In a series of roundtables and interviews, we received input from more than 75 CFOs and finance executives in the Netherlands. More than 100 finance professionals, including CFOs, finance directors, and finance managers (48%); business controllers (24%); financial controllers (8%); and finance transformation managers (4%) as well as other senior finance professionals (16%) in several organizations in the Netherlands, completed the survey. (As the 18th-largest economy in the world and the sixth largest in the European Union, the Netherlands is a valuable source of business insight. It ranks among the top five global leaders in innovation and is home to several large multinationals such as Shell, Philips, and Heineken.)

This survey was designed to obtain more insights into the current state of technology adoption in finance departments, as well as the challenges faced by finance departments and finance professionals when adopting new technologies. Finance professionals that participated in earlier roundtable sessions and (CFO) conferences were invited to participate.

Respondents come from several organizations, including multinationals, mid-cap companies, and large private organizations as well as some scale-ups; respondents were working in several industries, including manufacturing (28%), nonfinancial services (44%), financial services (13%), and the public sector (including healthcare and education; 15%).

DIGITAL TRANSFORMATION AND FINANCE

Digitalization has affected all kinds of business activities, including business models and supply chains, as well as support functions such as human resources and accounting. This shift to a digital, data-driven culture enables various new forms of cooperation among companies, customers, and employees, leading to new product and service offerings. At the same time, digitalization requires companies to reflect on their current strategy and to explore new business opportunities. This results in a broad set of responses to the change.

Our roundtable discussions indicate that when business leaders are dealing strategically with external trends, digital transformation requires drastic steps, as stated by one of the CFOs: “We decided to divest a large part of our core business to free up time and resources to develop new digital business models.”

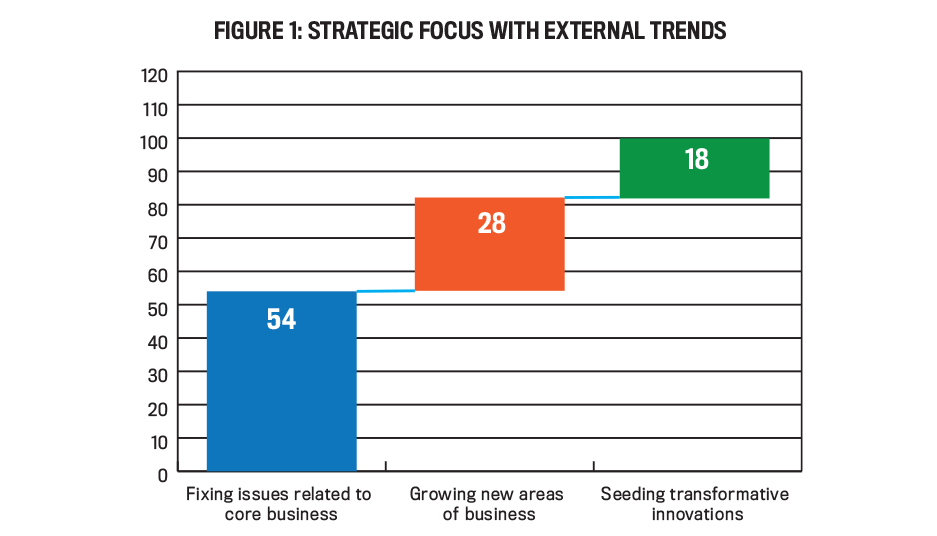

We found substantial differences across organizations, but on average, organizations focus on fixing issues related to core business (54%) followed by growing new areas of business (28%). Seeding transformative innovations is relatively limited compared to the other areas (18%). (See Figure 1.)

We found no differences for industry or ownership, suggesting that these strategic priorities are set by the top management of the organization rather than being mandated by industry developments or other external industry forces (such as degree of competition, industry associations, or availability of data).

We also asked respondents whether finance is involved in digital strategy initiatives and what part of the workforce in finance is involved in new digital strategy initiatives. While finance started out as a strictly administrative discipline, it has evolved into a function that helps organizations drive performance, implement transformations, and realize the organization’s strategic ambitions.

Our roundtable discussions suggest that the early involvement of finance in new digital strategic initiatives is key for adequate risk management and compliance and a core aspect of the finance department’s role in increased business leadership. One participant said, “If we [in the finance department] do not set up an adequate system of internal controls for these new digital initiatives, who will?”

