Whether it’s Accounting Standards Codification (ASC) 842 or International Financial Reporting Standards (IFRS) 16, the new guidance represents a change in the accounting treatment for leases held by a lessee, with the most significant change being that most leases, including operating leases, are now capitalized on the balance sheet.

Many public companies struggled to meet the January 2019 deadline. In fact, 77% of public companies that participated in a Deloitte survey after the compliance deadline reported that their companies were either unprepared or just somewhat prepared to comply. Companies commonly underestimated the timeline to comply and didn’t fully understand which contracts were actually leases, didn’t have knowledge where those hard-copy leases were stored, or lacked a system that captured the necessary data for compliance. Additionally, companies lacked a centralized process for entering into lease agreements and, as a result, didn’t have appropriate control and process documentation.

Most private companies are expected to meet ASC 842 and IFRS 16 standards starting in January 2022 (recently extended from January 2021 as a result of the COVID-19 pandemic), and, rather than getting discouraged by the challenges faced by their public counterparts, they should look to those experiences as a learning opportunity.

While large, global companies have robust finance and lease accounting departments that drive the compliance process, many mid-market organizations lack the in-house means to successfully manage the transition to, and maintenance of, the enhanced accounting requirements. Now is the time to consider solutions to help meet the deadline and sustain long-term compliance.

Here’s what those organizations can do to prepare and why they shouldn’t wait.

1. START NOW

Especially now that the deadline has been extended, it’s tempting to put off compliance planning, but businesses shouldn’t procrastinate. There are complex rules, such as the updated definition of a lease that now includes a contract that involves an asset that’s bundled as part of a service or supply contract. Additionally, there are many more aspects of a lease that need to be considered in the accounting for that lease. You’ll need to understand and internalize each of these elements in order to make informed decisions, and it will take time to research and acquire the right lease administration and accounting software needed to address your specific requirements.

Many companies thought they could rely on their existing software to manage the transition to ASC 842 and IFRS 16, but they quickly learned that the software was incapable of addressing the detailed requirements and instead resorted to manual review and spreadsheets. To start, you should assess your current approach and identify any gaps including those in your accounts payable/receivable and tax processes. Understanding what you have today as a baseline, plus what you will need to have in place post-compliance, will help create a scope of work and a detailed transition plan to successfully achieve your goals.

Don’t assume preparations will go quickly or easily. For accountants, getting up to speed with personal research and continuing education—without which compliance preparations can go awry—may take time. Gathering information, getting tools in place, establishing roles and responsibilities, and obtaining the required support, including consultants and software providers, will take both time and effort. Additionally, business as usual can’t simply be put on hold. There are regular priorities and functions that must continue while compliance planning is under way.

That said, the COVID-19 pandemic has affected the progress companies can make toward compliance, which is why the FASB voted to propose delaying ASC 842 lease accounting for certain entities, including private companies. Under the proposed delay, private companies will need to start to comply for fiscal years beginning after December 15, 2021.

2. GET THE LAY OF THE LAND

In the new leasing standards, all leases entered into by a lessee, including operating leases, are capitalized on the balance sheet. Previously, under ASC 840 and International Accounting Standard (IAS) 17, operating leases were expensed straight line, only appearing on the income statement. Under ASC 842 and IFRS 16, the only leases that don’t need to be capitalized are immaterial leases and, for IFRS 16, those that are 12 months or less in length or under $5,000. So, the first order of business is twofold: (1) gain a deeper understanding of the new lease accounting guidance in order to identify accounting gaps and (2) conduct an initial assessment of your current people, processes, and technology as they relate to leases and lease accounting.

Internal accounting departments should take the lead when it comes to assessing the impact of the new regulations, interpreting the standards, and ultimately setting the new accounting policies. External auditor engagement requirements around the new standards, as well as their positions on key accounting decisions, should be coordinated in advance to avoid unwelcome audit surprises. This will then lay the groundwork for data requirements, including a decision as to whether a company will need to re-abstract existing leases and future state process changes.

The majority of lease processes will have to change with the new regulations. Companies must identify, analyze, and improve upon existing business processes across all departments within the organization not only to ensure they meet the new requirements by the deadline, but to institutionalize this change for the future. As Figure 1 shows, leases have a path or process that they follow within an organization, and different departments will touch a lease at different stages.

Click to enlarge.

Click to enlarge.

