But how is the pandemic affecting their finance functions? To find out, IMA® (Institute of Management Accountants) conducted a global study of the impact of the pandemic on finance functions, focusing on changes in staffing, compensation, and the required skills.

To provide context, we start with the impact of the pandemic on organizations as a whole, looking at changes in revenues and staffing levels. Then we move to the impact on finance staff and the priorities of the finance function. Finally, we look at the areas in which finance professionals are looking to upskill and issues related to reskilling.

The results are based on a survey of 1,481 accounting and finance professionals located in five countries: China, India, Saudi Arabia, the United Arab Emirates (UAE), and the United States. Respondents were approximately evenly divided among these five countries. Slightly more than one-third of the survey respondents were women, with the percentage varying by country, ranging from a high of 51% in China to a low of 18% in Saudi Arabia.

IMPACT OF THE PANDEMIC ON ORGANIZATIONS

The news is full of stories of how organizations of all sizes are facing extreme financial hardships and at risk of going out of business during the COVID-19 pandemic. Large companies in strategic industries, such as airlines, are pleading for government assistance, while small businesses such as restaurants—often without the financial resources of larger companies—are also struggling to survive. Our survey results reflect an across-the-board decline in revenue, with very large companies (those with more than $10 billion in revenue) most likely to have experienced a considerable decline in revenue.

Yet despite the general decline in revenues among companies of all sizes, fully one-third of our survey respondents felt they were doing better than their competition, and fewer than 10% felt they were lagging behind their competitors. Companies’ belief in how they were faring compared to their competitors varied by company size: larger organizations (greater than 1,000 employees) were more likely (39%) to believe they were ahead of their competition than smaller (fewer than 100 employees) ones (29%).

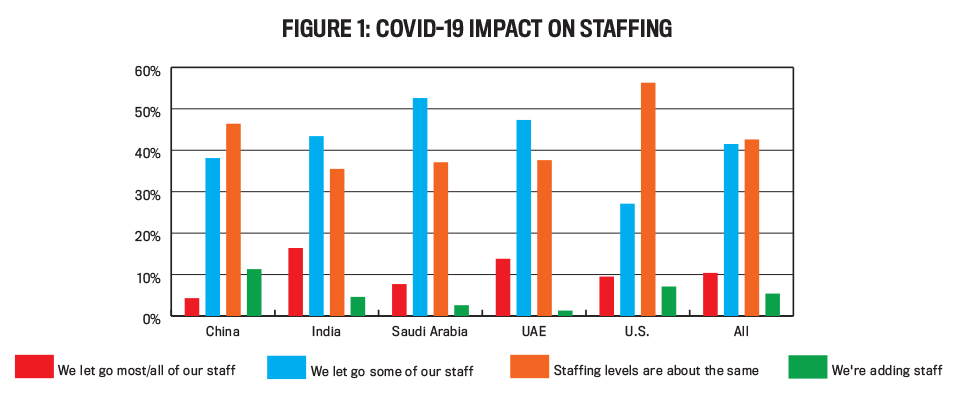

As has been widely reported in the news, the pandemic has severely affected employment around the world. Our survey confirms this: Approximately half of the companies surveyed have let some of their staff go. Yet companies’ response to the pandemic in this regard varied significantly by region, as shown in Figure 1.

Companies in the U.S. were the least likely to have reduced the size of their staff (36.6% of U.S. respondents reported their organization let go some or most of their staff), followed by China (42.4%) and India (59.8%). Those in the Middle East—Saudi Arabia (60.3%) and UAE (61.1%)—were most likely to have reduced staff size.

