Mindful that accounting and finance students must learn at warp speed to keep pace with technological innovation, the global education network AACSB International (AACSB) strives to connect educators, students, and businesses. In support of this mission, IMA® (Institute of Management Accountants) volunteered to provide resources to the AACSB for peer reviews of business and accounting accreditations. I’ve been one of those volunteers for 2020-2021, and I’ve learned a lot about how educating bodies are (and, in some cases, aren’t) adapting their curricula to meet this new challenge.

The six accounting standards of AACSB are organized into three categories: strategic management and innovation for accounting academic units, accounting learning and teaching, and accounting academic and professional engagement and professional interactions. The standards are built on the three themes of engagement, innovation, and impact. Among these, standard A5 includes learning experiences that develop skills and knowledge related to the integration of information technology in accounting and business. This includes the ability of both faculty and students to adapt to emerging technologies as well as the mastery of current technology.

KEEPING CURRENT

So how does integration of information technology in accounting and business occur in today’s curricula? The short answer: It varies. As I participated in several AACSB peer review teams in 2020 and 2021, I learned that in some schools, information technology still isn’t integrated, and in others it appears to be embedded in almost every course. Current technology continues to evolve at such a pace that by the time a curriculum gets approved, the technology may already be outdated. This is a big challenge for the professors and the schools as they all want to show that their programs embed the latest technology and that their students will be well prepared to use the technology in the workforce. But how fast can you move?

Some patterns I have seen include Microsoft Excel being the one application that’s embedded almost everywhere. But data analytics is a big focus in most companies, and they expect that their new graduate hires have a basic understanding of how to capture data, cleanse it, visualize it, and provide insights into the numbers that are being reported. Many schools are just starting to look at how to embed these technologies into their programs, and sometimes by the time they update the curriculum, there will be something else that needs to be included. It’s an active area of curriculum development.

To truly understand a data analytics tool, a cleansing tool, or a data visualization tool, you have to understand what the information represents and why you’re analyzing it. This is one area that’s very difficult to teach unless you have lots of case studies, and there may not be enough time in a semester to have more than one case study that goes into detail enough for the learning to occur.

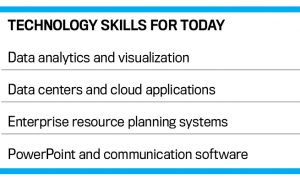

Members of IMA’s Technology Solutions and Practices Committee suggest that students need to learn and understand at least some of the following: data visualization, the cloud and how data centers are managed, data privacy, data analytics, enterprise resource planning software, R, Python, and PowerPoint (PPT). The last one surprised me, but I discovered during some of the AACSB peer reviews that schools were providing credit courses for students to learn how to use PPT and gain presentation skills.

Feedback received from companies that recruited at those schools included the students’ ability to present information, and it was lacking in many instances. Students must go beyond just understanding the numbers to presenting what they mean and sharing insights in visualizations other than the normal profit-and-loss or balance-sheet formats. Doesn’t this lead back to how data analytics is being taught? Just using a tool isn’t sufficient. The curriculum needs to have the technology embedded throughout the course materials.

COURSEWORK CHANGES

Peer reviews are also showing that some schools are dropping basic courses; for example, one school is replacing cost accounting with a data analytics course.

Yet that’s sacrificing critical accounting competencies that students need for a career in public or management accounting. Many schools are also using their master’s programs as a means to educate the students in new technology. You can now find a master’s in data analytics, in addition to a master’s in accounting, and many students are staying five years to get a bachelor’s and a master’s and to earn 150 credit hours so they can take the CPA exam. Whether they are going into public or management accounting, are all students getting the varied curriculum they need?

Recent press is reporting on the need for college accounting programs to change. The recent American Institute of Certified Public Accountants and National Association of State Boards of Accountancy report, for example, discussed this need for change. IMA recently formed the IMA Management Accounting Competency Task Force to identify essential management accounting competencies for all entry-level accounting graduates. KPMG has created a master of accounting with data and analytics program in conjunction with more than 10 universities to address its needs for students with a strong analytics background.

Change is happening, but the pace of change needs to speed up. Technology has to be continuously embedded and not be an afterthought or an isolated case study. Until accounting programs understand how the accounting profession is changing, they will continue to change names of programs, making some inroads, but not capturing the needs of what finance hiring managers really need today.

Whatever your role in the accounting and finance profession, you’re a part of the change ahead. Professors must stay active in professional organizations to leverage materials available for creating new case studies based on new technologies. Industry executives need to give feedback to the schools they recruit from. Schools want to know what the needs are, as they want to place their students. Change within the profession is happening at a very rapid pace. What is being taught today will be outdated tomorrow. Continuing education is a must, and everyone must make sure to take advantage of all the continuing professional education opportunities available. Lifelong learning should be the mantra, especially in accounting and technology.

August 2021