It’s difficult to know what needs to change without understanding your current state. Mid-market organizations should start by asking basic questions about the existing people, processes, and technologies involved with leases today, such as:

- Which departments are responsible for lease administration and accounting?

- What roles within the departments are involved?

- What are the current lease processes?

- What technology, if any, is being used to manage leases?

- What lease data is available?

- Where is that data housed?

- Where are lease contracts stored?

Generally, companies have real estate leases stored in a centralized, standardized format, but the same can’t be said for equipment or embedded leases. These types of leases are typically executed on a local office or department level, and often there are many such levels. This will require communication with other departments and offices, such as accounting, legal, financial reporting, treasury, real estate, IT, and potentially some third-party vendors, to gather and inventory every existing lease.

Beyond getting a handle on your own processes, systems, and data, it’s critical to understand the implications and the impact of the guidance to ensure your plan will support compliance. Finance teams should put in place the right leaders to treat the new compliance process as a sustainable strategic asset and institute methods to monitor compliance to the new controls, assess progress, and adjust course as needed.

3. ASSESS EXISTING CONTRACTS

Critical to the new regulations is determining what qualifies as a lease and what doesn’t. Under the new guidance, a lease is considered “an arrangement that conveys the right to control the use of an identified asset for a period of time in exchange for consideration,” and it must be a tangible asset—no patents, copyrights, or other intellectual property. Control refers to a business’s right to derive all economic benefits from use of the identified asset as well as the right to oversee and direct its use.

In order to properly qualify your leases, you’ll need to take an inventory of all existing contracts. This is an especially difficult task if you have leased furniture, office equipment, or other non-real estate assets that may be spread across different departments. These types of contracts may be contained in filing cabinets or spreadsheets, across geographies, or may even be managed by external third parties. Additionally, as part of this process, you’ll need to establish new procurement policies, including a standardized assessment protocol for each contract and a way to abstract key lease data for loading into a centralized system.

Once you’ve identified all leases, it’s time to classify each by type: real estate, equipment, or embedded. Real estate leases are the most straightforward to identify and inventory and are often already being tracked in an organization. Equipment leases can be more challenging to identify because most companies have them spread across the organization, and they’re often managed within regional offices, distribution centers, or warehouses. In addition to different physical locations, the lease data could be spread across multiple, disparate systems—including enterprise resource planning (ERP) systems, procurement, lease accounting, and IT asset management technologies.

Finally, embedded leases are the most complicated to identify and may require a bit of detective work. How can a contract that contains a lease be identified? Among others, supply and service agreements should be carefully reviewed. If they mention (or if it’s understood) that some piece of equipment is provided as part of those contracts, then further assessment is necessary. Evaluate if the assets in question are “controlled” and if they’re “identifiable.” If the right to control the use of the asset and obtain all the economic benefits is present, then it’s considered an embedded lease. If it meets the definition of a lease, it then needs to be determined if it should be categorized as either an operating or finance lease.