IMPACT ON COMPENSATION IN FINANCE

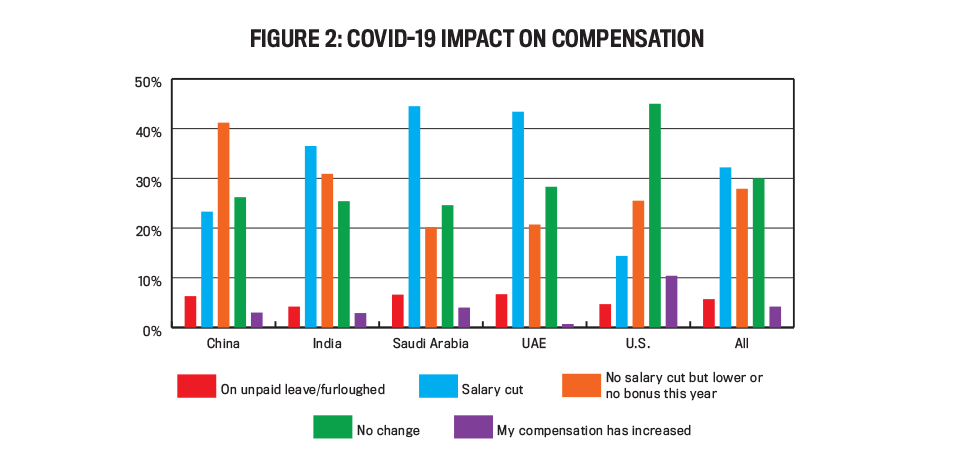

The pandemic has affected not only employment but also the compensation of those still employed. Most survey respondents have had a reduction in their compensation, whether in their salary, bonus, or both. Yet similar to the situation regarding employment, the impact of the pandemic on compensation varied significantly by country. Companies in the U.S. were least likely to change the amount paid to employees. Chinese companies were most likely to leave salaries unchanged but reduce the amount of bonus paid, reflecting the greater use of variable compensation in China than in the U.S. Finally, companies in India, Saudi Arabia, and the UAE were most likely to have cut the salaries of their employees. (See Figure 2.)

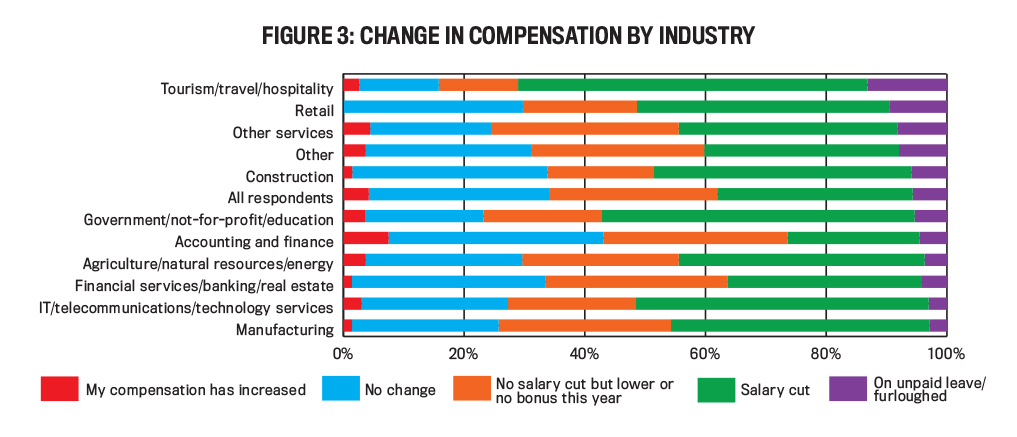

The impact of the pandemic has varied widely by industry. Many industries shut down completely at first and are only now beginning to reopen, while others remained open and were only slightly impacted. This can be seen in the change in respondents’ compensation since the pandemic began (see Figure 3).

Hardest hit are professionals in the tourism, travel, and hospitality industry—13% of respondents in that category were furloughed, and 58% had their pay cut. Also relatively hard hit were professionals in the government, not-for-profit, and education areas, with 5% furloughed and 52% experiencing a decrease in salary. Least affected were those working for companies in the accounting and finance industry.

Not surprisingly, changes in company staffing levels are reflected in changes to individuals’ compensation. Companies that downsized were more likely to have reduced employee compensation. Of respondents who reported their company had let go some of its staff, 80.3% also reported that they’d experienced a reduction in salary or bonus or that they had been furloughed, whereas the result was 55.9% for respondents in companies whose staffing levels remained about the same and 35% for those in companies that added staff.