Our results show that only 6% of the respondents (completely) disagreed with the statement that finance is very much involved in digital strategy initiatives. Another 54% of the respondents were neutral (ranging from “somewhat disagree” to “neither agree nor disagree” to “somewhat agree”). These results suggest that in more than half of the organizations, finance isn’t yet fully involved in digital strategy initiatives. Our survey responses indicate that finance’s involvement in digital strategy initiatives isn’t affected by the size of the organization or by industry.

We also asked respondents how finance compares to two other departments in the organization in regard to digital strategy. Our roundtable discussions suggested that other departments (specifically marketing and supply chain management) are currently more involved as they’re closer to the value-adding activities of the company.

For these other departments to recognize the value of strategic involvement from finance, attitudes within the finance departments themselves may need to change. One CFO acknowledges, “We were known as the ‘No’ department. As a result, nobody asked us for input because we would raise issues instead of providing solutions. This attitude has changed completely, in part because we hired a number of new people to get involved with and help the business.”

Survey respondents indicate that on average, more than 40% of the marketing workforce and 35% of the supply chain and operations workforce are significantly involved in digital strategic initiatives, compared to approximately 20% of the finance department. Not surprisingly, organizations that focus on seeding digital initiatives devote a higher percentage of their workforce in all departments (finance, supply chain and operations, and marketing) to new digital strategies.

DIGITALIZATION OF FINANCE DEPARTMENTS

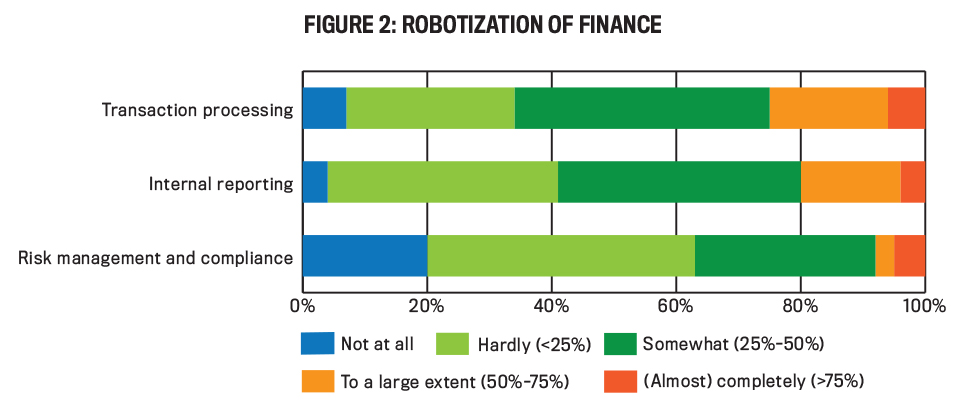

In addition to shaping digital strategy, finance departments are also tasked with taking up new technologies that affect finance operations directly in order to increase efficiency and to free up time for the business partner role. First, we focus on robotic process automation (RPA) to see whether it has replaced standardized, labor-intensive activities (see Figure 2).

Roundtable participants indicate that they’re currently experimenting with RPA or have already successfully proven the business case for RPA, though they follow different approaches for implementation. Most participants said they experiment with RPA in highly standardized processes, based on a “standardize first, robotize later” approach.

Others see RPA as an excellent opportunity to overcome inefficiencies in processes without the need for further standardization. As one CFO indicated, “The inefficient processes will benefit the most from using RPA. In those processes, people waste time on tasks that add no value.”

Our results show that transaction processing is currently the most automated/robotized activity (24% of the organizations have automated more than half of their activities in this area), followed closely by internal reporting (20%). Risk management and compliance appear to be more difficult to automate, even though some respondents indicate that fraud identification is an area where automation and robotics may be useful.

Respondents also indicate that these activities are likely to be further automated or robotized in the near future: For example, 80% of the respondents expect that more than half of the activities in transaction processing will be automated or robotized within the next three years. This suggests that large efficiency gains may be realized in the next couple of years.

ADOPTING EMERGING TECHNOLOGIES

In addition, our roundtables and survey provide some insights into the relatively low acceptance rate of some technologies that have been commonly mentioned as useful for the finance department. Finance departments in many larger, incumbent organizations are expected to navigate through the continuous challenges presented by their often-scattered legacy IT landscape.

While new enterprise resource planning (ERP) solutions often include elements from separate software packages (e.g., visualization software, automated reports, etc.), these solutions may also render previously developed technology solutions useless. This triggers a fear of investing in technology that will turn obsolete before it pays off. Upgrading ERP software packages may also require significant resources in terms of purchasing costs and implementation efforts. One finance transformation officer reported, “The IT resources required by ERP upgrades are diverted from other finance digital initiatives, so we risk moving slower in those areas.”

