According to a recent Accenture survey of CFOs and finance leaders, 99% of respondents believe that operating with real-time data is critical to navigating disruptions like a global pandemic, economic downturn, or natural disaster. Sixty-eight percent reported that real-time financial modeling will be critical to better business decision making, more accurate forecasting models, and improved data accuracy.

Those numbers are staggering, if somewhat unsurprising. Finance leaders universally acknowledge that flexible, real-time financial planning can provide resiliency in the face of disruption, but it also creates immense complexity for today’s finance teams that spend every waking hour tracking down the latest sales figures, analyzing expense reports, and updating spreadsheets. As any finance professional who has embraced dynamic planning can certainly attest, recognizing its value doesn’t make it any easier to achieve. The volume of data, its rapid rate of change, and its distribution across various teams and departments create a whole new set of headaches and challenges with which finance teams must contend on a daily basis.

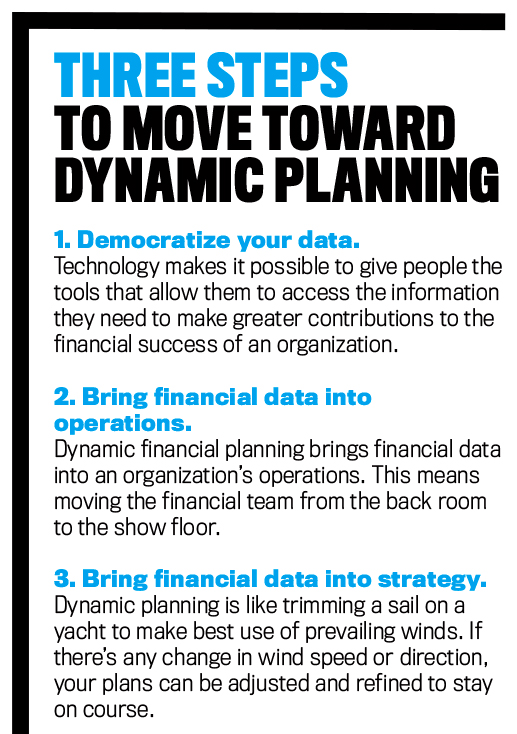

According to the Accenture survey, while 44% of finance leaders plan to conduct a majority of finance processes and operations in real time over the next three years, 43% cited technology as the most notable barrier to entry and strategic know-how as a close second. Fortunately, the technology to make dynamic forecasting an inexpensive and achievable reality already exists and will only continue to improve over time. To effectively prepare for and maximize the potential of this forecasting, there are several critical strategic shifts that businesses and finance teams can make now.

REAL-TIME FINANCIAL PLANNING

First, let’s break down what we mean by “real-time” planning. It’s a traditional practice to establish an annual budget cycle to track and measure business performance. Fiscal year data is used to inform go-forward projections for the year, and that performance is evaluated at the end of the cycle with monthly or quarterly checkpoints along the way.

Yet these budget processes can take months to modify, naturally inhibiting the flexibility and agility that organizations need to navigate the pandemic and other financial disruptions in real time. Amid COVID-19 spikes and ever-changing health guidelines, businesses have to be able to make decisions at a moment’s notice informed by the most current financial data.

This means adopting a rolling financial plan that accounts for transaction-level granularity. This includes new and projected hires—down to salary, benefits packages, commission rates, office supplies, and software licenses—cash flow as well as recurring and nonrecurring expenses. For sales-centric organizations, this would also include critical pipeline data like renewals, reductions, churn, and projected wins. All of this is transactional data that already exists within the organization. Your human resources team should have visibility into planned hires and anticipated monthly spending for employee training. Sales will have pipeline data within your organization’s customer relationship management where you can confidently anticipate net new customer acquisition or losses.

The systems and technologies in place should also allow finance teams to pull this data swiftly and more frequently without the need to update line items in a spreadsheet. Real-time reporting could mean finance teams are providing financial updates on a weekly or biweekly basis instead of monthly or quarterly. More importantly, they have the ability to provide the C-suite with a range of models the second a crisis hits so business leaders can make more informed decisions about workforce planning, spending, and more.

ADJUST TO INCREASED LONG-TERM UNCERTAINTY

To prepare for and adjust to business and market uncertainty, the practice of financial forecasting should encompass not just annual budgeting or monthly reports but also the moments everywhere in between.

Many businesses initially reacted to the pandemic as if it were a short-term crisis. Offices closed and noncritical facilities suspended operations as leadership teams closely monitored the evolving situation. To safeguard against any financial implications, teams adjusted budgets and expenses. Businesses announced layoffs and furloughs, ended or suspended contracts for nonessential services, and reduced travel costs and recurring expenses. Many reverted to zero-based budgeting to support cost-cutting and expense management efforts. (Whether or not zero-based budgeting is the best approach is an argument we’ll leave for another day.)