FINANCE FUNCTION PRIORITIES

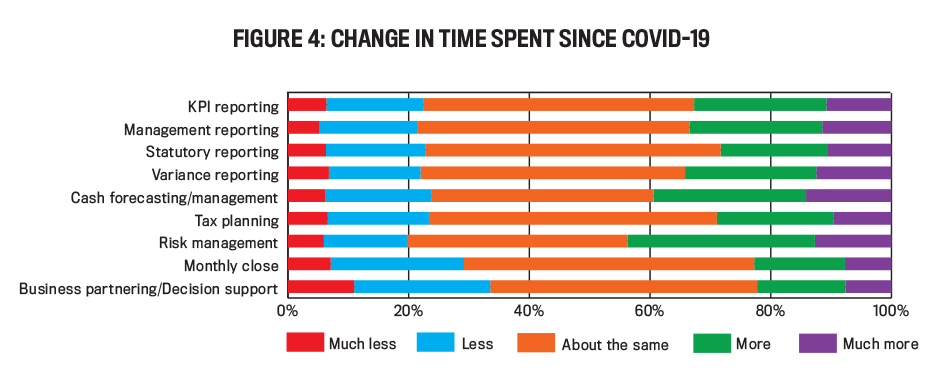

The COVID-19 pandemic has presented business with unprecedented challenges, putting organizations under pressure in ways that weren’t anticipated and posing new demands on the finance function. Where is finance focusing now? Figure 4 shows the change in time spent on various finance-related areas.

As might be expected, the largest increase in emphasis is seen in risk management, with nearly half (43.7%) of companies spending more (or much more) time in this area. This is followed by cash forecasting/management.

On the other hand, less time is being spent on business partnering and decision support, with 33.5% of companies spending less time in this area (as opposed to 22.2% spending more time). While this latter responsibility of finance is important, the reduced time spent on business partnering is understandable given the reduction in staffing at many companies and the need to devote more time to cash management and risk management while continuing to perform mandatory functions such as statutory reporting.

Looking to the future, a just-released study from IMA and ACCA (Association of Chartered Certified Accountants), The CFO of the Future, supports the continued emergence of the CFO as a strategic business partner, taking a leading role in business strategy formulation, validation, and execution; taking a wide view of performance across diverse stakeholder groups; and providing forward insights to the organization.

While there was a great deal of consistency across industries regarding the changing priorities of the finance function, several outliers stand out. One of these is the tourism, travel, and hospitality industry, where half of the respondents indicate their finance function is spending less time on business partnering and decision support. This reflects how hard this industry has been hit by the pandemic, with companies reducing staff to stay in business, and their need to focus on core functions for business survival.

PERSONNEL CHALLENGES

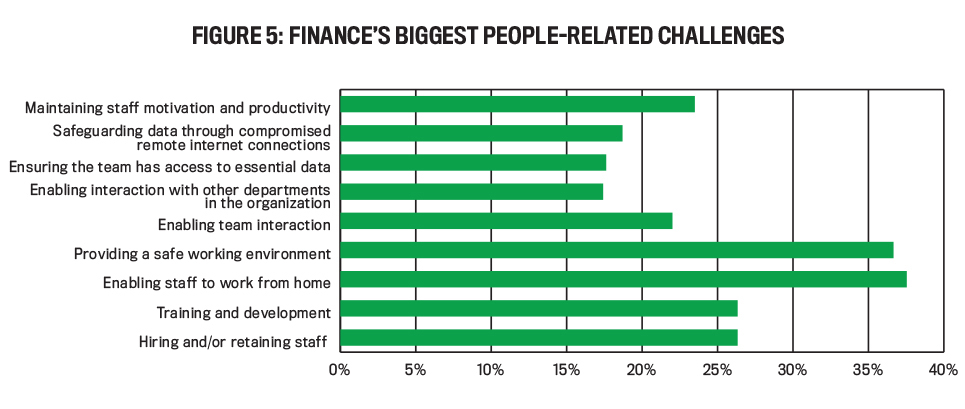

COVID-19 is extremely contagious, and precautions to reduce its spread, such as wearing masks and social distancing, are critical. Many organizations, often due to legal requirements, are facing the challenge of maintaining employees’ productivity while they work from home. In this regard, the pandemic has brought new personnel challenges to the forefront for finance.