4. GATHER DATA

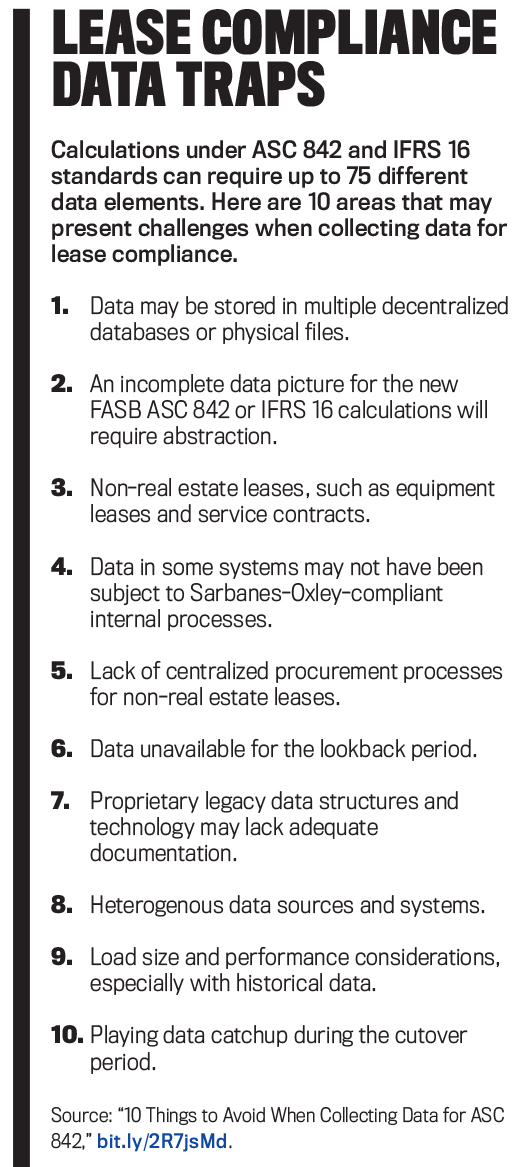

With an understanding of what contracts are categorized as leases, it’s then time to organize the data and prepare it for reporting. ASC 842 calculations, for example, require a comprehensive view of all the data, and that’s made far simpler if it’s consolidated and stored in one centralized location. Up to 75 different data points can be required for some of the more complex leases. Unfortunately, many mid-market organizations work with inefficient manual processes or legacy systems like Excel that are inadequate for compliant reporting. Considering the dozens, hundreds, or even thousands of leases a business may have, all missing and distributed data will need to be uncovered and gathered. This process could take days, weeks, or even months to accomplish.

After all the leases have been inventoried and the data points required for compliance calculations are identified, the next step is to perform a data gap analysis between what data exists today (legacy systems, spreadsheets, and databases that aren’t actively used or maintained, etc.) and what will be needed in the future. Gaps will need to be filled through brute force or what’s called “lease abstraction,” which involves extracting the relevant data from a lease summary of the key information. This serves as a condensed version of the original lease document and makes it easier to review the data quickly. Someone, usually a well-trained employee or an external firm, needs to review the actual lease to gather the data and create a complete abstract.

5. SELECT A TECHNOLOGY SOLUTION

Regardless of size, all companies are in the same position when it comes to lease administration and accounting software—everyone needs a new or, at minimum, upgraded software tool. Legacy lease administration and accounting systems used by larger companies are by definition not able to handle the new lease accounting requirements, and companies that have historically “out-muscled” lease accounting with a mix of manual efforts and spreadsheets can no longer do so because of the increased complexity and data requirements. The bottom line is anyone with more than a modest lease portfolio should have a system.

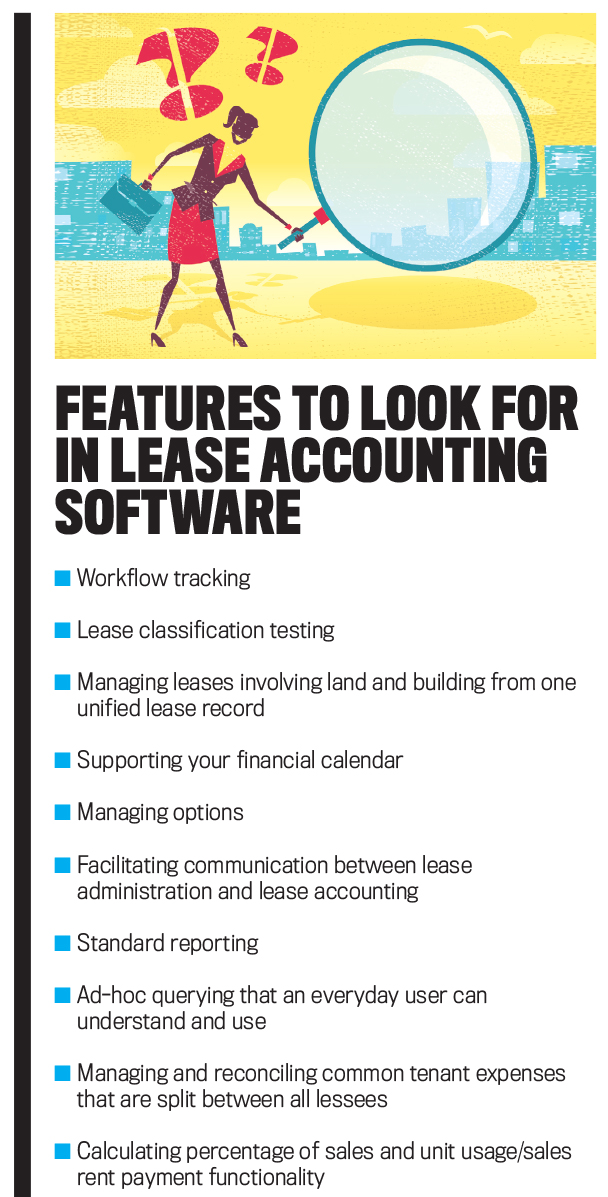

There are software options available for companies of all sizes and budgets. Selecting the right software for the job is a large endeavor, making it a stand-alone topic. The high-level steps include setting goals and objectives, defining the solution requirements, and assessing vendor fit.

