To keep up in a climate of increased data accessibility and rapid change, business leaders, including many CFOs and controllers, are nurturing an agile culture. This involves going beyond traditional project management practices to adapt a popular software development approach—agile methodology—to their business processes. Teams reap even greater benefits by leveraging a branch of agile, the scrum framework, as it enables teams to employ techniques that make implementing agile even easier.

As the finance and accounting profession progresses along its transformation journey from data stewardship to value creation and decision support, the need for the agile finance function has emerged. The agile finance function creates value through the following characteristics:

- Scalable, efficient operations

- Transparent, accessible data and metrics

- Frequent inspection to ensure fit-for-purpose insights

- Quick, responsible adaptation to change

- Empowered, capable, multidisciplinary teams

These attributes, when paired with advancing technologies, position finance to streamline day-to-day tasks, accelerate project delivery, bolster the quality and relevance of analytical results, and foster innovation and inclusion among staff.

AGILE AND SCRUM 101

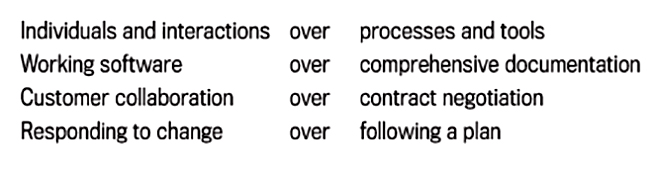

Agile methodology is a software development life cycle that focuses on iterative, incremental delivery by self-organizing, cross-functional teams. This people-centric, results-oriented approach to software development has become increasingly popular in recent years and has proven adaptable for business teams delivering products or projects of any type. The authors of “Manifesto for Agile Software Development” wrote that agile methodology values:

Although there are many branches or subsets of agile methodology, for example, Lean and Kanban software development, dynamic systems development method, or feature-driven development, scrum is one of the most popular branches of agile methodology and is widely regarded as one of the approaches most easily adaptable to projects other than software development.

According to Ken Schwaber and Jeff Sutherland, the authors of The Scrum Guide, scrum is “a framework within which people can address complex adaptive problems, while productively and creatively delivering products of the highest possible value.” As the scrum framework is founded on empiricism, it’s upheld by three pillars: transparency, inspection, and adaptation. In addition to rules intended to maximize value and efficiency in delivery, there are three primary components of the scrum framework: the scrum team, scrum events, and scrum artifacts.

The scrum team: In scrum, there is no project manager. Scrum team members are the product owner, development team, and scrum master. This self-organizing, and often multidisciplinary, team defines how its work should be delivered and possesses all the skills and competencies required to complete the work. The product owner is accountable for overall product value delivery and prioritizing the backlog to maximize that value. The development team actually works on the product (be it an ad hoc analysis report, fiscal plan, or new procedure). The scrum master ensures adherence to the scrum process and removes impediments from the development team’s path.

Scrum events: There are five scrum events: sprint, sprint planning, daily scrum, sprint review, and sprint retrospective. The sprint acts as a container for all other events and is the time-boxed iteration during which an increment, or component, of the final product will be delivered. Sprints are a maximum of one month in length, and common sprint lengths are one, two, or three weeks. All other sessions or scrum events are held to enable transparency and to present regular opportunities to inspect the product and adapt in real time, as deemed appropriate.

Scrum artifacts: The three scrum artifacts are the product backlog, sprint backlog, and increment or sprint goal. The product backlog is a prioritized list of everything needed in the final product or over the life of the project. A sprint backlog is a subset of the product backlog and represents the product backlog items, or features, that will be progressed during the sprint as well as the plan required to complete this work. The increment or sprint goal is the aggregate of all product backlog items that will be completed during the sprint with their associated value.

VALUE DELIVERY IN ACTION

Finance and accounting teams are already delivering value with agile and scrum. Here are a few examples of agile and scrum in action.

Financial planning and budgeting: Rather than developing static annual plans and holding teams accountable for delivery against those plans, a scrum approach to fiscal planning begins with a full-year plan, treating that plan as a true estimate. Management accountants, in partnership with operational leads, update the full-year plan by maintaining a 12-month outlook on a rolling basis or allowing for quarterly updates.

Performance, then, would be judged against quarterly plans that account for external environmental factors, market conditions, and changes in risk profiles. This model would allow for regular inspection of the product—in this scenario, the budget—and enables adaptation where deemed appropriate.

Finance operations: Nearly a decade ago, well before the modernization of finance and accounting gained traction across the profession, one of Scrum Inc.’s leaders determined that the absence of finance tasks from its backlog was a company impediment. The team identified all accounting activities, organized them by process type (for instance, account reconciliation, vendor payment, or reporting), and assigned all tasks to the backlog. The product owner’s assignment of cyclical and ad hoc tasks from the product backlog to weekly sprint backlogs enabled the team to reduce handoffs between departments, increase visibility to activities, and eliminate silos between accounting and operations.

Project management and analytics: The most common application of agile and scrum is for complex initiatives with unknown solutions and high reliance on feedback from the end users. In finance and accounting, this can be found in project management when implementing new digital technologies, enhancing existing systems, modifying processes to meet new regulatory requirements, or delivering ad hoc financial reports. Further, as the finance function continues to strengthen its analytics capability, scrum delivery could be the perfect delivery mode for efficiently responding to unplanned requests for insights that inform decision making.

UPSKILL WITH AGILE AND SCRUM

Businesses must often make decisions quickly to maintain a competitive advantage and, in many instances, to survive. To support these efficient decisions, organizations are redefining their approach to operational delivery and embarking upon an unprecedented number of transformation initiatives, or projects, to elevate outcomes, maximize value, and expedite daily activities.

This shift in focus has strengthened the need for agile culture and in-house project management expertise. Management accountants, with their expanding roles providing strategic planning and operational decision support, can fill that need by developing agile and scrum skills—as well as applying these principles and techniques to finance and accounting practices. Whether you’re a subject matter expert who works with IT to define requirements for changes to the accounting application you use daily or an analyst processing data sets to inform make-or-buy, staffing level, or financial risk decisions, increasing your knowledge of agile and scrum will prove invaluable.

January 2021