As Figure 5 illustrates, key among these are enabling staff to work from home (37.5% of respondents) and providing a safe environment (36.7% of respondents) for those who need to come to the workplace. Related to the first challenge is the need to train staff on the tools that enable them to work from home (26.3% of respondents).

IMPACT ON SKILLS NEEDED

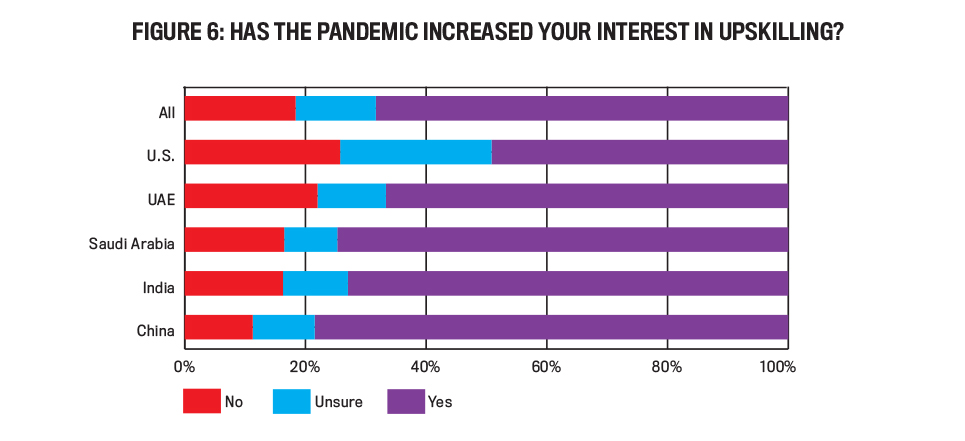

It doesn’t take a pandemic to interest finance professionals in upskilling: 78% of respondents were already interested in upskilling or reskilling prior to the pandemic, with the highest percentages in Saudi Arabia (89%) and China (88%) and the lowest in the U.S. (58%).

There’s now significant concern as to whether current professional skills will still be relevant in the post-COVID-19 era—12% of survey respondents believe their skills won’t be relevant, and another 10% are unsure. Again, results varied by country, with respondents in the U.S. most confident in the post-pandemic relevance of their skills. Those in India were the least confident, with only 69% believing their skills would be relevant, 15% believing they wouldn’t be, and 16% unsure.

Younger respondents were more likely to believe their skills won’t be relevant post-pandemic compared to older respondents (more than 50 years old). In contrast to the other age groups, and a bit surprisingly, all the respondents older than 60 believed their skills would be relevant in the future. This could reflect the more senior positions of the people in this group, where “soft” skills become increasingly important and “hard,” technical skills less so.

Respondents at smaller companies (fewer than 100 employees) were also more concerned about their skills, with 14% believing their skills wouldn’t be relevant and 11% unsure, compared with 9% and 11% for midsize (100-999 employees) organizations and 8% and 9% for large (1,000 employees or more) companies. This may reflect the fewer resources available to employees at these smaller companies to develop and maintain their skills.

The current high levels of unemployment globally have caused finance professionals to be more interested in gaining new skills. As Figure 6 shows, 68% of respondents indicated they were more interested in upskilling because of the pandemic. This percentage was greatest in China (78%) and lowest in the U.S. (49%).

This interest in upskilling wasn’t merely aspirational: 75% of survey respondents are working on improving their job skills during the pandemic. While the majority of respondents in every country in this study are doing so, the percentage is greatest in China (84%) and India (83%) and lowest in the U.S. (60%).

There’s a belief across all the regions that upskilling can help career advancement, with 80% agreeing with this idea. This belief is also widely held among most age groups, only declining for those in their 60s and older. It reaches its peak with those ages 30 to 39, perhaps because many of them have been out of school for some time, are at a stage in their career where they’re looking for career advancement, and are thus feeling the need to refresh their skills.

There was also a high degree of agreement across gender, although women (82%) were slightly more likely than men (78%) to see upskilling as helping to advance their careers. An exception was in Saudi Arabia where, perhaps due to prevalent gender roles, men (88%) were slightly more likely to agree than women (81%).

