business Reporting Language (XBRL), for periodic reporting under U.S. securities laws. Since then, regulators and market participants have implemented increasingly sophisticated systems that can read Forms 10-K and quickly allow users to access, analyze, and visualize the reported data along with comparable entities and indexes.

Using this technology, however, has required standard setters such as the Financial Accounting Standards Board and the International Accounting Standards Board (IASB) to produce a taxonomy for every data item reported on the financial statements. Importantly, these technology systems can work equally well for sustainable business reporting and mainstream financial reporting (see A Digital Transformation Brief: Business Reporting in The Fourth Industrial Revolution). In short order, this technology may become an instrumental driver for the convergence of financial and sustainability reporting.

PATHWAYS OF SUSTAINABILITY

Modern accounting systems matured for a market based on tangible goods. They also matured in an era in which “maximizing shareholder profits” became a shorthand interpretation of corporate fiduciary duties.

At the turn of the 21st Century, thought leaders, policy makers, and a range of other stakeholders clamored for a reassessment of what the profession deemed worthy of attention. Two interrelated but distinct accounting pathways have emerged. Both pathways rest on a single proposition: If human systems account for the right things, we can allocate our limited and precious resources in a way that avoids collective waste and instead builds collective value and healthy economies.

The first pathway incorporates multistakeholderism and aims at the concept of value preservation and creation at the individual entity level. This perspective considers the movement toward a market based on intangibles and the contributions of all stakeholders (resource contributors) to performance and value. Ocean Tomo’s most recent research, for example, reports that today, tangible assets represent only 10% of S&P market value.

Proponents of sustainable business reporting often look to this metric as evidence that accounting must evolve to provide information about committed management and talented employees, customer loyalty, supplier collaboration, reputation, and investor trust. Management’s willingness to identify, measure, and manage these factors reveals its attention to material matters that affect risk, resiliency, and innovation (see “CFOs as Value Creators”).

Proponents further assert that investors (particularly long-term asset managers) are estimating and trading on this enterprise-wide value. Much accounting literature assumes that “users” or “investors” are the same. Today, however, the largest asset managers and pension funds, considering the needs of asset owners that will hold low-turnover index funds and exchange-traded funds for decades, are seeking to screen investees based on their willingness to address sustainable business risks, opportunities, and strategies.

For example, in his 2020 annual CEO statement, Larry Fink announced that BlackRock, the world’s largest asset manager, would move to exclude investees that fail to report on climate-related risks, and he pointed to Sustainability Accounting Standards Board (SASB) standards specifically. Similarly, the Business Roundtable of more than 180 U.S.-based CEOs stated that the purpose of a business organization is to manage and perform in a way that preserves and produces value for all of its stakeholders, not only traditional lenders and equity investors.

The second pathway focuses on the effects or impacts of an organization’s activities on external stakeholders and the global community. The United Nations’ Sustainable Development Goals (SDGs) are a primary example. Organizations voluntarily report periodically on their progress in furthering these goals. Proponents of this approach seek new ways to account for the effects of organizations’ activities on the commons. The SDGs, by design, follow an impact methodology, creating a need for additional guidance: How does one company measure its progress and impact on the larger world? The challenge of measurement and reporting on the SDGs is an area of significant thought-leadership research.

Corresponding to investor demands to modernize accounting, new organizations, frameworks, and guidelines emerged. The first major player was Amsterdam-based Global Reporting Initiative (GRI), founded in 1997. Generally following impact accounting concepts, GRI’s guidelines aim to provide information not only for conventional investors but also for stakeholders in nonfinancial metrics. Another organization, the Carbon Disclosure Project (now formally known only by the acronym CDP), founded in 2000, took an alternative route on the concept of disclosure.

Organizations submit responses to an annual survey, and CDP assigns ratings and conducts further research on submitted data. Today, corporate organizations make an annual response to the CDP survey a priority. Although CDP is best known for its work on greenhouse gas emissions, energy, and climate, it also uses its survey methodology around water, deforestation, and supply chain.