As we entered 2021, it had become clear that finance teams and businesses need to adopt processes and strategies that give them the power to prepare for unanticipated disruptions three months, 12 months, and even two years from now. In practice, a rolling forecast should allow you to make more confident projections farther in advance and make adjustments along the way based on changes to business operations, sales strategies, or expense reductions. And the farther you build out your forecast, the more informed you’ll be on decisions that need to be made today.

BREAK DOWN SILOS

To build truly resilient and dynamic financial forecasts, businesses have to first focus on improving their ability to integrate data sets across every area of operations. Forecasts can’t and shouldn’t be produced in a silo, and the financial outputs can’t only be the property of the C-suite. This isn’t simply a matter of working with department heads—it requires collaboration across the entire organization.

Finance teams shouldn’t feel the need to pull their hair out trying to retrieve the latest pipeline data from sales or hiring expenses from human resources. The data itself is crucial, of course, but so, too, is the ease with which finance teams should be able to access it. A finance professional at a small professional services company should be able to seamlessly access how much an account executive is billing against a retainer or to evaluate what unanticipated expenses were incurred on an individual project in any given month. A finance professional at a high-growth software-as-a-service (SaaS) company should be able to calculate recruitment costs and projected expenses per employee down to the most granular of details without feeling like they’re breathing down the HR director’s neck every second of every day.

Building cross-functional workflows is one of the most important process improvements businesses can implement to empower their finance teams. Evaluate what data is needed to build better, more resilient financial models, assess how data is currently collected or shared across the organization, and look for ways to reduce or drive efficiencies. This might mean investing in integrations that automate information-sharing and/or creating regular touchpoints and meetings that bring finance teams face to face with the stakeholders responsible for owning the data they need.

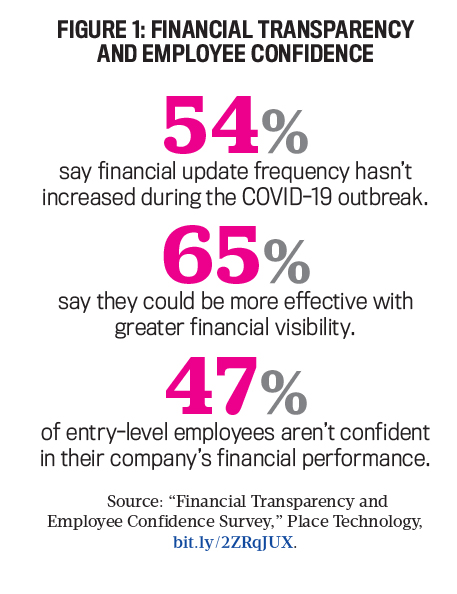

Breaking down data silos also provides a secondary benefit: employee engagement. With greater transparency throughout the organization, not only are teams held accountable to financial projections, they also have greater visibility into how they can contribute to those goals. In a recent Place Technology survey of U.S.-based companies, 65% of employees said they could make a more effective contribution if they had greater visibility into the financial performance of their organizations. (See Figures 1 and 2 for more survey results.) The silos that exist between teams aren’t sustainable for any business that’s looking to optimize its performance. By fostering greater collaboration and democratizing financial data, it can have a trickle-down effect to the entry level of an organization.

MAXIMIZE THE VALUE OF CUSTOMER DATA

Every business is dealing with a high degree of volatility, uncertainty, complexity, and ambiguity that ultimately affects forecasting demand. B2C businesses are subject to changes in consumer behavior as, say, unemployment rates increase or overall consumer spending plummets. B2B companies are at the mercy of their own customers’ overall business health.

Forecasting the consequences of market fluctuations has to be more comprehensive and embedded in day-to-day operations. What happens to cash flow and revenue if 20% (or 35% or 60%) of customers reduce or cancel contracts? How do those customer decisions influence marketing spend or recruitment efforts?

Financial forecasts are often structured using categories of products or services the business sells, and they don’t always include the required depth of information about customers. Having up-to-date information about customer segments and about individual customer health is vital to building a reliable forecast.

Start feeding real-time customer data into the forecasting model. What kind of behavior are you seeing from customers? Are they making new demands or changing their requirements? In an SaaS business, you could monitor which customers are most at risk of churn, assessed by the number of support tickets they have raised and how quickly they’re resolved. What would be the impact of losing these particular customers? Understanding these customer behaviors is much more likely to lead to accurate predictions.

This approach may also form the impetus for a more strategic approach to resource allocation. Can you invest in more support staff to increase their satisfaction levels and prevent customers from dropping contracts? Are you seeing customer demand decrease for any particular service? How does that impact staff composition and overall organizational health?

Looking at the forecast through a customer- or sales-centric lens can help to highlight trends and new propositions or products in which businesses should invest now or in the future.

IMPROVE SCENARIO MODELING

Finance teams are increasingly doing more with less. They may be asked to model different outcomes, the results of different decisions or different inputs using data across departments and teams. At a very basic level, these would be based on the extrapolation of trends. What decisions would need to be made if revenue or cash reserves continue to decline at their current rates? What about if those trends become more pronounced?

