USING EDI

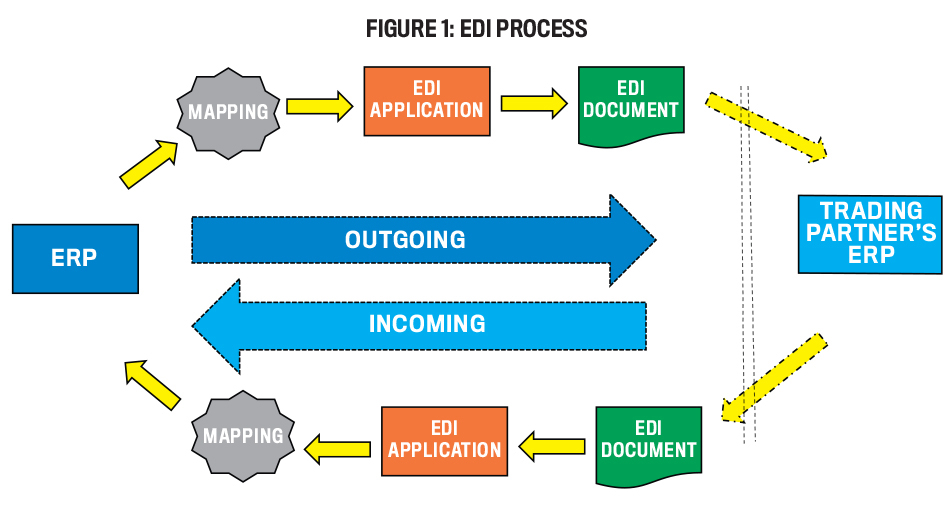

Companies began experimenting with EDI in 1970, and the first EDI standards were developed and released for the transportation industry in 1975. EDI provides a standard format that enables various business systems to communicate with each other. The most commonly used standards of EDI are ANSI ASC X12 (American National Standards Institute/Accredited Standards Committee X12), widely used in North America, and EDIFACT (Electronic Data Interchange For Administration, Commerce and Transport), used throughout the rest of the world. Both standards contain subgroups to accommodate the specific needs of various industries. The purpose of the standard is to determine the order and the location of the data in an EDI document, which contains elements, segments, and transactions. Elements are individual pieces of data. When elements are combined to make meaning, a segment is created. A transaction is a combination of several segments. Trading partners send and receive documents containing transactions such as invoices, orders, bills of lading, etc., either directly to their internal system or via an EDI network service provider. The process of sending a document requires three steps:- Identifying the data to be included in the document,

- Creating an EDI document, and

- Transmitting the EDI document.

Click to enlarge.

Receiving EDI documents mirrors the sending process. First, the trading partner receives the EDI document either directly into its internal system or through an EDI network service provider. The EDI data is converted to fit the internal system and then fed into that system. The information system transmits a confirmation receipt back to the sending partner.

Today, EDI integration has moved to a cloud environment. Also called integration platform as a service, the cloud version of EDI enables companies to integrate via any kind of protocol, format, and system regardless of whether the company’s information systems are maintained in-house, are managed by a third party, or are cloud-based. These cloud EDI solutions provide seamless upgrades without any disruption to business operations.

Some general benefits derived from using EDI include:

Click to enlarge.

Receiving EDI documents mirrors the sending process. First, the trading partner receives the EDI document either directly into its internal system or through an EDI network service provider. The EDI data is converted to fit the internal system and then fed into that system. The information system transmits a confirmation receipt back to the sending partner.

Today, EDI integration has moved to a cloud environment. Also called integration platform as a service, the cloud version of EDI enables companies to integrate via any kind of protocol, format, and system regardless of whether the company’s information systems are maintained in-house, are managed by a third party, or are cloud-based. These cloud EDI solutions provide seamless upgrades without any disruption to business operations.

