In 2019, IMA® (Institute of Management Accountants) published a Statement on Management Accounting (SMA) examining the growing importance of FP&A in companies. Titled Key Principles of Effective Financial Planning and Analysis, the SMA defines FP&A as a decision-making platform that includes reporting and analysis, planning and budgeting, forecasting, and financial modeling. It concludes that “few processes within the purview of a CFO have so much potential to create—or destroy—business value than FP&A.”

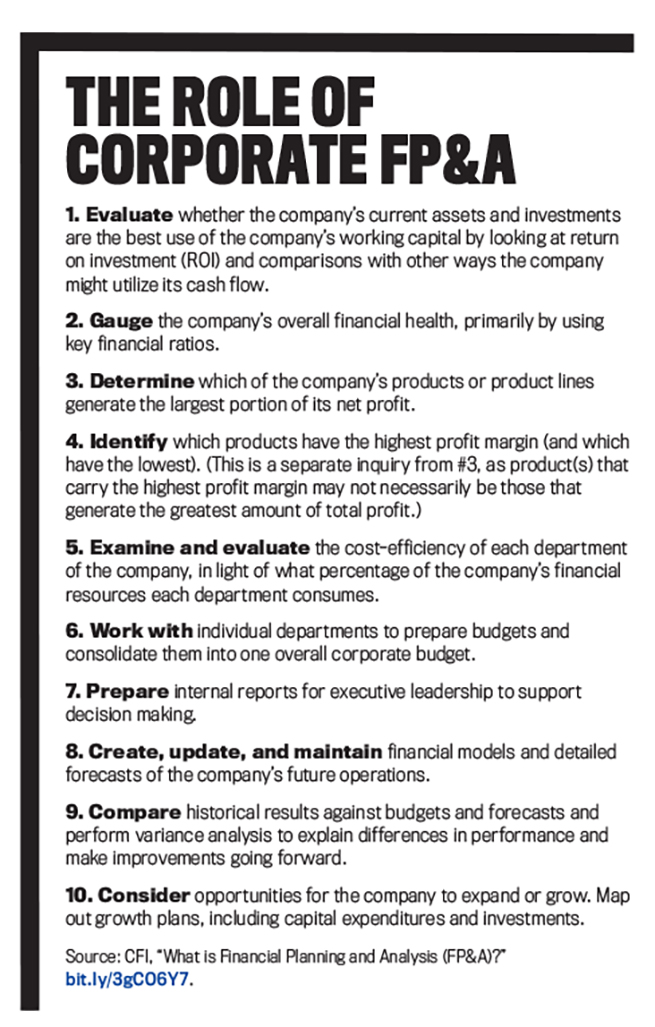

“The Role of Corporate FP&A” outlines the top roles of corporate FP&A as identified by Corporate Finance Institute® (CFI™). As the list illustrates, the typical role of an FP&A professional covers a broad range of issues central to the overall health and strategy of a company. (See CFI’s “What is Financial Planning and Analysis (FP&A)?” for more.)

While FP&A has been within the management accountant’s tool kit for decades, three recent trends have elevated the importance of FP&A skills: increased access to data, the availability of new business intelligence (BI) technologies, and the greater role of finance as a strategic partner. “The availability of data today has created the potential to gain business insights that we couldn’t get at even 10 years ago,” explains Judy Munro, senior managing director of executive search at Robert Half. “In the last decade we’ve seen the evolution of cloud-based platforms, subscription solutions, and business intelligence tools that have become very affordable. At the same time, companies have been demanding more strategic insights from their finance leaders. So it all looped together and created a substantial increase in demand for FP&A talent.”

FORWARD-LOOKING AND ADAPTIVE

How that shifts the focus from traditional accounting skills, says Munro, is an increased emphasis on predicting future outcomes. “As strategic advisors, FP&A professionals are striving to provide forward-looking information vs. historical trends,” she observes. And the end goal, according to Keith Anderson, CFO at Amwell, a U.S.-based telehealth service provider, is improving organizational performance. “There has been a massive shift to assess productivity and analyze data to become more efficient and effective in what you do,” he says, “and I think that has happened in a dramatic fashion especially over the last five years.” FP&A plays a crucial role in being a forward-thinking finance leader, he adds. “The better CFOs, the more visionary CFOs, know the importance of the FP&A function.”