The ability to produce more models in real time is one of the best methods for a company’s board or executive leadership team to steer the business through prolonged financial turbulence. Amid the pandemic, however, the complexity of potential outcomes increases, leaving finance teams to often feel overwhelmed at the sheer range of possible scenarios.

In an industry dominated by spreadsheets and manual processes, modeling in itself can be a time-consuming and challenging task. Modern accounting software has been widely adopted. It’s time for organizations to invest the same resources in the right technologies that significantly improve workflows and empower finance to provide this level of granularity, without taking hours of overtime. There are solutions in the market today, built for all sizes of companies, that not only improve these processes but allow them to be done with greater efficiency, increased accuracy, and more resiliency.

Ultimately, with more flexible forecasts and more evolved scenario-planning capabilities, organizations are better equipped to make informed decisions.

ESTABLISH GUARDRAILS AND CLEAR COMMUNICATION

Unknown information is often the biggest threat to an accurate forecast. Even at the smallest of organizations, visibility into expenses can be a challenge, but it’s ever more critical as organizations seek to cut costs and protect margins.

One-off expenses can add up over time, especially if finance teams aren’t aware of them. Marketing might have approved an increase in digital ad spend, but if finance isn’t aware of that expense until the invoice rolls through, it’s impossible to ensure that change is reflected in the company’s forecasted expenses and cash flow for the upcoming year.

That’s why it’s important for finance teams to establish controls that guard and monitor existing expenses and approval processes for any net new requests. These thresholds should be informed by the company’s financial forecasts and then delegated to each department. In turn, ensure there’s a clear process in place in which expenses are communicated back to finance in a timely manner. If there are cuts across departments, they need to be clearly identified for department leads and their teams.

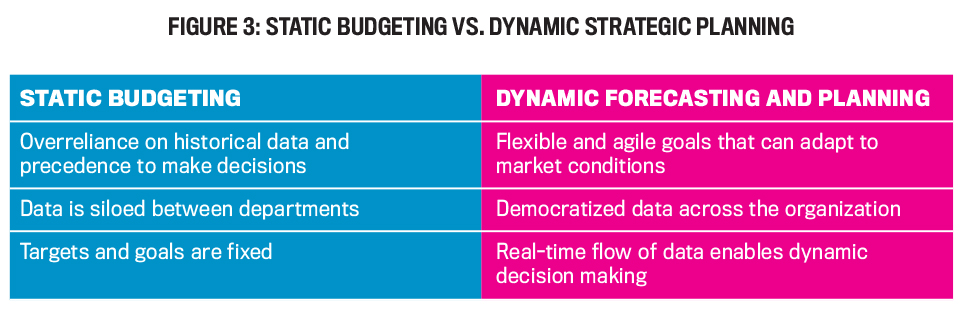

The transition to dynamic financial forecasting and planning won’t be achieved in a day, but finance teams and businesses should start that process immediately, beginning with an audit of existing processes and an evaluation of how data is accessed, shared, and used across the entire organization (see Figure 3). That involves collaborating more closely with different teams and with customers to ensure that the information on which forecasts are based is as current and future-focused as possible.

RELATIONSHIP BETWEEN THE CEO AND FINANCE

We’ve implemented these same best practices at Place Technology and have designed a business strategy grounded in financial forecasting. Our business is a fast-growing, venture-funded start-up, so remaining agile and being able to adapt to market conditions swiftly is critical to our continued growth.

We operate with a small finance team that’s closely integrated with the C-suite and operational teams. The sales and workforce strategies are informed by our business forecasts, and vice versa. This level of integration allows decisions to be based on what’s actually happening in the business—understanding the cause and effect—and managing these forecasts within an integrated solution allows those changes to be reflected in real time. That isn’t to say we couldn’t make them regardless, but it would take a lot more time—which is a critical concern for a small team with limited resources.

According to a study from U.S. Bank, 82% of small businesses fail due to poor management of cash flow. Without cash, a business can’t pay its rent and utilities or meet payroll—it can be a critical barometer for the health of the business overall. The challenge is that it can also be a very difficult thing to project. That’s why we have been steadfast in closely collaborating to ensure the decisions we make are based on the cash that flows in and out daily, weekly, monthly, and quarterly, not just top-line revenue. There are certain opportunities that may seem lucrative on paper but are extremely risky from a cash perspective and have become even riskier amid the pandemic.

In 2020, we employed a higher level of risk analysis, which involved all business functions. We conducted an audit of the business’s overall expenditure and put a temporary hold on any operational expenses that weren’t critical. We also extended our scenario planning to account for the market volatility and disruption that was projected. If the company goes over our budget in one area, how will that impact our forecasted cash flow moving forward? If sales underperforms for consecutive months, do we have enough cash reserves to maintain business operations? Any organization should have access to financial and operational data to answer these critical questions and make strategic decisions that can help navigate any crisis situation.

April 2021