Some general benefits derived from using EDI include:

- Reduced costs of personnel, supplies, and office/storage space,

- Improved data quality through reduced data-entry errors,

- Reduced time of completion of a business cycle, from ordering to cash collection,

- Improved business efficiency by enabling employees to focus their attention on critical issues rather than correcting mistakes,

- Improved data security through the use of passwords and encryption programs,

- Reduced disruptions during the auditing process,

- Increased strategic benefits through the enabling of demand-driven business models,

- Improved decision-making processes as a result of having access to information instantaneously, and

- Enhanced social responsibility and sustainability through reduced paper use.

USING BLOCKCHAIN

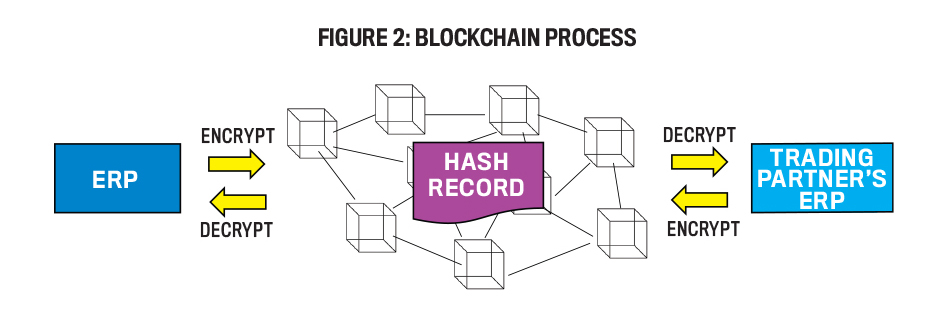

Blockchain is a decentralized information system that relies on peer-to-peer technology and cryptography to create a shared ledger of transaction records. The system records an ever-growing ledger of verified transactions that are grouped as batches (blocks) in a single, secure, and immutable (append-only) database. When a customer wants to order some goods from a vendor, the customer could send the purchase order as a hash record to the vendor, who decrypts the sales order using a private/public key combination (see Figure 2). Alternately, the customer and vendor could negotiate and create a smart contract that represents the terms of the contract and automate all the subsequent steps in the process. Click to enlarge.

Blockchain not only enables the sending and receiving of documents, but it also can automate subsequent steps in the process.

Currently, there are developments where the encrypting, sending, decrypting, and receiving of the transaction takes place more or less on its own without user intervention. Once the user submits the form to initiate the process, the document is sent to the vendor using the peer-to-peer network while maintaining a record on the distributed ledger.

A more advanced option is to develop a smart contract where every subsequent step is monitored and an automatic response is created using certain trigger events. For example, once the purchase order is received by the vendor and the shipment of the inventory is confirmed, the payment is automatically created without any human intervention.

Since the blockchain is a single shared record of transactions, the information needed is replicated across the participants’ networks and can be obtained by all parties involved in the transaction. The consistency of data among network participants, product provenance, and traceability of product movements in the supply chain enable greater trust between trading partners.

The peer-to-peer nature of blockchain reduces transaction costs since intermediaries or third-party service providers are no longer needed to conduct the transaction. And with techniques such as smart contracts, the peer-to-peer arrangement can efficiently reduce the time it takes to process a transaction and enable the exchange of value in a greatly reduced time frame. The transaction settlement speed can be reduced from several days to minutes or hours depending on the transaction volume and processing capacity of the blockchain.

Blockchain’s fundamental component is the use of cryptography to authenticate parties to transactions and link one block to another by attaching the encrypted-yet-visible chain of hashes of transaction data. Privacy is maintained because users are only able to view the hashes and the digital identity on the blockchain since the actual identifying information of the individual or company isn’t shared with others.

Click to enlarge.

Blockchain not only enables the sending and receiving of documents, but it also can automate subsequent steps in the process.

Currently, there are developments where the encrypting, sending, decrypting, and receiving of the transaction takes place more or less on its own without user intervention. Once the user submits the form to initiate the process, the document is sent to the vendor using the peer-to-peer network while maintaining a record on the distributed ledger.