For Amwell, the FP&A function led the company through a crucial time in its history, allowing it to ramp up service in the United States when COVID-19 severely limited access to physician care. “FP&A made a night-and-day difference,” says Anderson. “We couldn’t have done it without the FP&A team.”

Originally the team was modeling utilization rates over a three- to five-year time period. When COVID-19 hit, the team had already built a robust model and was able to run multiple growth scenarios, Anderson explains. “When we started growing in leaps and bounds, the FP&A team was critical in making sure we could serve the community. The hours were long—running different scenarios, running different sensitivities. For example, in one day we did over 40,000 consultations by doctors on our platform. Just to give you an idea of the magnitude and importance of our company to the healthcare community, we were on the front line. We have 57,000 doctors on our platform delivering care. So to make sure that our technology platform was up and running, to make sure that we could pay the doctors, it was a lot of load balancing to support that level of volume. All this was down to the FP&A team,” he says.

“We also dedicated a lot of time working with the functional leaders over the last year, making sure we had a base model that was in alignment with operations and how we looked at the overall business,” explains Jessica Allen, VP of FP&A at Amwell and a CMA® (Certified Management Accountant). “When COVID hit, we had to look at things differently. We had to accelerate our product spend and keep talking with our customers under ever-changing circumstances. Once we started seeing our volumes change, we ran scenarios to make sure our leadership was equipped with information. That gave us a level of control in order to make the decisions necessary to ramp up our service.”

The need to respond rapidly to changing consumer spending patterns during the COVID-19 pandemic was also driving the FP&A function at PSCU, a credit union service organization operating as a cooperative providing traditional payments, digital experience, risk management, analytics, online banking, and loyalty programs for more than 1,500 credit union owners in the U.S.

As Jeremy Dobes, VP of financial analysis and reporting at PSCU as well as a CMA and CSCA® (Certified in Strategy and Competitive Analysis), explains, “FP&A allowed us to evaluate if we should hit the pause button on capital improvements to make sure we could weather the initial storm or whether we should further invest in scalability across the organization and continue to drive key investments made during the prior two to three years around digital banking and scalability. In the coming years, we are likely to see fewer physical branches open and more service/support in the digital space. This should continue to fuel PSCU’s growth in our call center as investments made over the past couple years better equip our agents to be able to service the member as if they were right in the branch office.”

Real-time FP&A was crucial for responding to the pandemic—understanding what the members of the credit unions were experiencing during the downturn, how they were spending, whether they were shifting between debit and credit cards, and how the average spend was changing, Dobes explains. “In the beginning of this pandemic in March, when there were grocery shortage issues and people were fearful of everything shutting down, we saw an initial blip in our data sets showing average ticket increase drastically over historical norms. Yet we also were able to model the impact of a slowdown in consumer spending in real time. If we wouldn’t have been able to collect and analyze real-time data and waited to see our financials at the end of the month, we wouldn’t have had that insight until it was three weeks too late.”

This real-time insight, Dobes explains, is a growing strategic advantage for the FP&A function. “What’s evolving is FP&A as a strategic influencer in the organization, and that is a skill set that will likely develop even more over time. It’s one thing to be able to understand the reporting and how a solution works.… It’s another thing to be able to influence business unit leaders across the aisle.”

BUILDING AN FP&A TEAM

As to how the finance function is responding to the increased focus on FP&A as a strategic asset within companies, Dobes notes that PSCU is evaluating the prospect of splitting its finance function into two different areas: “One is going to be in reporting in the traditional sense, and there is a skill set needed for that, and the other is FP&A—the person or team asking the questions to drive where we would like the business unit leaders to go.”

At the end of the day, says Amwell CFO Keith Anderson, when you’re running different scenario possibilities in any business, it boils down to the financials. “In addition to having a solid grounding in finance and accounting, your FP&A team needs to be excellent communicators,” Anderson says. “Every person on Jessica’s team knows how to model a financial statement, but the beauty of our FP&A team is the relationship they have with the rest of the organization. You can bring in any quant that can model stuff, but that will not be a successful FP&A person. They need to be able to develop partnerships with the various leaders of the organization because they’re running the company. So, it’s a very unique skill set to be an FP&A professional in a fast-growing company.”