Our results indicate that, among those technologies discussed, automated reports (used in 70% of the organizations) and visualization software (45%) are used most intensively; they appear to be established new technologies. On the other end of the spectrum, we find blockchain (4%), which is hardly used in finance departments despite its potential for disruption.

While blockchain is also rarely considered in organizations, several organizations are currently considering process mining (41%), which uses algorithms to analyze event log data (for example, transactions recorded in ERP systems) to understand the way operational processes are executed.

Process mining aims to improve process efficiency, analyze bottlenecks, explain process deviations, and confirm the adequacy of internal controls. Few organizations have implemented and subsequently abandoned new technologies (3% implemented and abandoned visualization software; 2% implemented and abandoned automated reports).

Many finance departments realize they will have to take a “both…as well as…” approach if they’re to succeed in their digital transformation. In other words, finance departments have to find a delicate balance in using the available resources both to optimize the legacy landscape as well as to embrace new digital technology.

Organizations that focus more on seeding transformative innovation use more visualization software and more automated reports in the finance department. Automated reports provide finance professionals more time for value-adding activities; visualization software provides the opportunity to derive insights from data and make better business decisions. This suggests that organizations that invest in digital strategy initiatives also use new technologies in the finance department more often; whether these new technologies drive the implementation of new digital strategies or whether these technologies follow from new digital strategies is open for discussion.

KEY CHALLENGES

We also asked what the main challenges are for organizations when implementing digital transformation in their finance departments. Roundtable discussions suggest that organizations differ in their overall approach to the finance transformation. One CFO summarized it as follows: “One source, one definition, one truth. We need to unify the landscape and make sure it all adds up.”

Some organizations see it as a program; they define a vision for their digital transformation and design a road map with milestones to measure progress. This road map shows what needs to be done and when, in order to meet finite overall goals. Others indicate that finance transformation is likely to continue for the foreseeable future. As one of the transformation officers explained, “We stopped calling it a program. Finance transformation is a continuous journey.”

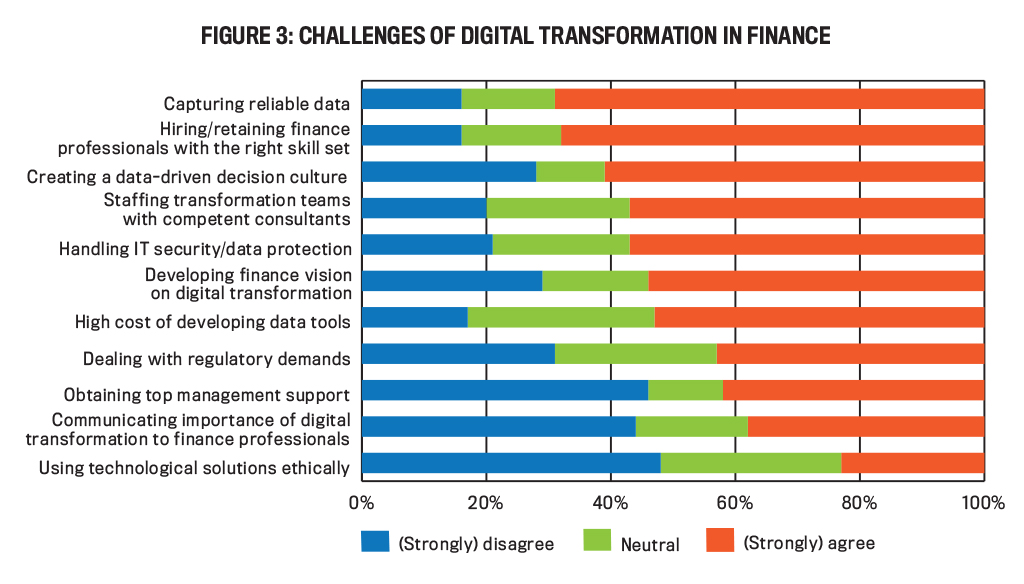

As Figure 3 indicates, key challenges for the digital transformation of finance in organizations are reported as capturing reliable data (problematic in 69% of the organizations), hiring and retaining finance professionals with the right skill set (68%), and—probably as a result of the previous two issues—creating a data-driven decision culture (61%). Using technological solutions ethically (problematic in 23% of the organizations), communicating the importance of digital transformation to the finance department (38%), and (lack of) top management support (42%) are seen as less of a problem.