A more advanced option is to develop a smart contract where every subsequent step is monitored and an automatic response is created using certain trigger events. For example, once the purchase order is received by the vendor and the shipment of the inventory is confirmed, the payment is automatically created without any human intervention.

Since the blockchain is a single shared record of transactions, the information needed is replicated across the participants’ networks and can be obtained by all parties involved in the transaction. The consistency of data among network participants, product provenance, and traceability of product movements in the supply chain enable greater trust between trading partners.

The peer-to-peer nature of blockchain reduces transaction costs since intermediaries or third-party service providers are no longer needed to conduct the transaction. And with techniques such as smart contracts, the peer-to-peer arrangement can efficiently reduce the time it takes to process a transaction and enable the exchange of value in a greatly reduced time frame. The transaction settlement speed can be reduced from several days to minutes or hours depending on the transaction volume and processing capacity of the blockchain.

Blockchain’s fundamental component is the use of cryptography to authenticate parties to transactions and link one block to another by attaching the encrypted-yet-visible chain of hashes of transaction data. Privacy is maintained because users are only able to view the hashes and the digital identity on the blockchain since the actual identifying information of the individual or company isn’t shared with others.

COMPARING EDI AND BLOCKCHAIN

EDI and blockchain share some important characteristics:- Both technologies can incorporate multiple trading partners. For example, one company can have many vendors and many customers depending on whether the transactions represent the revenue or the expenditure cycle.

- Both technologies enable the communication of transaction details.

- Companies can send and receive any type of documentation.

- Trading partners’ information systems don’t need to be compatible. EDI applications convert forms in various formats to a standard format before sending/receiving documents. Transaction hashes are sent/received; hence, the trading partner information systems don’t need to be compatible if using blockchain.

- Companies can limit and control access and portions of data that’s accessible to their trading partners.

- Both technologies enable an audit trail and maintain a detailed history of records centered on the entity.

- Adequate preventive controls need to be implemented and enforced. These include data-edit integrity controls, access controls, and general controls such as source document preparation, management policies, and user responsibilities.

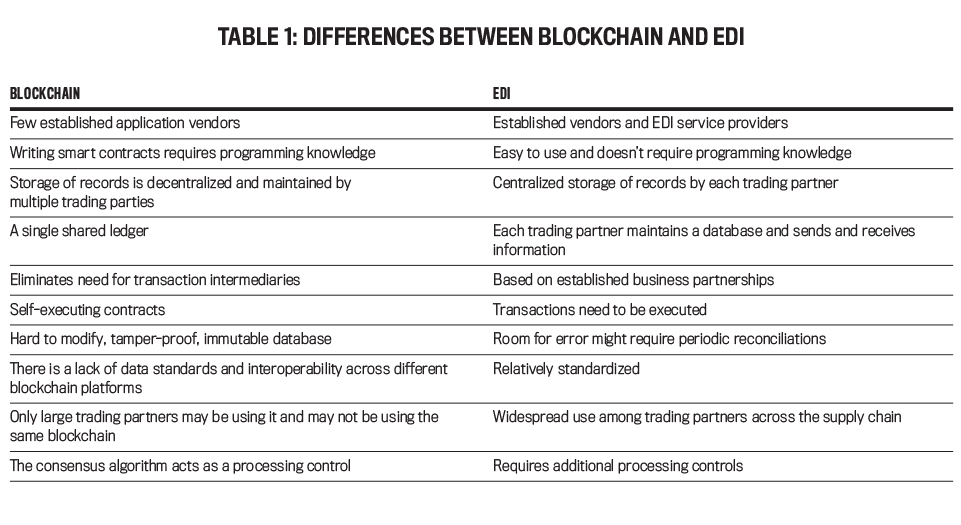

Even though there are several similarities, there are some important differences between the two that companies should consider before deciding on which application to use (see Table 1).

Click to enlarge.