Amwell has taken a functional approach to building its FP&A team, says Jessica Allen. “We take a business-partner focus—so we’ve got a revenue-focused team, we’ve got an expense-focused team, and then we have someone who works for me that rolls it all up together and really owns our overall five-year model.” In the team, she adds, “Everyone is pairing with someone in the organization where that functional person knows that they’ve got a partner they can bond with about their part of the business.”

In terms of acumen, it isn’t just analytical prowess that Allen is looking for in an FP&A team member. “I look for people with some grit,” she says. “I want them to come in and help us build something and not just do things that were done before. I’m looking for entrepreneurial finance people who want to feel like they’re owning something, who thrive in a team-centered culture, where we do a lot of new things, and build off each other’s ideas to make a really collaborative environment.”

When it comes to ensuring the right FP&A talent in companies, one size doesn’t fit all. In terms of attracting, retaining, and developing the right FP&A talent, says Judy Munro, “Companies are employing a wide range of recruitment techniques, mentoring and training programs, including the establishment of ‘FP&A colleges’ within larger companies—all of which are spearheaded by the growing demand from CFOs for greater analytic talent. But the bottom line for choosing or grooming potential FP&A talent is their enthusiasm for the business and analytics.”

Many companies are developing their FP&A staff from within, training and upskilling existing team members. “They’re training people who may have started off in accounting and are exhibiting more interest in the business, and therefore getting into the strategy, the planning, the analysis,” Munro explains. “Fundamentally, they start off in accounting because that foundation is essential to everything you’re going to look at in an FP&A role, but a passion for business analysis is the common denominator.”

GETTING THE MOST FROM FP&A

With so much riding on the success of FP&A in companies, what should CFOs be doing to ensure they have the right resources to ensure the overall success of the business? Here are some recommendations from the interview subjects:

- It’s important to have operational alignment and have the critical-thinking skills to examine the areas of the business that are going to be impacted by changes in your business environment.

- Have your core foundational model at the ready so, when big issues like the pandemic occur, you’re capable of making the right decisions for your company.

- Examine as many scenarios and ranges as possible so you aren’t surprised by unforeseen risks, and then look for opportunities around how to operate differently.

- There needs to be internal repositories of information. Without pointing all of the systems into a central repository, information doesn’t flow as freely as it should, which can delay the information and bottleneck decisions.

- Even with droves of data, at the end of the day you still need to be able to simplify it to tell the story the data is telling you. It’s one thing to get all the data in a system; it’s another to determine if the data is validating assumptions.

- The tone at the top is critical to the success of an FP&A team. Build a partnership with your FP&A team. You can overcome a lot of challenges like systems and data issues that are really pervasive if you have the right people in place who approach those situations as a team. That’s where the tone at the top and the leadership come into play.

- FP&A has a unique viewpoint in a company and can be a unifying function in building processes and facilitating communication.

FP&A Resources from IMA®

IMA Statement on Management Accounting, Strategic Analysis—Methods for Achieving Superior and Sustainable Performance, April 2020.

IMA Statement on Management Accounting, Key Principles of Effective Financial Planning and Analysis, July 2019.

Lawrence Serven and Kip Krumwiede, “The People Side of FP&A,” Strategic Finance, July 2019.

Lawrence Serven, “12 Principles of Best Practice FP&A,” Strategic Finance, November 2017.

Delivering Business Value: The Role of FP&A in Execution, September 2017.

Flexible Budgeting Applied to Sustainability Measurements, August 2015.

Count Me In podcast, “Ep. 84: Jason Krantz—Data and Analytics | Driving Business Strategy,” August 24, 2020.

Count Me In podcast, “Ep. 46: Larry Serven—How to Execute Your Strategy for Long-term Value Creation,” February 3, 2020.

Count Me In podcast, “Ep. 24: Debbie Jacobs—FP&A: Leadership and Relationships,” October 31, 2019.

©2020 by Ramona Dzinkowski. For copies and reprints, contact the author.

October 2020