Selecting a vendor can be straightforward if managed properly. Key functionality to look for includes:

- Built-in lease classification functionality to identify whether a lease is a finance or operating lease;

- The ability to support the standards required to bifurcate real estate composed of land and building by easily identifying and managing both operating and finance accounting schedules for land and building, respectively, on a single lease record; and

- The ability to establish balance sheet entries to set up right-of-use assets and liabilities for each lease.

Be sure to consider lease administration and accounting software that was built to comply with the new standard. Many public companies faced with overwhelming compliance demands turned to makeshift, improvised solutions in order to make the deadline. They soon found these to be unsustainable and unable to support ongoing compliance.

The hardest part of implementing a system is the collection and migration of data and coordination with vendors. This is where many public companies experienced delays and cost overruns. Any data that gets lost or materially altered during this transition can set back a business for weeks, so having an established backup and recovery process is of utmost importance. Here again, selecting a solution partner with standard tools, templates, and reload strategies can help mitigate any issues occurring during this “cutover” period. Along with data, implementing and testing a new system represents a significant risk factor that needs to be managed aggressively.

6. ENSURE LONG-TERM COMPLIANCE

Always remember that compliance isn’t a onetime event—it’s a continuous process that will need to become part of standard operating procedures and require the effort of all stakeholders. Determine who will be responsible for certain tasks, such as members from legal, IT, finance, and accounting, and then build your team. Consider whether help from outside consultants will be required and, to reiterate, ensure your technology supports what you’ll need from a data and reporting perspective and that your technology partner is updating its systems to maintain compliance.

Compliance will also involve a change in lease processes, and you’ll need to identify, analyze, and improve upon existing processes across those same departments. New policies also bring changes to internal controls. Review existing control structures related to leases and assess whether current reporting and disclosure practices require adjustments. New internal controls must be designed, established, and documented for audit purposes to comply with the new standards, as well as to ensure ongoing Sarbanes-Oxley compliance.

COMPLIANCE IN THE PRESENT AND FUTURE

By starting preparations for the new leasing standards now, mid-market organizations will be set up for long-term success in meeting compliance when the standards take effect. While overhauling systems and processes can be an enormous undertaking, it also presents an opportunity to operate more efficiently in the years ahead.

Requirements brought on by the new guidance are incredibly difficult, if not impossible, to achieve through spreadsheet reporting alone. Lease accounting software systems reduce risk, create process efficiencies, increase control, and provide better visibility into the entire lease portfolio. Historically, smaller to midsize companies have had to settle for subpar solutions. That’s no longer the case.

Today, more enterprise-level, yet cost-effective, solutions that integrate administration, accounting, and finance functions into one platform are entering the market. These solutions combine the advanced functionality to support compliance and also help generate monthly rent rolls, ensure companies pay only what they owe through templated reconciliations, streamline the lease abstraction process, and manage key lease terms and dates to help organizations stay on top of renewals, administer and account for non-real estate leases, and automate lease administration and accounting reporting.

Enterprise-level software can leverage the lease administration and lease accounting know-how necessary for large company compliance and deliver it to midsized organizations. By incorporating all of these elements, these holistic software solutions help companies keep a pulse on occupancy costs. Mid-market organizations should look for enterprise-class software with a proven record of solving the complex problems of large organizations. These robust solutions can cost-effectively ensure that companies of all sizes can both achieve compliance today and sustain it in the future.

CFO and finance teams play a critical role in assessing which solution is right and, in particular, whether it will support the financial disclosures required by the standard. Often senior finance executives serve as the executive sponsor to the compliance project, as part of that role includes championing the project internally. Initially, this will help secure the necessary budget and resources. At later stages, it will help clear any obstacles that could compromise project milestones, targets, or goals.

In our current environment, having a lease administration and accounting software solution is a true advantage. It enables organizations to zero in on their occupancy costs by quickly assessing their leases to better understand key clauses, such as kick-out and co-tenancy, and to identify the low hanging fruit or those locations where they can immediately start paying less rent or none at all. Other key lease provisions relating to rent abatement that should be explored include the interpretation of essential services, causality, condemnation, and force majeure.

October 2020