Since EDI is an established application, it will be easier to find vendors and EDI applications—as well as a large number of potential trading partners and supply chain participants already using EDI. As a new technology, blockchain might require companies to take a longer time relative to EDI for onboarding a trading partner during the early stages of adoption. Furthermore, until widespread adoption occurs, it may result in a lock-in with existing trading partners. Once blockchain becomes more widespread, however, the initial time required to onboard vendors or customers may become relatively short.

Another difference is compatibility. Currently, companies need to use the same type of blockchain to communicate. Ethereum, Hyperledger Besu, and R3 Corda are all examples of different blockchains in supply chain management—and they’re all incompatible with each other. In contrast, it isn’t an issue with EDI since service providers act as an intermediary between trading partners.

It’s also important to consider how much additional programming and technical skills the company might need to add. While the initial EDI implementation requires mapping the record source to a standardized format, this generally requires minimal programming knowledge, if any. Using blockchain to send and receive transaction data, however, may require modifying existing applications and developing new interfaces with the existing systems and blockchain.

Even if the plans are to just send and receive documents, it will require writing code to enable the execution of documents in blockchain once a document is submitted to the existing information system. And if the goal is to automate the process, developing smart contracts will require programming knowledge. So while blockchain does provide an opportunity for automation that EDI doesn’t offer, it will require greater programming expertise.

Blockchain’s decentralized structure is one feature that’s often touted by proponents. One advantage of this is availability. In other words, if one of the nodes in the blockchain network goes offline, the other nodes can continue to keep the data and system available for network participants. In addition, every node in the blockchain network contains a copy of the transaction.

Further, any given block may contain various unrelated transactions from stakeholders regardless of whether it’s a private or public blockchain. Any transaction submitted to the blockchain is stored on a single ledger, minimizing and even eliminating the need for reconciliation of records between trading partners.

Yet this could also impact transaction processing speed and scalability: The signature verification, consensus, and redundancy in a blockchain add to the processing burden on distributed systems. As a result of these additional processes, blockchains (particularly ones using proof-of-work algorithms) process a much lower number of transactions per second than centralized systems. This may soon change, however, as significant advances are being made by companies such as SETL and UBS with projects that can deliver a capacity of processing as many as 100,000 transactions per second.

In contrast, EDI is a centralized system. Trading partners are required to each maintain a database of transactions. Even with an intermediary, this could result in differences between the two trading partners’ records due to processing errors. Thus, companies must periodically reconcile transactions with their trading partners.

Blockchain also removes the need for a central, trusted authority to verify the transactions have occurred, the identities of the parties in the transaction, and that they are eligible to participate in transactions. For example, in financial transactions using blockchain, there isn’t a need for a bank or company like VISA or MasterCard to clear and settle transactions.

Instead, a reliable, systematic mechanism in the blockchain is used to maintain the identity of entities, verify transactions of the entities, and append these transactions to the current state of the blockchain, which is replicated across all participants. EDI doesn’t provide these services. Data that’s entered into the system isn’t validated before being sent to the trading partner.

Click to enlarge.

Since EDI is an established application, it will be easier to find vendors and EDI applications—as well as a large number of potential trading partners and supply chain participants already using EDI. As a new technology, blockchain might require companies to take a longer time relative to EDI for onboarding a trading partner during the early stages of adoption. Furthermore, until widespread adoption occurs, it may result in a lock-in with existing trading partners. Once blockchain becomes more widespread, however, the initial time required to onboard vendors or customers may become relatively short.

Another difference is compatibility. Currently, companies need to use the same type of blockchain to communicate. Ethereum, Hyperledger Besu, and R3 Corda are all examples of different blockchains in supply chain management—and they’re all incompatible with each other. In contrast, it isn’t an issue with EDI since service providers act as an intermediary between trading partners.

It’s also important to consider how much additional programming and technical skills the company might need to add. While the initial EDI implementation requires mapping the record source to a standardized format, this generally requires minimal programming knowledge, if any. Using blockchain to send and receive transaction data, however, may require modifying existing applications and developing new interfaces with the existing systems and blockchain.