The next decade saw the addition of two new organizations. First, the International Integrated Reporting Council (IIRC), founded in 2010, advocated its six-capitals framework. (See “Multicapital vs. Multistakeholder?” for the applications of this language.) Unlike other groups, IIRC didn’t advocate for specific reporting but articulated principles on value creation and preservation.

SASB, founded in 2011, initially took a U.S.-based view and issued guidelines to enhance disclosures in Forms 10-K. Reflecting the view that sustainability enhances financial performance, SASB standards aim specifically to inform investor decision making. SASB, which is restating its conceptual framework for global use, doesn’t directly reflect an impact on accounting methodology. Preparers and auditors report the appeal of SASB’s industry-based approach that focuses reporting efforts on the most relevant ESG areas and metrics.

SUSTAINABILITY ACCOUNTING AND REPORTING

Responding in 2015 to concerns over the financial risks related to climate change, the global Financial Stability Board answered calls from influential business leaders by establishing a special Task Force on Climate-related Financial Disclosure (TCFD). The task force (and others’) analyses characterize the financial risks related to climate change as foreboding, framing the issue not as a matter of “if” but of “when” and “how much.”

Research on economic risks related to climate change shows that society’s responses have significant trade-offs: Either the risks will manifest as increasingly severe and costly losses due to weather events, or they will be incurred by proactive transitional costs that also represent opportunities from transitioning to carbon neutrality. Completing its mission by 2018, the TCFD issued recommendations for 11 points of disclosure related to corporate governance, risks, expected costs, and opportunities related to climate change. Today, the U.K.-based Climate Disclosure Standards Board (CDSB) advocates for the adoption and implementation of the TCFD recommendations, which are gaining general acceptance.

By 2020, sustainability reporting (or integrated reporting, considering some level of convergence) had indeed become mainstream, as evidenced by the annual research by the Governance & Accountability (G&A) Institute, Inc. For 2019, the G&A Institute reported that 90% of the S&P 500 produced some form of an external report, an all-time high (see Figure 1).

The system-wide challenge, however, is that this reporting isn’t standardized. Reporters are issuing information that follows aspects of different reporting guidelines such as SASB, GRI, CDP, TCFD, or SDGs or in response to the proprietary surveys of MSCI and Sustainalytics. Data aggregators such as Bloomberg, Refinitiv, and Datamaran gather, analyze, compare, and deliver this ESG data, along with other financial, regulatory, and web-based information to the market. This voluntary, patchwork system has evolved in response to market demands but too slowly for some as they observe a world at risk.

Preparers spend time evaluating different frameworks and understanding the implications of different sustainable business indicators. Auditors need consistent standards to issue assurance. Lenders, long-term and institutional equity investors, and other resource providers want information for their own capital allocation decisions. Management needs information for minimizing risks, identifying opportunities, building valuable relationships, and executing strategy for resilience.

Contrast this with mainstream financial reporting, which has developed over decades into only two main systems, U.S. Generally Accepted Accounting Principles and International Financial Reporting Standards (IFRS). With generally accepted and regulatory endorsed standards, practitioners, auditors, analysts, lawyers, asset managers, and other stakeholders know how to access guidelines—whether on paper, via electronic databases, or digitally. Comparatively, sustainability reporting is described as “still the Wild West.” This lack of infrastructure has made connecting financial and sustainability reporting an expensive challenge. Yet it’s what the range of stakeholders to the information life cycle are demanding.

EUROPE TAKES MAJOR STEPS

Since 2017, the movement toward convergence has accelerated, with Europe primarily leading the way. This movement is occurring at every level—governmental, regulatory, standard setter, and professional associations.

In June 2017, concurrent with the effective date of Directive 2014/95/EU, the European Commission (EC) published nonbinding guidelines on nonfinancial reporting to help organizations implement the directive and disclose sustainable business information in a way that would achieve some comparability. And in 2019, the EC published additional guidelines on reporting climate-related information that largely endorsed, albeit unofficially, the CDP survey methodology and TCFD reporting guidelines.