This suggests that most finance employees and their managers understand the importance of digital transformation, and communication and top management support aren’t considered issues. This is a change from about five years ago, when top management support for digital transformation in the finance department was lacking and digital transformation was seen as “an IT thing.” At this point, the transformation appears to be held back mainly by practical and operational challenges such as a lack of reliable data and a lack of skilled finance professionals.

CHANGING COMPETENCIES

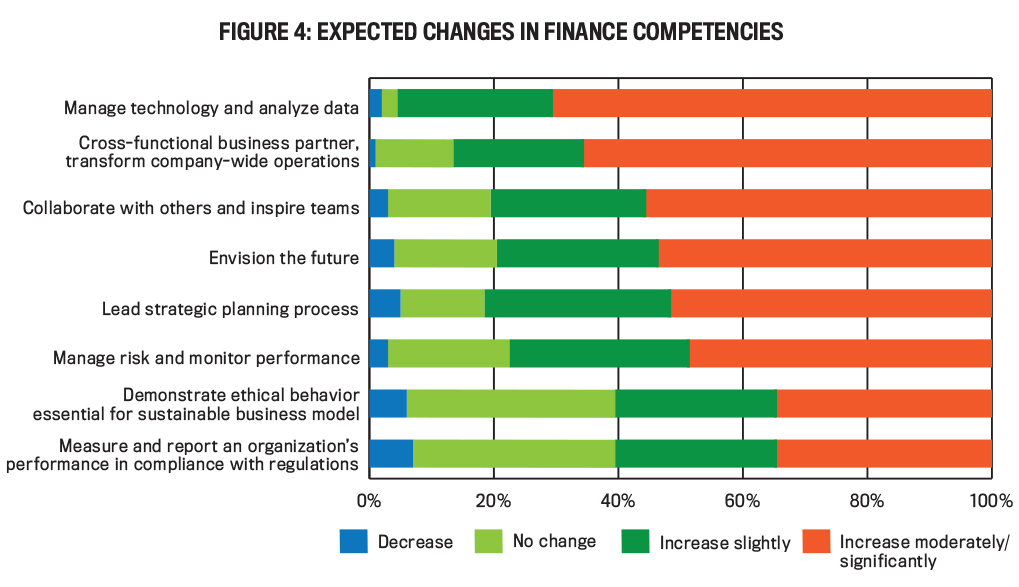

The ongoing digital transformation of the finance department may require new competencies for finance professionals. It’s been argued that some of the traditional finance activities will become less important while new value-adding roles and activities are emerging. Based on the IMA® (Institute of Management Accountants) Management Accounting Competency Framework, we asked respondents whether they expect a change in finance professionals’ competencies in the next three years (see Figure 4).

While roundtable participants agree that new capabilities and competencies need to be added to the finance department, there’s no consensus yet on how to go about it. Old-guard accountants have excellent core accounting skills but may be resistant to new technologies while younger hires are more tech-savvy but tend to be weaker on the fundamentals. The challenge for many organizations is attracting new professionals with different skill sets and training them in core accounting skills while at the same time encouraging more established finance professionals to add new technological capabilities to their skill set.

In addressing specific competencies, the respondents think that “manage technology and analyze data” (71% expected a significant increase), “cross-functional business partner and transform company-wide operations” (66%), and “collaborate with others and inspire teams” (56%) will become more important over the next couple of years.

But it should be noted that even the competency that’s least likely to increase significantly in importance (“measure and report an organization’s performance in compliance with regulations”) is still expected by 35% of the respondents to become more important. Overall, this suggests that there will be increased demands on finance professionals: They need to enhance their partnership with the business, increase their soft skills, manage risks, guard the reliability of data, ensure compliance with regulation, and so on.