Even if the plans are to just send and receive documents, it will require writing code to enable the execution of documents in blockchain once a document is submitted to the existing information system. And if the goal is to automate the process, developing smart contracts will require programming knowledge. So while blockchain does provide an opportunity for automation that EDI doesn’t offer, it will require greater programming expertise.

Blockchain’s decentralized structure is one feature that’s often touted by proponents. One advantage of this is availability. In other words, if one of the nodes in the blockchain network goes offline, the other nodes can continue to keep the data and system available for network participants. In addition, every node in the blockchain network contains a copy of the transaction.

Further, any given block may contain various unrelated transactions from stakeholders regardless of whether it’s a private or public blockchain. Any transaction submitted to the blockchain is stored on a single ledger, minimizing and even eliminating the need for reconciliation of records between trading partners.

Yet this could also impact transaction processing speed and scalability: The signature verification, consensus, and redundancy in a blockchain add to the processing burden on distributed systems. As a result of these additional processes, blockchains (particularly ones using proof-of-work algorithms) process a much lower number of transactions per second than centralized systems. This may soon change, however, as significant advances are being made by companies such as SETL and UBS with projects that can deliver a capacity of processing as many as 100,000 transactions per second.

In contrast, EDI is a centralized system. Trading partners are required to each maintain a database of transactions. Even with an intermediary, this could result in differences between the two trading partners’ records due to processing errors. Thus, companies must periodically reconcile transactions with their trading partners.

Blockchain also removes the need for a central, trusted authority to verify the transactions have occurred, the identities of the parties in the transaction, and that they are eligible to participate in transactions. For example, in financial transactions using blockchain, there isn’t a need for a bank or company like VISA or MasterCard to clear and settle transactions.

Instead, a reliable, systematic mechanism in the blockchain is used to maintain the identity of entities, verify transactions of the entities, and append these transactions to the current state of the blockchain, which is replicated across all participants. EDI doesn’t provide these services. Data that’s entered into the system isn’t validated before being sent to the trading partner.

One of the major advantages in the blockchain is the immutability of the distributed ledger. Because the blocks are linked to the previous block using previous block hashes, the attempt to roll back transactions or alter a previously written transaction will require changing the hashes of all subsequent blocks. Since the majority of the nodes have already accepted the current state of the blockchain as valid, any change to a previous block will be rejected. For example, if one entity tried to tamper with the data in a block that’s already included in the blockchain, it will change the hash of the most recent block and put the altered chain on the one node, which will become out of sync with the other nodes carrying the correct data.

EDI doesn’t provide immutability, so transactions can be subsequently modified and thus result in erroneous transactions. And apart from preventive controls, EDI requires processing controls to be implemented, enforced, and maintained. Blockchain, on the other hand, consists of consensus algorithms that handle processing controls.

DEVELOPMENT STRATEGIES

In addition to the two technologies’ features and functionality, another consideration to assess is the work and effort required to implement each of them. There are two methods of obtaining EDI. One is to develop an in-house EDI network among the trading partners. This option may be costly and requires the company to develop and maintain maps and specifications for each trading partner connection. The second option is to outsource to a third-party EDI service provider. Many enterprise resource planning (ERP) systems, such as Oracle and SAP, also provide EDI solutions.

Some factors to consider when selecting an EDI service provider are the number of trading partners already using a specific service provider, the level of support and training available, the flexibility of the application, compatibility with existing systems, transparency in the communications, and the level of access and workflow controls available. An advantage of a third-party EDI service provider is that companies may have the option to select a pay-as-you-go pricing model as well as a monthly or annual subscription pricing model. This provides some flexibility based on a company’s particular business needs.

In comparison, there are currently two ways to implement blockchain among trading partners: permissioned or private blockchains. One development strategy is to build a permission/private blockchain from scratch, which involves the acquisition of computing infrastructure, network, and storage. Although the cost of the hardware can be reduced by using infrastructure as a service (IaaS) cloud computing services, the in-house development costs can be very costly. Developers with expertise in encryption, peer-to-peer networking, and blockchain architects are rare and command a very high salary.