The EC also adopted, in 2018, a 10-point action plan to support financing of sustainable business activities. Pursuant to this action plan, the EC established a technical expert group to assess four areas: (1) establishing new standards around the definition of “environmentally sustainable activities,” (2) green bonds, (3) climate benchmarks, and (4) related disclosures.

Following from the technical expert group’s work, two major acts with interrelated effects were approved. First, Regulation (EU) 2019/2088, the Sustainable Finance Disclosure Regulation, imposes new disclosure obligations on the financial services industry regarding the use of ESG factors in their respective assessment processes. Certain disclosures relate to the financial institutions as entities, and others relate to the financial products they offer.

Second, approved in June 2020, Regulation (EU) 2020/852, referred to as the “Taxonomy Regulation,” establishes definitions that help market participants classify and describe activities by the extent to which they are environmentally sustainable. Upon implementation, the Taxonomy Regulation will establish a system-wide common language for an investment product’s greenness. Following these regulations, three major EC authorities—European Securities and Markets Authority, European Banking Authority, and European Insurance and Occupational Pensions Authority—are coordinating their work to produce authoritative updates to existing rules.

New regulations on financial market participants create burdens on reporters. In order for financial institutions to meet their obligations, they’ll need investees to provide their sustainable business data. That is, raising capital from EU countries will now require corporate entities to provide the data so that the financial institutions can comply with reporting requirements for their portfolios. To meet this moment, the EC has directed the European Financial Reporting Advisory Group (EFRAG), through its Steering Group, to explore the next steps.

Under this authority, EFRAG has established a task force to perform the technical preparatory work to determine the right organization to be charged with delivering European nonfinancial reporting standards. The result of this work could be a recommendation for the establishment of an entire new body to set reporting standards.

Yet one challenging, unsettled point remains in that investigation: Should sustainable business reporting reflect the needs of investors, lenders, and mainstream stakeholders who assess performance and value in monetary terms? Alternatively, should nonfinancial reporting reflect the effects of an entity’s performance on other external stakeholders and other users?