It has been widely reported by IMA and by others that the digital transformation of the finance function will change the role played by finance, the jobs in the finance function, and the skills needed by those in the finance function. How does the perceived impact of COVID-19 compare to the impact of digital transformation? About 58% of respondents believe the pandemic will be as disruptive when it comes to job skills.

The level of agreement was greatest in India (70%). This may be surprising given the large IT infrastructure within the country but may reflect the extent of the pandemic there. The lowest level of agreement (and highest level of disagreement) was in the U.S. (42%), which may reflect the politicization of the response to the pandemic there. Saudi Arabia and the UAE both had 58% of respondents agreeing, while 59% of respondents in China agreed.

SKILLS NEEDED POST-COVID-19

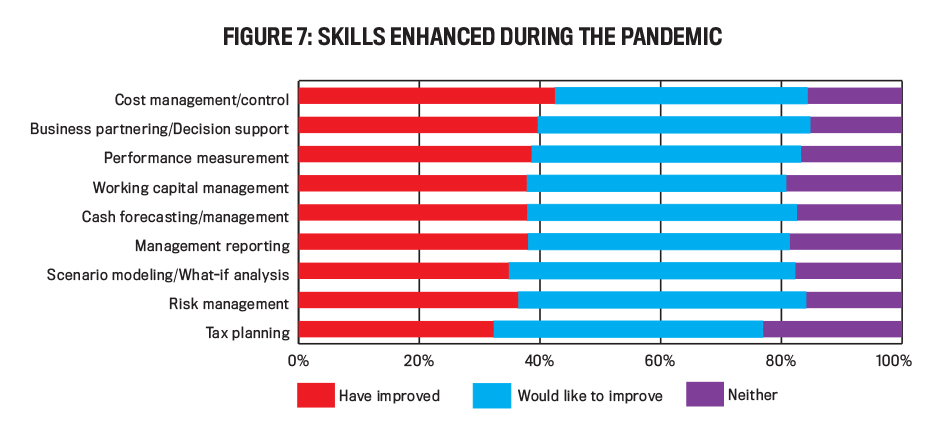

A good number of professionals in finance are concerned about maintaining or enhancing their skills during this challenging business environment. So what skills have they been working on, perhaps during their stay-at-home period? As shown in Figure 7, leading the list is cost management/control.

Yet perhaps more interesting is the wide range of knowledge domains in which respondents have worked to improve—and plan to improve—their skills. More than 80% of respondents have improved, or plan to improve, in each of the skills listed, with the only exception being tax planning. These various skills are all part of the CMA® (Certified Management Accountant) program, which comprehensively covers the skills needed by management accountants today.

The benefit of professional certification was seen from a comparison of salaries earned by those possessing CMA certification with those who don’t. In each of the five countries, CMAs earned more than non-CMAs. Clearly, investing in advancing one’s professional skills pays off.

Yet in these challenging economic times, it isn’t enough for employees to want to upskill. They also need the financial resources required to do so. Fully 72% of respondents believed companies should financially support upskilling of their employees. This was consistent across all the countries in this study.

What did vary was the actual support of upskilling efforts. Overall, 49% of employers supported upskilling/ reskilling of employees. This varied from highs of 57% in China and 55% in the U.S. to lows of 39% in the UAE and 45% in Saudi Arabia.

A TIME OF UNCERTAINTY

The COVID-19 pandemic is presenting business with a challenge not seen in recent times. The impact has been global, affecting every country and organizations of all sizes. Many finance functions have reduced the size of their staff or reduced staff compensation.

The current economic environment is presenting challenges to finance functions on several levels. It’s necessitating a shift in priorities, with increased emphasis on risk management and cash forecasting and management. It’s also requiring great attention to enabling staff to work from home and eventually return to the office safely.

Many finance professionals have concerns about the evolving skill set needed in a post-pandemic world. Most are working to improve their skills in a wide range of topics. In this rapidly changing world, one thing remains constant: Finance professionals must constantly work to enhance their skills in order to maintain and advance their careers.

November 2020