Alternatively, organizations can utilize a blockchain that is hosted as a service from cloud service providers. Technology giants such as SAP, Amazon, Microsoft, and IBM are involved in the blockchain as a service (BAAS) space, and Accenture is focused on providing blockchain consulting services. Open-source blockchain platforms such as the Hyperledger Fabric significantly reduce the development cost of the backbone blockchain infrastructure, protocol, and encryption method.

Ultimately, the labor cost of development, testing, and configuration of the blockchain decentralized applications and smart contracts will remain to be cost drivers and barriers for many smaller organizations. Moreover, the pricing of the service by blockchain host and administrator may need to be considered given the novelty of the technology.

MAKING THE RIGHT CHOICE

Before deciding to invest in blockchain technology, management should consider two fundamental questions:

- What is the problem we would like to solve using blockchain?Decision makers should obtain a thorough understanding of the existing problem. Further, they should consider the relative impact of the problem on the mission and strategy of the company.

- Is there an alternative solution?One common mistake executives make is adopting new technology without an in-depth understanding and analysis of costs, risks, operations, and maintenance.

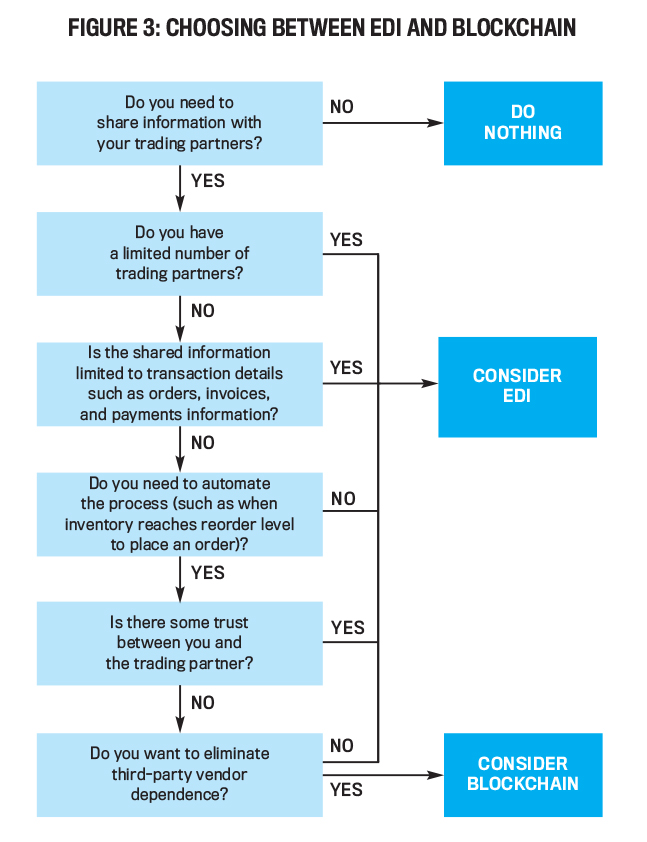

When considering alternatives, management should look at the existing technology, compatibility, investment, time required for implementation, maintenance requirements, expert skills needed, adequacy of technical support, and other factors. A decision tree such as the one in Figure 3 can help assess whether the business problem is a good use case for blockchain technology.

Click to enlarge.

Click to enlarge.

Further, management should decide whether there is a significant competitive advantage in embracing blockchain technology and whether the investment could be justified compared to the potential benefit—not just of the technology itself but in being an early adopter. Companies that choose to be early adopters are essentially guinea pigs and will likely experience challenges in implementation and transition that the late majority will be able to avoid.

While focused on comparing EDI and blockchain, the approach and process we’ve described here is applicable for evaluating many technology decisions, particularly when choosing between a new technology still in infancy and a more established alternative. A critical evaluation of the business use case based on the costs, benefits, advantages, and disadvantages of available alternatives options will help.

June 2020