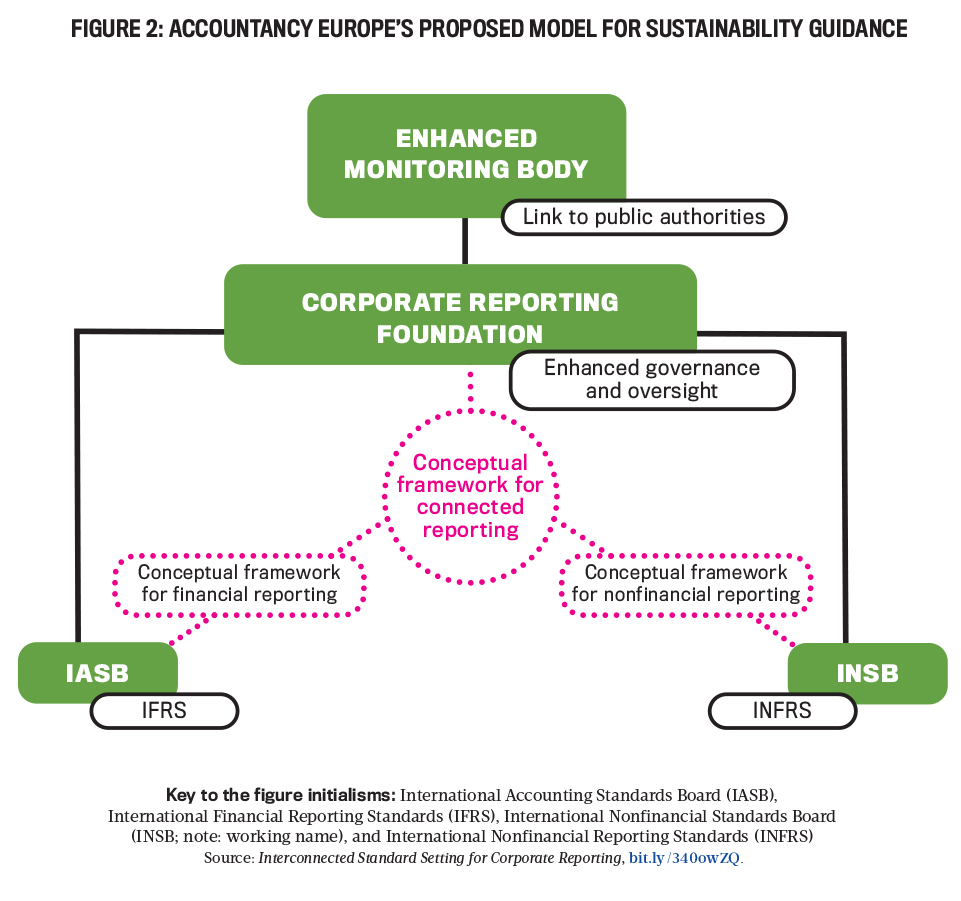

Many believe that the right place for standard setting is a new body under the IFRS Foundation. The IFRS Foundation issued a consultation paper ; for public comment on the prospect of establishing a parallel board to the IASB to issue authoritative guidance on sustainable business information. The influential International Federation of Accountants (IFAC) publicly endorsed this approach. Citing the goal of an eventual integrated set of standards, Accountancy Europe also endorsed this approach by advocating for the monitoring model shown in Figure 2.

On the sustainable business reporting side, the major standard-setting and framework organizations—CDP, CDSB, GRI, IIRC, and the SASB—facilitated by the Impact Management Project, the World Economic Forum, and Deloitte Touche Tohmatsu, executed a “Statement of intent to work together towards comprehensive corporate reporting," with the understanding that too much confusion remains in the marketplace and that working collaboratively toward an aligned, comprehensive reporting system will facilitate their shared goals.

Connected with this initiative, each of the main organizations, IIRC, SASB, and GRI, are submitting amendments to their frameworks and standards. Most notably, SASB, which built its framework with Form 10-K as a target, has issued “Proposed Changes to the SASB Conceptual Framework & Rules of Procedure.” In late November 2020, the IIRC announced a formal intention to merge with SASB with the establishment of a new Value Reporting Foundation. These changes, if adopted, will help SASB facilitate global adoption of sustainability accounting standards in a way that aims for integrated value reporting.

TECHNOLOGY ACCELERATES CONVERGENCE

Many view the fragmented and divergent reporting ecosystem as a costly impediment for accountants and the companies, clients, and public that they serve. IFAC estimates that fragmented regulations result in compliance costs of $780 billion annually to the financial sector alone. At the same time, the world is experiencing a data revolution that can enable the profession to provide trustworthy, auditable, and accessible machine-readable information, capable of automatic update and that applies to financial and sustainable business information equally. Technology can create the infrastructure to enable comparison, convergence, and better measurement of the indicators of performance and value. Such changes can lead to significant compliance savings by all participants along the data life cycle.

An initiative for a system-wide solution or the creation of a global taxonomy registry and an open taxonomy innovation platform is being considered as part of the work by the EFRAG task force. It will require an effective cooperation between regulators, standard setters, preparers, and market participants. Accounting innovation will enable the profession to revitalize itself for the next generations—that is, remain sustainable—for a world of quickly changing risks (such as a pandemic) and demands for quality information.

Although Europe is currently the primary driver, its movement is on the precipice of fostering change in global markets and the accounting profession. This movement toward streamlining the number of reporting regulations and disclosure standards, fostered by automation, can overcome the pricey fragmentation issues, including the separation of financial reporting and sustainable business reporting.

Rather than stand still, accounting is adapting in a way that will facilitate the identification, measurement, and management of value through the contribution of multiple stakeholders. It will also lead to a better understanding of the relationship between an organization’s activities and impacts on the commons. In this way, accounting will continue to deliver on its fundamental, centuries-old purpose, fostering good decision making on the responsible use of precious resources for successful ventures.

January 2021