KEEPING CURRENT

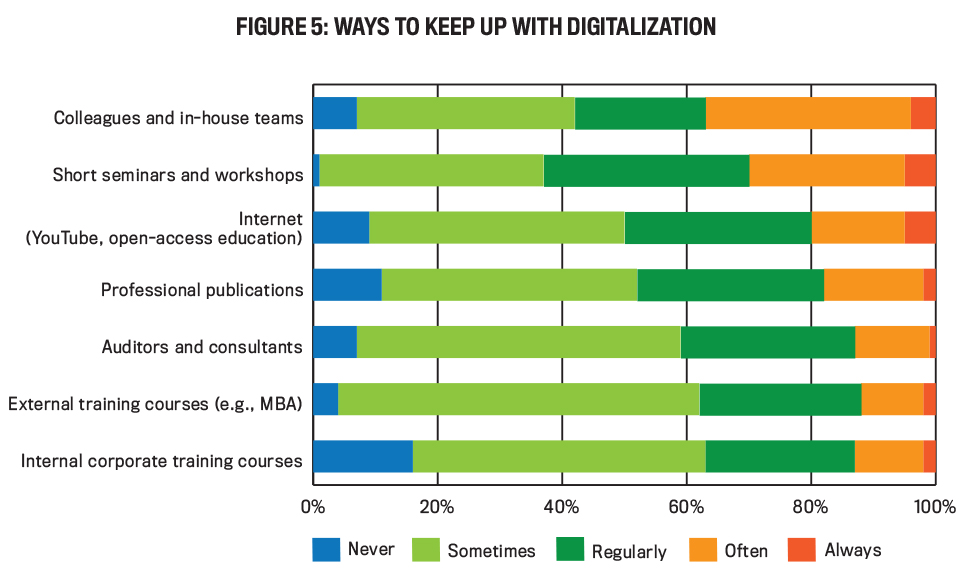

Finally, we asked the respondents to indicate how finance professionals stay ahead of developments in digital transformation (see Figure 5).

Our results show that finance employees most frequently use short seminars and workshops (63% answering regularly, often, or always); colleagues and in-house teams (58%); and web-based resources (e.g., YouTube, open-access education such as Coursera, etc.; 50%) to keep up with digital transformation. Internal corporate training courses (37%) and external training courses (e.g., MBA program; 38%) are used less often. This suggests that there’s a lack of structural investment in finance department professionals to keep them up to speed in this digital era; training appears to be rather ad hoc and fragmented.

In fact, while roundtable participants recognize the need for established finance professionals to acquire new skills and knowledge, most CFOs seemed to lean toward just hiring new talent. As one CFO revealed, “I have replaced 35% of my staff in the finance department in the last two years.” While recruiting new talent and replacing finance department employees who are unwilling or unable to make the change is one way to acquire skills and competencies quickly, it isn’t likely to be a viable long-term strategy. Few organizations can afford to replace one-third of their finance department every two years.

Several CFOs said they’re trying to provide learning opportunities within their departments to make sure that their current staff can be developed and retained. As one CFO explained, “I have arranged for external training for two of my finance department employees. They now understand the data much better; in fact, they understand it so well that other employees (from finance, yet also marketing) have asked whether they can follow the course as well, as they can see that it provides value to the business.”

Our roundtable contributors recognize that the acquisition, development, and retention of finance professionals are going to be key issues for CFOs in the near future. Most participants in the roundtables stressed that they thought the finance transformation can only succeed if it’s a team effort. Rather than trying to find superstar finance employees by requiring each individual in the team to possess all the skills and competencies described previously, it’s probably more feasible and effective to select a variety of individuals with diverse capabilities and skill sets to build a super team. This means that the CFO will have to lead and actively manage the change process in the finance department.

PREPARING STRATEGICALLY

Digital technologies are affecting business operations as well as finance department activities, and becoming tech-savvy is a key challenge for finance professionals. Our study confirms that CFOs and other finance professionals are aware of these challenges and devote considerable time to manage them. Organizations seeking to maximize the benefits from technology should lay out a few key strategic plans:

Drive digital strategy initiatives: Make sure that finance is involved early in digital strategic initiatives, even if improving current operations appears key, both to ensure that digital processes are clearly defined and to remain relevant in the future.

Focus on value-adding technologies: Embark upon technological initiatives that help to increase the efficiency and/or effectiveness of finance, with a focus on those projects that are likely to create value. In addition, strike a balance between upgrading current legacy systems and implementing new technologies.

Accelerate closing the skills gap: Develop new skills and competencies (e.g., managing technologies and analyzing data, operating as a cross-functional business partner, and transforming organization-wide operations), yet don’t lose sight of the “regular” finance and accounting skills.

Manage the finance team: It’s unlikely that one individual possesses all the new skills and competencies. CFOs should focus on building a team of individuals who jointly have all the required skills and competencies, which may also mean that the current finance teams need to be rebalanced to implement new skills.

Develop a data-driven decision culture: CFOs and senior finance professionals can promote a data-driven decision culture by challenging finance employees as well as the business on the basis of data and insights rather than opinions. Finance is in an excellent position to fulfill this role, as it has a complete overview of the organization.

Given the department’s core competencies—proficiency of interpreting financial and nonfinancial data, ensuring reliability of information, deriving insights from reports, advising management, and providing a complete overview of the organization—with the right eye toward technology and the future, finance can enhance its role within the organization and increase its relevance.

February 2021